AmeriTrust Announces Second Quarter 2025 Financial Results

Rhea-AI Summary

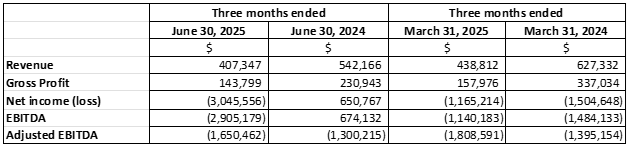

AmeriTrust Financial Technologies (OTCQB:AMTFF), a fintech platform focused on automotive finance, has released its Q2 2025 financial results. The company reported revenue of $407,347, showing a decline from both Q1 2025 ($438,812) and Q2 2024 ($542,166).

The company's cash position decreased to $6.07 million as of June 30, 2025, compared to $10.23 million at the end of 2024. Working capital surplus declined to $2.10 million from $4.00 million in the same period. The quarter's Adjusted EBITDA loss was impacted by foreign exchange movements and increased personnel costs due to new hires.

Positive

- Working capital remains positive at $2.10 million

- Company maintains substantial cash position of $6.07 million

Negative

- Revenue declined 6.7% quarter-over-quarter to $407,347

- Revenue decreased 24.9% year-over-year from $542,166

- Cash position reduced by 40.6% from December 2024

- Working capital surplus decreased by 47.5% from December 2024

- Increased personnel costs impacting EBITDA

News Market Reaction 1 Alert

On the day this news was published, AMTFF gained 7.25%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

TORONTO, ON / ACCESS Newswire / August 27, 2025 / AmeriTrust Financial Technologies Inc. (TSXV:AMT)(OTCQB:AMTFF)(Frankfurt:1ZVA) ("AmeriTrust", "AMT" or the "Company"), a fintech platform targeting automotive finance, is announcing that it has filed its interim Consolidated Financial Statements and Management's Discussion and Analysis report for the three and six months ended June 30, 2025. These documents may be viewed under the Company's profile at www.sedarplus.ca.

Cash on hand at June 30, 2025, was

Revenue for the second quarter of 2025 decreased to

About AmeriTrust Financial Technologies Inc.

AmeriTrust Financial Technologies Inc., listed on the TSX Venture Exchange, OTCQB, and Frankfurt markets, is a finance solution and fintech provider disrupting the automotive industry. AmeriTrust's integrated, cloud-based transaction platform facilitates transactions amongst consumers, dealers, and funders. AmeriTrust's platform is being made available across the United States.

For further information, please visit the AmeriTrust website or contact:

Shibu Abraham

Chief Financial Officer and Director

E: info@ameritrust.com

P: 1-800-600-6872

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Non-IFRS Measures:

This news release makes reference to "EBITDA" and "Adjusted EBIDTA" which are non-IFRS financial measures. The Company believes that these measures provide investors with useful supplemental information about the financial performance of its business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating its business. Although management believes these financial measures are important in evaluating the Company's performance, they are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS. These non-IFRS financial measures do not have any standardized meaning and may not be comparable with similar measures used by other companies. For certain non-IFRS financial measures, there are no directly comparable amounts under IFRS. These non-IFRS financial measures should not be viewed as alternatives to measures of financial performance determined in accordance with IFRS. Moreover, presentation of certain of these measures is provided for year-over-year comparison purposes, and investors should be cautioned that the effect of the adjustments thereto provided herein have an actual effect on the Company's operating results.

"EBITDA" is defined as Earnings before Interest, Taxation, Depreciation and Amortization. Management believes this is a useful metric in evaluating the ongoing operating performance of the Company.

"Adjusted EBITDA" is defined as Earnings before Interest, Taxation, Depreciation, Amortization, Share Based Compensation expense, Provision for expected credit loss on lease contracts and revision to the provision, foreign exchange loss, and other one-time costs is an additional measure used by management to evaluate cash flows and the Company's ability to service debt. Adjusted EBITDA is a non-IFRS measure and should not be considered an alternative to operating income or net income (loss) in measuring the Company's performance.

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements relating to the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects" and similar expressions. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding future plans and objectives of the Company, the intention to grow the business, operations, and existing and potential activities of the Company, future prospects of the Company, the ability of the Company to execute on its business plan and the anticipated benefits of the Company's business plan, negotiations with potential funding partners and the ability of the Company to secure additional funding, are forward looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. As a result, we cannot guarantee that any forward-looking statement will materialize, and the reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated.

Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as at the date of this news release, and the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by Canadian securities law.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States unless registered under the U.S. Securities Act and applicable state securities laws, unless an exemption from such registration is available.

SOURCE: AmeriTrust Financial Technologies Inc.

View the original press release on ACCESS Newswire