Environmental Scoping Kicks Off Tunkillia PFS & ML Programs

Rhea-AI Summary

Barton Gold Holdings (BGDFF) has initiated environmental scoping work for its Tunkillia Gold Project in South Australia, following the publication of its Optimised Scoping Study (OSS). The project shows promising metrics with projected total production of 942,000 oz gold and ~2M oz silver, with average annual production of ~120,000 oz gold and ~250,000 oz silver.

The project's financial highlights include A$2.7 billion in operating free cashflow, an NPV of A$1.4 billion (at 7.5% discount rate), a 73% IRR, and a 0.8-year payback period. A 'Starter' pit is expected to produce ~206,000 oz gold for A$825 million operating free cash in the first 13 months. The company has engaged ERIAS Group to prepare an environmental Scoping Report, a crucial step toward Mining Lease approval in South Australia.

Positive

- Strong financial metrics with A$2.7B operating free cashflow and 73% IRR

- Significant production scale: 942koz gold and 2Moz silver total

- Quick payback period of 0.8 years

- Initial 'Starter' pit to generate A$825M operating free cash in first 13 months

- Company plans transition to producer status from 2026

Negative

- Environmental and Mining Lease approvals still pending

- Project execution dependent on successful completion of environmental assessments

News Market Reaction

On the day this news was published, BGDFF gained 3.33%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Scoping Report to define environmental programs for ML Application

HIGHLIGHTS

Recent Tunkillia OSS confirms large-scale gold project generating

$2.7b n operating free cash1Barton Gold fully funded to accelerate key long-lead PFS and Mining Lease programs

ERIAS engaged to lead environmental assessments for future Mining Lease applications

ADELAIDE, AUSTRALIA / ACCESS Newswire / May 7, 2025 / Barton Gold Holdings Limited (ASX:BGD)(FRA:BGD3)(OTCQB:BGDFF) (Barton or Company) is pleased to announce the acceleration of long-lead feasibility work programs for its South Australian Tunkillia Gold Project (Tunkillia) following the recent publication of Tunkillia's Optimised Scoping Study (OSS). The Tunkillia OSS has identified a compelling large-scale operation with (at an A

total payable metal: 942koz gold and ~2Moz silver

avg annual production: ~120koz gold and ~250koz silver

operating free cashflow: A

$2.7 billion Net Present Value (NPV

7.5% ): A$1.4 billion Internal Rate of Return (IRR):

73% Payback period: 0.8 years

andA 'Starter' pit producing ~206koz Au for A

$825m operating free cash in the first 13 months

Barton has now engaged the ERIAS Group to prepare an environmental 'Scoping Report', which is the first step in the environmental and Mining Lease (ML) approvals process in South Australia. Once agreed with South Australia's Department for Energy and Mining (DEM), the Scoping Report will set out the agreed scope of works for Tunkillia environmental assessments which will then support a future ML application.

Commenting on the appointment of ERIAS Group, Barton MD Alexander Scanlon said:

"Tunkillia's new Optimised Scoping Study has confirmed a large-scale, competitive gold and silver operation with significant economies of scale offering strong financial and capital leverage to a rapidly evolving gold market.

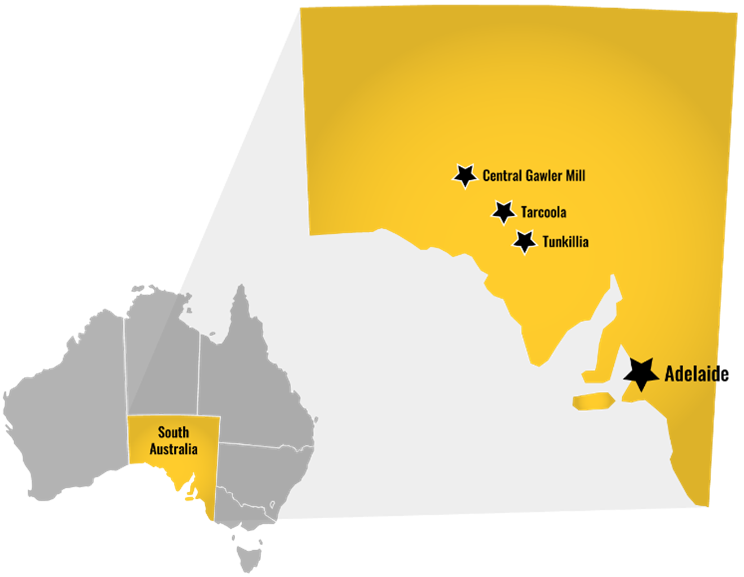

"We are accelerating Tunkillia in parallel with studies for 'Stage 1' operations leveraging our Central Gawler Mill. Our goal is to transition to 'producer' from 2026, generate cash flows, and then use these to develop Tunkillia as our 'Stage 2' expansion project for a lower-cost, lower-risk and lower-dilution pathway to 150,000ozpa gold.

"We are pleased to work with ERIAS as a leading South Australian environmental and social impact advisor."

1 Refer to ASX announcement dated 5 May 2025

Authorised by the Managing Director of Barton Gold Holdings Limited.

For further information, please contact:

Alexander Scanlon | Jade Cook |

About Barton Gold

Barton Gold is an ASX, OTCQB and Frankfurt Stock Exchange listed Australian gold developer targeting future gold production of 150,000ozpa with 1.7Moz Au & 3.1Moz Ag JORC Mineral Resources (64.0Mt @ 0.83 g/t Au), brownfield mines, and

Tarcoola Gold Project

Tunkillia Gold Project

Key Regional Infrastructure

|  |

Competent Persons Statement & Previously Reported Information

The information in this announcement that relates to the historic Exploration Results and Mineral Resources as listed in the table below is based on, and fairly represents, information and supporting documentation prepared by the Competent Person whose name appears in the same row, who is an employee of or independent consultant to the Company and is a Member or Fellow of the Australasian Institute of Mining and Metallurgy (AusIMM), Australian Institute of Geoscientists (AIG) or a Recognised Professional Organisation (RPO). Each person named in the table below has sufficient experience which is relevant to the style of mineralisation and types of deposits under consideration and to the activity which he has undertaken to quality as a Competent Person as defined in the JORC Code 2012 (JORC).

Activity | Competent Person | Membership | Status |

Tarcoola Mineral Resource (Stockpiles) | Dr Andrew Fowler (Consultant) | AusIMM | Member |

Tarcoola Mineral Resource (Perseverance Mine) | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Tarcoola Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tarcoola Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Exploration Results (until 15 Nov 2021) | Mr Colin Skidmore (Consultant) | AIG | Member |

Tunkillia Exploration Results (after 15 Nov 2021) | Mr Marc Twining (Employee) | AusIMM | Member |

Tunkillia Mineral Resource | Mr Ian Taylor (Consultant) | AusIMM | Fellow |

Challenger Mineral Resource | Mr Dale Sims (Consultant) | AusIMM / AIG | Fellow / Member |

The information relating to historic Exploration Results and Mineral Resources in this announcement is extracted from the Company's Prospectus dated 14 May 2021 or as otherwise noted in this announcement, available from the Company's website at www.bartongold.com.au or on the ASX website www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the Exploration Results and Mineral Resource information included in previous announcements and, in the case of estimates of Mineral Resources, that all material assumptions and technical parameters underpinning the estimates, and any production targets and forecast financial information derived from the production targets, continue to apply and have not materially changed. The Company confirms that the form and context in which the applicable Competent Persons' findings are presented have not been materially modified from the previous announcements.

Cautionary Statement Regarding Forward-Looking Information

This document may contain forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "expect", "target" and "intend" and statements than an event or result "may", "will", "should", "would", "could", or "might" occur or be achieved and other similar expressions. Forward-looking information is subject to business, legal and economic risks and uncertainties and other factors that could cause actual results to differ materially from those contained in forward-looking statements. Such factors include, among other things, risks relating to property interests, the global economic climate, commodity prices, sovereign and legal risks, and environmental risks. Forward-looking statements are based upon estimates and opinions at the date the statements are made. Barton undertakes no obligation to update these forward-looking statements for events or circumstances that occur subsequent to such dates or to update or keep current any of the information contained herein. Any estimates or projections as to events that may occur in the future (including projections of revenue, expense, net income and performance) are based upon the best judgment of Barton from information available as of the date of this document. There is no guarantee that any of these estimates or projections will be achieved. Actual results will vary from the projections and such variations may be material. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. Any reliance placed by the reader on this document, or on any forward-looking statement contained in or referred to in this document will be solely at the readers own risk, and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof.

* Refer to Barton Prospectus dated 14 May 2021 and ASX announcement dated 4 March 2025. Total Barton JORC (2012) Mineral Resources include 909koz Au (30.8Mt @ 0.92 g/t Au) in Indicated category and 799koz Au (33.2Mt @ 0.75 g/t Au) in Inferred category, and 3,070koz Ag (34.5Mt @ 2.80 g/t Ag) in Inferred category as a subset of Tunkillia gold JORC (2012) Mineral Resources.

SOURCE: Barton Gold Holdings Limited

View the original press release on ACCESS Newswire