Benton Provides Update on Its Stake in Clean Air Metals Inc. - New PEA Delivers C$219.4M pre-tax NPV, 39% IRR for the Thunder Bay North Project

Rhea-AI Summary

Benton (BNTRF) reports Clean Air Metals' new PEA for the Thunder Bay North project with a pre-tax NPV8 of C$219.4M and pre-tax IRR of 39% against a project capital cost of C$89.5M. After-tax NPV is C$157.5M and after-tax IRR is 32%. At spot prices the pre-tax NPV8 rises to C$316M with a pre-tax IRR of 52%.

The study designs a low-cost operation using temporary infrastructure and toll milling, with a 2.5-year capital payback and projected 45% operating margin. Updated resources: 14.9M t indicated @ 2.66 g/t 2PGE, 0.40% Cu, 0.24% Ni; plus 2.49M t inferred @ 1.62 g/t 2PGE. Benton holds 24.6M shares (9.8%) of Clean Air Metals and a 0.5% NSR on specified deposits.

Positive

- Pre-tax NPV8 of C$219.4M

- Pre-tax IRR of 39% (after-tax 32%)

- Project capital cost of C$89.5M with 2.5-year payback

- Indicated resource: 14.9M t @ 2.66 g/t 2PGE

- Benton equity stake of 24.6M shares (9.8%) and a 0.5% NSR

Negative

- No mineral reserves reported

- Inferred resource limited to 2.49M t at lower grade

- Project requires upfront capital of C$89.5M to develop

News Market Reaction – BNTRF

On the day this news was published, BNTRF gained 62.41%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Thunder Bay, Ontario--(Newsfile Corp. - October 9, 2025) - Benton Resources Inc. (TSXV: BEX) ("Benton" or the "Company") is pleased to announce that the newly announced Clean Air Metals PEA Delivers C

Highlights from the Clean Air announcement.

- The project has a

$219.4M 1 pre-tax NPV8 against a project capital cost of$89.5M . After-tax NPV of$157.5M - The pre-tax internal rate of return (IRR) is

39% , and the after-tax IRR is32% - At spot pricing1, pre-tax NPV8 totals

$316M with pre-tax IRR of52% - The asset is designed from the ground up as a low-cost, high-margin producer with access to the first seven months from collaring the ramp portal. The project maximizes the use of temporary infrastructure and utilizes toll milling at a nearby facility

- The capital payback is 2.5 years from the start of production through healthy operating margins of

45% - Baseline environmental studies are primarily completed to support future permitting of the project

- The Project is near the City of Thunder Bay, Canada, where key highway and electrical infrastructure and support are located

- The Company has positive relationships and is working closely with nearby Indigenous communities to allow full and meaningful participation in the project

- The resource has been updated with additional drilling and new pricing, highlighting a 14.9M tonne indicated resource grading 2.66 g/t 2PGE2,

0.40% Cu and0.24% Ni - Additionally, there are 2.49M tonnes of inferred resource grading 1.62 g/t 2PGE2,

0.31% Cu and0.19% Ni. There are no reserves

SOURCE: Clean Air Metals, Inc.

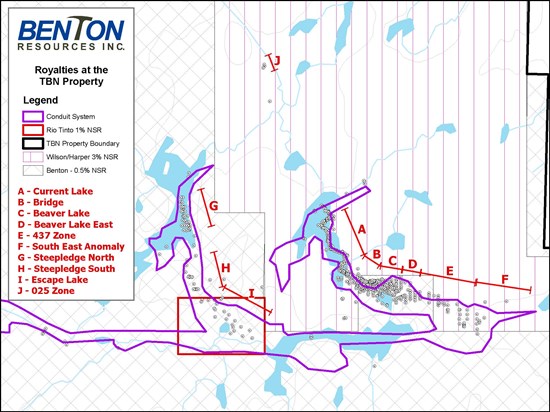

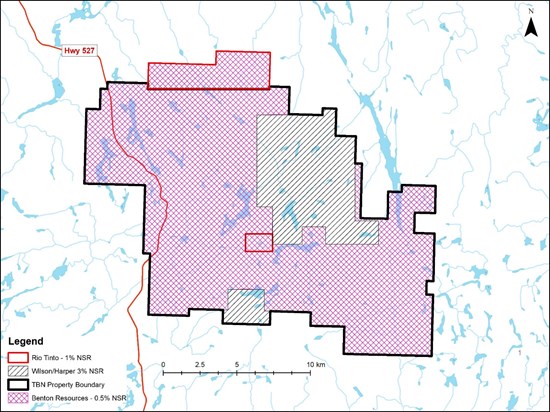

Maps: Benton's Interest for Thunder Nay North and Escape Lake Deposits.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3657/269811_80bddeefd4003815_002full.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3657/269811_80bddeefd4003815_003full.jpg

Benton Resources is a well-financed mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Benton has a diversified, highly prospective property portfolio and holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains net smelter return (NSR) royalties with potential long-term cash flow.

Benton is focused on advancing its high-grade Copper-Gold Great Burnt Project in central Newfoundland, which has a Mineral Resource estimate of 667,000 tonnes @

On behalf of the Board of Directors of Benton Resources Inc.,

"Stephen Stares"

Stephen Stares, President

Parties interested in seeking more information about properties available for option can contact Mr. Stares at the number below.

For further information, please contact:

Stephen Stares, President & CEO

Phone: 807-474-9020

Email: sstares@bentonresources.ca

Nick Konkin, Investor Relations

Phone: 647-249-9298 ext. 322

Email: nick@grovecorp.ca

Website: www.bentonresources.ca

Twitter: @BentonResources

Facebook: @BentonResourcesBEX

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements."

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company's expectations or projections.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/269811