American Workforce Burnout Reaches Tipping Point

Rhea-AI Summary

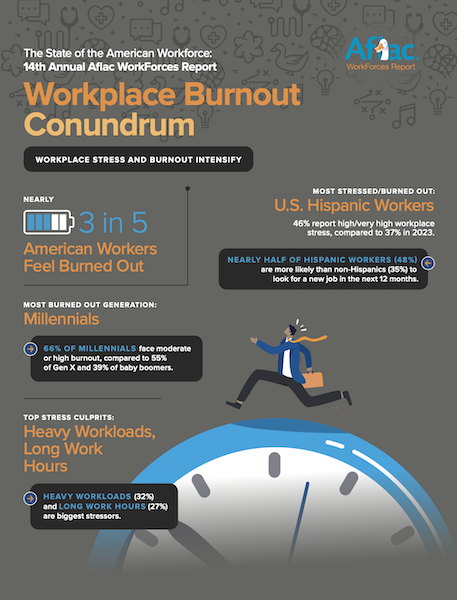

Aflac's 14th annual WorkForces Report reveals increasing workplace stress and burnout affecting nearly 3 in 5 American workers. Millennials show the highest burnout rates at 66%, compared to Gen X (55%) and baby boomers (39%). Employee stress levels rose to 38% in 2024 from 33% in 2023, with Hispanic workers experiencing significantly higher rates. The report highlights growing financial vulnerability, with 51% of employees unable to afford $1,000 in unexpected medical expenses. Notably, 93% of employees see an increasing need for supplemental insurance, while 62% would consider leaving their jobs for better benefits even with a pay cut.

Positive

- 93% of employees recognize the need for supplemental insurance (highest in 14 years)

- 91% of employees report positive impact from corporate social responsibility efforts

- 77% consider CSR initiatives important for employment decisions

Negative

- Employee stress levels increased to 38% in 2024 (from 33% in 2023)

- 51% of employees cannot afford $1,000 in unexpected medical expenses

- 50% of employees admit to 'quiet quitting' behaviors

- 64% of employees cannot go more than one month without a paycheck

- Rising employee turnover risk with 62% willing to leave for better benefits

News Market Reaction

On the day this news was published, AFL declined 0.80%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

14th annual Aflac WorkForces Report uncovers very high levels of burnout are nearly twice as likely among U.S. Hispanic employees than non-Hispanics

Originally published on Aflac Newsroom

COLUMBUS, GA / ACCESSWIRE / November 20, 2024 / American employers and employees are facing a conundrum: heightened levels of workplace stress and burnout. This concern is exacerbated by ongoing rising costs of health care, financial vulnerability and looming worry about the future of their families, according to the 14th annual Aflac WorkForces Report1 released by Aflac Incorporated, a leading provider of supplemental health insurance and products in the U.S. The report has been tracking for more than a decade the state of the American workplace among employees and employers - capturing trends, attitudes, needs and experiences in health care and benefits administration.

Workplace stress and burnout intensify

The Aflac WorkForces Report uncovers that burnout is affecting nearly 3 in 5 American workers - with a notable generational gap. Far more millennials, ages 28-43 (

Heavy workloads (

"In an ever-changing ecosystem, the results of the Aflac WorkForces Report reinforce the importance of employers doubling down on their understanding of what drives stress and potential signs of burnout among their employees. With a keen grasp of the pain points, employers can proactively develop programs and put measures in place to ensure employees feel supported both on and off the clock," said Jeri Hawthorne, senior vice president and Chief Human Resources Officer, Aflac Incorporated.

Counterproductive behavior poses new challenges for employers

According to the report, among all employees across all workplace models,

Not doing everything required in job descriptions:

14% remote;15% hybrid;8% on-site.Taking on secondary work without permission from employers:

22% remote;14% hybrid;11% on-site.

"Understanding performance dynamics of all workplace models is crucial for employers as they try to create work environments that will satisfy their employees and keep productivity at peak levels," said Hawthorne. "At the same time, employees may need to understand that decreases in productivity will signal to employers that their current model, whether on-site, remote or hybrid, is not working and they will likely consider changes."

Financial vulnerability fueled by anxiety, looming worry

American workers who have experienced some anxiety when thinking about the impact of an unexpected serious medical condition is on the rise:

The report also revealed that most employees do not understand the costs associated with a serious medical diagnosis such as cancer. More than three-quarters (

The youngest generation of workers, Gen Z, ages 18 to 27, continues to be the most financially vulnerable, with

Looking for a lifeline

With ongoing feelings of financial fragility - and stress and worry about the rising costs of health care - both employers and employees are eager for solutions, noting supplemental insurance as a viable step to help toward financial stability and added peace of mind. Benefits continue to be critical to employee retention, in part because employees consider benefits packages to be important to their physical, financial and mental well-being. In fact, in 2024, the importance of benefits to overall loyalty, workplace engagement and willingness to refer a friend to their organization reached an all-time high.

The study found a growing number of employees would consider leaving their jobs for better benefits, even if it meant taking a pay cut (

"When

U.S. Hispanic employees eager for benefits that address family illnesses and family history

In the survey, U.S. Hispanic employees expressed a strong interest in supplemental insurance that addresses illnesses that run in their families (

U.S. Hispanic employees' overall work experience and satisfaction are influenced by benefits options more often than non-Hispanic employees: productivity (

A sense of purpose drives well-being

The study shows employees benefit significantly from participating in employers' corporate social responsibility (CSR) efforts, with

CSR efforts also can boost employee recruitment and retention, as

The 2024-2025 Aflac WorkForces Report highlights the vital role of comprehensive benefits in employees' well-being, satisfaction, resilience and retention. Additional survey findings, an infographic, trends and more can be found in the 2024-2025 Aflac WorkForces Report at Aflac.com/AWR.

ABOUT THE 2024-2025 AFLAC WORKFORCES REPORT

The 2024-2025 Aflac WorkForces Report, conducted by Kantar on behalf of Aflac, is the 14th annual study examining benefits trends, attitudes and use of employee benefits in the U.S. workforce in various industries and business sizes. The employee survey took place online June 6-July 10, 2024, and the employer survey took place online June 6-21, 2024. Throughout this report, some percentages may not add up to

ABOUT AFLAC INCORPORATED

Aflac Incorporated (NYSE: AFL), a Fortune 500 company, has helped provide financial protection and peace of mind for nearly seven decades to millions of policyholders and customers through its subsidiaries in the U.S. and Japan. In the U.S., Aflac is the No. 1 provider of supplemental health insurance products.3 In Japan, Aflac Life Insurance Japan is the leading provider of cancer and medical insurance in terms of policies in force. The company takes pride in being there for its policyholders when they need us most, as well as being included in the World's Most Ethical Companies by Ethisphere for 18 consecutive years (2024), Fortune's World's Most Admired Companies for 23 years (2024) and Bloomberg's Gender-Equality Index for the fourth consecutive year (2023). In addition, the company became a signatory of the Principles for Responsible Investment (PRI) in 2021 and has been included in the Dow Jones Sustainability North America Index (2023) for 10 years. To find out how to get help with expenses health insurance doesn't cover, get to know us at aflac.com or aflac.com/espanol. Investors may learn more about Aflac Incorporated and its commitment to corporate social responsibility and sustainability at investors.aflac.com under "Sustainability."

Media contact: Jon Sullivan, 706.573.7610 or jsullivan@aflac.com

Analystandinvestorcontact: David A. Young, 706.596.3264 or dyoung@aflac.com

1 Aflac.com/AWR

2National Cancer Institute's Financial Burden of Cancer Care/Cancer Trends Progress Report

3 LIMRA 2023 US Supplemental Health Insurance Total Market Report.

SOURCE Aflac

View additional multimedia and more ESG storytelling from Aflac Incorporated on 3blmedia.com.

Contact Info:

Spokesperson: Aflac Incorporated

Website: https://www.3blmedia.com/profiles/aflac-incorporated

Email: info@3blmedia.com

SOURCE: Aflac Incorporated

View the original press release on accesswire.com