Desert Gold Delivers PEA Update for SMSZ Project with USD $61 Million After-Tax NPV (10%) and 57% IRR at USD $2,850/oz Gold for Barani and Gourbassi Deposits in West Mali

Rhea-AI Summary

Desert Gold (OTCQB: DAUGF) released an updated PEA for the SMSZ Project (Barani & Gourbassi) on November 25, 2025. The study models a 10-year open-pit oxide operation with average throughput of 36 ktpm and total contained gold of 130,700 oz, yielding ~113,100 oz recoverable at 87% recovery. At a base price of USD $2,850/oz the after-tax NPV(10%) is $61M and IRR 57% (payback 2.5 years); at the spot price $4,070/oz NPV(10%) is $124M and IRR 101%. Initial capex is ~$20.4M and LOM capex ~$36.5M; AISC is $1,137/oz. The PEA is preliminary and includes inferred resources.

Positive

- After-tax NPV(10%) $61M at $2,850/oz gold

- IRR 57% at $2,850/oz (101% at $4,070/oz spot)

- Total recoverable 113,100 oz with 87% process recovery

- Initial capex $20.4M and LOM capex $36.5M (modular plant reduces upfront cost)

- Average throughput 36 ktpm enabling doubled production vs prior plan

Negative

- PEA includes inferred resources and is preliminary (±25% accuracy)

- Funding requirement increased from $16M to $23M

- Average recovered grade 0.96 g/t, a relatively low-grade operation

- AISC $1,137/oz, leaving narrower margin vs lower gold prices

Delta, British Columbia--(Newsfile Corp. - November 25, 2025) - Desert Gold Ventures Inc. (TSXV: DAU) (FSE: QXR2) (OTCQB: DAUGF) ("Desert Gold" or the "Company") is pleased to announce the results of its newly updated Preliminary Economic Assessment ("PEA") for the Barani and Gourbassi deposits, located on its

The updated PEA outlines the open-pit oxide mining operation with the addition of the Gourbassi East Deposit with projected increase in production from 18,000 tonnes per month to approximately 36,000 tonnes per month (or 432,000 tonnes per annum at steady state) over a mine life of 10 years. The study was completed by Minxcon, with technical work and cost estimation exceeding the minimum standards typically required for a PEA and completed to a confidence level of ±

The PEA mine plan includes a total of 130,700 ounces of gold contained, with an estimated 113,100 ounces expected to be recovered through a simple, gravity and CIL processing flowsheet, based on an average metallurgical recovery of

At the current spot gold price of USD

The mining plan is still designed to be broken out into two phases, starting with open-pit operations at Barani East before transitioning to the Gourbassi deposits. A modular gravity and CIL processing plant will be commissioned at Barani for the first phase of production and later moved to Gourbassi as operations shift. This staged approach helps keep initial capital costs low, avoids duplicating infrastructure, and allows the Company to unlock value from multiple oxide gold zones across the SMSZ Project in a flexible and cost-effective manner.

PEA Highlights:

- After-tax NPV

10% of$61 million and after-tax IRR of57% based on$2,850 /oz gold - Doubling gold production from 18.3kt per month to 36kt per month

- Addition of the Gourbassi East oxide and transition pit

- Changing the baseline forecast from

$2,500 t o$2,850 - Funding requirement increased from

$16 million to$23 million to increase production - Updated mine life of 10 years

- All in sustaining cost per oz ("AISC") of USD

$1,137 - After-tax payback of 30 months at base case of

$2,850 /oz gold - Cumulative cash-flow of

$126 million after-tax over 10 years on base case assumptions - Total payable gold production of 113,100 ounces

- Average strip ratio for the combined operations is estimated at 2.60:1

Company CEO Jared Scharf commented: "We are delighted to bolster our previous mine strategy. With less than

Table 1. Financial and Operating Metrics from the Preliminary Economic Assessment

*Note: This Preliminary Economic Assessment (PEA) is an early-stage study that includes Inferred Mineral Resources. These resources are considered too geologically uncertain to support economic evaluations that would allow them to be classified as Mineral Reserves. As such, this PEA is preliminary in nature and its results-including projected mine plans and economics-should not be relied upon as definitive. There is no certainty that the proposed development scenarios will be realized. Only Mineral Reserves have demonstrated economic viability under NI 43-101 guidelines.

1Sustaining costs also includes Mobilization and reinstalment of the modular processing facility from the Barani to the Gourbassi Deposit

2025 SMSZ Updated Preliminary Economic Assessment (PEA) Highlights | |

| Production | |

| Mine Life (years) | 10.0 |

| Total Gold Production (oz) | 130,700 |

| Average Annual Gold production (oz) | 11,400 |

| Total mineralized mine (kt) | 4,239 |

| Total waste mined (kt) | 11,040 |

| Total material mined (kt) | 15,278 |

| Total waste-to mineralization ratio | 2.60 |

| Average gold grade (g/t) | 0.96 |

| Gold process recovery (%) | 87 |

| Average Process Plant Throughput (ktpm) | 36 |

| Operating Costs | |

| Mining costs per tonne (Total Material) | |

| Mining cost per tonne (Mineralization) | |

| Mining cost per tonne processed | |

| G&A cost per tonne processed | |

| Processing cost per tonne processed | |

| Total Cash cost per tonne processed | |

| Total Cash cost (per ounce sold) | |

| Mine site all in sustaining cost (per ounce sold) | |

| Capital Costs | |

| Initial Capital Expenditure (Initial Capex) | |

| Sustaining Capital Expenditures1 | |

| Net Reclamation costs (cost less salvage value) | |

| Total Capital Expenditure - Life of Mine | |

| Total Capital Expenditure (per ounce sold)- life of mine | |

| Base Case Economic Assessment: | |

| IRR (after tax) | |

| NPV @ | |

| NPV @ | |

| Payback (years) | 2.50 |

| Economic Assessment: | |

| IRR (after tax) | |

| NPV@ | 236 M |

| NPV @ | 124 M |

Financial Analysis and Sensitivities

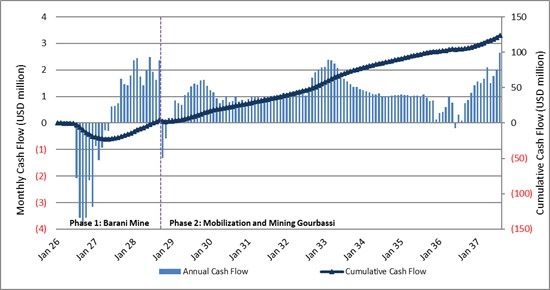

The SMSZ Project is expected to generate a total after-tax free cash flow of

Figure 1: After-tax Cash Flow over Life of Mine for both Barani and Gourbassi West and East

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4954/275838_236c51367406ba69_001full.jpg

The SMSZ Project demonstrates strong leverage to gold price, as illustrated in the sensitivity analysis presented in Table 2. With the gold market on a continuously increasing, a new base case scenario of US

Table 2: PEA Sensitivities to Gold Price, Operating Costs (OPEX) and Capital Costs (CAPEX)

*

| Gold Price Sensitivity | ||||

| Range | Gold Price | After Tax NPV ( | IRR | Payback (months) |

| - | 36 | 44 | ||

| - | 46 | 40 | ||

| - | 56 | 31 | ||

| 0 | 61 | 30 | ||

| 66 | 30 | |||

| 77 | 29 | |||

| 87 | 28 | |||

| 124 | 25 | |||

| OPEX Sensitivity | ||||

| Range | OPEX ($/t) | After Tax NPV ( | IRR | Payback (months) |

| - | 25 | 70 | 29 | |

| - | 27 | 67 | 30 | |

| - | 28 | 64 | 30 | |

| 0 | 30 | 61 | 30 | |

| 31 | 58 | 31 | ||

| 33 | 55 | 32 | ||

| 34 | 52 | 32 | ||

| CAPEX Sensitivity | ||||

| Range | CAPEX ($) | After Tax NPV ( | IRR | Payback (months) |

| - | 28.8 | 65 | 29 | |

| - | 30.5 | 64 | 29 | |

| - | 32.2 | 62 | 30 | |

| 0 | 33.9 | 61 | 30 | |

| 35.6 | 60 | 31 | ||

| 37.3 | 59 | 32 | ||

| 39.0 | 58 | 32 | ||

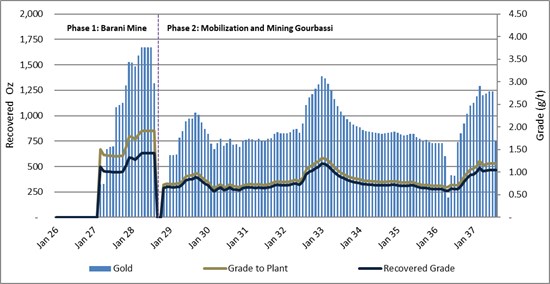

Gold Production

Average annual gold production over the life of mine is estimated at 11,300 ounces (or ~942 ounces per month), with total payable gold production projected at approximately 113,100 ounces across both the Barani and Gourbassi deposits.

Figure 2. Production Profile for both Barani and Gourbassi based on months

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4954/275838_236c51367406ba69_002full.jpg

Capital Costs

The initial capital cost is estimated at approximately

Initial capital is largely directed toward developing the Barani East deposit, including installation of the modular processing plant. Sustaining capital is allocated primarily to the relocation of that plant to the Gourbassi site during the second phase of mining. By utilizing a modular plant that can be redeployed rather than duplicated, Desert Gold has significantly reduced upfront capital costs. This staged approach helps control early expenditures and avoids unnecessary infrastructure overlap. A breakdown of the initial capital estimate, totaling US

Table 2. Summary of Initial and Sustaining Capital Costs

| Initial Capital | |

| Item | Cost ($USD) |

| Process plant mobilization, construction, and relocation | |

| Tailings and water management facilities | |

| Power and Water infrastructure | |

| Site access, civil works, and mine establishment | |

| Fleet, camp, and support services | |

| Indirect Capital and Owner's costs | |

| Contingency ( | |

| Sustaining Capital | |

| Item | Cost ($USD) |

| Process plant mobilization, construction, and relocation | |

| Tailings and water management facilities | |

| Power and Water infrastructure | |

| Site access, civil works, and mine establishment | |

| Indirect Capital and Owner's costs | |

| Contingency ( | |

| Ongoing equipment maintenance and renewals | |

Cash Costs

Total cash costs for the SMSZ Project are estimated at

Cost estimates were derived from vendor quotations, current fuel and labor assumptions in Mali, and benchmarking against similar oxide gold operations across West Africa.

Table 3. Total Cash Costs for Both Barani and Gourbassi Deposits

| Total Cash Costs | |

| Cost Item | Cost ($USD) |

| Mining Cost (per tonne processed) | |

| Processing Cost (per tonne processed) | |

| G&A Cost (per tonne processed) | |

| Total Cost (per tonne processed) | |

| Royalties and Other (per tonne processed) | |

| Total Cash Cost (per ounce sold) | |

Mineral Resource Estimate

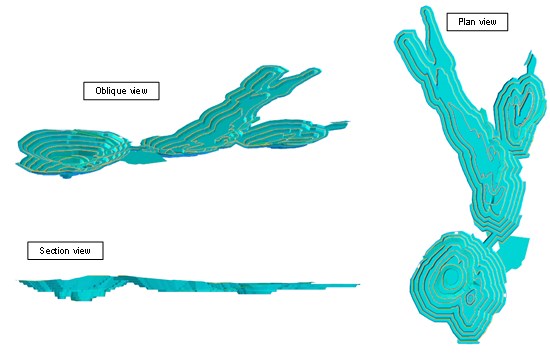

The current Preliminary Economic Assessment (PEA) for Desert Gold's SMSZ Project focuses exclusively on oxide and transitional mineralization within optimized open pits at the Barani East, Barani Gap, Gourbassi West, Gourbassi West North, and Gourbassi East deposits. These four zones collectively contribute approximately 130,700 ounces of gold to the mine plan (after mining modifying factors), with an average recovered grade of 0.96 g/t Au and a projected gold recovery of

Importantly, the study excludes some of the smaller pits identified during the PEA which may offer additional upside in future technical work. Furthermore, the current cutoff grade for reporting the Mineral Resource Estimate (MRE) is 0.2 g/t Au.

The total Measured and Indicated (M&I) Resources now stand at 11.12 Mt grading 0.94 g/t Au for 336,800 ounces, while Inferred Resources total 27.16 Mt grading 1.01 g/t Au for 879,900 ounces. The total ounces reflect the oxide, transition and sulfide/fresh mineralization for the SMSZ Project. The PEA only focused on the oxide and transitional material and therefore the PEA pits were optimized on the oxide and transition material. The exclusion of the sulfides, which contribute ~

Key exploration targets such as Mogoyafara South, Linnguekoto West, and the Keniegoulou area were not included in the current PEA, though they collectively host substantial Inferred Resources and represent clear upside for future expansion. In total, over 1 million ounces of gold remain outside of the current PEA pit shells (resources which are deeper, narrower, or require higher strip ratios) and could be integrated into subsequent development scenarios pending additional drilling and studies.

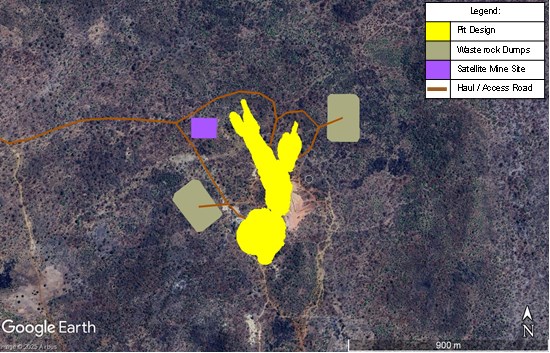

Figure 3: Gourbassi East PEA pit design

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4954/275838_236c51367406ba69_003full.jpg

Table 4. Total Mineral Resource Update for SMSZ Project

**Only the highlighted resource blocks, specifically those within the Gourbassi West, Gourbassi West North, Gourbassi East, Barani Gap and Barani East oxide/transitional zones, are incorporated into the current PEA mine plan. All other resources, including sulfide material and smaller or deeper pits, are excluded from the economic analysis at this current stage.

| Mineral Resource Category | Project | Project Sub Division | Tonnes (In Situ) | Gold Grade | Gold Content | |

| Mt | g/t | kg | oz | |||

| Measured | Gourbassi | Gourbassi West | 2.46 | 0.78 | 1,920 | 61,600 |

| Barani | Barani East | 0.68 | 2 | 1,360 | 43,900 | |

| Total Measured | 3.14 | 1.05 | 3,280 | 105,500 | ||

| Indicated | Gourbassi | Gourbassi East | 2.72 | 1.06 | 2,880 | 92,600 |

| Gourbassi West | 4.28 | 0.65 | 2,790 | 89,700 | ||

| Barani | Barani East | 0.98 | 1.56 | 1,520 | 49,000 | |

| Total Indicated | 7.98 | 0.9 | 7,190 | 231,300 | ||

| Total M&I | 11.12 | 0.94 | 10,470 | 336,800 | ||

| Inferred | Mogoyafara | Mogoyafara South | 14.33 | 0.97 | 13,920 | 447,500 |

| Linnguekoto | Linnguekoto West | 1.47 | 1.42 | 2,080 | 67,000 | |

| Gourbassi | Gourbassi East | 2.22 | 1.21 | 2,670 | 86,000 | |

| Gourbassi West | 3.46 | 0.75 | 2,610 | 83,800 | ||

| Gourbassi West North | 2.45 | 0.72 | 1,760 | 56,500 | ||

| Barani | Barani East | 1.24 | 1.38 | 1,710 | 55,100 | |

| Barani Gap | 1.07 | 0.88 | 940 | 30,200 | ||

| Keniegoulou | 0.46 | 2.4 | 1,090 | 35,200 | ||

| KE | 0.47 | 1.23 | 580 | 18,600 | ||

| Total Inferred | 27.16 | 1.01 | 27,370 | 879,900 | ||

Notes:

- Cut off grade applied at 0.2 g/t

- No Geological loss has been applied

- This resource is redrived from the base case study using

$2,850 /oz - Mineral Resources are stated inclusive of Mineral Reserves

- Mineral Resources are reported as total Mineral Resources and are not attributed

- Columns might not add up due to rounding

- Inferred Mineral Resources have a low level of confidence and while it would be reasonable to expect that the majority of the inferred Mineral Resources would upgrade to Indicated with continued exploration, due the uncertainty of the Inferred Mineral Resources, it should not be assumed that such upgrading will occur

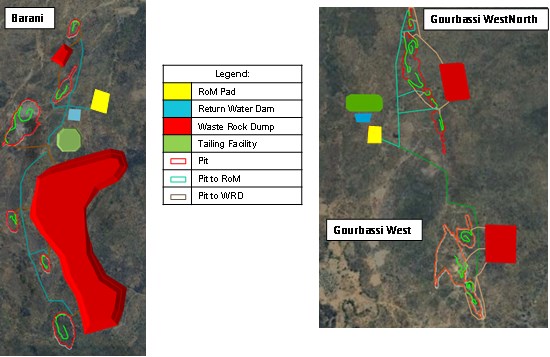

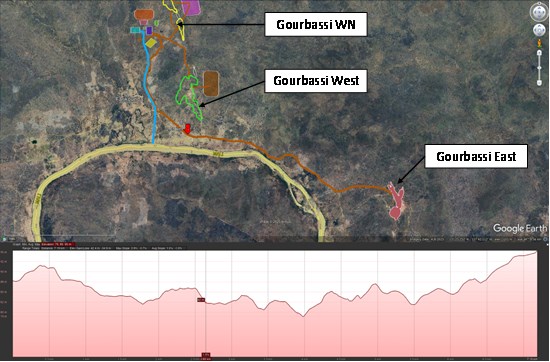

Mining

The SMSZ Project is located within gently undulating terrain in southwestern Mali. The regional topography, semi-arid climate, and established infrastructure are well suited to conventional open-pit mining methods, with no underground mining planned at this stage. The current PEA targets shallow oxide and transitional material from the Barani East, Gourbassi West, Gourbassi West North, and Gourbassi East deposits. While deeper sulfide mineralization exists beneath these pits, it has not been considered in the current mine plan but may be evaluated in future technical studies.

Mining operations will consist of three independent open pits; each developed in pushback phases. Pit slopes are designed using a combination of 25° inter-ramp angles in saprolite and 44° angles in transition and fresh rock, based on geotechnical criteria and material strength observed in pit optimization work. Given the dominance of oxide and transition ore, significant portions of the material (especially in the upper benches) are expected to be free-digging, requiring minimal to no blasting.

To maintain mining selectivity and limit dilution, ore zones will be mined using 5 m high benches with a fleet of medium-sized hydraulic excavators (~5 m³) and 35-40 t haul trucks. Waste rock and deeper transitional material will be mined on 10 m benches using larger drills and excavators, supported by conventional blast patterns where necessary. Mining will be conducted by owner-operated fleets, with supporting equipment such as dozers, water trucks, graders, and light vehicles deployed across each pit.

The open-pit operation is designed to deliver an average of 1,200 tonnes per day (tpd) of mineralized material, split between Barani and Gourbassi in two staged campaigns. Peak material movement across pits is expected to reach ~12,000 tpd total when accounting for waste rock at Barani and a maximum of ~5,400tpd at Gourbassi.

A total of approximately 11Mt of waste rock and 4.24 Mt of ore are planned to be mined over the 10-year mine life, yielding a life-of-mine strip ratio of 2.60:1. The mined ore has an average grade of 0.96 g/t Au, and metallurgical testing indicates a process recovery of

Ore will be either fed directly to the modular CIL process plant or temporarily stockpiled for blending. Waste rock will be transported to designated waste rock dumps or used in the construction of tailings embankments and haul roads as required.

The following table shows the Mineral Resources in the PEA pits. The Pits were only optimized on oxide and transitional mineralized material. Fresh mineralized material was excluded during the pit optimization process resulting in only

Table 6. Mineral Resources within the Barani and Gourbassi designed pits.

| Pit Area | Mineral Resource Classification | Tonnage | Grade | Content |

| kt | (g/t) | (koz) | ||

| Barani | Measured | 148 | 2.42 | 11.5 |

| Indicated | 43 | 1.91 | 2.7 | |

| Inferred | 339 | 1.58 | 17.3 | |

| Grand Total | Total | 530 | 1.84 | 31.4 |

Notes:

- This is Mineral Resources only in the PEA designed pits

- No Mining Conversion factors have been applied to the tonnes, grade and content in this Table

- No Mineral Reserves is stated in the PEA

| Pit Area | Mineral Resource Classification | Tonnage | Grade | Content |

| kt | (g/t) | (koz) | ||

| Gourbassi West &West North | Measured | 1,289 | 0.92 | 38.1 |

| Indicated | 377 | 0.86 | 10.4 | |

| Inferred | 1,452 | 0.93 | 43.2 | |

| Grand Total | Total | 3,117 | 0.92 | 91.8 |

Notes:

- This is Mineral Resources only in the PEA designed pits

- No Mining Conversion factors have been applied to the tonnes, grade and content in this Table

- No Mineral Reserves is stated in the PEA

| Pit Area | Mineral Resource Classification | Tonnage | Grade | Content |

| kt | (g/t) | (koz) | ||

| Gourbassi East | Measured | - | - | - |

| Indicated | 291 | 1.13 | 10.6 | |

| Inferred | 223 | 1.11 | 8.0 | |

| Grand Total | Total | 514 | 1.12 | 18.6 |

Notes:

- This is Mineral Resources only in the PEA designed pits

- No Mining Conversion factors have been applied to the tonnes, grade and content in this Table

- No Mineral Reserves is stated in the PEA

Figure 4. Mining Site Layouts

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4954/275838_236c51367406ba69_004full.jpg

Figure 5. Gourbassi East Mining Site Layouts

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4954/275838_236c51367406ba69_005full.jpg

Figure 6. Gourbassi Layouts

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4954/275838_236c51367406ba69_006full.jpg

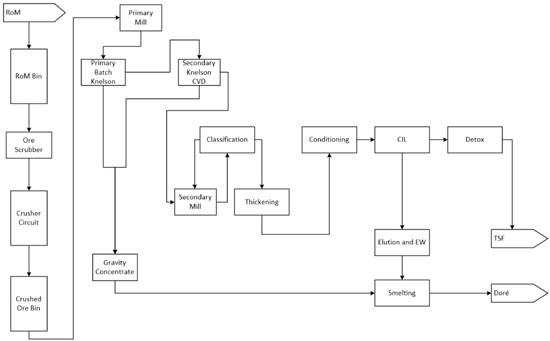

Metallurgy

The metallurgical test work conducted to date supports a conventional, low-risk processing flowsheet for the SMSZ Project. Testing has focused on near-surface oxide and transitional material from the Barani East, Gourbassi West, and Gourbassi West North deposits all of which demonstrate free-milling gold mineralization suitable for gravity recovery followed by carbon-in-leach (CIL) processing.

Preliminary bottle roll and gravity recovery tests, combined with regional analogues, indicate an average gold recovery of

The proposed modular process plant will initially operate at 36 kilo tonnes per month, beginning at Barani and later relocating to Gourbassi to support a staged development plan. The circuit will include:

- Scrubbing and crushing

- Gravity recovery (Knelson + CVD)

- Secondary grinding of gravity tails

- CIL leaching, elution, electrowinning, and smelting

Figure 7. PEA Processing Block Flow Diagram

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4954/275838_236c51367406ba69_007full.jpg

Access and Infrastructure

The SMSZ Project benefits from its location in a well-established mining district southwestern Mali, approximately 15 km from Kenieba and within trucking distance of multiple world-class gold operations. The region is serviced by a network of sealed roads and well-maintained dirt roads, enabling year-round access to site and direct logistical links to Bamako and Senegal.

Desert Gold has positioned the SMSZ Project for staged, capital-efficient development by leveraging existing road infrastructure, a low strip-ratio oxide resource base, and a modular plant design that will be relocated from Barani to Gourbassi during the mine life. This phased approach avoids duplicate infrastructure and significantly reduces upfront capital.

The current exploration camp is fully equipped to support field operations, with core logging and storage facilities, temporary accommodations, and logistical staging areas already in place. During production, key site infrastructure will include:

A 36 ktpm modular gravity + CIL processing plant (initially at Barani, then moved to Gourbassi)

- Diesel-generated power (3.0 MVA installed capacity)

- Water supply via pit dewatering and rainfall collection

- Tailings storage and waste rock facilities at both pit areas

- Service roads, maintenance facilities, and mobile support equipment

- A staffed camp and offices for operations personnel

The site's gently rolling topography, soft oxide-hosted mineralization, and access to local labour pools further enhance the Project's suitability for rapid, low-cost development.

Next Steps

The Company is in advanced discussions with potential partners to secure funding to begin construction at Barani East as soon as possible. The company is evaluating a number of funding options and hopes to provide the market with material guidance on this subject in the near future. Certain pre-mining activities have already begun at the Barani site including the completion of construction of the security parameter fence around the Barani East starter pit.

Additional geotechnical work is being contemplated at the Barani East pit as management believes there could be an opportunity to further optimize the pit design with a primary goal of deepening the pit and reducing the stripping ratio from the existing PEA model.

At the Barani Small Mine Permit and Gourbassi West/West North and Gourbassi East deposits, new drill programs have been designed to test for extensions along strong strike and to depth of known gold zones with the aim of expanding exiting gold zones and incorporating new gold zones into the mine plan.

About Desert Gold Ventures

Desert Gold Ventures Inc. is a gold exploration gold company which controls properties in both Mali and Cote d'Ivoire. This includes the 440km2 SMSZ Project in Western Mali as well as the newly optioned 297 km2 Tiegba gold project in western Cote d'Ivoire within the prolific Birimian greenstone belt.

For further information, please see our website www.desertgold.ca or contact.

Jared Scharf, President and CEO

Email: jared.scharf@desertgold.ca

Qualified Person(s)

The Preliminary Economic Assessment (PEA) and accompanying Mineral Resource Estimate (MRE) for the SMSZ Project were completed by Minxcon Group and were prepared in accordance with the definitions and guidelines set out by the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), as adopted by reference under National Instrument 43-101 - Standards of Disclosure for Mineral Projects. The estimates also adhere to the CIM Best Practice Guidelines for Mineral Resource Estimation (2019).

The technical content of this news release, including data verification and interpretation related to the PEA and MRE, was prepared and reviewed under the supervision of Mr. Daniel (Daan) van Heerden (B Eng (Min.), MCom (Bus. Admin.), MMC, Pr.Eng. (Reg. No. 20050318), FSAIMM (Reg. No. 37309), AMMSA), a Director with Minxcon who is a Qualified Person (QP) as defined by NI 43-101 and independent of Desert Gold Ventures Inc. The full NI 43-101 Technical Report for the SMSZ Project will be filed and available on SEDAR+ (www.sedarplus.ca) within 45 days of this news release.

The scientific and technical information contained in this news release has been also reviewed and approved by Ty Magee (M.Sc., P. Geo), a Qualified person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Magee is an advisor and consultant to Desert Gold Ventures and is considered independent of the Company.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/275838