CleanTech Acquires Significant Package of Fluorspar Projects Totaling 7,180 Acres for US$4,000,000 in Illinois-Kentucky Fluorspar District

Rhea-AI Summary

CleanTech Vanadium Mining Corp. (OTCQB: CTVFF) has entered into a binding option-to-purchase agreement to acquire a significant package of Fluorspar mining projects in Kentucky and Illinois for US$4,000,000. The acquisition covers 7,180 acres with over 720 historic drill holes and approximately 60,000 feet of fault length across major geological structures.

The purchase terms include an initial payment of US$250,000 upon signing, followed by three annual payments of US$250,000 from 2026-2028, and a final payment of US$3,000,000 in 2029. The company has the flexibility to acquire either both project groups for the full price or choose one group for US$2,250,000.

The projects include several significant deposits, with the flagship Campbell-Crotser property containing a historic resource estimate of 805,841 tons grading 37.10% CaF2. The acquisition positions CleanTech as one of the largest Fluorspar players in the USA, with the company aiming to become a leading supplier of Fluorine for uranium enrichment, EV batteries, and metal production.

Positive

- Acquisition of extensive Fluorspar projects totaling 7,180 acres in strategic location

- Historic resource estimates across multiple properties including 805,841 tons at Campbell-Crotser

- Flexible payment structure with only $250,000 initial payment required

- Control of approximately 60,000 feet of fault length across major geological structures

- Over 720 historic drill holes providing extensive exploration data

- Strategic position in one of North America's most important mineral provinces

Negative

- Significant future payments required totaling $3.75M through 2029

- Historic resource estimates require verification and may not meet current standards

- Several properties require additional exploration and development

- Some properties have access limitations due to flooding

News Market Reaction

On the day this news was published, CTVFF gained 4.55%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - August 12, 2025) - CleanTech Vanadium Mining Corp. (TSXV: CTV) (OTCQB: CTVFF) ("CleanTech" or the "Company") is pleased to announce that, through its

Transaction Summary

Under the OTP executed on August 7, 2025, the Vendor agreed to sell to CleanTech, the Fluorspar Projects for a total of US

- US

$250,000 upon OTP signing (paid); - US

$250,000 on or before September 1, 2026; - US

$250,000 on or before September 1, 2027; - US

$250,000 on or before September 1, 2028; and - US

$3,000,000 on or before September 1, 2029.

The Fluorspar Projects are divided into two groups, CleanTech has the option to acquire both groups for the Purchase Price or choose any one of the two groups in the Fluorspar Projects and pay a total of only

Strategic District Position

CleanTech's Fluorspar Projects consist of over a dozen distinct Fluorspar deposits with over 720 historic drill holes, covering over 7,180 acres and collectively control key segments of the Western Kentucky Fluorspar District's most productive fault systems, representing approximately 60,000 feet of fault length across major geological structures. Those Fluorspar Projects provide long-term exploration potential across underexplored extensions of proven systems.

The district's unique geological setting, established transportation infrastructure, and proximity to major industrial consumers positions CleanTech's Fluorspar Projects as highly strategic domestic fluorspar assets in an import-dependent market in the United States.

"With this transaction, CleanTech has now become one of largest Fluorspar players in the USA in terms of Fluorspar resource holdings and Fluorspar project land size in the heart of the Kentucky-Illinois Fluorspar District," commented Ron Espell, President of CleanTech. "CleanTech's goal is to be the leading Fluorspar mining company to supply Florine, a critical mineral and essential ingredient in uranium enrichment to produce nuclear fuel to power plants, in battery electrolytes in most electric vehicles and large-scale energy storage systems, and as a fluxing agent for steel and aluminum production," further commented by Ron Espell.

Table 1. The Fluorspar Projects Under Option by CTV in Illinois - Kentucky Fluorspar District

| Project | Area Acres | Historic Resource Estimate (tons)* | CaF2% | Zn% |

| Tabb (Lafayette-Crouch-Simpkins-Travis) | 1,008 | 6,560,000[1] | 14.2 | 3 |

| Babb-Barnes | 324 | 424,000[2] | 44 | |

| Robinson-Lasher | 1,524 | 31 | 14 | |

| Robinson-Lasher Bethel Horizon | 70,000[3] | 32 | ||

| Robinson-Lasher Shetlerville Horizon | 105,000[4] | 30 | ||

| Robinson-Lasher sub-Rosiclare Horizon | 387,225[5] | 5 - 10 | 14 | |

| Carr | 30 | 100,000[6] | 30 | |

| Big Four | 196 | |||

| Pitillo | 170 | |||

| Memphis | 587 | 23,600[7] | 18 | |

| Franklin | 104 | |||

| Kirk-Tyner-Wring | 941 | 72,000[8] | 43 | |

| Eagle-Watson | 99 | 58 | ||

| Beard-Jones | 1,584 | |||

| Susie Beeler | 341.9 | |||

| Lee Mine (IL) | 271.5 | |||

| Campbell-Crotser* | 226 | 805,841[9] | 37 | 3.23 |

* Campbell Crotser is under a separate OTP as described in the Company's news release dated July 2, 2025

The key assumptions, parameters, and methods used to prepare this historical resource estimate are not available. The Company has not reviewed or validated the historic data, and caution should be taken as a qualified person has not done sufficient work to classify these historical resource estimates as a current mineral resource and the Company is not treating them as a current mineral resource. The historic resource does not demonstrate economic viability and should not be relied on. The Company considers the historical estimate relevant as it indicates significant fluorspar mineralization within the project area; however, the reliability is uncertain given the age of the data, and differences between historical estimation methods and current Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards. The historical resource categories were defined prior to the adoption of current CIM Definition Standards and differ materially from current categories such as 'Inferred Mineral Resource.' The historical estimates do not meet current CIM requirements for mineral resource classification because of insufficient verification, lack of documented estimation methodology, and absence of QA/QC protocols. Steps to verify and upgrade the historical estimates to current CIM standards include (i) compilation and validation of all historical drill data, (ii) twin drilling of select historical holes, (iii) confirmatory drilling in key areas of mineralization, (iv) updated geological modeling, and (v) preparation of a new mineral resource estimate in accordance with NI 43-101.

CleanTech's Fluorspar Projects Summary

The Western Kentucky Fluorspar District represents one of North America's most strategically important mineral provinces, containing the United States' largest known fluorspar districts and most prolific production history from approximately 1896-1975. Located in Crittenden and Livingston counties, Kentucky, and extending into southern Illinois, the Illinois-Kentucky Fluorspar District ("IKFD") has been the focus of extensive exploration[10] and development activities more than 150 years[11]. Mining operations have extracted 12.5 million tons of refined fluorspar in the IKFD since the late 1800s[12]. The neighboring Illinois portion of the district (north of the Ohio River) is documented in having produced over 20 million tons of crude fluorspar throughout its history[13].

A thorough review of historic and current geological reports by the Company revealed significant mineral resource potential supported by over 720 historic drill holes across CleanTech's Fluorspar Projects covering approximately 7,180 acres within the heart of Western Kentucky Fluorspar District. Each CleanTech's Flursopar Project is strategically positioned along major fault systems that have historically controlled mineralization throughout the 1,000-square-mile district.

Geologically, CleanTech's Fluorspar Projects are within the Kentucky-Illinois fluorspar district, where Mississippian-age limestones are cut by NW-SE normal faults and locally by dikes to which may be related to subsurface intrusive activity. Fluorspar is the principal commodity and accessory sphalerite and galena, occurring in steep fault-fill veins, breccia zones, and localized carbonate replacements along favorable beds. Shoots typically thicken at bends, step-overs, relay ramps, and fault-dike intersections, providing predictable structural controls and repeatable targets across the belt[14],[15].

The IKFD represents one of the most significant fluorspar provinces globally, hosted within Mississippian sedimentary rocks that have been extensively faulted into a complex block pattern[16]. The primary deposits (optioned by CleanTech) - Campbell-Crotser, Tabb, Babb-Barnes, and Robinson-Lasher - occur along steeply-dipping normal faults (70-90°) that displace favorable limestone formations, particularly the St. Genevieve and St. Louis limestones. These fault-hosted vein deposits formed through replacement of pre-existing calcite by fluorite, with ore shoots typically ranging 200-1000 feet in strike length, 200-500 feet in height, and 3-10 feet in width[17]. The Campbell deposit, for example, occurs along the Big Creek Fault with a 12-foot average width and 26-foot total vein width, containing approximately 805,000 tons grading

These deposits are geochemically linked to deeper carbonatite-lamprophyre magmatism, as evidenced by the widespread occurrence of mafic dikes throughout the district and their spatial association with zinc-rich mineralization[19]. The cryptovolcanic Hicks Dome structure, dated at approximately 270 Ma (million years ago), represents a key thermal and geochemical center that likely provided both heat and fluorine-rich volatiles for regional mineralization. The dome is underlain by alkalic igneous rocks and explosive breccias, visible in aeromagnetic data, may reflect deeper ultramafic intrusive activity and suggests that the observed surface mineralization represents the upper expression of a much larger magmatic-hydrothermal system driven by mantle-derived carbonatitic melts[20].

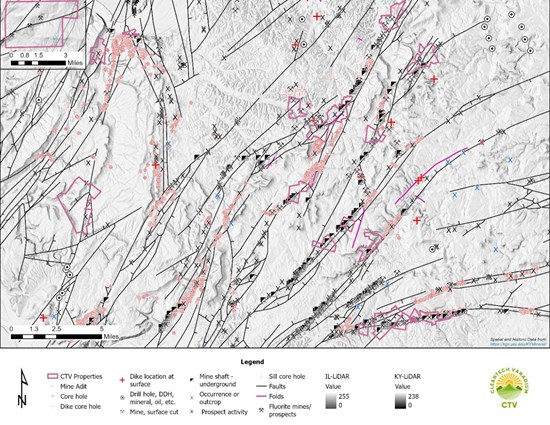

Figure 1. Illinois - Kentucky Fluorspar Projects Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8597/262229_bb934cbc54390a60_002full.jpg

Highlights from CleanTech's Fluorspar Projects:

Campbell-Crotser Leads Resource Base

Optioned under a separate OTP by CleanTech described in the Company's news release dated July 2, 2025, the Campbell-Crotser stands as the flagship asset, hosting a historic resource estimate of 805,841 tons of fluorspar grading

The Rock Creek Fault system, striking northeast at N20°E with a 75° northwest dip, exhibits 650 feet of stratigraphic displacement. The fault places Degonia Formation against Golconda Formation at surface, creating optimal conditions for fluorspar mineralization. Of the total 30,000-foot system length, approximately 6,200 feet shows confirmed mineralization, with Campbell-Crotser controlling the most prospective central segment[22]. The project underwent systematic exploration beginning with Pennwalt Chemicals Corporation's 13-hole drilling program from 1946-1948. The major exploration effort was conducted by Cerro Corporation from 1972-1974, involving 69 total core holes with approximately 39,600 feet of drilling[23]. The Campbell Deposit shows some of the highest-grade intervals, with individual drill holes reporting 48

Tabb (Lafayette-Crouch-Simpkins-Travis) System Demonstrates Exceptional Scale

The Tabb Fault system represents the district's most significant geological structure, extending 19 miles (100,320 feet) through southern Crittenden and western Caldwell counties. This large fault system has historically produced

Recent exploration by Honeywell's Project Joust program focused on the K-4 cluster, a 4,000-foot segment of the eastern Tabb system. Honeywell's 2012-13 "Project Joust": 59 HQ holes (of which 50 intersect fluorite bodies on the project), 55,105 ft; 2.41 million tons of historic resource grading

Babb-Barnes Shows Production-Ready Infrastructure

The Eagle Babb-Barnes represents an immediately viable operation, featuring complete mine infrastructure including an 800-foot shaft with stations at 300, 500, and 700-foot levels. The project sits on the Babb Fault system, which extends over 15,000 feet with a 3,300-foot mineralized segment controlled by the operation[27].

Historic production totaled 145,335 tons grading

Robinson-Lasher Showcases Zinc Potential

The Robinson-Lasher, encompassing 1,524 acres in Livingston County, sits along the Robinson Fault, a near-vertical structure with 20,000 feet of total strike length. The project controls approximately 1,700 feet of the fault system, where bedded replacement deposits have been developed through a 1,270-foot decline to 240 feet vertical depth[31].

This project has undergone extensive exploration with 232 core holes to at least 9,855 ft with a historic resource of 70,000 tons grading

Carr: The Carr is located 12 miles northwest of Salem, Kentucky, on the Crittenden-Livingston County line at the confluence of Deer Creek with the Ohio River, covering 30 acres of mineral rights[35]. The entire project lies in the floodplain of the Ohio River, where the Ellis Mine fault is projected onto the project for 1,400 feet[36]. Vein and bedded fluorite-barite mineralization is present at the nearby Ellis Mine, where 300,000 tons of material grading

Big Four: Controls 12,000 feet of the Commodore3. At least 25 boreholes have been drilled on this project totaling approximately 15,000 feet1.

Pittillo: The Pittillo (or Pattillo) is in Crittenden County, 6 miles north of Salem, Kentucky, with mineral rights covering 3 tracts containing a total of 170 acres[38]. The project is situated within one of the major horsts of the district, bounded by the Sheridan fault system, containing two north to northwest-trending faults with small stratigraphic displacement that host known mafic dikes1. Alcoa conducted drilling on the structures and discovered narrow zones of zinc mineralization, primarily sphalerite, in fractured and brecciated St. Louis limestone walls1. The prospect contains sphalerite-dike occurrences like other known deposits in the district, most notably the Hutson zinc mine, but these targets have been inadequately explored[39]. Several vertical core holes are recommended to be drilled in the breccia structures to establish the presence of mineralization in favorable beds within the St. Louis and Salem limestones, with potential for small but high-grade zinc mineralization1.

Memphis: Positioned on the Levias-Crittenden Springs system, controlling 5,600 feet of untested western fault segments plus historic gravel estimates of 23,600 tons grading

Franklin: The Franklin is in Crittenden County, 6 miles northeast of Salem, Kentucky, encompassing mineral rights under two tracts totaling 104 acres1. The prospect is positioned along the southern portion of the Levias-Crittenden Spring fault system, where the Fredonia formation forms the footwall and the Tar Springs formation forms the hanging wall, with apparent stratigraphic displacement of 700 feet accommodated by four northeast-trending step faults1. The Franklin Mine operated on the project with two shafts and extensive drifting, producing an estimated 40,000 to 60,000 tons of fluorspar of unknown grade based on old mine maps1. The northeast-trending fault structures have never been systematically drilled and appear to represent good targets for additional small-scale fluorspar-zinc mineralization[40].

Kirk-Tyner-Wring: Located on the 26-mile Moore Hill Fault system, controlling 2,500 feet of the principal mineralized zone with a historic estimate of 72,000 tons grading

Eagle-Watson: Located 3 miles east of Salem, Kentucky on the northeast-trending Moore Hill Fault System, the Eagle-Watson lies on one of the most productive fault systems in the district. The Moore Hill fault system extends approximately 26 miles in length and is one of the longest fault systems in the Kentucky district. Approximately 99 acres of surface and mineral rights are controlled on the Eagle Watson. This project has been explored by at least 9 boreholes and several shallow auger holes of unspecified length[43].

Beard-Jones: The Beard-Jones is located 11 miles northeast of Salem, Kentucky, in Crittenden County, covering 1,584 acres of mineral rights[44]. The project is situated on the northern portion of the Commodore fault system, one of the principal northeast-trending fault systems in the district, with a fault system approximately 2,000 feet wide and stratigraphic separation of at least 450 feet[45]. Historical production from the prospect came from a narrow footwall graben, totaling approximately 15,000 to 20,000 tons of fluorspar from the Beard mine1. Alcoa acquired the properties and drilled approximately 53 holes to explore the footwall graben, with four additional holes drilled on other fault structures1. The available information suggests that 12,000 feet of fault structure remains untested, with geological mapping indicating potential for rotational movement that could produce extraordinary wide vein widths[46].

Susie Beeler: The Susie Beeler is located 2.5 miles east of Salem, Kentucky, encompassing 299 acres of surface rights and 341.9 acres of mineral rights[47]. The project is positioned on the Claylick fault system, one of the principal northeast-trending fault systems in the district, bounded by footwall and hanging wall faults with surface width varying from 500 to 1,000 feet and stratigraphic separation of 550 to 650 feet[48]. Historical production prior to 1945 amounted to approximately 18,000 tons from shafts on two different veins of the fault system1. Alcoa acquired the properties in 1945 and drilled 33 holes, though core recovery was poor due to badly broken ground, with only two holes cutting promising mineralization1. Frontier Spar Corporation conducted additional exploration including nine shallow percussion holes and nine angle diamond holes, revealing a 350-foot-wide breccia zone with some mineralization but determined that most structures contained small shoots[49].

Lee Mine (Hardin Co. IL): Located in Hardin County, Illinois, this is the only project in the portfolio situated outside Kentucky. The project contains 271 acres of mineral rights controlled. The Lee Fault Mine has never been thoroughly explored and remains largely speculative with no established historic estimate or production history documented in the available materials[50].

Fluorspar Market Overview

According to United States Geological Survey, China produced over

China has shifted from being a net exporter to a significant importer of fluorspar since 2023, due to rising demand from the booming energy storage system including batteries. Chinese customs data indicate that full-year 2024 fluorspar imports (all grades) rose

Qualified Person

The technical and scientific information contained in this news release has been reviewed and approved by Carlos Zamora, CPG, a member of the American Institute of Professional Geologists (AIPG) since 2024, who is an independent Qualified Person as defined by National Instrument 43-101.

About CleanTech Vanadium Mining Corp.

CleanTech is a mining company focused on critical mineral resources in the USA. The Company has an option to acquire 7,180 acres of mineral rights with historic Fluorspar resources across multiple projects in in Illinois-Kentucky Fluorspar district. CleanTech also owns a

Further information on CleanTech can be found at www.cleantechvanadium.com.

ON BEHALF OF THE BOARD

"Ron Espell"

President

For more information about CleanTech, please contact:

Phone: 1.877.664.2535

info@cleantechvanadium.com

www.cleantechvanadium.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING INFORMATION

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words "believes," "may," "plans," "will," "anticipates," "intends," "could", "estimates", "expects", "forecasts", "projects" and similar expressions, and the negative of such expressions. Such forward-looking information, which reflects management's expectations regarding CleanTech's future growth, results of operations, performance, business prospects and opportunities, is based on certain factors and assumptions and involves known and unknown risks and uncertainties which may cause the actual results, performance, or achievements to be materially different from future results, performance, or achievements expressed or implied by such forward-looking information. Forward-looking information in this news releases includes: the acquisition of ownership in the Campbell Crotser Project, the presence of a land grab for fluorspar projects and Fluorspar as CleanTech's major vertical, logistical advantages at the Campbell Crotser Project, the ability to advance the Project in both the near and long term, the availability of infrastructure that would assist in the advancement of the Project. Forward-looking statements are based on the opinions and estimates of management of CleanTech at the date the statements are made and are based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Many of these assumptions are based on factors and events that are not within the control of CleanTech, there is no assurance they will prove to be correct and are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements.

Forward-looking information involves significant risks and uncertainties, should not be read as a guarantee of future performance, events or results, and may not be indicative of whether such events or results will actually be achieved. A number of risks and other factors could cause actual results to differ materially from expected results discussed in the forward-looking information, including but not limited to: changes in operating plans; ability to secure sufficient financing to advance the Company's project; conditions impacting the Company's ability to mine at the project, such as unfavorable weather conditions, development of a mine plan, maintaining existing permits and receiving any new permits required for the project, and other conditions impacting mining generally; maintaining cordial business relations with strategic partners and contractual counter-parties; meeting regulatory requirements and changes thereto; risks inherent to mineral resource estimation, including uncertainty as to whether mineral resources will be further developed into mineral reserves; political risk in the jurisdictions where the Company's projects are located; commodity price variation; and general market, industry and economic conditions. Additional risk factors are set out in the Company's latest annual and interim management's discussion and analysis, available on SEDAR+ at www.sedarplus.ca.

Forward-looking information is based on reasonable assumptions by management as of the date of this news release, and there can be no assurance that actual results will be consistent with any forward-looking information included herein. Readers are cautioned that all forward- looking statements in this news release are made as of the date of this news release. The Company undertakes no obligation to update or revise any forward-looking information in this news release to reflect circumstances or events that occur after the date of this news release, except as required by applicable securities laws.

[1] Honeywell International, 2012, Project Joust interim report, Livingston & Crittenden Counties, Kentucky: internal report, 47 p

[2] Mining & Minerals Services, Inc., 2011, Western Kentucky fluorspar & zinc project prospectus: Mining & Minerals Services, Inc., Marion, Kentucky, 24

[3] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[4] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[5] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[6] Mining & Minerals Services, Inc., 2011, Western Kentucky fluorspar & zinc project prospectus: Mining & Minerals Services, Inc., Marion, Kentucky, 24

[7] Mining & Minerals Services, Inc., 2011, Western Kentucky fluorspar & zinc project prospectus: Mining & Mineral Services, Inc., Marion, Kentucky, 24

[8] Mining & Minerals Services, Inc., 2011, Western Kentucky fluorspar & zinc project prospectus: Mining & Minerals Services, Inc., Marion, Kentucky, 24

[9] Adamson, R.S., 1993, Summary report on the West Kentucky fluorite-zinc properties, Livingston and Crittenden Counties, Kentucky; Hardin County, Illinois: consulting report for Silverspar Minerals Inc., 32 p.

[10] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[11] Honeywell International, 2012, Project Joust interim report, Livingston & Crittenden Counties, Kentucky: internal report, 47 p.

[12] Denny, F.B., Nelson, W.J., Breeden, J.R., and Lillie, R.C., 2020, Mines in the Illinois portion of the Illinois-Kentucky Fluorspar District: Illinois State Geological Survey Circular 604

[13] Denny, F.B., Nelson, W.J., Breeden, J.R., and Lillie, R.C., 2020, Mines in the Illinois portion of the Illinois-Kentucky Fluorspar District: Illinois State Geological Survey Circular 604

[14] Mining & Minerals Services, Inc., 2011, Western Kentucky fluorspar & zinc project prospectus: Mining & Minerals Services, Inc., Marion, Kentucky, 24

[15] Adamson, R.S., 1993, Summary report on the West Kentucky fluorite-zinc properties, Livingston and Crittenden Counties, Kentucky; Hardin County, Illinois: consulting report for Silverspar Minerals Inc., 32 p.

[16] Mining & Minerals Services, Inc., 2011, Western Kentucky fluorspar & zinc project prospectus: Mining & Minerals Services, Inc., Marion, Kentucky, 24

[17] Mining & Minerals Services, Inc., 2011, Western Kentucky fluorspar & zinc project prospectus: Mining & Minerals Services, Inc., Marion, Kentucky, 24

[18] Adamson, R.S., 1993, Summary report on the West Kentucky fluorite-zinc properties, Livingston and Crittenden Counties, Kentucky; Hardin County, Illinois: consulting report for Silverspar Minerals Inc., 32 p.

[19] Denny, F.B., Nelson, W.J., Breeden, J.R., and Lillie, R.C., 2020, Mines in the Illinois portion of the Illinois-Kentucky Fluorspar District: Illinois State Geological Survey Circular 604

[20] Trela, J., Freiburg, J.T., Gazel, E., Nuelle, L., Maria, A.H., Malone, D.H., and Molinarolo, J.M., 2024, Petrologic relationship between lamprophyres, carbonatites, and heavy rare-earth element enriched breccias at Hicks Dome: Terra Nova, https://doi.org/10.1111/ter.12712.

[21] Adamson, R.S., 1993, Summary report on the West Kentucky fluorite-zinc properties, Livingston and Crittenden Counties, Kentucky; Hardin County, Illinois: consulting report for Silverspar Minerals Inc., 32 p.

[22] Adamson, R.S., 1993, Summary report on the West Kentucky fluorite-zinc properties, Livingston and Crittenden Counties, Kentucky; Hardin County, Illinois: consulting report for Silverspar Minerals Inc., 32 p.

[23] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[24] Adamson, R.S., 1993, Summary report on the West Kentucky fluorite-zinc properties, Livingston and Crittenden Counties, Kentucky; Hardin County, Illinois: consulting report for Silverspar Minerals Inc., 32 p.

[25] Honeywell International, 2012, Project Joust interim report, Livingston & Crittenden Counties, Kentucky: internal report, 47 p.

[26] Honeywell International, 2012, Project Joust interim report, Livingston & Crittenden Counties, Kentucky: internal report, 47 p.

[27] Mining & Minerals Services, Inc., 2011, Western Kentucky fluorspar & zinc project prospectus: Mining & Minerals Services, Inc., Marion, Kentucky, 24

[28] Mining & Minerals Services, Inc., 2011, Western Kentucky fluorspar & zinc project prospectus: Mining & Minerals Services, Inc., Marion, Kentucky, 24

[29] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[30] Adamson, R.S., 1993, Summary report on the West Kentucky fluorite-zinc properties, Livingston and Crittenden Counties, Kentucky; Hardin County, Illinois: consulting report for Silverspar Minerals Inc., 32 p.

[31] Mining & Minerals Services, Inc., 2011, Western Kentucky fluorspar & zinc project prospectus: Mining & Minerals Services, Inc., Marion, Kentucky, 24

[32] Mining & Minerals Services, Inc., 2011, Western Kentucky fluorspar & zinc project prospectus: Mining & Minerals Services, Inc., Marion, Kentucky, 24

[33] Gatten, O.J., 2008, Shawnee zinc exploration project, Hampton prospect, Livingston County, Kentucky: Kaysville, Utah, North American Exploration, Inc., unpublished report prepared for Cheryl Wilson, Dynamex Resources Corporation, 117 p.

[34] Gatten, O.J., 2008, Shawnee zinc exploration project, Hampton prospect, Livingston County, Kentucky: Kaysville, Utah, North American Exploration, Inc., unpublished report prepared for Cheryl Wilson, Dynamex Resources Corporation, 117 p.

[35] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[36] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[37] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[38] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[39] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[40] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[41] Mining & Minerals Services, Inc., 2011, Western Kentucky fluorspar & zinc project prospectus: Mining & Minerals Services, Inc., Marion, Kentucky, 24

[42] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[43] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[44] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[45] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[46] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[47] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[48] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[49] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[50] US. Steel Corporation, 1983, Illinois-Kentucky Fluorspar District properties report: Frontier Spar Corporation & USS Resource Development, 257 p.

[51] (https://pubs.usgs.gov/periodicals/mcs2025/mcs2025-fluorspar.pdf)

[52] https://www.indexbox.io/blog/fluorspar-china-market-overview-2024-3/

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/262229