Critical Metals Corp. Nasdaq-CRML Announces Multiple Extensions to Known Resources & Multiple New Ultra High-Grade Mineralization Results of 27.0% Heavy REE’s for the 2025 Drilling Campaign for Area B, Fjord & Others with Immediate Near-Term Growth Potential & 2026 Drilling Target Selection

Rhea-AI Summary

Critical Metals Corp (Nasdaq: CRML) reported final assay results from its 2025 drilling at Area B and the Fjord Deposit, Tanbreez Rare Earths Project, Greenland. TREO+Y grades from 2025 diamond drilling range ~0.40%–0.47% (Area B/Fjord) with HREO ~26–27%, and broader Area B results span ~0.35%–0.77% TREO+Y. The Fjord area remains open along strike, and results are expected to support a revised Mineral Resource Estimate and 2026 drilling and mine‑planning studies. Next steps include infill/extension drilling and optimization for 2026 field season.

Positive

- Drill results demonstrate laterally extensive mineralization across Area B over a ~1,750m corridor

- Heavy rare earth oxide (HREO) content approximately 26–27% of TREO+Y, indicating strategic metal richness

- Fjord deposit remains open along strike, supporting potential resource expansion and revised MRE work

- Assay suite shows consistent presence of strategic elements (Ga, Hf, Ce, Y, Nb) across holes

Negative

- Reported TREO+Y grades are modest, ranging ~0.35%–0.77%, which may limit near‑term economic cutoffs

- Current 2025 drilling is broadly spaced, leaving continuity and tonnage estimates uncertain without infill drilling

- No economic weighting applied and a 3,000ppm cutoff used, which leaves metal value and equivalence unquantified

- Results require a revised Mineral Resource Estimate and further mine planning before clear development metrics exist

News Market Reaction

On the day this news was published, CRML gained 8.57%, reflecting a notable positive market reaction. Argus tracked a peak move of +17.1% during that session. Our momentum scanner triggered 37 alerts that day, indicating elevated trading interest and price volatility. This price movement added approximately $113M to the company's valuation, bringing the market cap to $1.44B at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

CRML was up 3.42% pre-news, while peers like UAMY (+10.95%), USAS (+8.85%), and SLI (+4.29%) also gained, suggesting broader basic materials strength alongside company-specific drilling news.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Jan 30 | License extension | Positive | -6.0% | Austrian government renewed Wolfsberg mining license for two more years. |

| Jan 30 | Project team update | Positive | -6.0% | Appointed project delivery team to fast-track Tanbreez pilot development. |

| Jan 27 | Operations technology | Positive | -0.2% | Announced autonomous communications and drone system for Tanbreez. |

| Jan 16 | Corporate webcast | Neutral | +2.3% | Scheduled business update call and webcast for January 22, 2026. |

| Jan 15 | Saudi JV term sheet | Positive | -3.8% | Non-binding 50/50 JV for up to $1.5B Saudi rare earth processing facility. |

Recent positive strategic and project updates often saw negative next-day price reactions, indicating a tendency toward sell-the-news behavior.

Over the past month, CRML reported a Wolfsberg mining license extension, a Tanbreez project delivery team, and a large Saudi JV term sheet of up to $1,500,000,000, plus infrastructure and communications upgrades at Tanbreez. Despite largely constructive news, several items saw negative 24-hour moves between -3.77% and -6%. Today’s drilling update at Tanbreez, highlighting grade and resource extension potential, fits the pattern of operational progress across its rare earth and lithium assets.

Regulatory & Risk Context

An active Form F-3 resale shelf filed on 2025-10-20 covers up to 18,030,303 existing and warrant-linked shares for a selling holder. The company would not receive proceeds from resales, only potential cash from any PIPE Warrant exercises at $7.00 or $0.0001 per share.

Market Pulse Summary

The stock moved +8.6% in the session following this news. A strong positive reaction aligns with consistent project advancement at Tanbreez, where 2025 drilling delivered TREO+Y grades of 0.40%–0.47% and heavy rare earth proportions of 26%–27%. Historically, CRML often saw negative one-day moves on positive news, so any large gain could face profit-taking. An active resale shelf for 18,030,303 shares also adds overhang risk from selling securityholders, which may influence how long strength was sustained.

Key Terms

heavy rare earth oxide technical

ppm technical

peralkaline-hosted technical

wgs84 zone 23n technical

AI-generated analysis. Not financial advice.

NEW YORK, Feb. 09, 2026 (GLOBE NEWSWIRE) -- Critical Metals Corp. (Nasdaq: CRML) (“Critical Metals Corp” or the “Company”), a leading critical minerals mining company, today announced that it has received the final assay results from the 2025 drilling program at Area B and the Fjord Deposit at the Tanbreez Rare Earths Project in Greenland.

Key Highlights

Area B – Extent of mineralization:

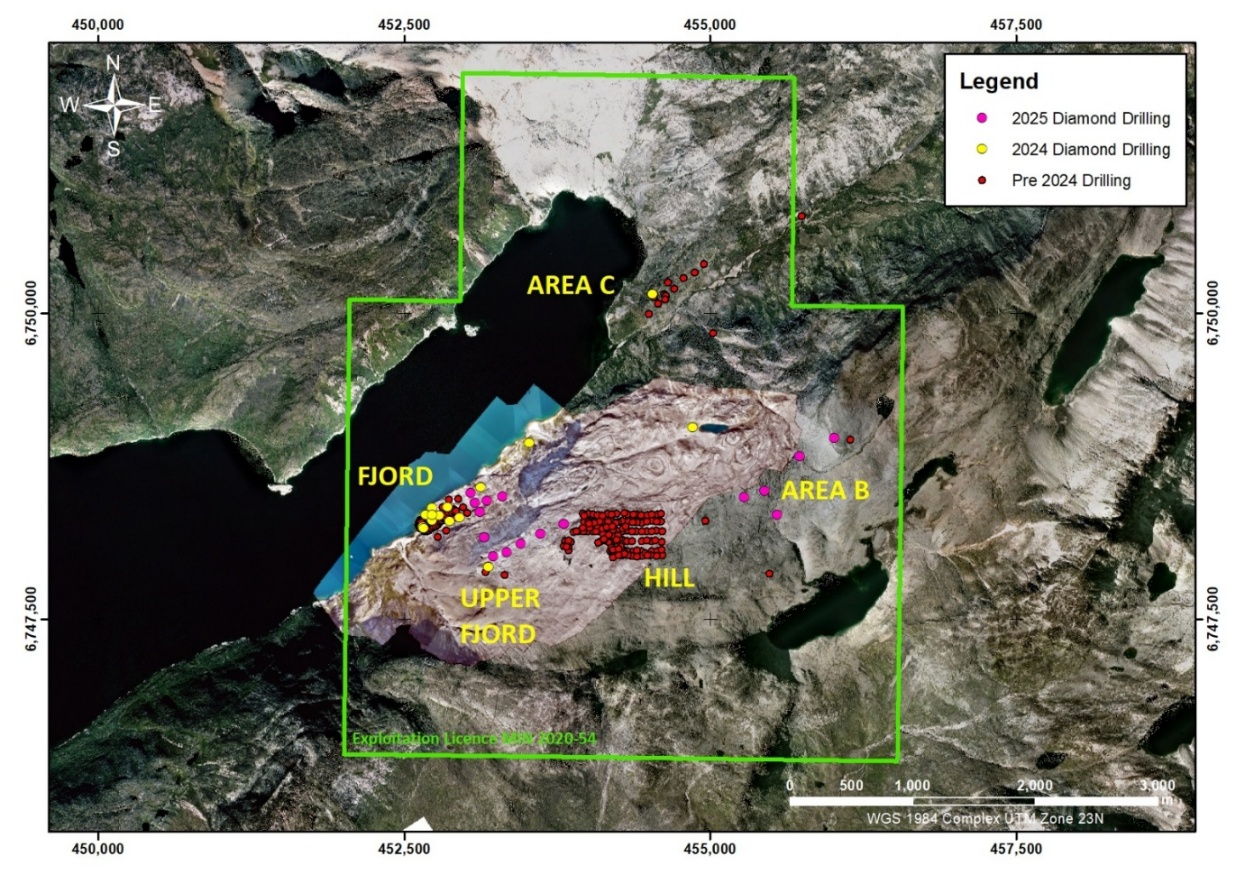

Broad-spaced drilling results successfully demonstrate significant and extensive mineralisation potential across Area B, located immediately adjacent to the eastern margin of the Hill Zone Deposit (refer to ASX announcements dated 16 December 2025 and 15 January 2026, Figure 2).

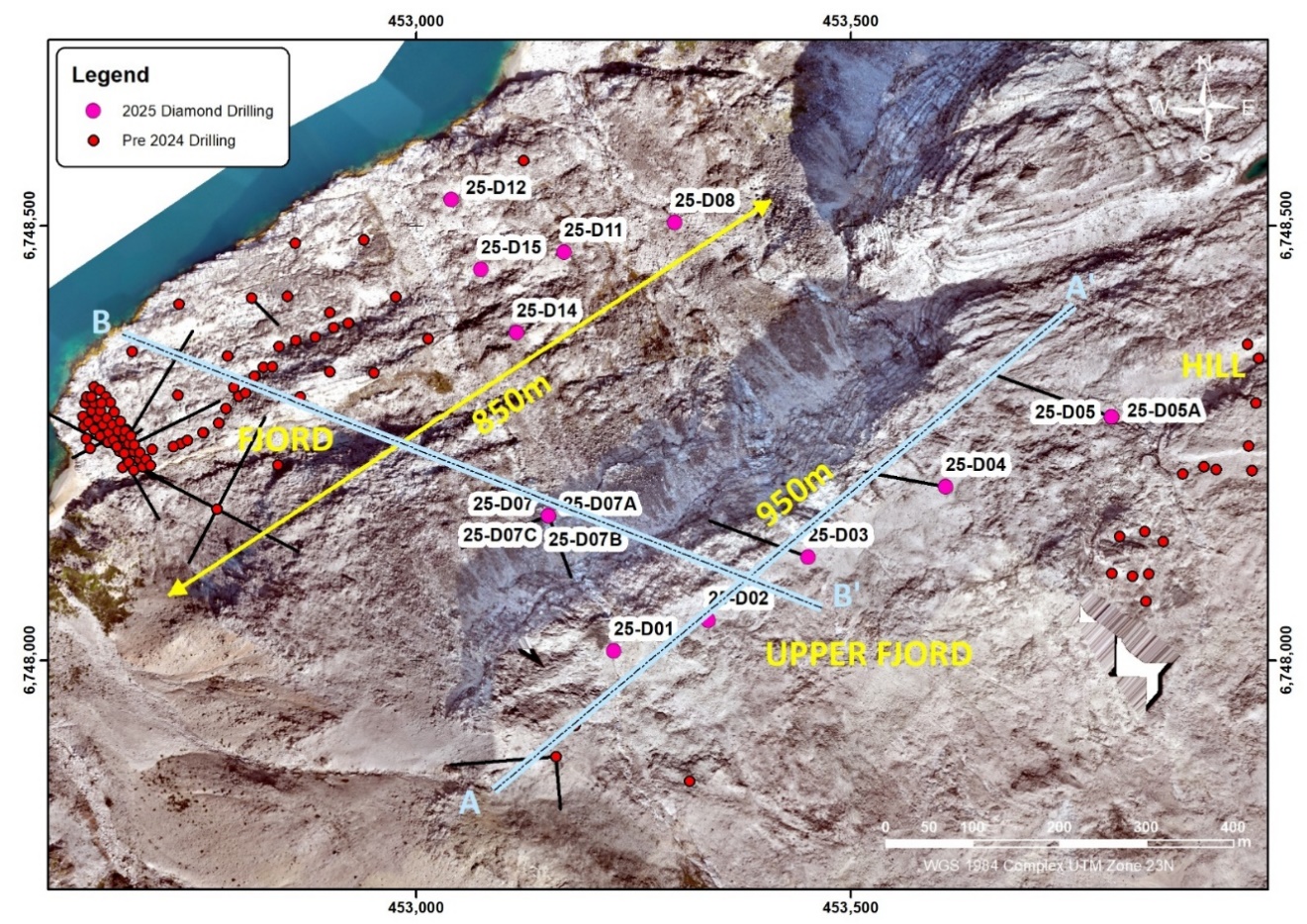

Fjord Deposit – Extent of mineralization:

The Fjord area remains open along strike, with mineralization consistently confirmed near surface and demonstrating strong lateral and vertical continuity (refer to ASX announcements dated 16 December 2025 and 15 January 2026, Figure 2).

Resource growth potential:

The 2025 Fjord and Upper Fjord drilling results provide a strong indication of potential for resource growth and extension drilling for 2026 currently being planned.

Grade profile:

Total Rare Earth Oxide (TREO+Y) grades from the 2025 diamond drilling range from

Tony Sage, Chief Executive Officer of Critical Metals Corp., commented:

“I am very encouraged by the 2025 deep diamond drilling results, which continue to demonstrate meaningful extensions to our known Mineral Resource and confirm consistent rare earth mineralisation across the Fjord, Upper Fjord, Hill and now, Area B zone. These results enhance our confidence in the broader REE potential of the Tanbreez Deposit.

Importantly, the new assay data is expected to add further mineralised tonnage to the existing Hill and Fjord Deposits, supporting a potential uplift in scale and continuity across a significantly larger project footprint. This reinforces Tanbreez as a strategic, long‑life rare earth asset.

Our team is now progressing extension and infill drilling programs for the 2026 field season, focused on optimising future pit designs and advancing Mineral Resource studies. These next steps are aimed at de‑risking the project and positioning Tanbreez for future development milestones.”

New results are as follows.

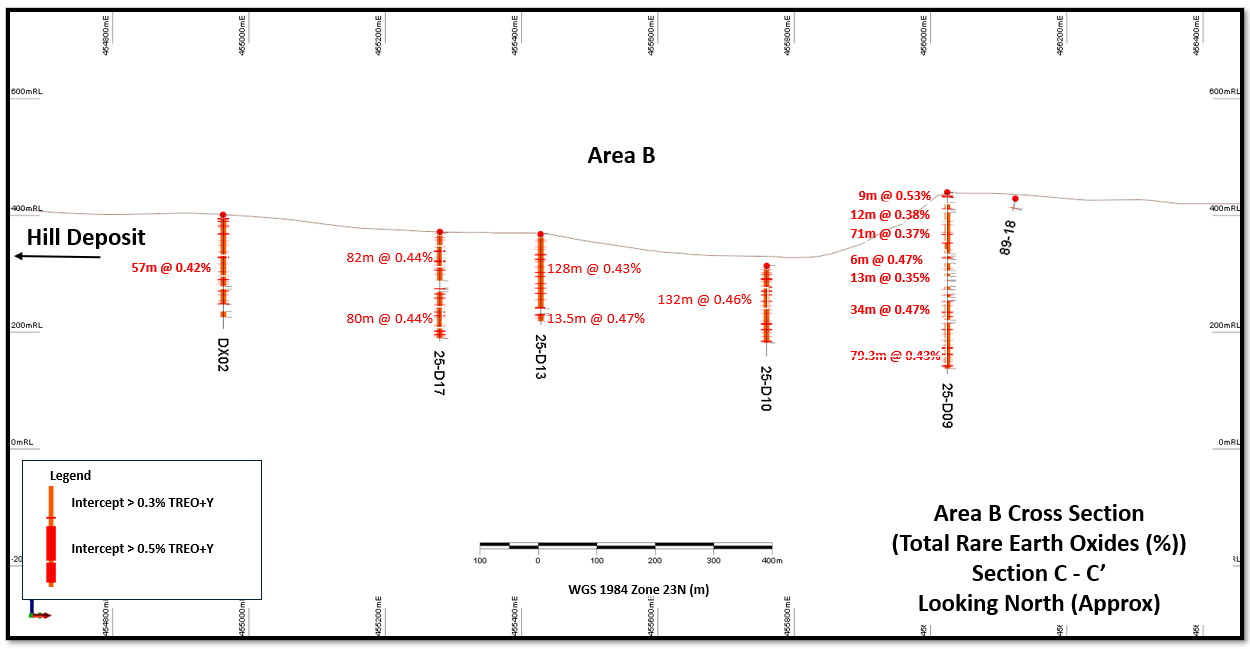

AREA B -– Final 2025 drill results

Hole 25-D10

132.0m @

Hole 25-D13

128.0m @

13.5m @

Hole 25-D16

6.0m @

37.0m @

93.0m @

Hole 25-D17

82.0m @ 0.4386 TREOY (

2.0m @

80.0m @

Area B – Geological context and exploration results

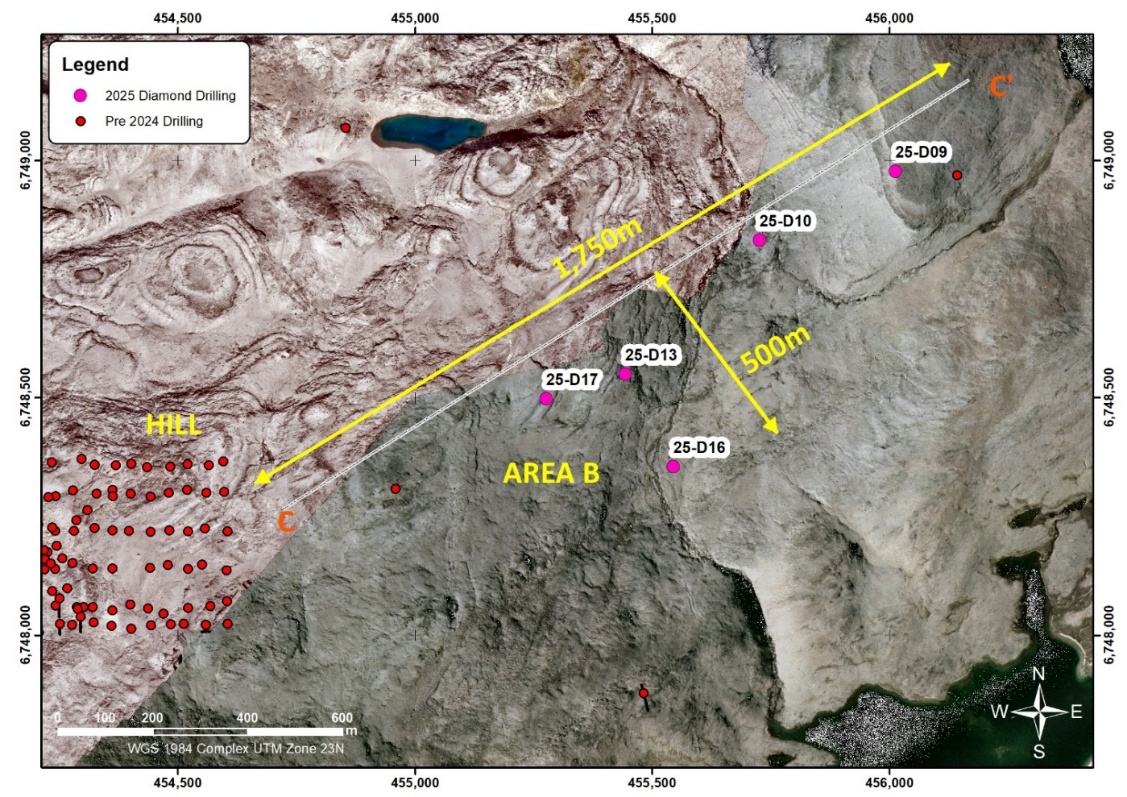

Area B is located to the east-northeast of the Hill Deposit and spans an approximately 1,750 metre corridor of highly prospective geology. All drilling completed in 2025 within this area has returned broad intervals of rare earth mineralization, with TREO+Y grades typically ranging from ~

Drill holes 25-D17, 25-D13, 25-D10 and 25-D09 formed part of a reconnaissance drilling program designed to assess the prospectivity within this eastern extension of the Hill Deposit.

While the current drilling pattern remains widely spaced, results to date indicate strong geological and grade continuity across the corridor. This continuity highlights significant laterally extensive mineralization potential within Area B, which is positioned immediately adjacent to the eastern margin of the Hill Zone Deposit.

In addition, results have now been returned for the final 2025 drillhole at the Fjord deposit.

Fjord Deposit – Final 2025 drill results

Hole 25-D14

16.5m @ 0.4003 TREOY (

38.0m @ 0.3801 TREOY (

Hole 25-D15

55.5m @ 0.406 TREOY (

Holes 25‑D14 and 25‑D15 are located at the northeastern end of the Fjord Deposit and confirm that mineralization remains open along strike. The assay results are consistent with previously reported drilling in this area and are expected to support preparation of a revised Mineral Resource Estimate, as well as the advancement of subsequent mine planning studies (refer to Table 1).

The assay results continue to demonstrate consistent rare earth grades and highlight the presence of strategic metals, including gallium, hafnium, cerium, and yttrium. These outcomes further reinforce Tanbreez’s status as a globally significant peralkaline-hosted rare earth system with scale potential and exposure to multiple strategic metals exposure.

Details of the 2025 drilling program are provided in Table 1 (collar information), with mineralized greater than >

Figure 1. Diamond drill hole pad DDH25-5 drilled September 2025.

Figure 2. Area B ground proofing September 2025 for drill pad locations below 25-D09.

Figure 3 . Project Dilling historical 2007- 2014 and 2024 and 2025 Summary Plan (WGS84 zone 23N)

Figure 4. Area B - over 1,750m strike length of TREO mineralization

Figure 5. Project Drilling: historical (2007- 2014) and 2024 and 2025 Summary Plan (WGS84 zone 23N).

Figure 5. Area B - over 950m strike length of TREO mineralization

Area B and Hill Zone Deposit Tie-in Zone

Drill holes 25‑D17, 25‑D13, 25‑D10 and 25‑D09 formed part of a reconnaissance program designed to assess the prospectivity east‑northeast of the Hill Deposit. Although the drill spacing remains broad, results clearly indicate significant laterally extensive mineralization potential across Area B, whis is located immediately adjacent to the eastern margin of the Hill Zone Deposit.

Based on the results reported in this announcement, additional drilling across Area B and the Upper Fjord area is considered warranted to further define mineralized scale, continuity and potential resource growth.

Results from Area B, together with the broader 2024 and 2025 drilling programs, demonstrate TREO+Y grades ranging from approximately

Grade Summary - Area B 2025 Drilling

- Total Rare Earth Oxide + Yttrium (TREO+Y): ranges between approximately

0.35% –0.61% . - Heavy Rare Earth Oxide (HREO) proportion: ranges between approximately 21–

27% of TREO+Y. - Strategic and associated elements: Gallium oxide (~99 ppm), hafnium oxide (~292 ppm), yttrium oxide (~690 ppm), and cerium oxide (~1,646 ppm) are consistently present, together with zirconium oxide (

0.9% –2.4% ), niobium (~1,154ppm), and tantalum (~85ppm).

Reporting and Methodology Notes

- TREO+Y represents the sum of La₂O₃, CeO₂, Pr₂O₃, Nd₂O₃, Sm₂O₃, Eu₂O₃, Gd₂O₃, Tb₄O₇, Dy₂O₃, Ho₂O₃, Er₂O₃, Tm₂O₃, Yb₂O₃, Lu₂O₃, and Y₂O₃.

- A minimum downhole intercept width of 2m has been applied.

- No economic weighting has been applied to the reported results.

- A grade cut-off of 3,000ppm for TREO+Y has been applied with no metal equivalence calculation.

- All drilling and assay results, including both higher and lower grade intervals, are reported to ensure balanced and transparent disclosure.

Next Steps

The Company is undertaking a detailed review of several optimization strategies, which will be integrated with the advanced planning currently underway for the 2026 field season.

| Hole ID | Easting | Northing | Elevation | Dip | Azimuth | Depth |

| 25-D10 | 455727.9 | 6748831.9 | 313.8 | -90 | 0 | 155.4 |

| 25-D13 | 455446.7 | 6748549.4 | 368.3 | -90 | 0 | 155.9 |

| 25-D14 | 453114.7 | 6748379.0 | 83.0 | -90 | 0 | 65.0 |

| 25-D15 | 453073.0 | 6748451.9 | 50.3 | -90 | 0 | 65.4 |

| 25-D16 | 455543.4 | 6748348.19 | 373.3 | -90 | 0 | 161.0 |

| 25-D17 | 455275.1 | 6748499.5 | 372.5 | -90 | 0 | 188.0 |

| Total | 790.7 |

Table 1- 2025 reported Drilling Coordinates based on WGS1984 Zone 23 North grid system with results to date for 2025.

About Critical Metals Corp.

Critical Metals Corp (Nasdaq: CRML) is a leading mining development company focused on critical metals and minerals, and producing strategic products essential to electrification and next generation technologies for Europe and its western world partners. Its flagship Project, Tanbreez, is one of the world's largest, rare-earth deposits and is in Southern Greenland. The deposit is expected to have access to key transportation outlets as the area features year-round direct shipping access via deep water fjords that lead directly to the North Atlantic Ocean.

Another key asset is the Wolfsberg Lithium Project located in Carinthia, 270 km south of Vienna, Austria. The Wolfsberg Lithium Project is the first fully permitted mine in Europe and is strategically located with access to established road and rail infrastructure and is expected to be the next major producer of key lithium products to support the European market. Wolfsberg is well positioned with offtake and downstream partners to become a unique and valuable asset in an expanding geostrategic critical metals portfolio.

With this strategic asset portfolio, Critical Metals Corp is positioned to become a reliable and sustainable supplier of critical minerals essential for defense applications, the clean energy transition, and next-generation technologies in the western world.

For more information, please visit https://www.criticalmetalscorp.com/.

Cautionary Note Regarding Forward Looking Statements

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements may include expectations of our business and the plans and objectives of management for future operations. These statements constitute projections, forecasts and forward-looking statements, and do not guarantee performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this news release, forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target,” “designed to” or other similar expressions that predict or indicate future events or trends or that are not statements of historical facts. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements for many reasons, including the factors discussed under the “Risk Factors” section in the Company’s Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission. These forward-looking statements are based on information available as of the date of this news release, and expectations, forecasts and assumptions as of that date, involve several judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Critical Metals Corp.

Investor Relations: ir@criticalmetalscorp.com

Media: pr@criticalmetalscorp.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/4d2392ec-9896-4452-85ea-010fdc946d37

https://www.globenewswire.com/NewsRoom/AttachmentNg/f0723cea-c84e-4a96-8d4d-271b19c203cc

https://www.globenewswire.com/NewsRoom/AttachmentNg/c7d18355-d5a9-4dd4-a24e-0429dc0f8399

https://www.globenewswire.com/NewsRoom/AttachmentNg/c6c21536-783e-499b-9baa-1818d56f7bdd

https://www.globenewswire.com/NewsRoom/AttachmentNg/f9549eb4-9572-456b-b5ea-252db4a7f51d

https://www.globenewswire.com/NewsRoom/AttachmentNg/19c671fb-e711-4c4b-92e6-fd9bc7e239d5