Copper Fox Completes Preliminary Geometallurgical Model on Van Dyke ISCR Copper Project

Rhea-AI Summary

Copper Fox Metals (OTCQX:CPFXF) has completed a Preliminary Geometallurgical Model (PGM) for its 100% owned Van Dyke in-situ copper recovery project in Arizona. The study identifies key mineralogical domains and data gaps in the project's metallurgical results to support a future Pre-Feasibility Study (PFS).

The Van Dyke project's 2020 Preliminary Economic Assessment projected annual production of 85 million pounds of Grade A copper cathode at full capacity. The PGM revealed consistent mineralogical domains with typical "Supergene" copper deposits, focusing on oxide and transition zones. The study established protocols for future metallurgical testing and recommended additional testwork using whole drill core samples.

Positive

- Project capable of producing 85 million pounds of Grade A copper cathode annually at full capacity

- Identification of clear mineralogical domains supports development of updated geometallurgical model

- Significant exploration potential exists to increase resource base

Negative

- Data gaps in metallurgical database represent potential risk for copper extraction variability

- Additional metallurgical testwork required before advancing to PFS stage

News Market Reaction 1 Alert

On the day this news was published, CPFXF gained 2.73%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Calgary, Alberta--(Newsfile Corp. - August 28, 2025) - Copper Fox Metals Inc. (TSXV: CUU) (OTCQX: CPFXF) (FSE: HPU) ("Copper Fox" or the "Company"), through its wholly owned subsidiary Desert Fox Van Dyke Co., is pleased to provide the results of the Preliminary Geometallurgical Model completed by Samuel Engineering on its

In 2020, Copper Fox announced the results of an updated Mineral Resource Estimate (MRE) and Preliminary Economic Assessment (PEA) on Van Dyke using a US

- Project economics sensitive to copper price,

- Significant exploration potential to increase resource base, and

- A recommendation to advance the project to prefeasibility study (PFS) stage.

Preliminary Geometallurgical Model (PGM)

The PGM achieved three critical components for developing an updated geometallurgical model to support the completion of a PFS level of investigation by identifying the mineralogical domains (zones) in the Van Dyke deposit, "data gaps" in the project metallurgical results across the deposit and developed recommendations for future metallurgical testing.

Elmer B. Stewart, President and CEO of Copper Fox, stated, "The PGM has identified the data gaps in the metallurgical coverage across the Van Dyke deposit and recommendations for future sampling to gain greater certainty on the metallurgical variability across the Van Dyke deposit. The PGM is a critical part of the Execution Plan that maps out the scope, timing and estimated cost of the studies required to meet the threshold of a PFS level study."

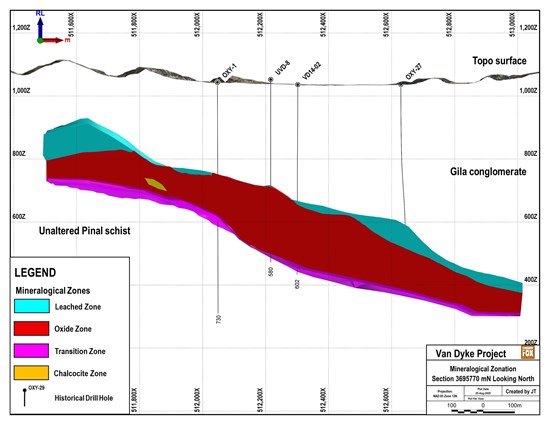

Mineralogical Domains

The mineralogical domains identified in the Van Dyke deposit are consistent with the general description of "Supergene" copper deposits (see Figure-1 and Table-1). At Van Dyke, the oxide and transition zones are the main zones of interest. Below the transition/chalcocite zones the mineralization, where present, consists of sporadic concentrations of chalcopyrite and pyrite.

Figure-1: Cross section showing distribution of mineralogical zones within the Van Dyke copper deposit.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2177/264208_9a47ea9af4cc8b3c_001full.jpg

Table-1: General description of the mineralogical zones within the Van Dyke copper deposit.

| Mineralogical Zone | Description |

| Leached | Contains variable concentrations of clays and iron-oxides (limonite-hematite-goethite-jarosite). May contain trace concentrations of copper oxide minerals. Typically contains less than 200ppm total copper (TCu). |

| Oxide | Contains variable concentrations of azurite, malachite, and chrysocolla with lesser concentrations of cuprite and native copper. Contains greater than 250ppm acid soluble copper (ASCu) and very low concentrations of cyanide soluble copper (CNCu). |

| Transition | Contains variable concentrations of acid soluble and cyanide soluble copper minerals with gradual transition at depth from ASCu to more CNCu. |

| Chalcocite | Contains CNCu concentrations greater than |

Gap Analysis

Metallurgical testwork at Van Dyke consists of; eight (8) pressure leach tests (PRT) on whole core samples in 2014 and, 65 bottle roll leach tests (BRT) in 2023 from selected drillholes located within the Phase I leaching plan (year 1-7) set out in the 2020 PEA. Data gaps in the metallurgical database represent potential risk of variability in copper extraction and recovery.

The metallurgical testwork completed on similar deposits in Arizona was used to benchmark mineral characterization, process route selection and assessing processing risks for the Van Dyke project. The data from these tests were correlated spatially to the 2020 resource block model and the mineralogical domains identified within the Van Dyke deposit.

Identification of the data gaps allows for pre-selection of representative sample locations within the mineralogical domains from future drillholes to support an updated geometallurgical model.

Future Testwork Recommendations

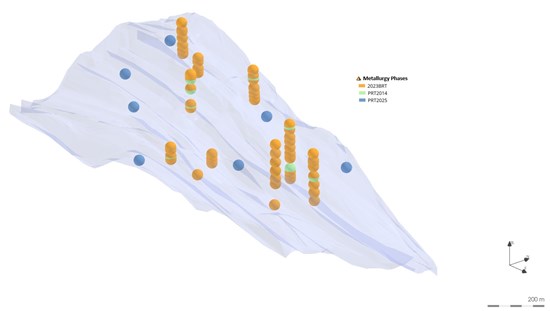

Recommendations for additional metallurgical testwork include using whole drill core samples to characterize the mineralization, identify mineralogy, BRT and corresponding PRT tests to establish correlation between the two tests, and their associated residue assays to evaluate/confirm optimum acid addition and consumption, leach cycle duration, and predicted copper extraction (Figure-2).

The closed-cycle PRT tests should include solvent extraction of the pregnant leach solution and detailed mineralogical studies on head samples as well as leach residues for each test. The quantification of carbonates and clays should be performed on head samples.

Figure-2: Plan view of the Van Dyke copper deposit show locations of existing and recommended metallurgical test sample locations. Blue = proposed metallurgical samples; Orange = 2023 BRTs; Green = 2014 PRTs.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2177/264208_9a47ea9af4cc8b3c_002full.jpg

Sampling Protocols

Completion of the PGM established the following protocols for future metallurgical testing:

- Sample preparation and analysis and bottle roll testing on a sub-sample of the head sample.

- Testing protocols, PRT column height, leach solution chemistry, application rates or additional methods considering hydraulic pressure limits that include the following:

- Consideration of higher initial acid content to improve leach cycle time.

- Define sequential (multiple columns in series) tests to better understand transmissivity and its impact over time.

- Consideration of reverse flow test for pH optimization.

- Consideration of duplicate tests.

- Assay/mineral studies on the leached sample residue.

Qualified Person

Elmer B. Stewart, MSc. P. Geol., President, and CEO of Copper Fox, is the Company's non-independent, nominated Qualified Person pursuant to National Instrument 43-101, Standards for Disclosure for Mineral Projects, and has reviewed and approves the scientific and technical information disclosed in this news release.

About Copper Fox

Copper Fox is a Canadian resource company focused on copper exploration and development in Canada and the United States. The principal assets of Copper Fox and its wholly owned subsidiaries, being Desert Fox Copper Inc., and Northern Fox Copper Inc. are the

On behalf of the Board of Directors,

Elmer B. Stewart

President and Chief Executive Officer

For additional information, contact: Lynn Ball at investor@copperfoxmetals.com or 1-844-464-2820

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains forward-looking statements within the meaning of the Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, and forward-looking information within the meaning of the Canadian securities laws (collectively, "forward-looking information"). Forward-looking information is identifiable by use of the words "believes", "may", "plans", "will", "anticipates", "intends", "budgets", "could", "estimates", "expects", "forecasts", "projects" and similar expressions, and the negative of such expressions. Forward-looking information in this news release includes statements about: advancing the project to the PFS stage; results of a preliminary geometallurgical model; data gaps; future sampling programs and updating the geometallurgical model.

The economic with the forward-looking information contained in this news release, Copper Fox and its subsidiaries have made numerous assumptions regarding, among other things: completing the planned geometallurgical program; the availability of service providers; the geological, metallurgical, engineering, financial and economic advice that Copper Fox has received is reliable and is based upon practices and methodologies which are consistent with industry standards; and the stability of economic and market conditions. While Copper Fox considers these assumptions to be reasonable, these assumptions are inherently subject to significant uncertainties and contingencies.

Additionally, there are known and unknown risk factors which could cause Copper Fox's actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information contained herein. Known risk factors include among others: advancing the project to the PFS stage may not occur as planned or at all; an updated preliminary geometallurgical model may not be completed as planned or at all; future sampling programs may not be completed as planned or at all; uncertainties relating to interpretation of the previous results; the overall economy may deteriorate; uncertainty as to the availability and terms of future financing; fluctuations in commodity prices and demand; uncertainty related to potential threat of tariffs; currency exchange rates; and uncertainty as to timely availability of permits and other governmental approvals.

A more complete discussion of the risks and uncertainties facing Copper Fox is disclosed in Copper Fox's continuous disclosure filings with Canadian securities regulatory authorities at www.sedarplus.ca. All forward-looking information herein is qualified in its entirety by this cautionary statement, and Copper Fox disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events, or developments, except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/264208