Allied Critical Metals Announces Material Increase to Mineral Resource Estimate at Borralha Tungsten Project in Northern Portugal

Rhea-AI Summary

Allied Critical Metals (OTCQB: ACMIF) announced an updated Mineral Resource Estimate at the Borralha Tungsten Project (effective 16 Nov 2025) focused on the Santa Helena Breccia.

The MRE reports 13.0 Mt Measured & Indicated at 0.21% WO3 (27,062 t contained WO3) and 7.7 Mt Inferred at 0.18% WO3 using a 0.09% WO3 cut-off. The update incorporates 4,210 m of 2025 RC drilling, density updates, revised grade shell and improved geostatistics, and supports a targeted PEA in Q1 2026. Metallurgical work shows gravity-dominant recoveries ~75–85% with potential Cu-Sn-Ag by-product upside. A NI 43-101 technical report will be filed on SEDAR+ within 45 days.

Positive

- M+I resource expanded to 13.0 Mt at 0.21% WO3

- Contained WO3 of 27,062 tonnes in M+I

- Updated model built from 4,210 m of 2025 RC drilling

- Metallurgy indicates ~75–85% WO3 gravity recoveries

- PEA targeted for Q1 2026 supported by current MRE

Negative

- Resource cut-off uses an APT price of US $500/MTU while spot is ~US $700/MTU

- Final RC holes were terminated early, leaving western and northern extensions open

- Inferred grade declined to 0.18% WO3 from prior 0.20% in 2024

News Market Reaction

On the day this news was published, ACMIF gained 19.33%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Highlights:

- One of Europe's Premier Emerging Tungsten Assets materially increases its mineral resource estimates with Measured and Indicated Resource Estimate (M+I) increasing to 13.0 Mt at

0.21% WO₃ and Inferred Resource Estimate to 7.7 Mt at0.18% WO₃.

- Significant resource growth strengthens ACM's position ahead of Q1 2026 PEA as tungsten prices surge approx.

70% in past six months.

Vancouver, British Columbia--(Newsfile Corp. - November 19, 2025) - Allied Critical Metals Inc. (CSE: ACM) (OTCQB: ACMIF) (FSE: 0VJ0) ("Allied" or the "Company"), which is focused on its

The updated MRE marks a major step change from the 2024 MRE (4.98 Mt Indicated at

UPDATED MINERAL RESOURCE ESTIMATE (MRE)

(Effective date: 16 November 2025; based on

TABLE 1 — Mineral Resources at

| Classification | Tonnes (Mt) | WO₃ (%) | Contained WO₃ (t) |

| Measured | 1.0 | 0.22 | 2,088 |

| Indicated | 12.0 | 0.21 | 24,974 |

| M+I | 13.0 | 0.21 | 27,062 |

| Inferred | 7.7 | 0.18 | 13,878 |

* The MRE was prepared in accordance with the CIM Definition Standards (2023) and National Instrument 43-101—Standards for Disclosure of Mineral Projects ("NI 43-101") and replaces the previous maiden resource dated March 25, 2024.

Roy Bonnell, CEO & Director of Allied, commented: "This updated MRE is a major milestone for the Borralha Project. Growing the Measured and Indicated resources to 13.0 million tonnes at

"This updated MRE strengthens not only the technical foundation of the Borralha Project, but also our position within the ongoing environmental and permitting processes, with anticipated approvals in Q1, 2026. It provides an excellent foundation to further build the MRE for our anticipated PEA in Q1 2026 by, among other things, pairing two or three holes to reach more mineralization which weren't accessible with RC in this campaign. Alongside the drilling and geological work, our team has been advancing the Environmental Impact Assessment and navigating the extensive regulatory and administrative steps required in Portugal. Today's results support the robustness of the project as we progress through these parallel workstreams. The combination of geological growth, improving confidence, and continued permitting momentum gives us a clear and responsible path forward toward development."

Note: In accordance with NI 43-101 Section 3.5, Mineral Resources are reported separately by category and must not be aggregated. Measured and Indicated Resources may be combined for reporting purposes, but Inferred Resources cannot be added to other categories. No combined grade is reported for Measured + Indicated + Inferred.

Highlights:

- New MRE incorporates 1) RC step-outs, 2) infill drilling, 3) density updates, 4) revised grade shell, 5) improved geological model 6) enhanced geostatistical parameters.

- WO₃-only cut-off grade is

0.09% WO₃, consistent with the expectable underground LHOS potential and gravity-dominant metallurgy.

- Strong continuity of mineralization confirmed; extensions defined toward the north dip and western flank.

- Metallurgy indicates simple, low-cost gravity flowsheet with ~75

-85% WO₃ recovery and potential Cu-Sn-Ag by-product upside to be defined in the PEA.

- Updated block model supports growing potential for scalable, long-life underground operation.

- The final RC holes were terminated before reaching the anticipated mineralized corridors, leaving the western and northern down-dip extensions open. This indicates that significant potential remains for additional resource growth with only modest further drilling, which will be addressed in the next core drilling campaign planned for Q1 2026.

GEOLOGICAL & METALLURGICAL CONTEXT

Drilling confirms that the Santa Helena Breccia is a large, subvertical, coarse-fragment collapse breccia, strongly mineralized in wolframite ± ferberite, with accessory cassiterite, chalcopyrite, silver sulphosalts, and low deleterious elements. Mineralization displays strong structural control and excellent lateral continuity. This updated MRE does not yet take into account any future breccia complexes or other geological anomalies that may be present at the Borralha Project.

Metallurgy

Existing metallurgical programs (bench-scale testing, mineralogical studies, and semi-industrial work by MinePro), together with ongoing metallurgical test work at Wardell Armstrong International (SLR), indicate:

- Coarsely liberated wolframite, well suited to gravity concentration.

- Heavy Liquid Separation (5 mm) delivering exceptional performance, rejecting >

50% of the mass at high WO₃ recovery. - Spirals and shaking tables effective for fine clean-up stages.

- Final sulfide flotation required to clean the gravity concentrate and remove sulfide minerals.

- Cassiterite and chalcopyrite exhibit realistic beneficiation potential, with metallurgy to be provided by MinePro's independent QP for the NI 43-101 Technical Report.

- Wardell Armstrong (UK) test work is underway, with results expected in Q1 2026 to support PEA flowsheet definition and recoveries.

By-products (Cu-Sn-Ag)

Although not included in cut-off or resource calculation:

- Chalcopyrite follows sulfide flotation which leads to potential Cu concentrate;

- Cassiterite follows gravity circuit which leads to potential Sn concentrate; and

- Ag could report to sulfide concentrate.

These metals represent future upside to be defined within the PEA.

Cut-off grade rationale

Resources are reported above a

- APT price: US

$500 /MTU; - Underground long-hole stoping conceptual mining; and

- An implicit

0.09% WO₃ grade shell was constructed using a numeric-model iso-value of 0.6. Minor isolated volumes <5,000 m³ were removed to satisfy CIM RPEEE (Reasonable Prospects for Eventual Economic Extraction) continuity criteria and to avoid isolated blocks lacking reasonable prospects for extraction.

NEXT STEPS

The updated MRE provides the foundation for Allied's maiden PEA planned for Q1 2026, evaluating a scalable underground operation leveraging gravity-dominant processing with by-product potential. The next steps include:

- Completion of Wardell Armstrong (UK) detailed metallurgy (underway);

- Engineering trade-off studies to support PEA;

- Phase 2 RC & diamond drilling targeting western & down-dip expansion; and

- Environmental and hydrogeological baseline program (ongoing).

QUALIFIED PERSONS

The updated MRE was prepared by Vítor Arezes, MIMMM, QMR #703197, Vice President Exploration of Allied Critical Metals, Qualified Person under NI 43-101. The scientific and technical information contained in this release has been reviewed and approved by Mr. Vítor Arezes, BSc, MIMMM (QMR), Vice-President Exploration of Allied Critical Metals Inc., a Qualified Person under NI 43-101. Mr. Arezes is not independent of the Company as he is an officer of Allied Critical Metals Inc.

The updated MRE was reviewed and validated by J. Douglas Blanchflower, P.Geo. of Minorex Consulting. The scientific and technical information contained in this release has also been reviewed and approved by Mr. J. Douglas Blanchflower, P.Geo. (License nr. 19086), Minorex Consulting, a Qualified Person under NI 43-101. Mr. Blanchflower is independent of the Company and its mineral properties.

In addition, the metallurgical information in this news release was reviewed by Mr. David Castro López, MIMMM, QMR #685484 of MinePro Lda. The scientific and technical information contained in this release has also been reviewed and approved by Mr. David Castro López, MIMMM, a Qualified Person under NI 43-101. Mr. Lopez is independent of the Company and its mineral properties.

NI 43-101 TECHNICAL REPORT FILING

A Technical Report prepared supporting the updated Mineral Resource Estimate will be filed on SEDAR+ within 45 days of this news release, in accordance with Section 4.2 of NI 43-101.

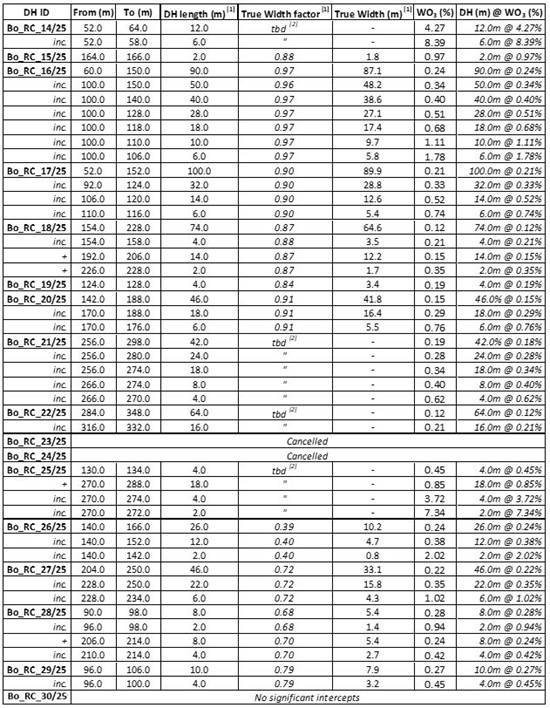

Table 2 - 2025 Campaign Interval Highlights

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11632/275151_acmtable2.jpg

Notes: [1] Reported intervals are downhole lengths. Estimated true widths were calculated from hole orientation and the interpreted geometry of the mineralized corridors. Estimates may vary locally where geometry changes. Where intervals fall outside the resource block-model domains, true widths are not estimated and only downhole lengths are reported. [2] True widths are unknown to be defined after further MRE update.

All of the above drill results were previously disclosed as first time disclosure by the Company in its past news releases, as follows: (i) on September 4, 2025 - Bo_RC_14/25; (ii) on September 11, 2025 - Bo_RC_15/25, Bo_RC_17/25, and Bo_RC_22/25; (iii) on September 29, 2025 - Bo_RC_21/25 and Bo_RC_26/25; (iv) on October 22, 2025 - Bo_RC_16/25, Bo_RC_18/25, and Bo_RC_19/25; (v) on November 5, 2025 - Bo_RC_27/25 and Bo_RC_28/25; and (vi) on November 12, 2025 - Bo_RC_20/25, Bo_RC_25/25, Bo_RC_29/25, and Bo_RC_30/25.

About the Borralha Tungsten Project

Allied's Borralha Tungsten Project is one of the largest and most historically significant past-producing tungsten operations in Western Europe. Located in northern Portugal, Borralha was once the second-largest tungsten mine in the country and supplied strategic materials to European and Allied industries during the 20th century, including both World Wars and the Cold War period.

Today, the project is undergoing a modern revitalization based on a combination of scale, grade, metallurgy, and jurisdictional strength. Mineralization is dominated by coarse-grained wolframite, which is highly desirable in global markets due to its favorable processing characteristics and higher recoveries compared to scheelite-bearing deposits.

Borralha benefits from existing infrastructure, shallow mineralization, and a simple processing route, making it one of the most advanced tungsten development projects in the European Union. These attributes are particularly important in the context of the EU Critical Raw Materials Act (2024/1252) and NATO strategic autonomy initiatives, both of which explicitly identify tungsten as a defense-critical raw material subject to severe supply risk.

With the EU currently dependent on over

ON BEHALF OF THE BOARD OF DIRECTORS

"Roy Bonnell"

Roy Bonnell

CEO and Director

For further information or investor relations inquiries, please contact:

Dave Burwell

Vice President, Corporate Development

Email: daveb@alliedcritical.com

Tel: 403-410-7907

Toll Free: 1-888-221-0915

ABOUT ALLIED CRITICAL METALS

Allied Critical Metals Inc. (CSE: ACM) (OTCQB: ACMIF) (FSE: 0VJ0) is a Canadian-based mining company focused on the expansion and revitalization of its

Please also visit our website at www.alliedcritical.com.

Also visit us at:

LinkedIn: https://www.linkedin.com/company/allied-critical-metals-inc/

X: https://x.com/@alliedcritical/

Facebook: https://www.facebook.com/alliedcriticalmetalscorp/

Instagram: https://www.instagram.com/alliedcriticalmetals/

The Canadian Stock Exchange does not accept responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This news release contains "forward-looking statements", including with respect to the use of proceeds. Wherever possible, words such as "may", "would", "could", "should", "will", "anticipate", "believe", "plan", "expect", "intend", "estimate", "potential for" and similar expressions have been used to identify these forward-looking statements. These forward-looking statements reflect the current expectations of the Company's management for future growth, results of operations, performance and business prospects and opportunities and involve significant known and unknown risks, uncertainties and assumptions, including, without limitation, those listed in the Company's Listing Statement and other filings made by the Company with the Canadian securities regulatory authorities (which may be viewed under the Company's profile at www.sedarplus.ca). Examples of forward-looking statements in this news release include, but are not limited to, statements regarding the proposed timeline and use of proceeds for exploration and development of the Company's mineral projects as described in the Company's Listing Statement, news releases, and corporate presentations. Should one or more of these risks or uncertainties materialize or should assumptions underlying the forward-looking statements prove incorrect, actual results, performance or achievements may vary materially from those expressed or implied by the forward-looking statements contained in this news release. These factors should be considered carefully, and prospective investors should not place undue reliance on the forward-looking statements. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements and reference should also be made to the Company's Listing Statement dated April 23, 2025 and news release dated May 16, 2025, and the Company's most recently filed management's discussion and analysis, all as filed under its SEDAR+ profile at www.sedarplus.ca for a description of additional risk factors. The Company disclaims any intention or obligation to revise forward-looking statements whether as a result of new information, future developments or otherwise, except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/275151