Nord Precious Metals Outlines Plans for Phase-1 Drill Program at its Castle East High-Grade Silver Property

Rhea-AI Summary

Nord Precious Metals (OTCQB: CCWOF) is launching a 3,600-metre Phase‑1 of a planned 30,000‑metre drill program at Castle East beginning this fall, targeting 29 newly modelled silver veins. The first three holes will test veins and extensions above and below the Nipissing Diabase and near diabase‑volcanic contacts, with initial drilling focused on 7 modelled veins.

Company historical data (2019–2022, ~60,000 metres) identified significant silver intercepts both within and outside the diabase. The lower diabase contact in Castle East can reach ~600 metres vertical depth, previously under‑explored; modern directional and wedge drilling plus downhole geophysics will be used to access these targets.

Positive

- 3,600‑metre initial Phase‑1 drill allocation

- 29 newly modelled silver veins expanded target inventory

- Initial drilling to test 7 modelled veins at multiple depths

- Historical 60,000‑metre dataset shows significant silver intercepts

Negative

- Lower diabase contact can be as deep as ~600 metres, increasing drilling depth and cost

- Historic exploration was limited near eroded upper contacts, leaving Castle East under‑explored

- Results are exploratory; program requires successive phases before resource definition

News Market Reaction

On the day this news was published, CCWOF gained 7.87%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Targeting 29 newly modeled veins

Coquitlam, British Columbia--(Newsfile Corp. - November 3, 2025) - Nord Precious Metals Mining Inc. (TSXV: NTH) (OTCQB: CCWOF) (FSE: QN3) ("Nord" or the "Company") is finalizing plans to start the initial 3,600-metre phase of its 30,000-metre drill program this fall.

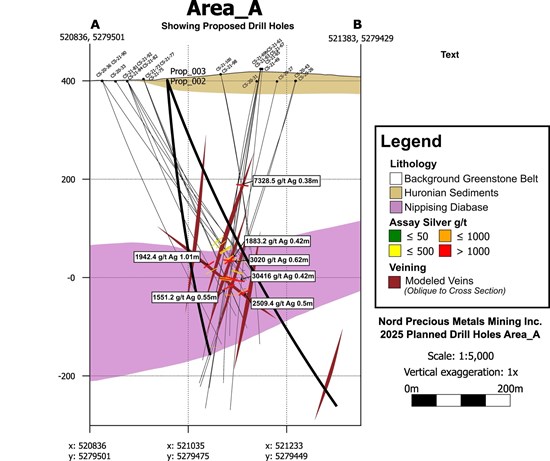

This first phase will be used to follow up on the newly modelled data which identified a potential 29 veins. The first three holes will be testing potential silver veins and vein extensions above and below the Nipissing Diabase as well as silver veins near the upper and lower contacts between the diabase and the Archean volcanic lithologies.

In the vertical cross section below, two of the proposed holes are shown (bold black lines). The initial drilling will be targeting a total of 7 modelled veins at different depths. While historically, the majority of silver production came from veins within the Nipissing Diabase near the upper contact, the data derived from the first 60,000-metres drilling program between 2019 and 2022 identified significant silver intercepts within the diabase as well as both above and below the diabase within the Archean volcanic lithologies.

"Recent compilation of structural and drill data has identified twenty-nine silver veins, broadening targets for high-grade intercepts across the property," stated Frank J. Basa, P.Eng., CEO of Nord Precious Metals.

Due to the thickness of the diabase, historical production from the lower contact area, along with exploration undertaken at the time, was limited to those areas to the west of the Castle East leases, where the upper contact had been eroded leaving the lower contact closer to surface. In the Castle East area, 2 km east of the past-producing Castle Mine, the lower contact can be down to a vertical depth of 600 metres, deeper than most historical drilling reached, leaving the lower contact of the diabase vastly under-explored. With current diamond drilling technology significantly more advanced than when most of the historic exploration drilling was done in the area, the lower contact is now more accessible using more accurate directional drilling and wedge hole drilling followed by downhole geophysics.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2093/272974_a9ec4b09a49de82a_002full.jpg

Following completion of the first phase, the Company is planning additional drilling with each successive phase based on all previous results, in line with the 30,000-meter drill program strategy outlined in an earlier news release.

Drill for Structure, Mine for Grade

Veins in the Cobalt and Gowganda Camps are known to host very high-grade silver in high-grade ore shoots within individual veins and networks of veins. Historically, the most efficient method to explore was to sink a shaft to reach a known mineralized vein. While mining high-grade mineralization on that vein, exploration would continue by further drifting along the vein while simultaneously setting up multiple drill stations underground allowing better access and shorter drill holes. The Company has discovered numerous, high-grade intercepts within a relatively small area worthy of this method. Given the nature of these veins to form a network of vein systems, developing a ramp to any one of these intercepts would open up prospects of finding new silver veins with the potential of associated cobalt and other critical metals mineralization as is evidenced from historical workings in the Camp.

Qualified Person

The technical information in this news release was approved and prepared under the supervision of Mr. Frank J. Basa, P.Eng., (PEO), director of Nord Precious Metals, a qualified person in accordance with National Instrument 43-101.

About Nord Precious Metals Mining Inc.

Nord Precious Metals Mining Inc. operates the only permitted high-grade milling facility in the historic Cobalt Camp of Ontario, where the Company has established a unique position integrating high-grade silver discovery with strategic metals recovery operations. The Company's flagship Castle property encompasses 63 sq. km of exploration ground and the past-producing Castle Mine, complemented by the Castle East discovery where drilling has delineated 7.56 million ounces of silver in Inferred resources grading an average of 8,582 g/t Ag (250.2 oz/ton) in 27,400 tonnes of material from two sections (1A and 1B) of the Castle East Robinson Zone, beginning at a vertical depth of approximately 400 meters. Note that mineral resources that are not mineral reserves and do not have demonstrated economic viability. Please refer to the Nord Precious Metals Press Release May 27, 2020, for the resource estimate.

Nord's integrated processing strategy leverages the synergistic value of multiple metals. High-grade silver recovery supports the economics of extracting critical minerals including cobalt, nickel, and other battery metals, while the Company's proprietary Re-2Ox hydrometallurgical process enables production of technical-grade cobalt sulphate and nickel-manganese-cobalt (NMC) formulations. This multi-metal approach, combined with established infrastructure including TTL Laboratories and underground mine access, positions Nord to capitalize on both precious metals markets and the growing demand for battery materials.

The Company maintains a strategic portfolio of battery metals properties in Northern Quebec through its

More information is available at www.nordpreciousmetals.com.

"Frank J. Basa"

Frank J. Basa, P. Eng.

Chief Executive Officer

For further information, contact:

Frank J. Basa, P.Eng. Chief Executive Officer 416-625-2342

or:

Wayne Cheveldayoff, Corporate Communications P: 416-710-2410 E: waynecheveldayoff@gmail.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution Regarding Forward-Looking Statements

This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to vary materially from forward-looking statements. The Company does not undertake to update any forward-looking information in this news release or other communications unless required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/272974