Canadian Gold Resources to Expand Maiden Diamond Drill Program & Provides Update on Bulk Sampling Program at Lac Arsenault, LIFE Offering Update; Disclosure Corrections

Rhea-AI Summary

Canadian Gold Resources (OTC:CDNGF) will expand its maiden Lac Arsenault diamond drill program to roughly double the originally permitted size (initially 36 holes / 3,000 metres) after IP survey targets identified high-priority vein and stockwork zones.

The company deferred a planned 5,000‑tonne bulk sample to spring 2026 due to later-than-expected ATI permitting and winter access constraints, and now expects results and related cash flow in Q3 2026. The previously announced LIFE offering is being restructured and will not proceed as filed. Corrections: 519,821 finder’s warrants (not 533,821) and total options granted adjusted to 1,800,000.

Positive

- Maiden drill program proposed to double from 3,000m

- Identified multiple high-priority IP targets along Baker–Mersereau

- All permits for bulk sampling, including ATI, have been obtained

- Bulk-sample results expected in Q3 2026

Negative

- 5,000‑tonne bulk sample deferred to spring 2026

- Listed issuer LIFE Offering paused and being restructured

- Delay caused by late ATI permit receipt and winter access

Dieppe, New Brunswick--(Newsfile Corp. - November 14, 2025) - Canadian Gold Resources Ltd. (TSXV: CAN) ("Canadian Gold" or the "Company") provides an operational update regarding its maiden diamond drill program and the planned 5,000-tonne bulk sampling program at the

Company Plans to Significantly Increase Maiden Lac Arsenault Diamond Drill Program

Canadian Gold has submitted amended permit applications seeking approval to expand its maiden drill program to roughly twice the originally planned scope of 36 holes totaling 3,000 metres. This decision follows ongoing geophysical interpretation that has identified numerous high priority vein and stockwork type drill targets.

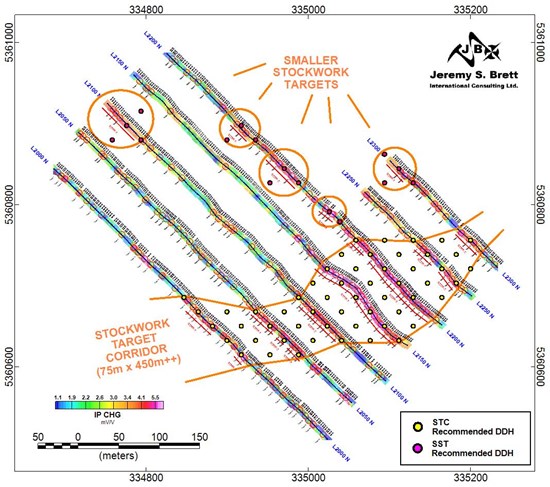

The Company recently completed a tightly spaced Induced Polarization ("IP") survey across the Baker–Mersereau structural corridor. Preliminary geophysical interpretation work carried out by Jeremy S. Brett International Consulting Ltd. has identified multiple IP signatures along Line 2200N that closely resemble the response associated with the known high-grade Baker vein (please see Image 1, below). Although the Mersereau vein has not yet been fully interpreted on the current working map, its position and continuity are clearly expressed in the IP data, further reinforcing the technical rationale for expanding the drill program. In addition, possible stockwork zones have been identified up to 100m wide.

These new geophysical targets, combined with a second set of drill collar locations submitted under the amended permit application, support the potential for a substantially larger first-phase drill campaign. The targets are situated within what the Company and its consultants refer to as the Stockwork Target Corridor, a near-surface (0–30 metres vertical depth) zone characterized by strong structural preparation and distinctive geophysical response. Given the strength and coherence of these new geophysical targets, the Company is evaluating a plan to materially increase the number of drill holes beyond the previously permitted minimum, with the objective of fully testing these newly defined priority areas.

Management Commentary

"We are very encouraged by the results of our recent Induced Polarization ("IP") Survey at Lac Arsenault," said Ron Goguen, President & CEO of Canadian Gold Resources. "The tightly spaced IP work across the Baker–Mersereau structural corridor has outlined multiple new high-priority vein and stockwork targets, some of which mirror the response of the high-grade Baker vein. The data also clearly define the continuity of the Mersereau vein. Based on these findings, we've submitted amended permits to roughly double the size of our maiden drill program to properly test these new geophysical targets."

"The delay in receiving the ATI permits pushed our operating window into winter conditions", said Mr. Goguen. "Extracting and transporting material at this time of year would not be safe, or cost-effective. Out of caution we have elected to move the bulk sample into the spring of 2026. This results in only a minimal shift to the expected timing of results and any related free cash flow and we remain fully prepared to proceed as soon as conditions allow."

Bulk Sample Program Deferred to Spring 2026 Due to Permitting Delays and Seasonal Access Constraints

The Company is pleased to confirm that it has now obtained all permits required to execute the bulk sampling program, including the Authorization for Work in the Environment (ATI), as well as all approvals received during the recently completed First Nations consultation process. These permitting achievements represent a significant milestone for the Company and fully clear the regulatory path for bulk sample extraction.

Although Canadian Gold is fully permitted and operationally ready, the start of bulk sample extraction has been rescheduled to spring 2026. The primary reason for this deferral is the later-than-expected receipt of the final ATI permit, which occurred after the Company's anticipated timeline. By the time approval was received, winter conditions in the Lac Arsenault area had already set in, with significant snowfall and ground freeze-up limiting safe and efficient field operations. Attempting to extract and transport mineralized material during winter would materially increase costs, reduce operational efficiency, and introduce unnecessary safety risks. Management has therefore determined that initiating the program in early spring 2026 is the most prudent and responsible course of action.

While the timing of the physical extraction has shifted, the Company expects the financial implications of this revised schedule to be minimal. Under the previous plan, extraction was to begin in autumn 2025, with processing anticipated by mid-Q1 2026. With extraction now scheduled for spring 2026, the Company expects to receive results and related cash flow from the bulk sampling program in Q3 2026, representing only a modest adjustment to the timing of potential proceeds.

IP Survey Lines, Gridded Chargeability & Planned Drill Holes

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11663/274511_ee7f7aaeb4f1f8f4_001full.jpg

LIFE Offering Update

In view of the rescheduling of the bulk sampling program and expected timeframe for results to be reported, the Company will not be proceeding with its listed issuer financing exemption offering (the "LIFE Offering") as announced on October 23, 2025. The Company is currently restructuring its offering and intends to file amended and restated offering documents in the near future. A news release will be issued at that time.

Corrections to Prior Disclosure

The Company wishes to correct certain disclosure in previously issued news releases as follows:

- On January 2, 2025, the Company announced that it had closed a non-brokered private placement of flow-through and non-flow through units and reported that it had issued 533,821 finder's warrants. The correct number of finder's warrants is 519,821, each warrant entitling the holder to acquire one common share of the Company at

$0.25 per share for a period of 24 months.

- On January 28 and February 28, 2025, the Company announced that it had granted 1,500,000 options to members of the board of directors and 500,000 options to certain officers, employees and non-investor relations consultants. The Company wishes to report that 200,000 of the options granted to non-investor relations consultants have been cancelled resulting in an aggregate grant of 1,800,000 options.

About the Lac Arsenault Project

The Lac Arsenault Property, located in Québec's Gaspé region, lies along the Grand Pabos Fault within the Gaspé–Newfoundland tectonic belt. This structure is interpreted to share geological characteristics with prolific gold-bearing systems such as the Cadillac–Larder Lake Fault Zone in Abitibi and the Cape Ray–Valentine Lake Shear Zone in Newfoundland. The property hosts several high-grade, epithermal-style vein systems, including the Baker, Mersereau, and Dunning veins, with historical exploration outlining significant gold-silver-base metal mineralization that provides a strong platform for the Company's current work. Covering more than 3,600 hectares, Lac Arsenault is strategically located near tidewater at New Richmond, Québec, offering excellent road, power, and rail infrastructure within one of Canada's most established mining jurisdictions.

Historical Resource Estimate Disclosure (NI 43-101 2.4)

- Stevenson, L. (1975): 40,000 tonnes grading 15.43 g/t Au and 197 g/t Ag (Esso Minerals Canada).

- Côté, R. (1996): 199,580 tonnes grading 9.59 g/t Au (~61,536 contained oz Au).

These historical estimates predate NI 43-101 and were based on sampling, trenching, and drilling using manual polygonal methods. A Qualified Person has not completed sufficient work to classify the estimates as current mineral resources or reserves. The Company is not treating them as current and further verification is required.

These historical estimates pre-date the adoption of current CIM Definition Standards (2014) and therefore cannot be directly compared to modern resource categories (i.e., "Inferred," "Indicated," or "Measured"). The terminology and estimation methodologies used at the time are not compliant with current CIM categories, and no classification equivalence is implied.

The Company considers these historical estimates to be relevant, as they demonstrate the presence of significant gold and silver mineralization at shallow depths within the Baker and Mersereau vein systems, which remain priority targets for verification and expansion. However, their reliability is uncertain because the underlying data, methods, and QA/QC procedures are not adequately documented to current standards. The Company is not treating the estimate as current.

To the Company's knowledge, there are no more recent mineral resource estimates available for the Lac Arsenault Property that would supersede these historical figures.

To bring these into compliance, Canadian Gold plans to:

- Conduct systematic drilling to confirm grades and geometry;

- Complete verification sampling and density determinations;

- Build a validated geological model with modern QA/QC protocols;

- Commission an independent NI 43-101 compliant resource estimate.

Qualified Person Statement:

The scientific and technical information in this news release has been reviewed and approved by Mark Smethurst, P.Geo., Director of Canadian Gold and a Qualified Person under NI 43-101.

About Canadian Gold Resources Ltd.

Canadian Gold Resources Ltd. (TSXV: CAN) is a junior exploration company advancing three high-grade gold properties totaling ~16,000 hectares in Québec's Gaspé Peninsula. The Company's strategy is to unlock the potential of historically explored assets through modern exploration and development, supported by a management team with a proven track record in discovery and project advancement.

For further information, please contact:

Ronald J. Goguen

President & CEO, Director

Canadian Gold Resources Ltd.

rongoguen@cdngold.com

+1 (506) 857-4090

Investor Relations

investors@cdngold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Canadian Gold trades on the TSX Venture Exchange under the ticker CAN and has 36,667,221 common shares outstanding.

Forward-Looking Statements Disclaimer:

This news release contains "forward-looking statements," including but not limited to statements regarding anticipated exploration activities, timing, objectives, and potential outcomes of the drill program. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties that may cause actual results to differ materially. Readers are cautioned not to place undue reliance on these statements. Canadian Gold disclaims any obligation to update or revise any forward-looking information, except as required by applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/274511