Lux Metals to Acquire High-Grade Gold La Grande Project in Quebec

Rhea-AI Summary

Lux Metals (BBBMF) entered an option agreement to acquire a 100% interest in the La Grande Project in James Bay, Québec, subject to a 4% royalty and TSXV approval.

The district-scale project covers 15,357 ha across a >40 km Archean gold trend, with year-round Transtaiga Road access and nearby hydroelectric power. Historical work includes 253 drill holes (52,472 m) and notable intercepts such as 83.8 m @ 7.95 g/t Au. Lux must complete a private placement of at least C$2.0M and, after closing, issue shares equal to 19.9% outstanding to La Pulga; milestone share issuances of 4,000,000 shares apply at defined NI 43-101 resource thresholds.

Positive

- District-scale land package of 15,357 ha

- Over 40 km prospective Archean gold trend

- Year-round road access via Transtaiga Road

- Historical dataset: 253 holes, 52,472 m

- High-grade historical intercept: 83.8 m @ 7.95 g/t Au

Negative

- Immediate share issuance equals 19.9% dilution to existing holders

- Underlying royalty of 4% on project

- Transaction is related-party; requires TSXV review and approval

- Deal requires minimum C$2.0M financing to proceed

- La Pulga may terminate if TSXV approvals not obtained within 60 days

Vancouver, British Columbia--(Newsfile Corp. - November 11, 2025) - Lux Metals Corp. (TSXV: LXM) ("Lux" or the "Company") is pleased to announce that it has entered into an option agreement dated November 10, 2025 (the "Option Agreement") with La Pulga Mining Corp. (the "Optionor") to acquire an undivided

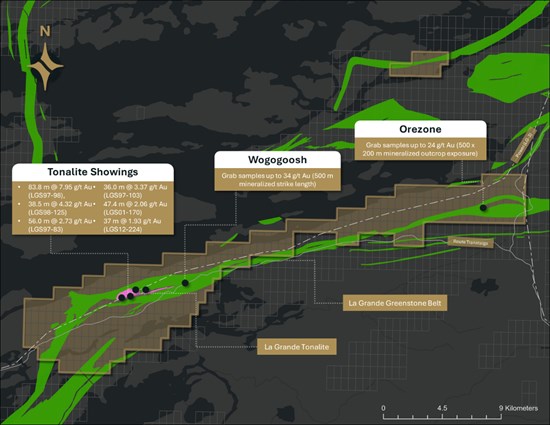

The Project is transected by the all-season Transtaiga Road, approximately 80 kilometres east of the community of Radisson. La Grande comprises 15,357 hectares across two exclusive exploration right (EER) blocks, covering more than 40 kilometres of prospective Archean greenstone belt within the La Grande Subprovince (see Figure 2). The Project is road accessible year-round and is situated close to hydroelectric power infrastructure.

Transaction Highlights

Lux granted an option to acquire a

100% interest in the La Grande Project, a high-grade gold project strategically situated in the James Bay region of Quebec.Notable historical drill results (see Figure 3) include1:

83.8 metres @ 7.95 g/t Au (LGS97-98)

38.5 metres @ 4.32 g/t Au (LGS98-125)

56.0 metres @ 2.73 g/t Au (LGS97-83)

36.0 metres @ 3.37 g/t Au (LGS97-103)

47.4 metres @ 2.06 g/t Au (LGS01-170)

37.0 metres @ 1.93 g/t Au (LGS12-224)

Historical drilling has defined broad, continuous zones of gold mineralization beginning near surface and extending to depths of approximately 300 metres, demonstrating excellent continuity within the mineralized system.

Gold mineralization is structurally controlled, predominantly associated with a regional east-northern shear zone that transects the property.

The Project spans 15,357 ha across 40 km of prospective Archean greenstone belt with historical drilling focused on only a two-kilometre portion of the trend, leaving significant upside potential along strike.

Excellent infrastructure with year-round road access via the Transtaiga Road and proximity to hydroelectric power and service centres in Radisson and the La Grande-4 (LG-4) hydroelectric generating station.

Carl Ginn, President and CEO of Lux, stated: "La Grande represents a rare opportunity to secure a district-scale land package in a proven gold belt. With multiple mineralized zones and a fertile regional shear system extending across the property, the Project offers significant discovery potential. Our exploration strategy will target high-grade zones both down plunge from historical drilling and along untested surface targets along the broader 40-kilometer gold trend."

Figure 1. La Grande regional location map in James Bay, Quebec.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11776/273927_0133cb6e14703a62_001full.jpg

Figure 2. La Grande Project map showing 40km of Archean gold trend, historic drilling and sampling results.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11776/273927_0133cb6e14703a62_002full.jpg

La Grande Project Highlights

The La Grande Project is notable for its large number of gold occurrences and the extent of past exploration. More than a dozen named showings have been documented, including Zone 32, Pari, Ugo, Brèche, Vein Zone, Mico, Milan, Orezone, and Wogogoosh. These mineralized zones occur in varied geological contexts from broad shear-hosted quartz-carbonate systems several metres wide, to narrow laminated quartz veins hosting exceptionally high gold grades. The Zone 32 system has been the most extensively drilled to date and demonstrates both wide, continuous zones of gold mineralization and discrete high-grade intercepts.

The historical results indicate significant widths of mineralization from surface to depths of approximately 300 m, with multiple holes ending in mineralization. While the majority of historical drilling targeted the Zone 32 system, many other showings remain largely untested by drilling despite strong surface results from trenching and channel sampling.

From the mid-1990s through 2015, the La Grande Project saw sustained exploration, including geological mapping, geophysics, geochemistry, trenching, and drilling1. Over this period, 253 diamond drill holes totaling 52,472 metres were completed, primarily on the Zone 32 system, alongside 235 trenches, 14,180 rock and channel samples, and 9,700 till samples. This work defined multiple mineralized trends, returned significant high-grade intercepts, and established a large, well-documented exploration dataset that provides a strong foundation for modern targeting.

Figure 3. Longitudinal Section showing high-grade gold intercepts along 2 km mineralized trend at La Grande

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11776/273927_0133cb6e14703a62_003full.jpg

Geology

La Grande Project is strategically located within a major, regionally extensive shear system developed along the contact between the La Grande Tonalite and adjacent basaltic volcanic rocks. This structural corridor, which transects much of the Project's 40+ kilometre strike length, is recognized as the principal control on gold mineralization in the region.

The tonalite–basalt contact is a particularly favourable host environment, as competency contrasts between lithologies create enhanced fracturing and permeability during deformation, allowing gold-bearing fluids to focus along these boundaries. Within the Project area, these structures range from discrete high-strain zones only a few metres wide to broad shear corridors up to 30 metres in thickness. Alteration is typically dominated by sericite, carbonate, and silica, with sulphide assemblages of pyrite, pyrrhotite, and lesser chalcopyrite and arsenopyrite1. These features are consistent with orogenic gold systems across the Archean greenstone terranes of the Canadian Shield.

Infrastructure

The Project has excellent year-round road access via the Transtaiga Road and is within close proximity to hydroelectric power and service centres in Radisson and LG-4. Québec's James Bay region is consistently ranked among the top jurisdictions globally for mineral exploration and development, offering a stable regulatory framework, modern infrastructure, and strong community and logistical support.

Next Steps

Recent work has transformed the La Grande Project's vast historical dataset into a modern, integrated exploration dataset. All available geological, geochemical, geophysical, and drilling data have been digitized, spatially validated, and compiled into a single database capable of supporting advanced 3D geological modelling. This includes high-resolution drone-based LiDAR and orthophotography, which provide excellent topographic and structural control, as well as recent airborne and ground geophysical surveys that refine the definition of prospective shear zones and associated alteration systems.

This integrated database will allow Lux to rapidly generate and prioritize drill targets by combining historical results with modern structural interpretations, shortening the timeline from acquisition to targeted drilling and reducing duplicate early-stage work.

All reported intervals are downhole core lengths; true widths are not known at this time. The drilling results in this news release are from work conducted by Virginia Gold Mines between 1995 and 2015. The data is considered historical in nature and has been compiled from public sources believed to be accurate. The Company has not verified the historical drilling results, and therefore they should not be relied upon.

Transaction Terms

Under the terms of the Option Agreement, the Company can earn a

a private placement of not less than C

$2,000,000 (the "Financing"); andfollowing completion of the Financing, issuing to La Pulga the number of common shares of the Company ("Shares") equal to

19.9% of the then outstanding Shares following such issuance.

In the event the Company issues a technical report in accordance with National Instrument 43-101 ("NI 43-101") by a "qualified person" (as defined in NI 43-101) over any or all of the Project that demonstrates "mineral resources" (as defined in NI 43-101) of at least 500,000 ounces of gold equivalent mineralization, the Company will issue to La Pulga 4,000,000 Shares. In the event the Company issues a subsequent technical report in accordance with NI 43-101 that demonstrates additional "mineral resources" (as defined in NI 43-101) of at least 2,000,000 ounces of gold equivalent mineralization, the Company will issue to La Pulga an additional 4,000,000 Shares. Notwithstanding the foregoing, the Company will not issue any Shares to La Pulga to the extent that, after giving effect to such issuance, La Pulga will hold in excess of

For so long as La Pulga holds at least

La Pulga will have the right to designate one nominee for election or appointment to the Board of Directors of the Company; and

if the Company desires to sell, transfer or assign its rights in the Project to a third party, La Pulga will have a right of first refusal to acquire such rights on the same terms and conditions which the Company offers the same to a third party.

La Pulga's first Board nominee will be Jean-Félix Lepage, who was elected as a director of the Company at the Company's shareholder meeting held on September 9, 2025.

The Transaction is subject to the final acceptance of the TSX Venture Exchange (the "TSXV"). The Transaction is not an "arm's-length transaction" and therefore constitutes a "reviewable transaction" pursuant to TSXV Policy 5.3, as Jean-Félix Lepage, a director of the Company, is the CEO and a director of La Pulga. No finders' fees will be paid in connection with the Transaction.

La Pulga may unilaterally terminate the Option Agreement if the Company fails to obtain the necessary TSXV approvals within 60 days of the date of the Option Agreement or if the Company does not exercise the Option prior to the date that is 120 days from the date of TSXV acceptance.

Qualified person

The technical content of this news release has been reviewed and approved by Jonathan Marleau, P.Geo., Senior Geologist at Dahrouge Geological Consulting Ltd., an independent consultant of the Company, and a Qualified Person pursuant to National Instrument 43-101.

On Behalf of the Board of Lux Metals Corp.

Carl Ginn

President and Chief Executive Officer

For more information, please contact 604-678-5308 or info@lux-metals.com.

Neither TSX Venture Exchange, the Toronto Stock Exchange nor their Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note regarding Forward-Looking Statements

This press release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation. The forward-looking statements herein are made as of the date of this press release only, and the Company does not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. These forward-looking statements include, among other things: statements relating to the completion of the Financing and the Transaction; including TSXV approval and the closing of the Transaction; and statements relating to the Project, including the Company's future exploration plans.

Such forward-looking statements are based on a number of assumptions of the management of the Company, including, without limitation: that the parties will obtain all necessary corporate and regulatory approvals and consents required for the completion of the Transaction, including TSXV approval; that the other conditions to the completion of the Transaction will be fulfilled; that the Company will be able to complete the Financing; and that the Company will be able to complete planned exploration activities as anticipated.

Additionally, forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of the Company to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: the conditions to the consummation of the Transaction may not be satisfied; the Transaction may involve unexpected costs, liabilities or delays; the failure of the Company to complete the Financing; the failure of the Company to obtain all requisite approvals for the Transaction, including the approval of the TSXV; and the completion of the Transaction may be adversely impacted by changes in legislation, changes in TSXV policies, political instability or general market conditions.

Such forward-looking information represents the best judgment of the management of the Company based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information. Neither the Company nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this press release. Neither the Company nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this press release by you or any of your representatives or for omissions from the information in this press release.

1 Marleau, J., 2025. Assessment Report on the La Grande Project, Québec. Dahrouge Geological Consulting Ltd. for Electric Elements Mining Corp., October 2, 2025

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/273927