Bachem Shows Strong Growth in the First Half of 2025

Rhea-AI Summary

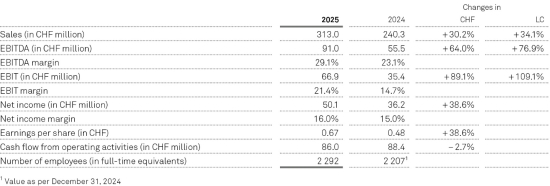

Bachem (OTC:BCHMY) reported robust financial results for H1 2025, with sales reaching CHF 313.0 million, marking a significant increase of 30.2% (34.1% in local currencies) compared to the prior year. The company's EBITDA surged 64% to CHF 91.0 million, with margin expanding to 29.1% from 23.1%.

Commercial API sales grew 32.4% to CHF 168.4 million, while Clinical Development revenue increased 36.9% to CHF 123.7 million. The company has raised its 2025 guidance to 13-18% sales growth and invested CHF 129.1 million in capacity expansion during H1.

Looking ahead, Bachem aims to achieve annual sales exceeding CHF 1 billion and an EBITDA margin over 30% by 2026, supported by significant investments including the new Building K facility and planned expansion in Sisslerfeld.

Positive

- None.

Negative

- Research & Specialties business declined 8.5% to CHF 20.8 million

- Significant capital expenditure requirements with over CHF 400 million planned for 2025

- GMP production in Building K still pending regulatory inspections

Bubendorf, Switzerland--(Newsfile Corp. - July 24, 2025) - Ad hoc announcement pursuant to Art. 53 LR

| Media Release |

Bachem shows strong growth in the first half of 2025

- Group sales showed strong growth reaching CHF 313.0 million (+

30.2% compared to the prior-year period, +34.1% in local currencies). - EBITDA grew to CHF 91.0 million (+

64.0% compared to the prior-year period, +76.9% in local currencies) with a margin of29.1% (prior-year period:23.1% ).

Outlook

- For 2025, Bachem is raising its guidance to between

13% and18% sales growth in local currencies. - Bachem confirms its outlook for an EBITDA margin in 2025 in local currencies in the high twenties.

- The company plans to make investments of more than CHF 400 million in 2025.

- Based on current orders, the company aims for annual sales of more than CHF 1 billion and an EBITDA margin of over

30% in 2026.

A black and white page with numbersAI-generated content may be incorrect.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10552/259916_figure1.jpg

Thomas Meier, CEO of Bachem, on the results for the first half of the year:

"We achieved strong sales growth in the first half of this year and are on a good path to meeting our annual goals. The impact of our ongoing operational excellence measures is becoming more visible. These measures allow us to meet the consistently high demand for peptides even more effectively. Our expansion project Building K is on track to add significant production capacity for our customers. I would particularly like to thank our more than 2 300 colleagues who are making this tremendous development possible.”

Group results

The Bachem Group (SIX: BANB) achieved sales of CHF 313.0 million in the first half of 2025 (+

Operating income before depreciation and amortization (EBITDA) amounted to CHF 91.0 million (+

As a result, the EBITDA margin was

Net income increased to CHF 50.1 million (+

Sales by product category

The Commercial API category achieved sales of CHF 168.4 million (first half of 2024: CHF 127.2 million, +

In the clinical drug development category (CMC Development), sales increased to CHF 123.7 million (first half of 2024: CHF 90.4 million, +

The research chemicals and specialties business (Research & Specialties) delivered CHF 20.8 million (first half of 2024: CHF 22.8 million, -

Substantial capacity expansion

Bachem is pursuing an investment program to expand capacity at all sites. CHF 129.1 million were invested in the first half of 2025 with significant volumes to be invested in the second half of the year. In addition to expansion, Bachem is also continuously optimizing the utilization of existing buildings and facilities through operational improvements.

Bachem began construction of its most advanced production plant for large volumes of peptides and oligonucleotides in 2021 (building “K”) in Bubendorf. The project is on track. First manufacturing lines are commissioned, and technical production activities are progressing. Conditional upon regulatory inspections, Bachem expects GMP production to begin within the course of the second half of 2025. The successful ramp-up of commercial production in the building is a key prerequisite for achieving the revenue target in 2026.

Bachem is planning for a further manufacturing site in Sisslerfeld in the Swiss municipality of Eiken. Bachem has submitted its site development plan (“Entwicklungsrichtplan”) to the authorities and first construction applications are planned for this year.

Bachem continues to invest in its entire network of sites, focusing on site-specific core competencies. In the US, high-volume capacity at the Vista site is being expanded. In Torrance, Bachem is focusing on promising small-volume clinical projects, while investments at the Vionnaz site in Western Switzerland are aimed at securing the supply of key precursors.

Outlook

For 2025 Bachem expects sales growth in local currencies between

The Half-Year Report 2025 and the presentation for the analyst- and media call are available on the website under the following link: https://www.bachem.com/about-bachem/investors-and-media/reports-and-presentations/

Financial Calendar

March 12, 2026 Publication of Annual Report 2025;

Media and Analyst conference

April 29, 2026 Annual General Meeting (financial year 2025)

July 30, 2026 Publication of Half-Year Report 2026

About Bachem

Bachem is a leading, innovation-driven company specializing in the development and manufacture of peptides and oligonucleotides. The company, which has over 50 years of experience and expertise, provides products for research, clinical development, and commercial application to pharmaceutical and biotechnology companies worldwide and offers a comprehensive range of services. Bachem operates internationally with its headquarters in Switzerland and sites in Europe, the US and Asia. The company is listed on the SIX Swiss Exchange. For further information, see www.bachem.com.

| For more information | |

| Media Dr. Daniel Grotzky Head Group Communications Tel.: +41 58 595 2021 | Investors Barbora Blaha Head Investor Relations Tel.: +41 58 595 0573 Email: ir@bachem.com |

This publication may contain specific forward-looking statements, e.g. statements including terms like "believe", "assume", "expect", "forecast", "project", "may", "could", "might", "will" or similar expressions. Such forward-looking statements are subject to known and unknown risks, uncertainties and other factors which may result in a substantial divergence between the actual results, financial situation, development or performance of Bachem Holding AG and those explicitly or implicitly presumed in these statements. Against the background of these uncertainties, readers should not rely on forward-looking statements. Bachem Holding AG assumes no responsibility to up-date forward-looking statements or to adapt them to future events or developments.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/259916