CompoSecure Completes Business Combination with Husky Technologies and Rebrands Corporate Entity to GPGI, Inc.

Rhea-AI Summary

CompoSecure (NYSE:CMPO) completed its business combination with Husky Technologies and rebranded the corporate entity to GPGI, Inc. The combined company is valued at $7.4 billion, with ~70% recurring revenues, ~$635 million 2026E pro forma adjusted EBITDA (~11.6x valuation) and an expected ~7.5% free cash flow yield in the first full year post-close. The deal is expected to be >20% accretive to adjusted diluted EPS in year one. Financing included an oversubscribed $2.0 billion private placement, Platinum Equity rollover of ~$1.0 billion, ~$2.0 billion debt, and the David Cote Family retaining a $1.0 billion equity stake. Common stock is expected to trade under ticker GPGI on the NYSE starting Jan 23, 2026.

Positive

- Combined enterprise value of $7.4 billion

- ~70% recurring revenues across the platform

- $635 million 2026E pro forma adjusted EBITDA (~11.6x)

- Expected >20% accretion to adjusted diluted EPS in year one

- $2.0B oversubscribed private placement plus $1.0B rollover

Negative

- $2.0B of new debt added to fund the transaction

News Market Reaction – CMPO

On the day this news was published, CMPO declined 6.22%, reflecting a notable negative market reaction. Our momentum scanner triggered 15 alerts that day, indicating notable trading interest and price volatility. This price movement removed approximately $172M from the company's valuation, bringing the market cap to $2.59B at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

CMPO traded at $22.17 with a +3.55% move while peers were mixed: PRLB -0.53%, IIIN +0.45%, RYI +2.88%, WOR +0.17%, ESAB +0.52%. Scanner momentum only flagged MTEN at -4.09%, suggesting this announcement drove a more stock-specific reaction than a broad sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 24 | Deal approval vote | Positive | +0.7% | Stockholders approved share issuance to complete the Husky business combination. |

| Nov 03 | Earnings and deal | Positive | +3.4% | Strong Q3 2025 results and initial announcement of the Husky combination. |

| Oct 27 | Earnings call setup | Neutral | +2.1% | Announcement of the Q3 2025 conference call schedule and webcast details. |

| Oct 09 | CFO transition | Neutral | -3.7% | Appointment of a new CFO and retirement of the prior finance executive. |

| Sep 24 | Crypto partnership | Positive | -1.5% | Arculus and N.exchange partnership to expand crypto swaps and smart routing. |

Recent CMPO news tied to the Husky business combination and strong earnings generally saw modestly positive price reactions, while strategic or operational updates such as partnerships or management changes have produced mixed moves, including some negative divergence. Overall, news-linked moves have been directionally positive more often than not.

Over the last few months, CompoSecure has been building toward the Husky Technologies combination that closed in January 2026. On Nov 3, 2025 (news_id 927465), the company reported strong 3Q25 results and outlined a combined enterprise value of $7.4B, which was followed by a +3.42% move. Stockholders later approved share issuance for the deal on Dec 24, 2025 (news_id 951290), with a smaller +0.67% reaction. Other events — including a new CFO, a crypto partnership, and a Q3 conference call notice — saw more mixed price responses, underscoring that investors reacted most consistently to the Husky-related strategic milestones.

Market Pulse Summary

The stock moved -6.2% in the session following this news. A negative reaction despite completion of the Husky deal would contrast with earlier positive responses to related announcements, such as the +3.42% move on the initial combination news and the +0.67% move on stockholder approval. Past divergences around management changes and partnerships show that execution or integration concerns can outweigh headline positives, so investor focus often shifts to delivery against outlined financial targets.

Key Terms

business combination financial

pro forma adjusted ebitda financial

free cash flow yield financial

private placement financial

AI-generated analysis. Not financial advice.

- Completed business combination with Husky Technologies creating a

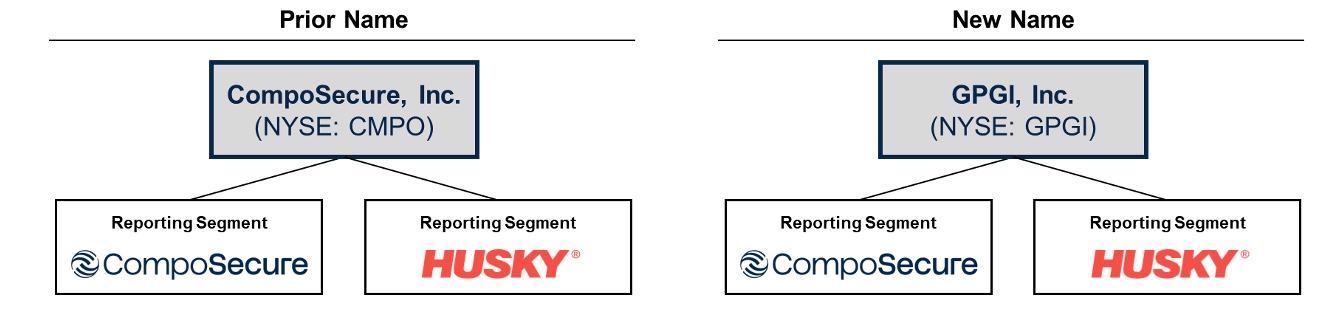

$7.4 billion best-in-class, diversified compounder - Rebrands corporate entity to GPGI, Inc. (“Great Positions in Good Industries”) with two reporting segments CompoSecure and Husky

Completed Business Combination

SOMERSET, N.J., Jan. 12, 2026 (GLOBE NEWSWIRE) -- CompoSecure, Inc. (NYSE: CMPO) completed its previously announced business combination with Husky Technologies Limited (“Husky”), a leader in highly engineered equipment and aftermarket services. The combination of Husky and CompoSecure creates a best-in-class, diversified compounder featuring two global market leaders with ~

As previously disclosed, the combined business is valued at

Rebrands Corporate Entity to GPGI, Inc.

In conjunction with closing the Husky transaction, CompoSecure is also announcing a rebrand to GPGI, Inc. (“GPGI”). The new name represents our core philosophy of acquiring and operating businesses that hold “Great Positions in Good Industries” – or “GPGI.” This rebranding follows the evolution of CompoSecure from a single operating business into a permanent capital platform purpose-built to acquire, own, and scale great businesses that can benefit from the systematic deployment of the Resolute Operating System. On a go-forward basis, both CompoSecure and Husky will retain their existing trade names and will be two distinct reporting segments operating independently as part of GPGI’s permanent capital platform. It is anticipated that the Company’s common stock will begin trading under the new name and ticker symbol “GPGI” on the New York Stock Exchange at the opening of trading on January 23, 2026.

Dave Cote, the Company’s Executive Chairman, and Tom Knott, the Company’s Chief Investment Officer, stated: “We are thrilled to announce the completion of the Husky transaction and the corporate entity’s name change to GPGI, Inc. We are making progress at both CompoSecure and Husky – and are even more convinced today about the prospects for both companies and for the broader platform. We remain focused on delivering results for our shareholders and investors and making GPGI an aspirational home for great operators and great businesses.”

About GPGI

GPGI, Inc. is a diversified, multi-industry compounder comprised of companies with great positions in good industries. The platform is managed by Resolute Holdings Management, Inc. (NYSE: RHLD) and is purpose-built to acquire, own, and scale high-quality businesses led by great operators, benefiting from a permanent capital base and the systematic deployment of the Resolute Operating System. GPGI currently consists of CompoSecure and Husky Technologies – two market leaders with best-in-class financials and durable opportunities for growth. For more information, please visit gpgi.com.

About CompoSecure, a GPGI Business

Founded in 2000, CompoSecure is a technology partner to market leaders, fintechs, and consumers enabling trust for millions of people around the globe. CompoSecure is a leader in metal payment cards, security, and authentication solutions. CompoSecure combines elegance, simplicity, and security to deliver exceptional experiences and peace of mind in the physical and digital world. CompoSecure’s innovative payment card technology and metal cards with Arculus security and authentication capabilities deliver unique, premium branded experiences, enable people to access and use their financial and digital assets, and ensure trust at the point of a transaction. For more information, please visit CompoSecure.com and GetArculus.com.

About Husky Technologies, a GPGI Business

Founded in 1953, Husky is a technology pioneer that enables the delivery of essential needs to the global community with industry-leading expertise and service. Husky is a leader in highly engineered equipment and aftermarket services. Husky’s products are used to manufacture a wide range of plastic products, including beverage and food containers, medical devices, and consumer electronic parts. Husky provides comprehensive and integrated systems solutions that are comprised of injection molding machines, molds, hot runners, controllers, and auxiliaries. For more information, please visit Husky.co.

Non-GAAP Financial Information

This press release includes certain non-GAAP financial measures that are not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and that may be different from non-GAAP financial measures used by other companies. We believe that Pro Forma Adjusted EBITDA and adjusted diluted earnings per share are useful to investors in evaluating our financial performance. We believe that these non-GAAP financial measures depict the performance of the business and underlying economics attributable to our stockholders. These measures should not be considered as measures of financial performance under U.S. GAAP, and the items excluded from these measures are significant components in understanding and assessing our financial performance. Accordingly, these key business metrics have limitations as analytical tools and should not be considered as alternatives to net income or any other performance measures derived in accordance with U.S. GAAP and may be different from similarly titled non-GAAP measures used by other companies. Due to the forward-looking nature of these measures, the charges excluded from the forward-looking Non-GAAP financial measures, including with respect to depreciation, amortization, interest, and taxes that would be required to reconcile the Non-GAAP financial measures to GAAP measures are inherently uncertain or difficult to predict, so it is not feasible to provide accurate forecasted Non-GAAP reconciliations without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included, and no reconciliation of the forward-looking Non-GAAP financial measures is included.

Forward Looking Statements

This press release contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These statements are based on the beliefs and assumptions of management. Although we believe that our plans, intentions, and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions, or expectations. Forward-looking statements are inherently subject to risks, uncertainties, and assumptions. Generally, statements that are not historical facts, including statements concerning our possible or assumed future actions, business strategies and events, including those of the CompoSecure and Husky businesses, anticipated outcomes of the acquisition of Husky or the rebranding of CompoSecure are forward-looking statements. In some instances, these statements may be preceded by, followed by, or include the words “believes,” “estimates,” “expects,” “projects,” “outlook” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” or “intends” or the negatives of these terms or variations of them or similar terminology. Forward-looking statements are not guarantees of performance. You should not put undue reliance on these statements which speak only as of the date hereof. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

CompoSecure Contact

ir@composecure.com

Husky Contact

media@husky.ca

___________________________

1 Enterprise value based on private placement price of

2 Non-GAAP Pro Forma Adjusted EBITDA net of management fees to Resolute Holdings.

3 Non-GAAP free cash flow yield defined as free cash flow (cash flow from operations less capital expenditures) divided by fully diluted equity value at

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/74cdcee5-6a78-4362-8e69-5dc7a0696b94