Cerrado Gold Announces Q4 And Annual 2024 Financial Results

Rhea-AI Summary

Cerrado Gold reported its Q4 and annual 2024 financial results, achieving 54,494 Gold Equivalent Ounces (GEO) in annual production, aligning with guidance. The company posted Q4 Adjusted EBITDA of $4.5 million and $24.4 million for the full year.

Key highlights include receiving $34 million in asset sale and option payment proceeds in Q4, totaling $49 million for the full year, with up to $25 million due in coming years. The company significantly improved its working capital position by $54.5 million.

Q4 production reached 10,431 GEO, with AISC of $1,953, higher than Q4/23's $1,594 due to lower production and Argentine inflation. The company raised its 2025 production guidance to 55,000-60,000 GEO, with AISC expected between $1,500-$1,700 per GEO. Cerrado's focus remains on ramping up heap leach production to 4,000-4,500 GEO monthly.

Positive

- Annual gold production of 54,494 GEO met guidance targets

- Q4 Adjusted EBITDA of $4.5M and annual EBITDA of $24.4M

- Received $34M in asset sale proceeds in Q4, total $49M for the year with additional $25M potential future payments

- Significant $54.5M improvement in working capital position

- Cash position increased from $0.4M to $26M year-over-year

- Reduced current debt payables by $35M

- Raised 2025 production guidance to 55,000-60,000 GEO from previous 50,000-55,000 GEO

Negative

- Q4 AISC increased to $1,953/oz from $1,594/oz in Q4 2023

- Production decreased in Q4 due to lower grade ore processing

- Working capital remains negative at -$12.9M despite improvement

- 2025 AISC guidance increased to $1,500-$1,700 from previous $1,300-$1,500 due to inflation and operational changes

- Ongoing inflationary pressures in Argentina affecting costs

- Reliance on rental crushing equipment impacting operational costs

News Market Reaction

On the day this news was published, CRDOF declined 1.46%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Annual production of 54,494 Gold Equivalent Ounces ("GEO"); in-line with guidance

Adjusted EBITDA of

$4.5 million for Q4, and$24.4 million for the full year excluding project sales proceeds from sale of Monte Do CarmoReceived

$34 million in Asset sale and Option payment proceeds in Q4: Received$49 million for the full year with up to$25 million ($15 million guaranteed) due in the coming years.Continued strengthening of the Balance sheet with a US

$54.5 million improvement in the working capital position achievedManagement to host a Conference Call to discuss the financial and operational results on May 1st, 2025, at 11:00 AM EDT

TORONTO, ON / ACCESS Newswire / May 1, 2025 / Cerrado Gold Inc. [TSX.V:CERT][OTCQX:CRDOF; FRA:BAI0] ("Cerrado" or the "Company") announces its operational and financial results for the fourth quarter ("Q4/24") including its Minera Don Nicolas ("MDN") gold project in Santa Cruz Province, Argentina and its Mont Sorcier High Purity DRI Iron Project in Quebec.

Production results for MDN were previously released on January 15, 2025. The Company's financial results are reported and available on SEDAR+ (www.sedarplus.com) and the Company's website (www.cerradogold.com).

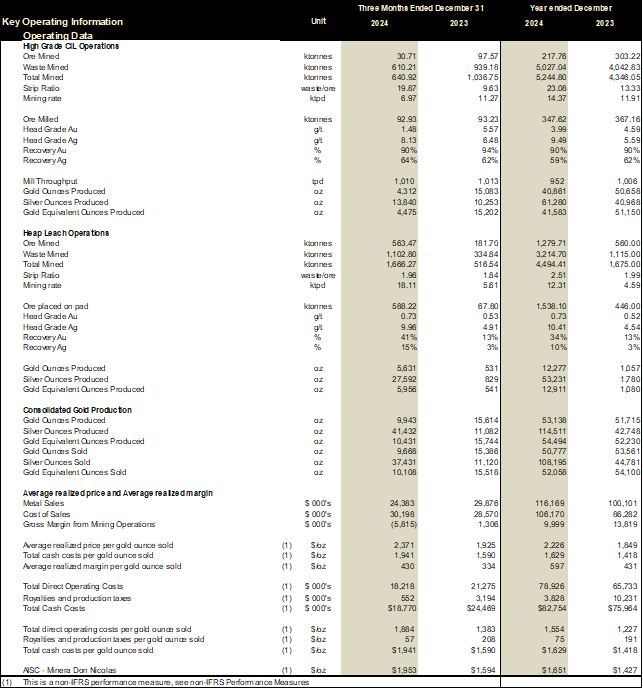

Q4/24 and Annual MDN Operating Highlights

Production of 10,431 GEO in Q4 and Annual production of 54,494 GEO

Adjusted EBITDA of

$4.5 million in Q4 and US$24.4 million for the year excluding assets sales and Option payment proceeds.Received

$34 million in Asset sale and Option payment proceeds in Q4: Received$49 million for the full year with up to$25 million ($15 million guaranteed) due in the coming years.AISC of

$1,953 during Q4 vs$1,594 in Q4/23 due to lower production levels and ongoing inflationary pressures in ArgentinaReceived Asset Sale and Option payments totaling

$34 M M during the quarter, significantly strengthening the balance sheet.Focus remains on ramping up heap leach production to 4,000 - 4,500 GEO per month

Operational results for the fourth quarter demonstrated a decrease in production relative to Q4/23 as high-grade ore to the CIL plant declined as mining from the Calandrias Norte pit was completed, and as the operation transitioned to focus on heap leach production. Ore from the Calandrias Norte open pit was exhausted late in the quarter and is now being replaced by processing lower grade stockpiles through the CIL plant. With higher gold prices, the CIL plant is expected to continue processing low grade stockpiles through Q2/25 when it will be blended with new high-grade material from initial underground mining feed from Q3/25 onward. The ramp up of heap leach operations continues to improve as crushing capacity continued to climb with production of 5,956 GEO during the quarter. The performance of the heap leach continues to depend on the output of the crushing circuit which, as of April 2025, is supported by the installation of a new secondary crusher. Recovery rates were in line with expectations, and we expect to see minor improvements from the heap leach as the new crushing and agglomeration circuit becomes operational in Q2/25. Due to the relatively fixed cost nature of the MDN operation, unit operating costs were higher in the quarter relative to the comparable period in 2023 due to lower production levels and inflationary cost pressure. Going forward, as rental equipment is replaced, a more stable fiscal environment materializes and production increases, costs are expected to decline.

Mark Brennan, CEO and Chairman commented, "The results from this quarter demonstrate our continued ability to maintain production while paying down debt through increased cashflows. This process has continued through the first quarter of 2025. We are well positioned to deploy capital in a strategic and fiscally prudent manner to ramp up exploration efforts at MDN, initiate our underground production at Paloma, complete a bankable feasibility study at our high grade/ purity Mont Sorcier DRI iron project, and fund the development of the Lagoa Salgada Project, assuming closing of the proposed acquisition of Ascendant Resources Inc.), while continuing to increase Cerrado's financial strength., We anticipate 2025 will be a transformative year for Cerrado."

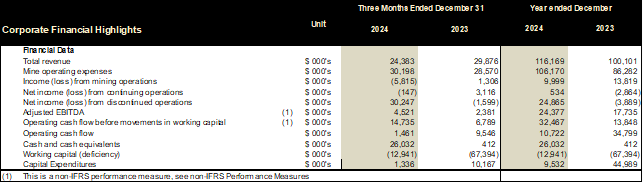

Cerrado has made significant improvements to its working capital position and balance sheet over the 2024 year. As at December 31, 2024, the Company had a working capital deficit of

Further improvement in the balance sheet has continued through Q1/25 and into Q2/25, with the final US

the current focus at MDN will be increasing production rates at its heap leach operation to around 4,000-4,500 GEO per month for the next 4 years, as outlined in the recent NI 43-101 Preliminary Economic Assessment Technical Report and Mineral Resource Estimate for The Minera Don Nicolas Mine in Santa Cruz, Argentina ("PEA"). Consistent production along with historically high gold prices, ensures the Company is well placed to continue its debt and payables reduction program as well as fund future development, exploration and push forward its development projects in Quebec and in Portugal, subject to closing the acquisition of Ascendant Resources.

Q4 Financial Performance

Table 1. Q4 and Annual 2024 Operational and Financial Performance

The Company produced 10,431 GEO and sold 10,108 GEO during Q4 2024. Production levels decreased from Q4 2023 as ore grades through the CIL circuit decreased with increased processing of low-grade stockpiles as mining at Calandrias Norte deposit was completed. As previously stated, lower production and ongoing inflationary pressures in Argentina, especially for labour, have seen unit costs increase in Q4/24 relative to Q4/23. Production from Calandrias Sur heap leach operations continued to ramp up towards full production during the quarter and achieved 5,956 GEO during Q4 2024. The crushing plant is now operating as expected, and additional capacity is planned to be installed during H1 2025, which is expected to provide much more stability over production rates and more consistent feed to the heap leach pad, improving Cerrado's overall operational and financial performance. As of April, production from the heap leach is running at approximately +3,000 GEO per month and should reach full capacity in Q2/25.

As noted, the Company completed a PEA of the heap leach operations at Calandrias Sur, Calandrias Norte and the development proposals for defined ore in the Martinetas area. MDN is currently following the development and production profile outlined in the PEA, however underground production is being brought forward to H2/25, targeting increased production and profitability for the near term. Any exploration success, particularly for new high-grade resources at MDN, would also be additive to the PEA.

Going into the first quarter of 2025 and beyond, Cerrado's MDN operations are benefitting from the completion of its recent expansionary capital expenditure program to grow production with its new heap leach operations, while sustaining CIL production from stockpiles until the end of Q2 2025. Higher gold prices have enabled the plant to remain operational by processing stockpiles through March and April. While the near-term cash generation profile continues to improve, the Company is actively working to term out the maturity of its current short term debt profile.

As noted in the Press Release dated April 15, 2025, the Company raised its 2025 annual production guidance to 55,000 - 60,000 GEO, up from 50,000 - 55,000 GEO, to include the addition of modest underground production. AISC costs are expected to be modestly higher than previously anticipated with an AISC of between

A new Exploration initiative began in Q1 with the focus on growing the known resources at MDN beyond those outlined in the recent Mineral Resource Estimate ("MRE"). The focus remains on defining high grade-near surface targets that can readily be brought into the mine plan, underground exploration as well as a regional program to better understand the potential of the significant land package Cerrado holds at MDN.

At the Mont Sorcier high grade/ purity DRI iron project operated by Cerrado's wholly owned subsidiary Voyager Metals Inc., work continued to advance the project with several workstreams related to permitting, social license and the initiation of the Feasibility Study which is targeted to be completed during Q1 2026. The high quality of the concentrate, grading over

The Company currently anticipates closing the proposed acquisition of all the outstanding common shares of Ascendant Resources Inc. not already owned by Cerrado in May 2025 (see Press Release dated February 3, 2025, for full details). Closing of the proposed acquisition is subject to the satisfaction of certain closing conditions and there is no assurance that it will close. Assuming closing of the transaction, the Company plans to continue to advance the Lagoa Salgada VMS project through several key workstreams to reach a construction decision by Q4 2025/Q1 2026.

Conference Call Details

Cerrado Gold Management will host a conference call on May 1, 2025, at 11:00 AM EDT to discuss the Q4 and Annual financial and production results. The presentation for the call can be found on the investor page on Cerrado Gold's website at cerradogold.com. Call details are as follows:

Pre-Registration for Conference Call

Participants can preregister for the conference by navigating to:

https://dpregister.com/sreg/10199377/ff0bb54608

Participants will receive dial-in numbers to connect directly upon registration completion.

Those without internet access or unable to pre-register may dial in by calling:

PARTICIPANT DIAL IN (TOLL FREE): 1-844-763-8274

PARTICIPANT INTERNATIONAL DIAL IN: 1-647-484-8814

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Andrew Croal P.Eng, Chief Technical Officer for Cerrado Gold, who is a Qualified Person as defined in National Instrument 43-101.

About Cerrado

Cerrado Gold is a Toronto-based gold production, development, and exploration company focused on gold projects in South America. The Company is the

In Argentina, Cerrado is maximizing asset value at its Minera Don Nicolas operation through continued operational optimization and is growing production through its operations at the Las Calandrias heap leach project. An extensive campaign of exploration is ongoing to further unlock potential resources in our highly prospective land package in the heart of the Deseado Masiff.

In Canada, Cerrado holds a

For more information about Cerrado please visit our website at: www.cerradogold.com.

Mark Brennan

CEO and Chairman

Mike McAllister

Vice President, Investor Relations

Tel: +1-647-805-5662

mmcallister@cerradogold.com

Disclaimer

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado, anticipated continued improvements in operating results and working capital position, expectations regarding the CIL plant processing lower grade stockpiles, the potential for improvement at MDN's heap leach operation, expectations regarding improvements in operating costs at MDN including AISC, additional capacity being added at the heap leach operation, the anticipated timing of completing the feasibility study at the Mont Sorcier project and the likelihood and anticipated date of closing the acquisition of Ascendant Resources Inc. In making the forward- looking statements contained in this press release, Cerrado has made certain assumptions. Although Cerrado believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

SOURCE: Cerrado Gold Inc.

View the original press release on ACCESS Newswire