Surging Demand for Data Infrastructure Fuels Real Estate Transformation Across Global Data Center Markets According to Cushman & Wakefield

Cushman & Wakefield releases 2025 Global Data Center Market Comparison

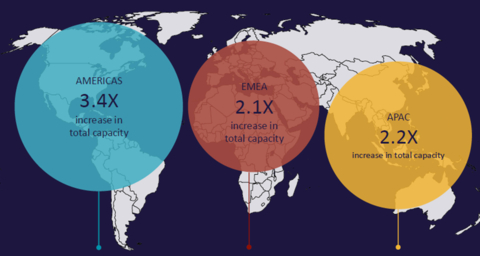

Increase in total capacity across

“We expect total capacity to continue its incredible growth trajectory across all global regions, with each expected to at least double based on the current development pipelines,” said John McWilliams, Head of Data Center Insights. “The industry experienced rapid expansion throughout the past year, a trend we expect to continue into 2025 and 2026. Artificial intelligence (AI) and machine learning (ML), which gained prominence in 2022, are key drivers of this demand now and into the future.”

Key trends include:

-

Land Demand and Suburban Shift: Larger site acquisitions for phased campus developments are becoming the norm, pushing data center projects away from urban cores and into suburban and rural areas.

Virginia ,Phoenix , andSydney rank among the top markets for land availability, as developers prioritize locations that support scalability and power integration. -

Record Pipeline Growth: The

Americas lead in planned data center capacity, withVirginia boasting a staggering 15.4GW in its development pipeline. Land values remain a top consideration in mature markets, driving greater attention to more cost-effective emerging locations like Johor andPennsylvania . - Powered Land Becomes Gold Standard: Land with pre-secured utility commitments is in high demand, with developers and even non-traditional buyers like electric vehicle and chip manufacturers competing for sites. These parcels offer a guaranteed path to power amid rising power constraints and long utility lead times.

- Investment Surges Across Real Estate Spectrum: The sector continues to attract significant institutional investment, with a sharp rise in joint ventures, mergers, and acquisition activity across colocation, hyperscale, and infrastructure outfits. Recently capitalized firms are increasingly targeting both established and emerging markets, fueling rapid pipeline growth and positioning data centers as one of the fastest-growing real estate asset classes globally.

-

Land Pricing and Competition Intensify: While the

Americas enjoy lower land costs overall, increased competition in top-tier markets has driven pricing upward. MidwesternU.S. markets likeIndianapolis andIowa remain among the most affordable, attracting spillover demand from more expensive neighbors.

While power availability and capacity in the data center construction pipeline are key factors in identifying the top data center markets worldwide, the 2025 edition of Cushman & Wakefield’s Global Data Center Market Comparison analyzes 20 critical variables tailored to hyperscale and colocation operators, occupiers, and developers across 97 global data center markets.

Established Markets Rankings:

|

APAC |

EMEA |

1. |

|

|

2. |

|

|

3. |

|

|

4. |

Johor |

|

5. |

|

|

6. |

|

|

7. |

|

|

8. |

|

|

9. Carolinas |

|

|

10. |

|

|

Emerging Markets Rankings:

|

APAC |

EMEA |

1. |

|

|

2. |

|

|

3. |

|

|

4. |

|

|

5. |

Bengaluru |

|

6. |

|

|

7. |

|

|

8. |

|

|

9. |

Batam |

|

10. |

|

|

The 2025 report emphasizes that while mature markets like

“The next frontier isn’t just about connectivity, it's about access to scalable land, power infrastructure, and favorable economics,” said McWilliams. “Emerging markets are gaining traction, but established hubs continue to lead the way, backed by larger development pipelines, mature infrastructure, and steady demand that keeps them at the center of global data center activity.”

For more information or to download the full report, visit: https://www.cushmanwakefield.com/en/insights/global-data-center-market-comparison

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in nearly 400 offices and 60 countries. In 2024, the firm reported revenue of

View source version on businesswire.com: https://www.businesswire.com/news/home/20250507978519/en/

Media Contact:

Savannah

savannah.durban@cushwake.com

Source: Cushman & Wakefield