Critical Mineral Resource at Falchani Exceeds 400,000 t Cesium (M+Ind) Within Existing Lithium Resource

Rhea-AI Summary

American Lithium (OTCQX:AMLIF) reports Falchani contains a globally significant cesium resource within its lithium resource base and announced processing optimization results and pilot plant preparations.

Key facts: Measured 43,539 t Cs; Indicated 392,742 t Cs; Inferred 393,668 t Cs (effective Oct 30, 2023). Test work produced a saleable mixed cesium sulfate (~18% Cs) and high‑purity SOP (45% K). Process improvements: Li recovery ~88%, Cs recovery ~85% with 50% acid recycle; sulfuric acid consumption reduced to ~240 kg/t (~50% lower vs Feb 2024 PEA). Pilot plant equipment testing is underway and pilot operations are expected within a few months.

Positive

- Measured + Indicated cesium ~436,281 tonnes (effective Oct 30, 2023)

- Testwork produced saleable mixed cesium sulfate (~18% Cs)

- High‑purity SOP produced containing 45% K

- Lithium recovery ~88% and cesium recovery ~85% with 50% acid recycle

- Sulfuric acid use cut to ~240 kg/t (~50% reduction vs Feb 2024 PEA)

Negative

- Mineral resources are not mineral reserves and lack demonstrated economic viability

- Cesium sulfate product currently ~18% Cs; further work needed to raise Cs content

- Pilot plant phase not yet started; operations expected only within a few months

News Market Reaction

On the day this news was published, AMLIF gained 19.62%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Major Process Improvements Provide Additional Pilot Plant Optimization Input

VANCOUVER, British Columbia, Oct. 09, 2025 (GLOBE NEWSWIRE) -- American Lithium Corp. (“American Lithium” or the “Company”) (TSX-V:LI | OTCQX:AMLIF | Frankfurt:5LA1) is pleased to highlight the globally significant cesium resource contained within the Falchani Lithium deposit and announce results of recent optimization work on the processing flowsheet, including the potential recovery of cesium by-products.

Cesium is officially recognized as a critical mineral in both the U.S. and Canada due to its rarity, strategic importance, and limited global supply. With the U.S. entirely reliant on imports, Falchani’s scale positions it as one of the world’s largest cesium resources, with potential to strengthen North American supply chains.

Test work was completed at the Australian Nuclear Science and Technology Organization (“ANSTO”) laboratories in Sydney, Australia. In parallel, TECMMINE in Lima, Peru, is currently testing newly acquired component equipment for the pilot plant phase, which is expected to commence within a few months.

Falchani’s volcanic-style lithium mineralization, with naturally low impurities, supports a straightforward flowsheet that produces high-purity lithium carbonate (>

The deposit contains a large-scale cesium resource within the lithium resource base (effective October 30, 2023):

- Measured: 69 Mt at 631 ppm Cs (43,539 t Cs)

- Indicated: 378 Mt at 1,039 ppm Cs (392,742 t Cs)

- Inferred: 506 Mt at 778 ppm Cs (393,668 t Cs)

Test work highlights and meaningful cost improvements include:

- Recycling

50% of acid streams maintains recoveries (Li88% , Cs85% , K35% ). - Counter-current leaching reduces sulfuric acid use to ~240 kg/t acid consumption, nearly

50% lower than outlined in the February 2024 PEA. - Additional savings are expected from reduced reagent demand, smaller gypsum waste volumes, and lower tailings costs.

- Soluble high purity crystalline SOP containing

45% K is produced at low temperatures after the cesium sulphate precipitation.

Alex Tsakumis, Interim CEO of American Lithium stated: “The proven ability to process Falchani’s volcanic lithium rocks into battery-grade lithium carbonate, cesium sulfate, and SOP demonstrates extensive technical progress. Flowsheet improvements that lower costs and enhance project economics show we have advanced well beyond simple resource endowment. Importantly, Peru is a net importer of SOP, and future Falchani operations could help meet domestic demand while also supporting exports.”

Table 1 – Falchani Mineral Resource Estimate – updated October 30, 2023

| Cutoff | Volume | Tonnes | Li | Million Tonnes (Mt) | Cs | K | Rb | ||

| Li (ppm) | (Mm^3) | (Mt) | (ppm) | Li | Li2CO3 | LiOH*H2O | (ppm) | (%) | ppm |

| Measured | |||||||||

| 600 | 29 | 69 | 2792 | 0.19 | 1.01 | 1.15 | 631 | 2.74 | 1171 |

| 1000 | 27 | 65 | 2915 | 0.19 | 1.01 | 1.15 | 647 | 2.71 | 1208 |

| 1200 | 25 | 61 | 3142 | 0.18 | 0.96 | 1.09 | 616 | 2.74 | 1228 |

| Indicated | |||||||||

| 600 | 156 | 378 | 2251 | 0.85 | 4.52 | 5.14 | 1039 | 2.92 | 1055 |

| 1000 | 136 | 327 | 2472 | 0.81 | 4.31 | 4.9 | 1095 | 2.87 | 1104 |

| 1200 | 129 | 310 | 2549 | 0.79 | 4.20 | 4.78 | 1069 | 2.86 | 1146 |

| Measured + Indicated | |||||||||

| 600 | 185 | 447 | 2327 | 1.04 | 5.53 | 6.29 | 976 | 2.90 | 1072 |

| 1000 | 163 | 392 | 2551 | 1.00 | 5.32 | 6.05 | 1021 | 2.84 | 1121 |

| 1200 | 154 | 371 | 2615 | 0.97 | 5.16 | 5.87 | 1009 | 2.84 | 1130 |

| Inferred | |||||||||

| 600 | 198 | 506 | 1481 | 0.75 | 3.99 | 4.54 | 778 | 3.31 | 736 |

| 1000 | 138 | 348 | 1785 | 0.6 | 3.3 | 3.75 | 886 | 3.18 | 796 |

| 1200 | 110 | 276 | 1961 | 0.54 | 2.87 | 3.27 | 942 | 3.10 | 850 |

- CIM definitions are followed for classification of Mineral Resource.

- Mineral Resource surface pit extent has been estimated using a lithium carbonate price of US

$20,000 per tonne and mining cost of US$3.00 per tonne, a lithium recovery of80% , fixed density of 2.40 g/cm3 for the mineralized Upper Breccia, Lithium Rich Tuff and Lower Breccia Geological Units and a fixed density of 2.70 g/cm3 for the mineralized Coarse Felsic Intrusion. - Tonnes are metric.

- Conversions: Li2CO3:Li ratio = 5.32, LiOH.H2O:Li ratio =6.05

- Totals may not represent the sum of the parts due to rounding.

- The Mineral Resource estimate has been prepared by Mariea Kartick, P. Geo., and Derek Loveday, P. Geo. Of Stantec Consulting Services Inc. in conformity with CIM “Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines and are reported in accordance with the Canadian Securities Administrators NI 43-101. Mineral resources are not mineral reserves and do not have demonstrated economic viability. The effective date of the Mineral Resource Estimate is October 30, 2023. There is no certainty that any mineral resource will be converted into mineral reserve.

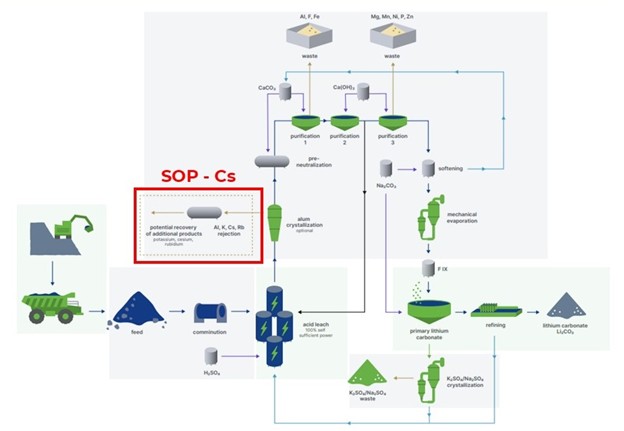

Figure 1 – Schematic Falchani Lithium Carbonate Processing Flowsheet highlighting SOP-Cs Stage

Qualified Person

Mr. Ted O’Connor, P.Geo., a Director of American Lithium, and a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical information contained in this news release.

About ANSTO Minerals

ANSTO Minerals is an international mining consultancy group located in Sydney, Australia, with an experienced team of 60+ engineers, metallurgists, chemists, and scientists who have been providing consulting services and process development services to the mining and minerals processing industries for well over 35 years. ANSTO Minerals has world-leading expertise in uranium ore processing, rare earth processing, zirconium/niobium/hafnium processing, base metals processing, lithium processing (brines and hardrock), and radioactivity control and management.

About TECMMINE

TECMMINE E.I.R.L. is a Peruvian metallurgical consulting company based in Lima, Peru with mineral processing and metallurgical testing laboratory facilities and experienced metallurgical personnel led by Eng. Jose Malqui.

About American Lithium

American Lithium is developing two of the world’s largest, advanced-stage lithium projects, along with the largest undeveloped uranium project in Latin America. They include the TLC claystone lithium project in Nevada, the Falchani hard rock lithium project and the Macusani uranium deposit, both in southern Peru. All three projects have been through robust preliminary economic assessments, exhibit significant expansion potential and enjoy strong community support.

For more information, please contact the Company at info@americanlithiumcorp.com or visit our website at www.americanlithiumcorp.com.

Follow us on Facebook, Twitter and LinkedIn.

On behalf of the Board of Directors of American Lithium Corp.

“Alex Tsakumis”

Interim CEO

Tel: 604 428 6128

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Cautionary Statement Regarding Forward Looking Information

This news release contains certain forward-looking information and forward-looking statements (collectively “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements in this news release include, but are not limited to, statements regarding the business plans, expectations and objectives of American Lithium. Forward-looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend", “indicate”, “scheduled”, “target”, “goal”, “potential”, “subject”, “efforts”, “option” and similar words, or the negative connotations thereof, referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management and are not, and cannot be, a guarantee of future results or events. Although American Lithium believes that the current opinions and expectations reflected in such forward-looking statements are reasonable based on information available at the time, undue reliance should not be placed on forward-looking statements since American Lithium can provide no assurance that such opinions and expectations will prove to be correct. All forward-looking statements are inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including risks, uncertainties and assumptions related to: American Lithium’s ability to achieve its stated goals;, which could have a material adverse impact on many aspects of American Lithium’s businesses including but not limited to: the ability to access mineral properties for indeterminate amounts of time, the health of the employees or consultants resulting in delays or diminished capacity, social or political instability in Peru which in turn could impact American Lithium’s ability to maintain the continuity of its business operating requirements, may result in the reduced availability or failures of various local administration and critical infrastructure, reduced demand for the American Lithium’s potential products, availability of materials, global travel restrictions, and the availability of insurance and the associated costs; the ongoing ability to work cooperatively with stakeholders, including but not limited to local communities and all levels of government; the potential for delays in exploration or development activities; the interpretation of drill results, the geology, grade and continuity of mineral deposits; the possibility that any future exploration, development or mining results will not be consistent with our expectations; risks that permits will not be obtained as planned or delays in obtaining permits; mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes (including work stoppages, strikes and loss of personnel) or other unanticipated difficulties with or interruptions in exploration and development; risks related to commodity price and foreign exchange rate fluctuations; risks related to foreign operations; the cyclical nature of the industry in which American Lithium operates; risks related to failure to obtain adequate financing on a timely basis and on acceptable terms or delays in obtaining governmental approvals; risks related to environmental regulation and liability; political and regulatory risks associated with mining and exploration; risks related to the uncertain global economic environment and the effects upon the global market generally, any of which could continue to negatively affect global financial markets, including the trading price of American Lithium’s shares and could negatively affect American Lithium’s ability to raise capital and may also result in additional and unknown risks or liabilities to American Lithium. Other risks and uncertainties related to prospects, properties and business strategy of American Lithium are identified in the “Risk Factors” section of American Lithium’s Management’s Discussion and Analysis filed on July 30, 2025, and in recent securities filings available at www.sedarplus.ca. Actual events or results may differ materially from those projected in the forward-looking statements. American Lithium undertakes no obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/49947731-23bc-4216-b68d-87514f7a5919