Bitmine Publishes New Chairman's Message Explaining Why Shareholders Should Vote YES to Approve the Amendment to Increase Authorized Shares

Rhea-AI Summary

Bitmine (NASDAQ: BMNR) published a Chairman's message asking shareholders to vote YES on Proposal 2 to increase authorized shares from 500 million to 50 billion. The voting deadline is January 14, 2026 at 11:59 p.m. ET; the annual meeting is January 15, 2026 at Wynn Las Vegas and will be livestreamed.

The company lists three reasons for the increase: capital markets flexibility (ATMs, convertibles, warrants), opportunistic deals including mergers and acquisitions, and the ability to implement future stock splits. The message links BMNR share moves to Ethereum price using a stated coefficient and shows illustrative BMNR price targets and corresponding split ratios for hypothetical ETH outcomes.

Positive

- Authorized shares increase enables ATMs, convertibles, and warrants

- Gives flexibility to pursue mergers, acquisitions, and opportunistic deals

- Allows future stock splits to keep per-share price accessible to retail investors

Negative

- Authorized shares jump 100x from 500 million to 50 billion, enabling significant dilution

- Stock splits and capital raises would increase shares outstanding materially

- BMNR price scenarios presented are illustrative and not forecasts, offering no guaranteed shareholder benefit

News Market Reaction – BMNR

On the day this news was published, BMNR gained 14.88%, reflecting a significant positive market reaction. Argus tracked a peak move of +10.6% during that session. Our momentum scanner triggered 134 alerts that day, indicating very high trading interest and price volatility. This price movement added approximately $1.72B to the company's valuation, bringing the market cap to $13.30B at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Crypto/fintech peers on the momentum scanner (e.g., WULF, IREN, MARA, RIOT) show gains around 9–11%, while BMNR was down 2.06% pre‑news. This divergence suggests the authorized-share amendment focus is more company-specific than sector-driven.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 22 | Crypto holdings update | Positive | -0.9% | Reported $13.2B in crypto, cash and moonshots plus 4,066,062 ETH holdings. |

| Dec 19 | Annual meeting invite | Neutral | +10.3% | Invited stockholders to Jan 15, 2026 Las Vegas meeting and outlined agenda. |

| Dec 08 | Crypto holdings update | Positive | +5.2% | Disclosed $13.2B in assets and ETH holdings exceeding 3.86 million tokens. |

| Dec 01 | Crypto holdings update | Positive | -12.6% | Announced $12.1B in assets and accelerated ETH purchases ahead of upgrade. |

| Nov 24 | Crypto holdings update | Positive | +19.6% | Reported $11.2B in assets and 3.63M ETH, about 3% of supply. |

News emphasizing ETH treasury growth often triggered large but mixed price reactions, with both strong rallies and sharp selloffs, while procedural meeting communications sometimes coincided with double‑digit gains.

Over the last several months, Bitmine repeatedly highlighted rapid growth in its ETH treasury and total crypto plus cash holdings, reaching multi‑billion‑dollar levels by late 2025. These updates (tags largely "crypto") sometimes led to sharp moves, both positive and negative, showing volatile sentiment around its ETH-centric strategy. Separately, the company has been building toward the Jan 15, 2026 annual meeting via invitations and proxy materials. Today’s Chairman’s message about increasing authorized shares fits into this broader effort to align the capital structure with its Ethereum-focused plans and anticipated corporate actions.

Regulatory & Risk Context

The company has an effective S-3ASR shelf registration dated 2025-07-28, expiring 2028-07-28, with at least 2 prior takedowns via 424B5. This provides a ready mechanism to raise capital that could interact with the proposed increase in authorized shares by facilitating future offerings.

Market Pulse Summary

The stock surged +14.9% in the session following this news. A strong positive reaction aligns with Bitmine’s pattern of sharp moves around strategic announcements and ETH-related positioning. The Chairman’s message connects a massive authorized-share increase from 500 million to 50 billion with plans for capital markets transactions and potential future stock splits tied to Ethereum-linked valuation scenarios. Investors would need to balance enthusiasm for ETH exposure with the company’s effective S-3ASR shelf and prior 424B5 usage, which together enable sizable future issuance that could affect existing holders.

Key Terms

at-the-market offerings financial

convertibles financial

warrants financial

stock splits financial

tokenization technical

payment rails technical

ETH/BTC technical

AI-generated analysis. Not financial advice.

BMNR shareholders are encouraged to review the Chairman's message and vote on the 4 proposals prior to the January 14, 2026 deadline

Bitmine will hold its Annual Stockholder Meeting at the Wynn Las Vegas on January 15, 2026

Bitmine remains supported by a premier group of institutional investors including ARK's Cathie Wood, MOZAYYX, Founders Fund, Bill Miller III, Pantera, Kraken, DCG, Galaxy Digital and personal investor Thomas "Tom" Lee to support Bitmine's goal of acquiring

The voting deadline is January 14, 2026 at 11:59 p.m. ET.

In the video, Chairman Tom Lee explains the rationale behind Proposal 2, which seeks shareholder approval to amend the Company's Amended and Restated Certificate of Incorporation to increase authorized shares from 500 million to 50 billion.

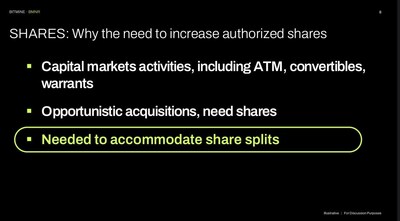

There are three reasons the Company needs to increase authorized shares:

- It would allow Bitmine to conduct capital markets activities, including at-the-market offerings, convertibles, and warrants.

- It would provide flexibility to pursue opportunistic deals, including potential mergers or acquisitions.

- Most importantly, it would enable the Company to implement future stock splits as needed.

Since pivoting in July to make Ethereum (ETH) its primary treasury asset, Bitmine has observed that its share price has closely tracked movements in ETH.

*Coefficient (per Bloomberg) is 0.015 ETH price plus accretion of ETH/share

The scatter chart in the gallery above shows the clear linkage (x-axis is ETH, y-axis is BMNR).

The Company believes Ethereum represents the future of finance, a supercycle driven by Wall Street reengineering on the blockchain. Major industry leaders agree, including Larry Fink, CEO of BlackRock, who said that tokenization is the next evolution of global markets. And the vast majority of tokenization is happening on Ethereum.

Previously, Bitmine noted its view that tokenization will drive ETH/BTC to reach all-time highs (0.0873).

- Targeting 0.25 as Ethereum proves to be the future of finance

This implies future ETH prices of:

$12 k$22 k$62 k$250 k$1m m)

These potential future ETH prices can be used to calculate "implied" future BMNR prices**

$22 k$500 $62.5 k$1,500 $250 k$5,000

**These are using the coefficient 0.15* ETH plus assumed accretion ETH/share of

To keep shares "accessible" to the public, the Company would want to split the shares, to reset the share price back towards

If BMNR shares are:

$500 $1,500 $5,000

These splits will increase total shares outstanding. Thus, Bitmine can only split shares in the future if the total authorized shares is increased.

Shareholders are encouraged to review the Chairman's message and vote prior to the January 14, 2026 deadline and are welcome to attend the annual meeting on January 15, 2026, at the Wynn Las Vegas.

You need to register in advance, to attend the meeting, please see here: https://web.viewproxy.com/BMNR/2026

The annual meeting will be livestreamed on Bitmine's X account: https://x.com/bitmnr

The Fiscal Full Year 2025 Earnings presentation and corporate presentation can be found here: https://bitminetech.io/investor-relations/

The Chairman's message can be found here:

https://www.bitminetech.io/chairmans-message

To stay informed, please sign up at: https://bitminetech.io/contact-us/

About Bitmine

Bitmine is a Bitcoin and Ethereum Network Company with a focus on the accumulation of Crypto for long term investment, whether acquired by our Bitcoin mining operations or from the proceeds of capital raising transactions. Company business lines include Bitcoin Mining, synthetic Bitcoin mining through involvement in Bitcoin mining, hashrate as a financial product, offering advisory and mining services to companies interested in earning Bitcoin denominated revenues, and general Bitcoin advisory to public companies. Bitmine's operations are located in low-cost energy regions in

For additional details, follow on X:

https://x.com/bitmnr

https://x.com/fundstrat

https://x.com/bmnrintern

Forward Looking Statements

This press release contains statements that constitute "forward-looking statements." The statements in this press release that are not purely historical are forward-looking statements which involve risks and uncertainties. This document specifically contains forward-looking statements regarding progress and achievement of the Company's goals regarding ETH acquisition and staking, the long-term value of Ethereum, continued growth and advancement of the Company's Ethereum treasury strategy and the applicable benefits to the Company. In evaluating these forward-looking statements, you should consider various factors, including Bitmine's ability to keep pace with new technology and changing market needs; Bitmine's ability to finance its current business, Ethereum treasury operations and proposed future business; the competitive environment of Bitmine's business; and the future value of Bitcoin and Ethereum. Actual future performance outcomes and results may differ materially from those expressed in forward-looking statements. Forward-looking statements are subject to numerous conditions, many of which are beyond Bitmine's control, including those set forth in the Risk Factors section of Bitmine's Form 10-K filed with the Securities and Exchange Commission (the "SEC") on November 21, 2025, as well as all other SEC filings, as amended or updated from time to time. Copies of Bitmine's filings with the SEC are available on the SEC's website at www.sec.gov. Bitmine undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/bitmine-publishes-new-chairmans-message-explaining-why-shareholders-should-vote-yes-to-approve-the-amendment-to-increase-authorized-shares-302651806.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/bitmine-publishes-new-chairmans-message-explaining-why-shareholders-should-vote-yes-to-approve-the-amendment-to-increase-authorized-shares-302651806.html

SOURCE BitMine Immersion Technologies, Inc.