Bunker Hill Announces Agreement to Acquire the Historic Ranger-Page Silver- Lead-Zinc Mines to Expand Exploration Potential in the Silver Valley of Idaho

Rhea-AI Summary

Bunker Hill Mining (OTCQB: BHLL) announced on October 27, 2025 that subsidiary Silver Valley Metals entered an asset purchase agreement to acquire the historic Ranger-Page silver-lead-zinc mines, adding ~1,205 acres to create a contiguous land package exceeding 6,200 acres in Idaho's Silver Valley.

The deal consideration is US$2.4M paid as 23,333,334 Bunker Hill shares (escrowed in tranches); closing is subject to TSX-V approval. Historical data show substantial past production (estimated 1.1B lbs Pb+Zn and 14.6M oz Ag) and a reported historical remaining resource of 218,000 tons at high grades, though that estimate is not NI 43-101 compliant.

Positive

- Consolidated land package exceeding 6,200 acres

- Adds approximately 1,205 acres to claim holdings

- Historic production: 1.1B lbs zinc+lead and 14.6M oz silver

- Transaction price US$2.4M for 100% Ranger-Page interest

- Supports restart plan targeted for H1 2026

Negative

- Consideration issued as 23,333,334 shares (potential dilution)

- Acquisition subject to TSX-V approval

- Historic remaining resource not NI 43-101 and unverified

- Prior mining ceased after low prices and a mill-destroying fire

News Market Reaction

On the day this news was published, BHLL gained 6.35%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

KELLOGG, Idaho and VANCOUVER, British Columbia, Oct. 27, 2025 (GLOBE NEWSWIRE) -- October 27, 2025 – Bunker Hill Mining Corp. (“Bunker Hill” or the “Company”) (TSX-V: BNKR |OTCQB: BHLL) is pleased to announce that its wholly-owned subsidiary Silver Valley Metals Corp., has entered into an asset purchase agreement with Silver Dollar Resources (Idaho) Inc., a subsidiary of Silver Dollar Resources Inc. (“Silver Dollar”), to acquire the Ranger-Page property which includes, six past-producing underground high-grade silver-lead-zinc mines located immediately adjacent to and to the west of the Bunker Hill Mine in the prolific Silver Valley mining district of Idaho, USA (the “Ranger-Page Mines”).

The acquisition is expected to consolidate one of the most historically productive areas of the Coeur d’Alene Mining District under Bunker Hill’s control, increasing the size of the Company’s mineral claim package by approximately 1,205 acres (4.8 km²). The asset acquisition will also include an extensive historical geological database. Contingent on exploration success, this could extend operational life at Bunker Hill, maximize economies of scale, and unlock additional local synergies.

Strategic Highlights

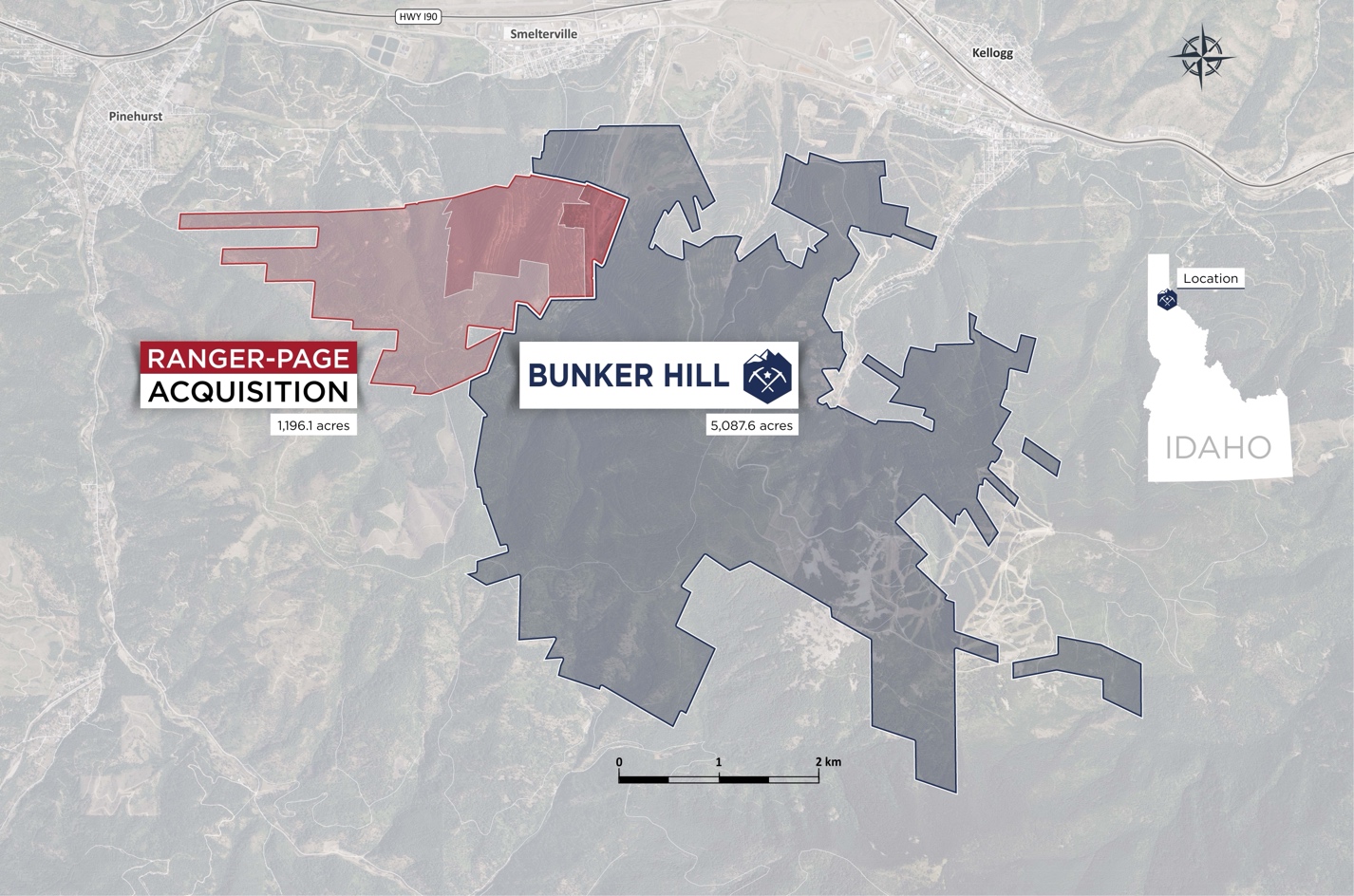

- Consolidated Land Position: The acquisition, once complete, will unite the Ranger-Page Mines and Bunker Hill mine (the “Bunker Hill Mine”) into a contiguous land package exceeding 6,200 acres (25 km2), creating one of the largest and most prospective holdings in the Silver Valley (Figure 1).

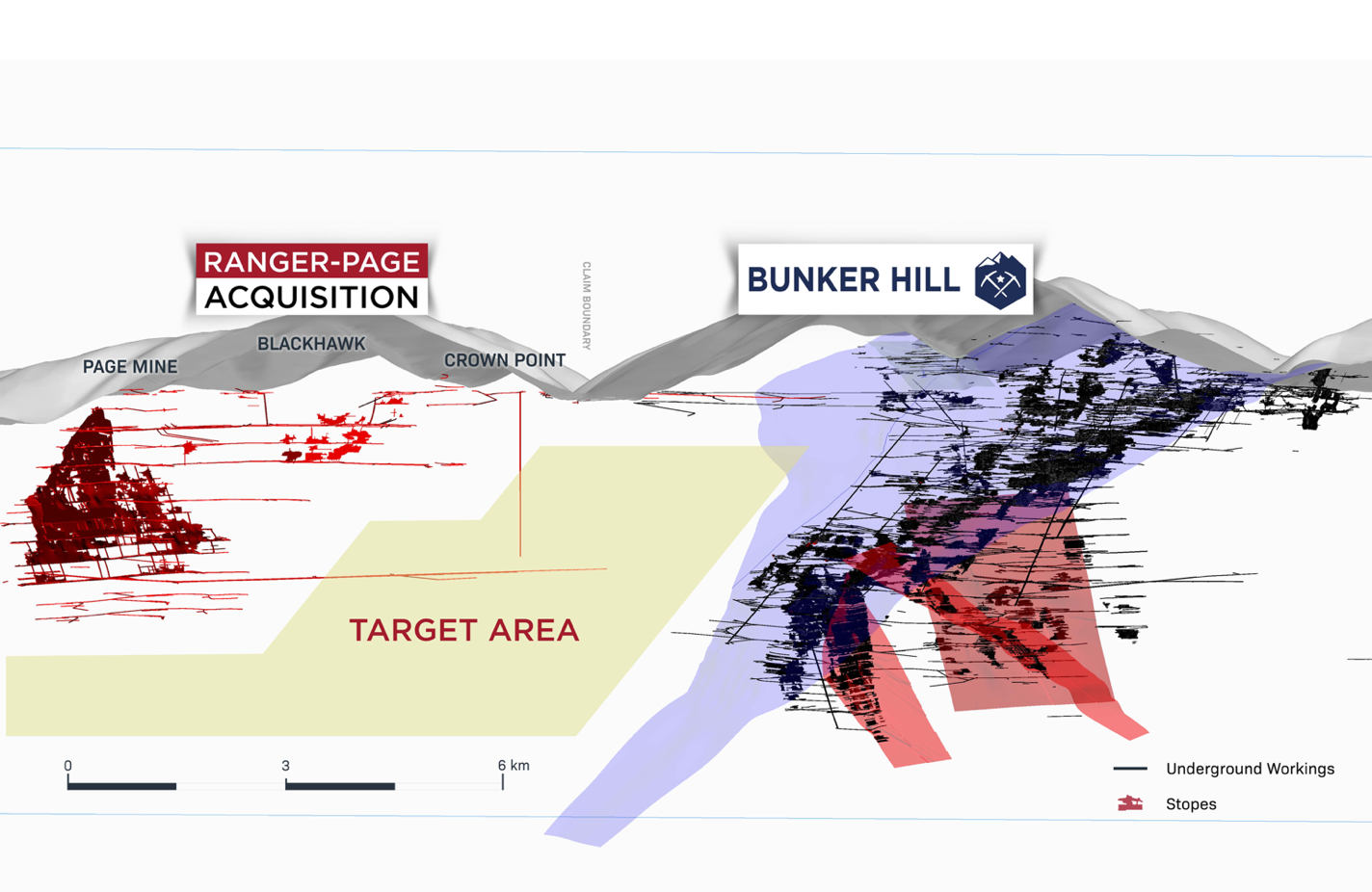

- Exploration Upside: Historical drilling and production data from the Ranger-Page Mines indicate high-grade silver-lead-zinc mineralization remains open at depth and along strike (Figure 2) (Drill hole 34-142_NE: 8 feet at 9.41 opt Ag,

13.4% Pb,3.1% Zn - see March 11, 2025 release here). - Infrastructure Synergies: The Ranger-Page Mines’ existing underground workings and surface access points could provide additional flexibility for future mine planning, ventilation, and exploration access to deeper levels of the Bunker Hill Mine system.

- Complementary to Restart Plan: The acquisition, once complete, will align with Bunker Hill’s ongoing restart of operations at the Bunker Hill Mine, targeted for H1 2026, and will enhance the Company’s upside optionality for future resource expansion and mill feed sources.

- Community benefits: This has the potential to create more local employment opportunities within the Silver Valley and stimulate procurement from regional suppliers in ways that benefit the local communities.

Sam Ash, President and CEO of Bunker Hill Mining, stated: “The addition of the Ranger-Page Mines will be another key step in our vision to re-establish Bunker Hill as a leading producer in the Silver Valley. The Ranger-Page mine infrastructure and mineralized zones are geologically continuous with the Bunker Hill system, offering immediate synergies for exploration, development, and potential future production.”

Figure 1 – Increased Overall Exploration Land Package

Figure 2 – Bunker Hill & Ranger Page Cross-section

| Galena-Quartz Veins: Pb-Ag | |

| Blue Bird Veins: Zn-Pb-Ag |

Highlights of the Ranger-Page Mines include:

- Silver, plus high-grade lead and zinc: High-grade historic production, the Ranger-Page Mines complex was a top 10 producer in the Silver Valley, estimated to have produced 1.1B pounds of zinc and lead mined and 14.6M ounces of silver.

- Six historic mines: Two historic mines produced to depths of 2,644 feet (805.9 m) and 1,200 feet (365.8 m), respectively. Four of the six mines were less than 200 feet (61 m) in depth, leaving significant open-ended exploration potential at depth.

- Historical remaining mine resource of 218,000 tons grading 87.4 g/t silver,

10.34% zinc, and5.22% lead. The estimated results were constrained by the depth of the Page Mine shaft. Mining ceased during a difficult period of historically low metal prices, compounded by a fire which destroyed the mill. No systematic exploration work was ever conducted to expand these estimated resources at depth. Note that a Qualified Person has not reviewed the historical data and has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserve. It is not known what parameters were used to calculate the historic mineral resource. The historic resource is not being treated by the Company as a Canadian NI 43-101 compliant resource and is listed here for reference only. - Under-explored property package: In particular, the area between the Ranger-Page Mines and Bunker Hill Mines – “the Silver Gap”, which contains similar host geology and structural framework. Due to the fragmented historical ownership, this highly prospective ~4km trend remains unexplored.

- Recent work by Silver Dollar identified numerous near-surface exploration targets along structures hosting historic mines on the Ranger-Page Mines. Maiden drilling on the Wyoming Target intercepted potentially underground mineable silver-lead-zinc mineralization in all three holes, including 162 g/t Ag,

15.5% Pb and4.1% Zn over 10 ft (3.04m) (drilled thickness, true thickness unknown) - see March 11, 2025, release here. - Patented lode claims: Ownership of surface and mineral rights.

Transaction Summary

Under the terms of the agreement, Bunker Hill will acquire

| Release Date | Payment Shares Release to Vendor Parent from Contractual Escrow |

| 6-month anniversary of closing date | 2,333,333 Payment Shares |

| 9-month anniversary of closing date | 2,333,333 Payment Shares |

| 12-month anniversary of closing date | Balance of the Payment Shares (18,666,668 Payment Shares) |

The completion of the acquisition will be subject to the approval of the TSX Venture Exchange (“TSX-V”). The Payment Shares will be subject to a four-month and one-day hold period from the date of issuance.

Conference Call and Webcast

Bunker Hill will host a webinar on October 30, 2025, at 8:00 a.m. PST | 11:00 a.m. EST. Participants may join the webinar by registering at the link below:

https://us06web.zoom.us/meeting/register/6HanpIlNSgSJHetEOcdSBQ

A replay of this webinar will be available on Bunker Hill’s website.

About Bunker Hill Mining Corp.

Bunker Hill is an American mineral exploration and development company focused on revitalizing our historic mining asset: the renowned zinc, lead, and silver deposit in northern Idaho’s prolific Coeur d’Alene mining district. This strategic initiative aims to breathe new life into a once-productive mine, leveraging modern exploration techniques and sustainable development practices to unlock the potential of this mineral-rich region. Bunker Hill Mining Corp. aims to maximize shareholder value by responsibly harnessing the mineral wealth in the Silver Valley mining district, focusing our efforts on this single, high-potential asset. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR+ and EDGAR databases.

On behalf of Bunker Hill Mining Corp.

Sam Ash

President and Chief Executive Officer

For additional information, please contact:

Brenda Dayton

Vice President, Investor Relations

T: 604.417.7952

E: brenda.dayton@bunkerhillmining.com

Cautionary Statements

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations (collectively, “forward-looking statements”). Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, “plan” or variations of such words and phrases.

Forward-looking statements in this news release include, but are not limited to, statements regarding the Company’s objectives, goals or future plans, including the restart and development of the Bunker Hill Mine; the achievement of future short-term, medium-term and long-term operational strategies; use and the expected benefits derived from the historical geological database obtained in the acquisition, including potential extension of operational life at Bunker Hill, efficiencies derived from economies of scale and availability of local synergies; whether indicated grade and other qualities of certain minerals remain open at depth and along strike; any benefits derived from the Ranger-Page Mines' existing underground workings and surface access points, including relating to future mine planning, ventilation and exploration access to deeper levels of the Bunker Hill Mine system; timing of operations at the Bunker Hill Mine; potential for future production at the Bunker Hill Mine; any enhancements to upside optionality for future resource expansion and mill feed sources; benefits to the local community including job creation and stimulation of procurement from regional suppliers; payments and timing of payments relating to the contractual escrow under the asset purchase agreement for the Ranger-Page Mines; and the timing of the webinar.

Factors that could cause actual results to differ materially from such forward-looking statements include, but are not limited to, those risks and uncertainties identified in public filings made by Bunker Hill with the SEC and with applicable Canadian securities regulatory authorities, and the following: the Company’s ability to raise additional capital for project activities on acceptable terms or at all; Bunker Hill’s ability to operate as a going concern and its history of losses; failure to obtain TSX-V approval; the fluctuating price of commodities; capital market conditions; restrictions on labor and its effects on international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the preliminary nature of metallurgical test results; the Company’s ability to restart and develop the Bunker Hill Mine and the risks of not basing a production decision on a feasibility study of mineral reserves demonstrating economic and technical viability, resulting in increased uncertainty due to multiple technical and economic risks of failure which are associated with this production decision including, among others, areas that are analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit, with no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved; failure to commence production would have a material adverse impact on the Company's ability to generate revenue and cash flow to fund operations; failure to achieve the anticipated production costs would have a material adverse impact on the Company's cash flow and future profitability; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine complex; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; and capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements in this news release are reasonable, undue reliance should not be placed on such statements or information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all, including as to whether or when the Company will achieve its project finance initiatives, or as to the actual size or terms of those financing initiatives. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Readers are cautioned that the foregoing risks and uncertainties are not exhaustive. Additional information on these and other risk factors that could affect the Company’s operations or financial results are included in the Company’s annual information form or annual report and may be accessed through the SEDAR+ website (www.sedarplus.ca) or through EDGAR on the SEC website (www.sec.gov), respectively.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/bdc54ef4-e2ec-4237-b56b-a86eedac8919

https://www.globenewswire.com/NewsRoom/AttachmentNg/90c9120b-5078-4d2f-9725-a32bea717938