Dryden Gold Discovers Broad Mineralized Gold System and Purchases Royalties at Sherridon

Rhea-AI Summary

Dryden Gold (OTCQB: DRYGF) reported results from the first three-hole, first-pass drill program at Sherridon on October 14, 2025, and purchased two 2% NSRs covering certain Sherridon claims.

Key drill results include broad, low-grade zones up to 136 m and higher-grade intercepts such as 36.40 g/t Au over 0.50 m and 12.00 g/t Au over 0.50 m. The program tested ~350 m of a ~5 km geophysical anomaly. The company paid CAN$20,000 to acquire/cancel two 2% NSRs; a remaining 1% NSR to Alamos Gold can be bought down by 0.05% for CAN$500,000.

Positive

- Broad mineralized zones up to 136 m

- High-grade intercept: 36.40 g/t Au over 0.50 m

- Purchased two 2% NSRs for CAN$20,000

- Tested 350 m of a 5 km geophysical anomaly

Negative

- Most long intercepts are low grade (e.g., 0.16–0.26 g/t Au)

- Results derive from only three holes (limited dataset)

- True thicknesses are unknown

News Market Reaction 1 Alert

On the day this news was published, DRYGF declined 11.66%, reflecting a significant negative market reaction.

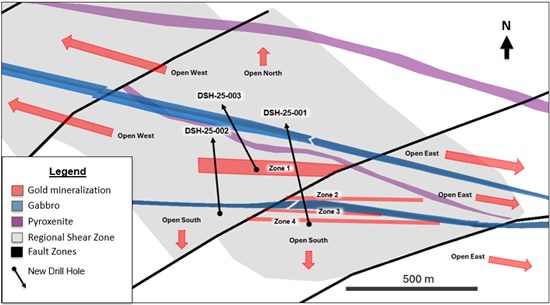

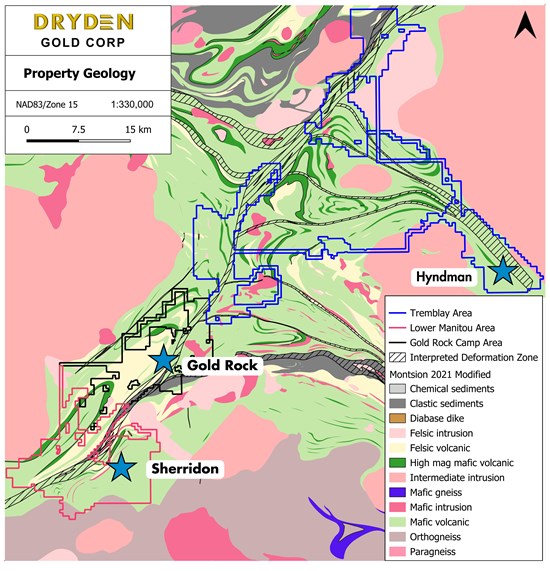

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - October 14, 2025) - Dryden Gold Corp. (TSXV: DRY) (OTCQB: DRYGF) (FSE: X7W) ("Dryden Gold" or the "Company") is pleased to announce drill results from its initial three-hole, first pass exploration program at the Sherridon Project ("Sherridon") in the Dryden Gold District. Using the Company's revised structural interpretations and complete assaying, drilling intersected several broad zones of anomalous gold mineralization (Figure 1). Sherridon is located approximately 35 kilometers south of the Gold Rock Camp (Figure 2) and represents the second regional discovery in the 2025 exploration program. The broad zones of gold mineralization are hosted within an east-west trending deformation corridor with an approximately five-kilometer geophysical anomaly. This corridor is a different style of mineralization than seen in the Gold Rock camp with a large anomalous gold zones representing a lower-grade bulk-tonnage target. The first pass drilling tested only 350 meters, along strike, of the five-kilometer geophysical anomaly.

The Company is also pleased to announce that it has purchased two of the net-smelter return royalties ("NSRs") covering certain claims currently being explored at Sherridon.

Drill Highlights:

- DSH-25-001 intersected 1.28 g/t gold over 19.00 meters including 2.55 g/t gold over 9.00 meters and including 36.40 g/t gold over 0.50 meters in a wide mineralized structure (Zone 4).

- DSH-25-001 intersected 0.40 g/t gold over 39.00 meters including 1.82 g/t gold over 7.00 meters in a second broad mineralized structure (Zone 3).

- A very extensive zone of anomalous gold mineralization of up to 136 meters was intersected in all three holes (Zone 1).

Trey Wasser, CEO of Dryden Gold, stated, "I am very excited to see our two-pronged exploration strategy being validated once again. While we remain laser-focused on expanding the mineralized footprint at Gold Rock, our regional efforts at Sherridon and Hyndman are beginning to prove the district-scale potential of Dryden Gold's large strategic land package. These new gold assays indicate broad zones of mineralization with a different alteration style than we see at Gold Rock or Hyndman. The geology team is excited about the potential for a completely different deposit model with potential bulk-tonnage scale at Sherridon. I am also pleased to have closed the transaction to buy the royalties on Sherridon. Purchasing royalties, at attractive prices, increases both property and shareholder value."

Dryden Gold's geology team has begun resampling historical core drilled adjacent to the new drill holes as historical assays are incomplete to identify these broader zones of mineralization. The resampling program is expected to further define these zones. The Company is also awaiting further geochemical results from these three initial holes at Sherridon, which will further aid in understanding this deposit model and unveil potential sources of gold bearing fluids. Multi-element geochemistry is anticipated to provide the ability to target potential higher-grade sections within the zone by modelling the distribution of more consistently anomalous elements such as arsenic or tellurium. In addition, the geochemical results will determine if there are other elements of interest due to the potential variety of fluid/metal sources and potential remobilization.

Figure 1: Plan map displaying generalized projected Sherridon geology, new drill holes and broad mineralized zones.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9776/270288_da96b574549e6a85_001full.jpg

Figure 2: Map showing location of Sherridon.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9776/270288_da96b574549e6a85_002full.jpg

Royalty Purchases

On October 3, 2025, the Company closed a transaction whereby it purchased, or otherwise cancelled, two

Sherridon Geology

Sherridon has a unique geological setting within the Dryden District. Mapping and drill holes at Sherridon have identified ultramafic dykes which are interpreted to indicate the presence of deeply rooted structures capable of tapping fertilized upper mantle rocks. In addition, the target area is located just ~1km north of syn-tectonic granitic intrusions which are theorized to have acted as both potential fluid source as well as a heat source to drive the upwelling of deeply sourced fluids and remobilization of earlier metal enrichment within the host basalt and unconformity.

Sherridon occurs along a second-order structure that connects to the Manitou-Dinorwic deformation zone (MDdz), a major deeply rooted structure which is believed to be one of the fluid pathways for the Gold Rock Camp targets. The orientation of the host deformation zone at Sherridon is unusual within the district and is interpreted by the Dryden Gold geologists to represent a particularly prospective location due to its resistance to reactivation during regional deformation and thus its capacity for fluid buildup. The lithological complexity of the Sherridon area suggests the presence of a rheologically complex contact zone, which is interpreted to have acted as a potential trap for transiently releases mineralizing fluids.

Marketing Update

Maura Kolb, P. Geo., President will be participating in the upcoming New Orleans Investment Conference, taking place on November 2-5, 2025, and will be presenting on November 3rd at 9:50am CT at Presentation Area One in the Exhibit Hall. Investors are encouraged to stop by Booth #228 to ask management questions about our fully funded, ongoing 20,000+ meter drill program. On November 6th, Maura will be giving a corporate presentation to new investors during a roadshow in Atlanta, Georgia, organized by Roger Fitzpatrick at the Palm Restaurant.

Exploration Manager, Ryan Humphries will be presenting at the Central Canadian Mineral Exploration Convention in Winnipeg on November 3rd during Session 5 at 1:30pm CT to give an exploration update.

CEO Trey Wasser will be meeting with investors at the 121 London Mining Investment Conference taking place on November 17-18. Shortly thereafter, Trey will also be participating in the Swiss Mining Institute Zurich conference from November 20-21 hosting more one-to-one meetings with guest speakers, Claude Bejet Peter Krauth, Florian Grummes, Eric Strand and more. We welcome investors to reach out for meetings and to review our updated corporate presentation, here.

For more information about which conferences management will be attending next, please visit our Events page, here.

Table 1: Gold Assay Results from Sherridon Program

| Target Area | Description | Drillhole | From | To | Length (m)* | Grade (g/t Au) | |

| Zone 4 | Mineralized zone south of the gabbro contact | DSH-25-001 | 36.00 | 55.00 | 19.00 | 1.28 | |

| Including | 40.00 | 49.00 | 9.00 | 2.55 | |||

| Including | 44.80 | 45.30 | 0.50 | 36.40 | |||

| Zone 3 | Mineralized zone along the south edge of the gabbro contact | DSH-25-001 | 83.00 | 122.00 | 39.00 | 0.40 | |

| Including | 83.00 | 90.00 | 7.00 | 1.82 | |||

| Including | 83.00 | 85.00 | 2.00 | 4.79 | |||

| Zone 2 | Mineralized zone along north edge of gabbro contact | DSH-25-001 | 131.00 | 148.50 | 17.50 | 0.24 | |

| Including | 133.00 | 136.90 | 3.90 | 0.63 | |||

| Zone 1 | Broad mineralized zone en echelon to D1 deformation corridor | DSH-25-001 | 194.30 | 326.00 | 131.70 | 0.18 | |

| Including | 200.00 | 202.00 | 2.00 | 0.91 | |||

| Including | 212.00 | 214.00 | 2.00 | 2.30 | |||

| Including | 274.00 | 280.00 | 6.00 | 0.58 | |||

| Including | 301.00 | 316.00 | 15.00 | 0.41 | |||

| Zone 1 | Broad mineralized zone en echelon to D1 deformation corridor | DSH-25-002 | 213.00 | 349.00 | 136.00 | 0.26 | |

| Including | 223.00 | 226.80 | 3.80 | 0.62 | |||

| Including | 239.00 | 240.20 | 1.20 | 0.78 | |||

| Including | 248.90 | 266.50 | 17.60 | 0.68 | |||

| Including | 298.70 | 299.20 | 0.50 | 12.00 | |||

| Including | 332.00 | 333.10 | 1.10 | 1.46 | |||

| Including | 340.40 | 341.00 | 0.60 | 3.21 | |||

| Zone 1 | Broad mineralized zone en echelon to D1 deformation corridor | DSH-25-003 | 8.20 | 85.00 | 76.80 | 0.16 | |

| Including | 14.25 | 14.90 | 0.65 | 2.34 | |||

| Including | 25.60 | 26.10 | 0.50 | 14.80 | |||

| Including | 38.00 | 38.50 | 0.50 | 2.23 | |||

| *Reported intervals are drilled core lengths; assay values are uncut | |||||||

Qualified Person

The technical disclosure in this news release has been reviewed and approved by Maura J. Kolb, M.Sc., P. Geo., President of Dryden Gold and a Qualified Person as defined by National Instrument 43-101 of the Canadian Securities Administrators.

Analytical Laboratory and QA/QC Procedures

The Company is drilling NQ size core. Samples are cut in half, with half going to the lab for analysis and half kept as a record. True thickness/widths of the mineralization are unknown, result intervals are reported as the drilled core lengths unless otherwise stated. All sampling completed by Dryden Gold Corp. within its exploration programs is subject to a Company standard of internal quality control and quality assurance (QA/QC) programs which include the insertion of certified reference materials, blank materials, and a level of duplicate analysis. Drill samples from the 2024 and 2025 program were sent to Activation Laboratories, with sample preparation and analysis in Dryden, where they were processed for gold analysis by 50-gram fire assay with an atomic absorption finish and over limits determined by Fire Assay with a gravimetric finish. Select samples were analyzed using metallic screens. Activation Laboratories systems conform to requirements of ISO/IEC Standard 17025 guidelines and meets assay requirements outlined for NI 43-101.

ABOUT DRYDEN GOLD CORP.

Dryden Gold Corp. is an exploration company focused on the discovery of high-grade gold mineralization listed on the TSX Venture Exchange ("DRY") and on the OTCQB marketplace ("DRYGF") and FSE ("X7W"). The Company has a strong management team and Broad of Directors comprised of experienced individuals with a track record of building shareholder value through property acquisition and consolidation, exploration success, and mergers and acquisitions. Dryden Gold controls a

For more information, go to our website www.drydengold.com.

CONTACT INFORMATION

| Trey Wasser, CEO Email: twasser@drydengold.com Phone: 940-368-8337 Ashley Robinson, Director of Corporate Communications Email: ir@drydengold.com X: @DrydenGold | Maura Kolb, M.Sc.. P. Geo., President Email: mjkolb@drydengold.com Phone: 807-632-2368 |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements include, but are not limited to, statements with respect to the acquisition of the Property, receipt of corporate and regulatory approvals, issuance of common shares; future development plans; future acquisitions; exploration programs; and the business and operations of Dryden Gold. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be "forward-looking statements." Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings including receipt of TSX Venture Exchange approval for the acquisition of the Property; risks related to environmental regulation and liability; the potential for delays in exploration or development activities; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in Dryden Gold's and the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and Dryden Gold and the Company do not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from Dryden Gold's and the Company's expectations or projections.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/270288