First Mining Announces Initial 2024 Duparquet Exploration Drilling Results

First Mining Gold has announced initial 2024 drilling results from its Duparquet Gold Project in Quebec. The Phase 2B winter drill program targeted North Zone and Rex Target areas. Highlights include hole DUP24-018 returning 3.11 g/t gold over 13.16m and 3.07 g/t gold over 10.32m. CEO Dan Wilton emphasized the upside potential and continuity of higher-grade mineralization at Duparquet. The winter program commenced in February 2024, involving seven holes over 2,856m. Further assay results are pending. The company aims to extend deeper mineralization trends and enhance resource and exploration confidence.

- Initial drilling results show significant gold grades: DUP24-018 with 3.11 g/t Au over 13.16m and DUP24-019 with 3.07 g/t Au over 10.32m.

- Winter drilling program successfully explored North Zone and Rex Target areas, enhancing resource confidence.

- CEO Dan Wilton emphasized the project's potential for high-grade mineralization and near-surface open-pit opportunities.

- Exploration activity in Quebec's prolific Abitibi gold belt could unlock additional resource growth.

- The Phase 2B program's systematic approach supports continuous high-grade trends and resource optimization.

- Pending assay results from the winter drill program indicate incomplete data for current evaluation.

- The Grade optimization and depth extension strategy may involve significant costs.

- Some drill holes showed lower-than-expected gold grades, such as DUP24-020 with no significant assay results.

- Higher operational costs associated with extensive drilling in multiple target zones.

Highlights include the Company's first ever targeting of the North Zone mineralization

returning 3.11 g/t Au over 13.16 m and 3.07 g/t Au over 10.32 m

Highlights include drill hole DUP24-018 returning 3.11 g/t Au over 13.16m, and hole DUP24-019 returning 3.07 g/t Au over 10.32m and 3.19 g/t over 4.53m. These results, coupled with additional holes through the winter program, continue to support ongoing testing and delineation of deeper mineralization trends at the North Zone target areas of the

"These initial results from our winter program are encouraging and continue to demonstrate the upside potential at the Duparquet Gold Project," stated Dan Wilton, CEO of First Mining. "These results demonstrate the strong continuity of higher-grade mineralization at

The Phase 2 winter program commenced in February 2024 and included a seven-hole, 2,856 m drill program. First Mining's 2024 winter exploration strategy aimed to explore plunge controls in several key mineralization trends, further supporting additional resource growth through grade optimization and depth extension. Drill holes DUP24-018 and DUP24-019 were successful in the intended approach, with intersections of significant gold mineralization consistent with the higher-grade trends that were targeted. Further assay results from the winter drilling are pending and are expected to be released in the coming weeks.

Hole ID | From (m) | To (m) | Length (m) | Grade (Au g/t) | Target | |

DUP24-018 | 144.00 | 144.69 | 0.69 | 20.00 | North Zone | |

DUP24-018 | 175.52 | 188.68 | 13.16 | 3.11 | ||

DUP24-018 | 376.47 | 377.00 | 0.53 | 11.70 | ||

DUP24-018 | 385.82 | 399.97 | 14.15 | 1.53 | ||

DUP24-018 | inc. | 393.74 | 394.24 | 0.50 | 17.70 | |

DUP24-019 | 87.94 | 98.26 | 10.32 | 3.07 | ||

DUP24-019 | inc. | 90.35 | 91.20 | 0.85 | 9.19 | |

DUP24-019 | 102.30 | 106.83 | 4.53 | 3.19 |

*Reported intervals are drilled core lengths (true widths are estimated at 75 |

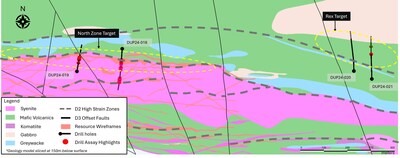

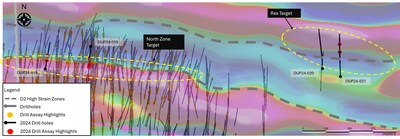

A plan map of the select Phase 2B winter exploration targets and drillhole locations are presented in Figure 1, and assay highlights of the initial holes from the 2024 Phase 2B drill program are presented in Table 1, with full assay results returned listed in Table 2 and drill hole locations included in Table 3.

The North Zone drilling strategy is focused on targeting strike extension opportunities as well as drill testing multiple deeper, higher-grade trends that support an extension down-plunge. The North Zone mineralization is hosted within porphyritic syenite with strong sericite and silica alteration, with higher grades being returned in zones with increased alteration, 2

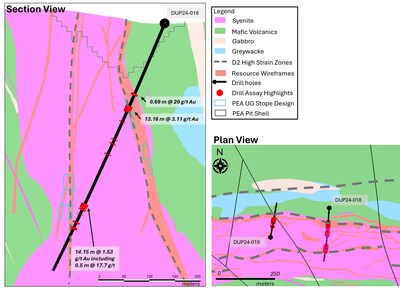

Drill hole DUP24-018 (Figure 3) was drilled across the mineralized shear zone at the northern contact of the Beattie syenite body and returned multiple intercepts of significant gold values. Highlights from the main mineralized shear zone include 20 g/t Au over 0.69 m at 144 to 144.69 m and 0.94 g/t Au over 3.78 m at 149.22 to 153 m that is hosted within a strong sheared and silica-altered basalt, and 3.11 g/t Au over 13.16 m at 175.52 to 188.68 m that is hosted within highly sheared and altered porphyritic syenite unit. This main zone has been characterized as a higher-grade area that is interpreted to have a strong potential for continuity down-plunge. First Mining has undertaken a systematic approach to explore this and a number of similar trends that will build further confidence in targeting drill extensions to depth in an effort to expand the mineral resource.

Additionally, further downhole within drill hole DUP24-018, several significant intercepts occur at 376.47-377.0 m which returned 11.70 g/t Au over 0.53 m, and at 385.82 - 399.97 m which returned 1.53 g/t Au over 14.15 m, including 17.70 g/t Au over 0.50 m from 393.74 - 394.24 m. These intercepts are all hosted within the syenite, and mineralization is associated with shearing, brecciation, and zones of silica and sericite alteration, increased veining and up to

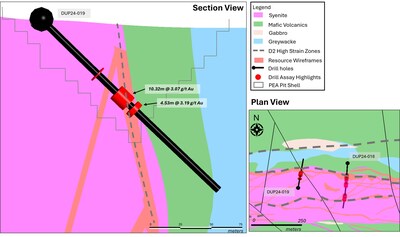

Hole DUP23-019 (Figure 4) was drill testing additional higher-grade zones along the mineralized shear zone at the northern contact of the Beattie syenite body. Highlights from the main mineralized shear zone include 0.7 g/t Au over 1 m at 84.5 to 85.5 m, 3.07 g/t Au over 10.32 m at 87.94 to 98.26 m (including 9.19 g/t Au over 0.85 m), and 3.19 g/t Au over 4.53 m at 102.3 to 106.83 m. These significant intercepts are hosted within syenite that is associated with strong silica and sericite alteration, quartz carbonate veining covering up to

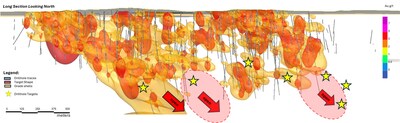

The North Zone target is a priority area for exploration optimization and potential extension of the open pit and underground resource. The recent drill results continue to support the area as a highly prospective target zone for the project, with potential to unlock meaningful upside along strike and at depth (Figure 5).

A new brownfields discovery target outside of the main Beattie syenite was identified in the 2023 summer campaign. The Rex Target (Figure 6) borders the northern contact of the Beattie Syenite and is approximately 500 m from the current mineral resource, and is hosted at the contact of a regional D2 structure where it is coincident with mafic volcanic stratigraphy established in mapping and supported by geophysical magnetic expression. A mafic volcanic surface grab sample collected during 2023 (sample 571507) returned 0.694 g/t Au, and a historical drill hole, DON10-122, returned 0.87 g/t Au over 9 m from 348.5 - 357.5m. First Mining has further tested the area with the drilling of two exploration holes the Rex Target during the winter 2024 program (DUP24-020 and DUP24-021), targeting a steep D2 structure that is projected from surface. The structure was intersected in both holes, with DUP24-021 returning 0.73 g/t Au over 3.85 m from 205.85 – 209.70 m, and 0.61 g/t Au over 1.0 m from 267.7 to 268.70 m. Mineralization is hosted within a brecciated graphitic structure with quartz carbonate veining and up to

"Our first 2024 drill results at

Exploration activities will be advancing at the

Hole ID | From (m) | To (m) | Length (m) | Grade (Au g/t) | |

DUP24-018 | 130.95 | 131.50 | 0.55 | 0.49 | |

DUP24-018 | 144.00 | 144.69 | 0.69 | 20.00 | |

DUP24-018 | 149.22 | 153.00 | 3.78 | 0.94 | |

DUP24-018 | inc. | 149.22 | 149.80 | 0.58 | 3.35 |

DUP24-018 | 175.52 | 188.68 | 13.16 | 3.11 | |

DUP24-018 | 192.00 | 192.88 | 0.88 | 0.44 | |

DUP24-018 | 209.00 | 210.00 | 1.00 | 0.47 | |

DUP24-018 | 210.88 | 211.64 | 0.76 | 0.45 | |

DUP24-018 | 212.40 | 213.00 | 0.60 | 0.47 | |

DUP24-018 | 247.20 | 248.34 | 1.14 | 0.58 | |

DUP24-018 | 252.19 | 252.95 | 0.76 | 0.60 | |

DUP24-018 | 256.00 | 257.65 | 1.65 | 0.99 | |

DUP24-018 | 264.00 | 264.68 | 0.68 | 0.58 | |

DUP24-018 | 271.20 | 271.70 | 0.50 | 0.70 | |

DUP24-018 | 278.47 | 280.32 | 1.85 | 1.41 | |

DUP24-018 | 321.21 | 321.90 | 0.69 | 0.91 | |

DUP24-018 | 376.47 | 377.00 | 0.53 | 11.70 | |

DUP24-018 | 385.82 | 399.97 | 14.15 | 1.53 | |

DUP24-018 | inc. | 393.74 | 394.24 | 0.50 | 17.70 |

DUP24-018 | 408.00 | 409.00 | 1.00 | 1.50 | |

DUP24-018 | 425.00 | 428.00 | 3.00 | 1.52 | |

DUP24-018 | 436.05 | 437.00 | 0.95 | 0.49 | |

DUP24-018 | 439.86 | 441.00 | 1.14 | 0.68 | |

DUP24-019 | 63.00 | 64.00 | 1.00 | 0.58 | |

DUP24-019 | 84.50 | 85.50 | 1.00 | 0.70 | |

DUP24-019 | 87.94 | 98.26 | 10.32 | 3.07 | |

DUP24-019 | inc. | 90.35 | 91.20 | 0.85 | 9.19 |

DUP24-019 | 102.30 | 106.83 | 4.53 | 3.19 | |

DUP24-020 | no significant assay results | ||||

DUP24-021 | 205.85 | 209.70 | 3.85 | 0.73 | |

DUP24-021 | 267.70 | 268.70 | 1.00 | 0.61 | |

*Reported intervals are drilled core lengths (true widths are estimated at 75 |

Table 3: Phase 2B Winter Drill Hole Locations, Duparquet Gold Project

Hole ID | Azimuth (°) | Dip (°) | Length (m) | Easting | Northing |

DUP24-018 | 185 | -68 | 531 | 631782 | 5374621 |

DUP24-019 | 10 | -45 | 150 | 631542 | 5374501 |

DUP24-020 | 0 | -47 | 300 | 633009 | 5374503 |

DUP24-021 | 0 | -53 | 348 | 633104 | 5374461 |

Note: Collar coordinates in UTM NAD 83 z17 |

The Duparquet Project is geologically situated in the southern part of the Abitibi Greenstone Belt and is geographically located approximately 50 km north of the city of

The Duparquet Project totals approximately 5,800 hectares focused along an area of 19 kilometres of strike length along the prolific Destor-Porcupine Fault Zone, along with numerous mineralized splays and influential secondary lineaments. The Duparquet Project includes the past-producing Beattie, Donchester and Duquesne mines as well as the

1 See October 20, 2023, NI43-101 Report titled "NI 43-101 Technical Report: Preliminary Economic Assessment Duparquet Gold Project"

All sampling completed by First Mining within its exploration programs is subject to a Company standard of internal quality control and quality assurance (QA/QC) programs which include the insertion of certified reference materials, blank materials and a level of duplicate analysis. Core samples from the 2023 drilling program at

Louis Martin, P.Geo., Senior Geologic Consultant of First Mining, is a "Qualified Person" for the purposes of NI 43-101 Standards of Disclosure for Mineral Projects, and has reviewed and approved the scientific and technical disclosure contained in this news release.

First Mining is a gold developer advancing two of the largest gold projects in

First Mining was established in 2015 by Mr. Keith Neumeyer, founding President and CEO of First Majestic Silver Corp.

ON BEHALF OF FIRST MINING GOLD CORP.

Daniel W. Wilton

Chief Executive Officer and Director

This news release includes certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable Canadian and

Forward-looking statements in this news release relate to future events or future performance and reflect current estimates, predictions, expectations or beliefs regarding future events. All forward-looking statements are based on First Mining's or its consultants' current beliefs as well as various assumptions made by them and information currently available to them. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the respective parties, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Such factors include, without limitation the Company's business, operations and financial condition potentially being materially adversely affected by the outbreak of epidemics, pandemics or other health crises, such as COVID-19, and by reactions by government and private actors to such outbreaks; risks to employee health and safety as a result of the outbreak of epidemics, pandemics or other health crises, such as COVID-19, that may result in a slowdown or temporary suspension of operations at some or all of the Company's mineral properties as well as its head office; fluctuations in the spot and forward price of gold, silver, base metals or certain other commodities; fluctuations in the currency markets (such as the Canadian dollar versus the

First Mining cautions that the foregoing list of factors that may affect future results is not exhaustive. When relying on our forward-looking statements to make decisions with respect to First Mining, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. First Mining does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by the Company or on our behalf, except as required by law.

The Company is a "foreign private issuer" as defined in Rule 3b-4 under the United States Securities Exchange Act of 1934, as amended, and is eligible to rely upon the

Technical disclosure contained in this news release has not been prepared in accordance with the requirements of

NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning the issuer's material mineral projects.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/first-mining-announces-initial-2024-duparquet-exploration-drilling-results-302150528.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/first-mining-announces-initial-2024-duparquet-exploration-drilling-results-302150528.html

SOURCE First Mining Gold Corp.

FAQ

What are the latest drilling results from First Mining Gold's Duparquet Project?

When did First Mining commence the 2024 Phase 2B winter drilling program?

What targets were explored in First Mining Gold's 2024 winter drill program?

What is the significance of the DUP24-018 drill hole?

What future exploration activities does First Mining plan for the Duparquet Project?