SPWR Q2’25: $67.5M Revenue, $2.4M Operating Profit

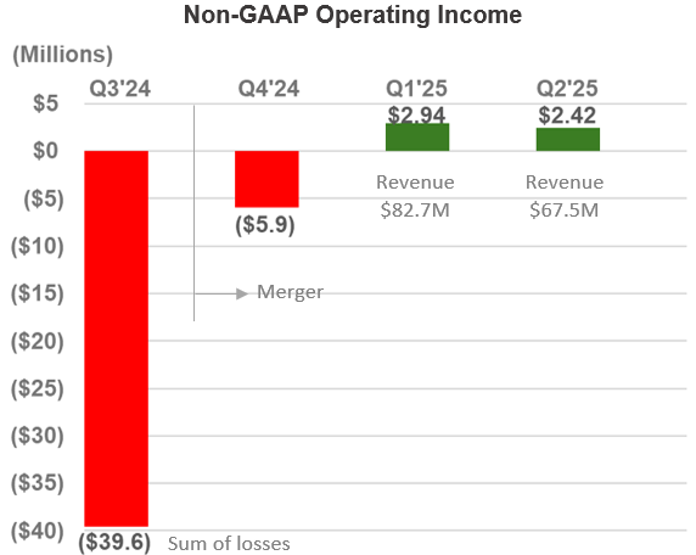

SunPower (NASDAQ: SPWR) reported Q2'25 financial results with revenue of $67.5 million, down from $82.7 million in Q1'25. Despite the revenue decline, the company achieved a non-GAAP operating profit of $2.4 million, supported by successful cost-cutting initiatives that reduced operating expenses by $4.6 million to $17.3 million.

The company's gross margin improved to 43% from 39% in Q1'25 through focusing on more profitable market segments. CEO T.J. Rodgers attributed the revenue decline to the ITC tax subsidy reduction impact, but noted that current bookings indicate Q2'25 will mark the end of the revenue freeze. For Q3'25, SunPower forecasts revenue of approximately $70 million and operating profit of about $3.0 million.

Key management changes include the departure of CFO Dan Foley and CLO Chais Sweat, with Jeanne Nguyen stepping in as interim CFO and Nicolas Wenker joining as the new CLO. The company also joined the Russell 3000 and Russell Microcap Indices and established a new low-cost finance center in Chennai, India.

SunPower (NASDAQ: SPWR) ha riportato i risultati finanziari del secondo trimestre 2025 con un fatturato di 67,5 milioni di dollari, in calo rispetto agli 82,7 milioni di dollari del primo trimestre 2025. Nonostante la diminuzione del fatturato, l'azienda ha registrato un utile operativo non-GAAP di 2,4 milioni di dollari, sostenuto da efficaci iniziative di riduzione dei costi che hanno portato a una diminuzione delle spese operative di 4,6 milioni, arrivando a 17,3 milioni di dollari.

Il margine lordo è migliorato al 43% rispetto al 39% del primo trimestre 2025, grazie al focus su segmenti di mercato più redditizi. Il CEO T.J. Rodgers ha attribuito il calo del fatturato all'impatto della riduzione del credito d'imposta ITC, ma ha sottolineato che le prenotazioni attuali indicano che il secondo trimestre 2025 segnerà la fine del congelamento dei ricavi. Per il terzo trimestre 2025, SunPower prevede un fatturato di circa 70 milioni di dollari e un utile operativo di circa 3,0 milioni di dollari.

Tra i cambiamenti chiave nella gestione figurano l'uscita del CFO Dan Foley e del CLO Chais Sweat, con Jeanne Nguyen che assume il ruolo di CFO ad interim e Nicolas Wenker che entra come nuovo CLO. L'azienda è inoltre entrata negli indici Russell 3000 e Russell Microcap e ha istituito un nuovo centro finanziario a basso costo a Chennai, India.

SunPower (NASDAQ: SPWR) reportó los resultados financieros del segundo trimestre de 2025 con ingresos de 67,5 millones de dólares, una disminución respecto a los 82,7 millones de dólares del primer trimestre de 2025. A pesar de la caída en ingresos, la compañía logró un beneficio operativo non-GAAP de 2,4 millones de dólares, apoyado por exitosas iniciativas de reducción de costos que disminuyeron los gastos operativos en 4,6 millones, hasta 17,3 millones de dólares.

El margen bruto mejoró al 43% desde el 39% del primer trimestre de 2025, gracias al enfoque en segmentos de mercado más rentables. El CEO T.J. Rodgers atribuyó la caída de ingresos al impacto de la reducción del subsidio fiscal ITC, pero señaló que las reservas actuales indican que el segundo trimestre de 2025 marcará el fin de la congelación de ingresos. Para el tercer trimestre de 2025, SunPower pronostica ingresos aproximados de 70 millones de dólares y un beneficio operativo de alrededor de 3,0 millones de dólares.

Los cambios clave en la gestión incluyen la salida del CFO Dan Foley y el CLO Chais Sweat, con Jeanne Nguyen asumiendo como CFO interina y Nicolas Wenker incorporándose como nuevo CLO. La compañía también se unió a los índices Russell 3000 y Russell Microcap y estableció un nuevo centro financiero de bajo costo en Chennai, India.

SunPower (NASDAQ: SPWR)는 2025년 2분기 실적을 발표하며 매출액이 6,750만 달러로 2025년 1분기의 8,270만 달러에서 감소했다고 밝혔습니다. 매출 감소에도 불구하고, 회사는 운영비용을 460만 달러 줄여 1,730만 달러로 낮추는 비용 절감 노력 덕분에 비-GAAP 영업이익 240만 달러를 달성했습니다.

회사의 총이익률은 2025년 1분기의 39%에서 43%로 개선되었으며, 이는 더 수익성 높은 시장 부문에 집중한 결과입니다. CEO T.J. Rodgers는 매출 감소가 ITC 세금 보조금 감소의 영향 때문이라고 설명했으나, 현재 예약 현황은 2025년 2분기가 매출 동결의 끝을 의미할 것이라고 밝혔습니다. 2025년 3분기에는 매출 약 7,000만 달러와 영업이익 약 300만 달러를 예상하고 있습니다.

주요 경영진 변화로는 CFO Dan Foley와 CLO Chais Sweat의 퇴임이 있으며, Jeanne Nguyen이 임시 CFO로, Nicolas Wenker가 새로운 CLO로 합류했습니다. 또한 회사는 Russell 3000 및 Russell Microcap 지수에 편입되었으며 인도 첸나이에 새로운 저비용 금융 센터를 설립했습니다.

SunPower (NASDAQ : SPWR) a publié ses résultats financiers du deuxième trimestre 2025 avec un chiffre d'affaires de 67,5 millions de dollars, en baisse par rapport à 82,7 millions de dollars au premier trimestre 2025. Malgré cette baisse du chiffre d'affaires, la société a réalisé un résultat opérationnel non-GAAP de 2,4 millions de dollars, soutenu par des initiatives efficaces de réduction des coûts qui ont permis de diminuer les charges opérationnelles de 4,6 millions, pour atteindre 17,3 millions de dollars.

La marge brute s'est améliorée à 43% contre 39% au premier trimestre 2025, grâce à un recentrage sur des segments de marché plus rentables. Le PDG T.J. Rodgers a attribué la baisse du chiffre d'affaires à l'impact de la réduction du crédit d'impôt ITC, mais a noté que les commandes actuelles indiquent que le deuxième trimestre 2025 marquera la fin du gel des revenus. Pour le troisième trimestre 2025, SunPower prévoit un chiffre d'affaires d'environ 70 millions de dollars et un résultat opérationnel d'environ 3,0 millions de dollars.

Parmi les changements clés dans la direction figurent le départ du directeur financier Dan Foley et du CLO Chais Sweat, avec Jeanne Nguyen qui prend le poste de directrice financière par intérim et Nicolas Wenker qui rejoint l'entreprise en tant que nouveau CLO. La société a également rejoint les indices Russell 3000 et Russell Microcap et a établi un nouveau centre financier à faible coût à Chennai, en Inde.

SunPower (NASDAQ: SPWR) meldete die Finanzergebnisse für das zweite Quartal 2025 mit einem Umsatz von 67,5 Millionen US-Dollar, was einem Rückgang gegenüber 82,7 Millionen US-Dollar im ersten Quartal 2025 entspricht. Trotz des Umsatzrückgangs erzielte das Unternehmen einen non-GAAP-Betriebsgewinn von 2,4 Millionen US-Dollar, unterstützt durch erfolgreiche Kostensenkungsmaßnahmen, die die Betriebskosten um 4,6 Millionen auf 17,3 Millionen US-Dollar reduzierten.

Die Bruttomarge verbesserte sich auf 43% gegenüber 39% im ersten Quartal 2025, indem man sich auf profitablere Marktsegmente konzentrierte. CEO T.J. Rodgers führte den Umsatzrückgang auf die Auswirkungen der Reduzierung der ITC-Steuervergünstigung zurück, merkte jedoch an, dass die aktuellen Auftragsbestände darauf hindeuten, dass das zweite Quartal 2025 das Ende des Umsatzstillstands markieren wird. Für das dritte Quartal 2025 prognostiziert SunPower einen Umsatz von etwa 70 Millionen US-Dollar und einen Betriebsgewinn von rund 3,0 Millionen US-Dollar.

Wichtige Managementänderungen umfassen den Weggang von CFO Dan Foley und CLO Chais Sweat, wobei Jeanne Nguyen als interimistische CFO einspringt und Nicolas Wenker als neuer CLO hinzukommt. Das Unternehmen ist außerdem in die Russell 3000- und Russell Microcap-Indizes aufgenommen worden und hat ein neues kostengünstiges Finanzzentrum in Chennai, Indien, eingerichtet.

- Operating profit of $2.4 million maintained despite $15.2 million revenue drop

- Successful cost reduction cutting operating expenses by $4.6 million to $17.3 million

- Gross margin improved to 43% from 39% in Q1'25

- Inclusion in Russell 3000 and Russell Microcap Indices

- Agreement secured to collect $16 million in delayed New Homes accounts receivable

- Establishment of low-cost finance center in India

- Revenue declined to $67.5 million from $82.7 million in Q1'25

- Departure of key executives including CFO and CLO

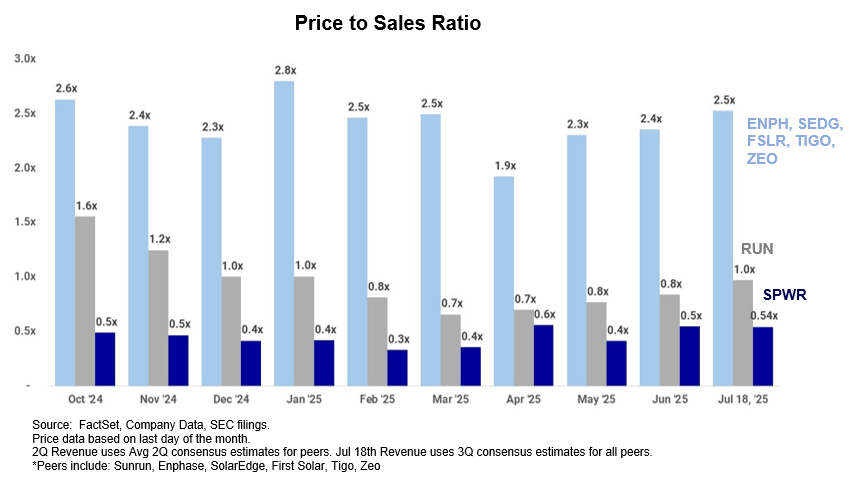

- Low price-to-sales ratio of 0.54x compared to industry average of 2.5x

- Cash balance remains tight at $11.1 million

Insights

Despite 18% revenue drop from Q1, SunPower maintained profitability through aggressive cost-cutting and improved margins amid ITC subsidy challenges.

SunPower delivered mixed results in Q2'25, with revenue declining 18.4% sequentially to

The revenue decline appears primarily driven by the phase-out of the 30% Investment Tax Credit (ITC), which has cooled demand faster than management initially projected. Their prior models anticipated quarterly revenue dropping to

From a cash perspective, SunPower ended Q2 with

Management's outlook suggests stabilization, with Q3'25 revenue projected around

The price-to-sales ratio of 0.54x suggests significant undervaluation relative to both technology peers (2.5x) and even struggling solar competitors (SunRun at 1.0x). Management attributes this to market perception issues, including confusion with the old bankrupt SunPower entity and aggressive risk factor disclosures in financial filings.

Vigorous Cost Cutting Offsets ITC-Related Revenue Drop

OREM, Utah, July 22, 2025 (GLOBE NEWSWIRE) -- SunPower, formerly d/b/a Complete Solaria, Inc. (“SunPower” or the “Company”) (Nasdaq: SPWR), a solar technology, services, and installation company, will present its Q2’25 results via webcast today Tuesday, July 22 at 1:00pm ET. Interested parties may access the webcast by registering here or by visiting the Events page within the IR section of the company website: https://investors.sunpower.com/news-events/events.

Fellow Shareholders:

The preliminary Q2’25 quarterly report of key financial parameters is shown below. The final Q2’25 quarterly report will be the 10Q report2 to be filed with the SEC on August 13, 2025.

| SunPower Revenue & Operating Income1 | |||||||

| Our First Two Quarters of 2025, Using Accounting Methods from Audited 10K | |||||||

| GAAP2 | NON-GAAP3 | ||||||

| ( | Q2 2025 | Q1 2025 | Q2 2025 | Q1 2025 | |||

| Revenue | 67,524 | 82,740 | 67,524 | 82,7404 | |||

| Gross Profit | 28,761 | 32,497 | 28,761 | 32,497 | |||

| Gross Margin | |||||||

| Operating Exp. | 31,479 | 31,455 | 26,343 | 29,559 | |||

| Operating Exp. (less commission) | 22,424 | 23,771 | 17,2885 | 21,8755 | |||

| Stock Comp., Intangible Costs6 | 5,136 | 1,896 | 0 | 0 | |||

| Operating Income Exp.6 (loss) | (2,718)6 | 1,042 | 2,4186 | 2,938 | |||

| Cash Balance7 | 11,125 | 10,553 | 11,125 | 10,553 | |||

_______________________

1 Operating income based on the non-GAAP results posted on our website [us.sunpower.com].

2 To see our 2025 GAAP financial statements, go to the SEC 10Q filing on our website.

3 Our non-GAAP financials are used to run the company and differ from the official GAAP report in three ways: no non-cash amortization of intangibles, no employee stock compensation charges (already reflected in share count) and no one-time M&A or downsizing events. (See note 4.)

4 The Q1’25 revenue and gross margin reported in our unaudited April 30, 2025 shareholder letter were lower,

5 Vigorous cost reduction program cut operating expense by

6 GAAP operating income is

7 Cash balances exclude restricted cash.

SunPower CEO, T.J. Rodgers, commented, “My last shareholder letter presented models for the impact on the solar industry of losing the

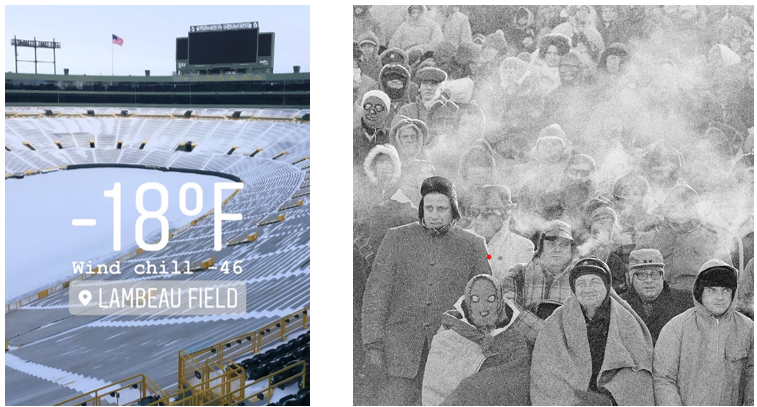

Rodgers continued, “The ITC revenue deep freeze was so fast and steep, it reminded me of my hometown of Oshkosh, Wisconsin when I woke up on January 31, 1967, the day after a typical “balmy” +5oF degree winter day – and it was 18oF below zero. That was also the day of the famous 1967 Ice Bowl game in Green Bay in which the Packers beat the Dallas Cowboys to win coach Lombardi’s fourth NFL championship. (Two weeks later the Packers beat the AFL champion Kansas City Chiefs in a game that would later be re-named Super Bowl I.) To wrap up the analogy, our current bookings are warming up and indicate that Q2’25 will be the end of the revenue freeze.”

When I got up on December 31, 1967, an arctic front had blasted us with windy (note the flag) ‑18oF weather on the day of the NFL Championship with the Dallas Cowboys, later dubbed the Ice Bowl. At that temperature, the fans’ breath immediately froze into an ice cloud that hung over Lambeau Field.

Summary of Q2’25 SunPower Results

- Our revenue dropped to

$67.5 million , but we remained profitable - Our operating profit was

$2.42 million , about the same as the prior quarter, but on$15.2 million less revenue, because of$4.59 million in cost cutting – an effort still underway

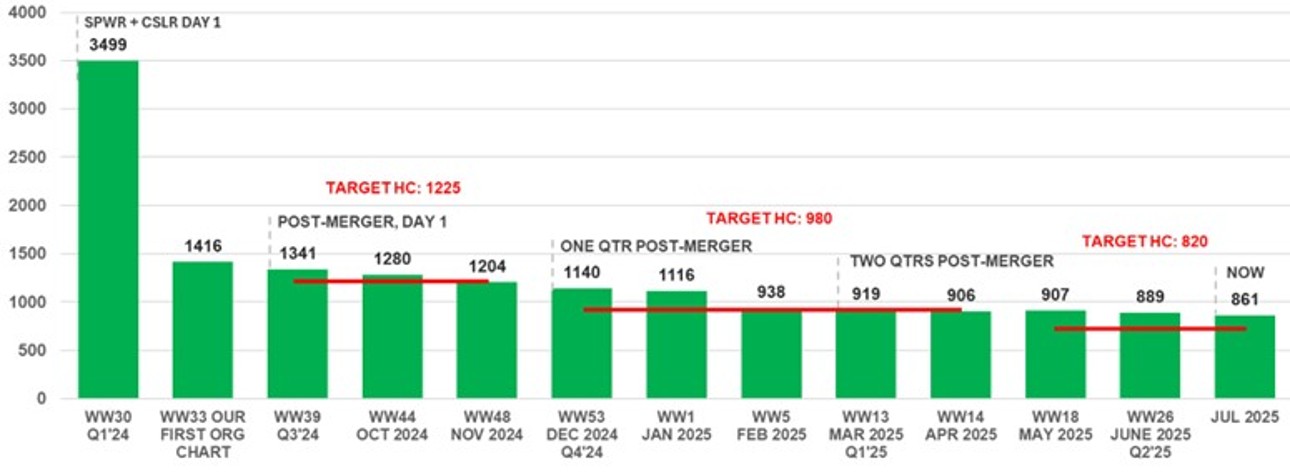

- SunPower “found another gear” in its cost reduction program. We are now down to 861 people – each of whom will receive

$500 in a stock bonus (about0.4% annualized dilution) for excellent quarterly performance

unPower Headcount History

Outlook

- For Q3’25 vs Q2’25, we forecast modestly increased revenue (about

$70 million ) - And increased operating profit (about

$3.0 million )

Subsequent Events

The SunPower estate signed an agreement with us on the last day of the quarter that authorizes us to collect all Old SunPower New Homes’ accounts receivable. This unnecessary AR controversy impeded collections in Q2’25, delaying

SunPower joined the Russell 3000 and Russell Microcap Indices. It will expand our shareholder base and increase the liquidity of our stock. The Russell Indices are widely used by investment managers and institutional investors for index funds and as benchmarks for active investment strategies.

India low-cost finance center created. Chennai, where we’ve engaged with two companies, has become our low-cost center for finance, including SOX. Excelencia, a company that uses “Chartered Accountants,” aka CPAs, will be doing most of our accounting work, and MylAI will be using its proprietary AI software to automate business processes for us.

CFO Dan Foley is leaving SunPower. He and I agreed last year that he could leave SunPower, but not before the 10K was filed and he had created a low-cost finance center in India. That’s now done, and Jeanne Nguyen, our Chief Accounting Officer, has become the interim CFO. We would like to thank Dan Foley for his hard work during the last year as we acquired and integrated SunPower, a company 10 times our size.

CLO and General Counsel Chais Sweat has left SunPower. Our new CLO, Nicolas Wenker, joins us with extensive in-house legal experience and is local to our new headquarters in Orem, Utah. We would like to thank Chais Sweat for his energetic assistance during the transition period.

SPWR board member Dan McCranie (Biography), a storied semiconductor sales and marketing executive, and during his career a Board member for 10 NASDAQ companies – including ON, Freescale and Cadence, has become the EVP of sales for our consolidated sales force.

So, Why Isn’t the Stock Price Higher?

We are proud of how lean and efficient our organization is and how quickly we’ve turned our losses into profits. Investors also appreciate the work we’ve done to restore – and profit from – the iconic SunPower name. So, why isn’t our share price higher? As of last Friday 7/18, our “price to sales (P/S) ratio,” our market capitalization divided by our revenue, was

| Market Capitalization Revenue | = | = | = | 0.54 |

Our basket of comparison tech stocks* has a stable P/S ratio of 2.5x (my old company, Cypress Semiconductor, had a 30-year median P/S ratio of 2.4x), but the solar industry has recently been under tariff and ITC pressure, which even caused the solar leader, SunRun, to bottom out at 0.7x, with a current recovery to 1.0x. So, why is SPWR dragging along at 0.54x despite good financial performance?

Fixing the Problems Reducing Price to Sales Ratio

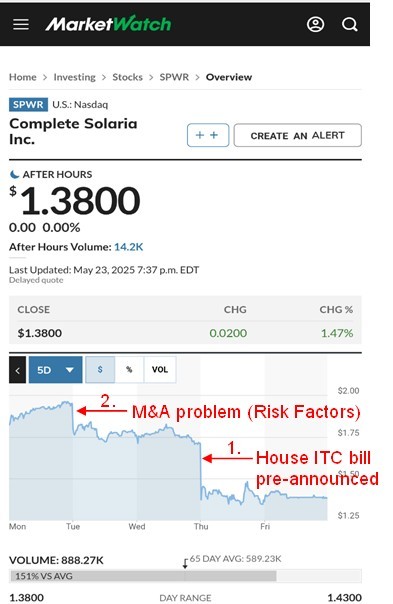

On April 30, 2025 the title on the earnings release read “First Profitable Quarter in Four Years,” a remarkable recovery in only 180 days for a three-company merger. Directly after that, our shares lost the momentum gained by getting hammered twice in one week as shown below.

1. The ITC Announcement drop was due to the first news leaks of the ITC cancellation.

2. Aggressive Risk Factor Presentation caused a share price drop just after our Q1’25 10Q was filed because of aggressively stated Risk Factors; for example, one risk factor said “…we may not achieve profitability…” in the very same quarterly report when the headline on our main report read “First Profitable Quarter in Four Years.” I now do a business check on the Risk Factors.

The actual Risk Factors (profit, cash flow, scale) themselves are an underlying problem: but our profitability is becoming higher and stable – in Q3’25 we intend to have a third consecutive quarter of profit which is likely to be the highest yet in the current run. And, we are working hard on acquisitions to grow inorganically to get to a more sustainable scale this year.

Bad reporting by stock services is a major problem about which I get multiple complaints. Yesterday, the first four SPWR articles on the Market Watch cellphone site were:

“Another Green Energy Subsidy Bust.” Aug. 9, 2024

“SunPower files for bankruptcy. It’s the latest blow for the troubled solar industry.” Aug. 6, 2024

“SunPower stock falls after solar power company files for bankruptcy.” Aug. 6, 2024

“SunPower files for Bankruptcy; to Sell Some Assets to Complete Solaria.” Aug. 6, 2024

Gentleman, why do you have your bots keep digging up dinosaur bones and beating us over the head with them? (To be completely fair, Market Watch is an excellent site and my prior complaint about ‘careless reporting’ was actually reported today.)

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, about us and our industry that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “will,” “goal,” “prioritize,” “plan,” “target,” “expect,” “focus,” “forecast,” “look forward,” “opportunity,” “believe,” “estimate,” “continue,” “anticipate,” and “pursue” or the negative of these terms or similar expressions. Forward-looking statements in this press release include, without limitation, our Q2’25 revenue projection, our expectations regarding our Q2’25 and fiscal 2025 financial performance, and expectations and plans relating to further cost control efforts. Actual results could differ materially from these forward-looking statements as a result of certain risks and uncertainties, including, without limitation, our ability to implement further headcount reductions and cost controls, our ability to integrate and operate the combined business with the SunPower assets, our ability to achieve the anticipated benefits of the SunPower acquisition, global market conditions, any adjustments, changes or revisions to our financial results arising from our financial closing procedures, the completion of our financial statements for Q2’25, and other risks and uncertainties applicable to our business. For additional information on these risks and uncertainties and other potential factors that could affect our business and financial results or cause actual results to differ from the results predicted, readers should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of our annual report on Form 10-K filed with the SEC on April 30, 2025, our quarterly reports on Form 10-Q filed with the SEC and other documents that we have filed with, or will file with, the SEC. Such filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements in this press release speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and SunPower assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Preliminary Unaudited Financial Results

The selected unaudited financial results for the Q2’25 are preliminary and subject to our quarter-end accounting procedures. As a result, the financial results presented in this press release may change in connection with the finalization of our closing and reporting processes and financial statements for Q2’25 and may not represent the actual financial results for such quarter. In addition, the information in this press release is not a comprehensive statement of our financial results for Q2’25, should not be viewed as a substitute for financial statements prepared in accordance with generally accepted accounting principles, and are not necessarily indicative of our results for any future period.

Non-GAAP Financial Measures

In addition to providing financial measurements based on generally accepted accounting principles in the United States of America ("GAAP"), SunPower provides additional financial metrics in this press release that are not prepared in accordance with GAAP ("non-GAAP"). Management believes the non-GAAP financial measures in this press release, in addition to GAAP financial measures, are useful measures of operating performance because the non-GAAP financial measures do not include the impact of items that management does not consider indicative of SunPower’s operating performance, such as amortization of goodwill and expensing employee stock options in addition to accounting for their dilutive effect, which facilitates the analysis of SunPower’s core operating results across reporting periods. The non-GAAP financial measures do not replace the presentation of SunPower’s GAAP financial results and should only be used as a supplement to, not as a substitute for, SunPower’s financial results presented in accordance with GAAP. Descriptions of and reconciliations of the non-GAAP financial measures used in this press release are included in the financial table above and related footnotes. We encourage investors to carefully consider our preliminary results under GAAP, as well as our preliminary non-GAAP information and the reconciliations between these presentations, to more fully understand our business. Non-GAAP financial measures are reported in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

| Company Contacts: | |

| Dan Foley CFO dfoley@completesolar.com | Sioban Hickie Investor Relations InvestorRelations@completesolar.com (801) 477-5847 |

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (PRELIMINARY) | ||||||||||||||||||

| (In Thousands) | ||||||||||||||||||

| COMPLETE SOLARIA, INC. - AS REPORTED Unaudited | SPWR - Unaudited | |||||||||||||||||

| Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | |||||||||||||

| GAAP operating income/(loss) from continuing operations | Note | (7,544 | ) | (9,494 | ) | (29,970 | ) | (21,501 | ) | 1,042 | (2,718 | ) | ||||||

| Depreciation and amortization | A | 357 | 329 | 305 | 1,745 | 1,582 | 1,419 | |||||||||||

| Stock based compensation | B | 1,341 | 1,229 | 1,516 | (1,019 | ) | 314 | 3,717 | ||||||||||

| Restructuring charges | C | 406 | 2,603 | 21,072 | 14,835 | - | - | |||||||||||

| Total of Non-GAAP adjustments | 2,104 | 4,161 | 22,893 | 15,561 | 1,896 | 5,136 | ||||||||||||

| Non-GAAP net Income (loss) | (5,440 | ) | (5,333 | ) | (7,077 | ) | (5,940 | ) | 2,938 | 2,418 | ||||||||

| Notes: | ||||||||||||||||||

| (A) Depreciation and amortization: Depreciation and amortization related to capital expenditures. | ||||||||||||||||||

| (B) Stock-based compensation: Stock-based compensation relates to our equity incentive awards and for services paid in warrants. Stock-based compensation is a non-cash expense. | ||||||||||||||||||

| (C) Acquisition Costs: Costs primarily related to acquisition, headcount reductions (i.e. severence), legal, professional services (i.e. historical carveout audits) and due diligence. | ||||||||||||||||||

Source: SunPower

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/571ef71b-baf1-465b-bbae-4a9d0dda9c4c

https://www.globenewswire.com/NewsRoom/AttachmentNg/8fbcaee6-f537-4199-81f6-6c8e63a1c500

https://www.globenewswire.com/NewsRoom/AttachmentNg/e67d4f6d-4bc5-4cb7-ae5a-35bda2d83993

https://www.globenewswire.com/NewsRoom/AttachmentNg/d4d56900-4141-4ee8-b047-ef4e87cce544

https://www.globenewswire.com/NewsRoom/AttachmentNg/f944586c-7454-4074-ba57-0194c4bca76b