BTCS Inc. Further Increases Target Funding to $225 Million for Strategic Ethereum Purchases Using DeFi/TradFi Flywheel

Rhea-AI Summary

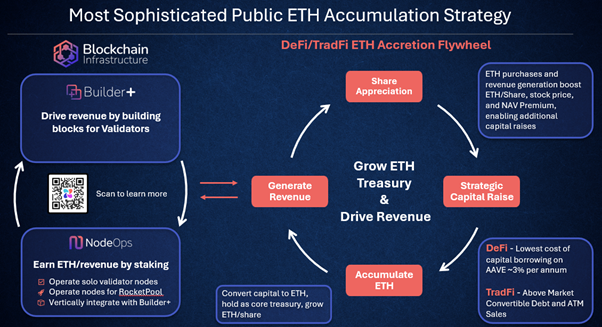

BTCS Inc. (Nasdaq: BTCS) has announced an increase in its funding target to $225 million to accelerate its Ethereum accumulation strategy. The blockchain technology company's approach leverages its vertically integrated operations, including solo staking through validator nodes and block building.

The strategy focuses on generating recurring, crypto-native revenue while enhancing long-term value per share through ETH-denominated returns compounding. CEO Charles Allen emphasized that the initiative aims to scale ETH per share while avoiding unnecessary dilution. The company plans to provide a detailed update on recent Ethereum purchases in the coming days.

Positive

- Increased funding target to $225 million for strategic Ethereum purchases

- Revenue generation through validator nodes and block building operations

- Capital-efficient strategy designed to avoid shareholder dilution

- Vertically integrated operations enabling ETH-denominated returns compounding

Negative

- Significant capital commitment required for funding target

- Exposure to cryptocurrency market volatility

- Execution risk in implementing the DeFi/TradFi strategy

News Market Reaction

On the day this news was published, BTCS declined 29.44%, reflecting a significant negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Silver Spring, MD, July 09, 2025 (GLOBE NEWSWIRE) -- BTCS Inc. (Nasdaq: BTCS) (“BTCS” or the “Company”) short for Blockchain Technology Consensus Solutions, a blockchain technology-focused company, today announced a funding target increase to

The Company’s vertically integrated operations, including solo staking through validator nodes and block building, are central to this approach. These activities not only generate recurring, crypto-native revenue but also enhance long-term value per share by compounding ETH-denominated returns.

“This is about scaling ETH per share, not just raising capital,” said Charles Allen, CEO of BTCS. “With a maturing crypto regulatory environment and increased institutional focus on Ethereum, now is the time to double down on our unique model—accumulating ETH through a capital-efficient strategy that avoids unnecessary dilution and strengthens shareholder alignment.”

The Company plans to issue a detailed update on recent Ethereum purchases later this week or next as it continues to execute its DeFi/TradFi flywheel.

About BTCS:

BTCS Inc. (Nasdaq: BTCS) (short for Blockchain Technology Consensus Solutions) is a U.S.-based blockchain infrastructure technology company currently focused on driving scalable revenue growth through its blockchain infrastructure operations. BTCS has honed its expertise in blockchain network operations, particularly in block building and validator node management. Its branded block-building operation, Builder+, leverages advanced algorithms to optimize block construction for on-chain validation, thus maximizing gas fee revenues. BTCS also supports other blockchain networks by operating validator nodes and staking its crypto assets across multiple proof-of-stake networks, allowing crypto holders to delegate assets to BTCS-managed nodes. In addition, the Company has developed ChainQ, an AI-powered blockchain data analytics platform, which enhances user access and engagement within the blockchain ecosystem. Committed to innovation and adaptability, BTCS is strategically positioned to expand its blockchain operations and infrastructure beyond Ethereum as the ecosystem evolves. Explore how BTCS is revolutionizing blockchain infrastructure in the public markets by visiting www.btcs.com.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release, constitute “forward-looking statements” within Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 including statements regarding plans to raise

For more information follow us on:

Twitter: https://x.com/NasdaqBTCS

LinkedIn: https://www.linkedin.com/company/nasdaq-btcs

Facebook: https://www.facebook.com/NasdaqBTCS

Investor Relations:

Charles Allen – CEO

X (formerly Twitter): @Charles_BTCS

Email: ir@btcs.com