Electrovaya Reports Q2 Fiscal Year 2025 Results

Rhea-AI Summary

Electrovaya (NASDAQ:ELVA) reported strong Q2 FY2025 financial results with revenue increasing 40% year-over-year to $15.0 million. The company achieved a net profit of $0.8 million ($0.02 EPS) compared to a loss in the prior year, marking its eighth consecutive quarter of positive Adjusted EBITDA at $2.0 million. Gross margins remained robust at 31.1%.

Key developments include securing a $51 million direct loan from EXIM and a $20 million working capital facility from BMO. The company has commenced battery system assembly at its Jamestown facility and placed over $40 million in capital equipment orders. Electrovaya received more than $25 million in orders during the quarter and reaffirmed its FY2025 revenue guidance exceeding $60 million.

Positive

- Revenue grew 40% year-over-year to $15.0M

- Achieved net profit of $0.8M, turning around from $0.8M loss previous year

- Strong gross margin of 31.1% with battery system margins at 31.5%

- Secured $51M EXIM loan and $20M BMO working capital facility

- Received over $25M in new orders during the quarter

- Reduced total debt to $13.1M from $18.4M year-over-year

- Expanding recurring revenue streams through energy services and software

Negative

- Commercial production at Jamestown facility not starting until mid-2026

- Significant capital expenditure required with over $40M in equipment orders placed

News Market Reaction – ELVA

On the day this news was published, ELVA gained 3.79%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Revenue increased

Adjusted EBITDA1 of

Net Profit for the quarter of

Reaffirms Fiscal 2025 Revenue Guidance Exceeding

TORONTO, ONTARIO / ACCESS Newswire / May 14, 2025 / Electrovaya Inc. ("Electrovaya" or the "Company") (Nasdaq:ELVA)(TSX:ELVA), a leading lithium-ion battery technology and manufacturing company, today reported its financial results for the second quarter of the fiscal year ending September 30, 2025 ("Q2 2025"). All dollar amounts are in U.S. dollars unless otherwise noted.

Financial Highlights:

Revenue for Q2 2025 was

$15.0 million , compared to$10.7 million in Q2 2024, an increase of40% .Gross margin was

31.1% in Q2 2025. Battery system margins remained strong at31.5% for the quarter.Adjusted EBITDA1 was

$2.0 million . Q2 2025 was the Company's eighth consecutive quarter of positive Adjusted EBITDA1.Net profit for the quarter was

$0.8 million , compared to a net loss in the prior year of$0.8 million . Earnings per share for the quarter was$0.02 .Total debt was

$13.1 million , compared to$18.4 million in the prior year. Total availability in our working capital facility is over$10 million .

Key Operational and Strategic Highlights - Q2 2025

Closed a

$51 million Direct Loan from Export-Import Bank of the United States: On March 7, 2025, the Company announced that it closed a direct loan in the amount of$50.8 million from the Export-Import Bank of the United States ("EXIM") under the bank's "Make More in America" initiative. This financing, in addition to the various grants and tax credits from the State of New York, is expected to fund Electrovaya's battery manufacturing buildout in Jamestown, New York including equipment, engineering and setup costs for the facility.

Closed a

$20 million working Capital Debt Facility with the Bank of Montreal: On March 10, 2025, the Company announced that it has closed a credit agreement with the Bank of Montreal Corporate Finance ("BMO") for a senior secured asset based lending facility (the "Facility") which includes a three year term and which includes the following features:

Revolving asset based facility of

$20.0 million Accordion of

$5.0 million to support further growth when requiredAncillary credit products for foreign currency hedging and credit cards

Continued Growth from OEM Partners & Leading End-Customers: The Company continues to see good momentum from its key OEM partners and end customers of its material handling products. During the quarter the Company received more than

$25 million in orders.

Domestic Manufacturing in Jamestown, New York: The Company has accelerated its plans for battery system assembly operations at its Jamestown facility, which have commenced initial battery system assembly activities. Over

$40 million worth of capital equipment orders have already been placed to support the lithium-ion cell manufacturing plans which are on schedule to begin commercial production in mid CY 2026.

Expansion of Recurring Revenue Streams: The Company continues to grow its recurring revenue base through energy services programs, software-enabled battery analytics, and aftermarket services, supporting long-term margin expansion.

New Vertical Expansion: Electrovaya continues to expand into new market verticals and received new high-voltage battery system orders through Sumitomo from a second global Japanese construction OEM.

Management Commentary:

"Our FY Q2 2025 period showcased that Electrovaya has passed our next major inflection point as we demonstrate strong growth, profitability and the support for significant scale from our new financial partners, EXIM and BMO," stated Dr. Raj DasGupta, Electrovaya's CEO. "Recent global trade tensions illustrate that our decision to grow domestic manufacturing and supply chains is going to yield further strength to our business and overall competitiveness. With growing demand from both existing and new customers, we are confident in our trajectory for sustained growth and innovation in the lithium-ion battery sector. Finally, we're also seeing growing contribution from recurring revenue, including energy services, data-enabled SaaS tools, and aftermarket parts and services, which is helping expand margins and build long-term customer relationships."

"FY Q2 2025 quarter was our eighth consecutive quarter of positive adjusted EBITDA1 and also historically we are showing a net profit for both the quarter and the six months period. Margins remained above

Positive Financial Outlook & Fiscal 2025 Guidance:

The Company anticipates strong growth into FY 2025 with estimated revenues to exceed

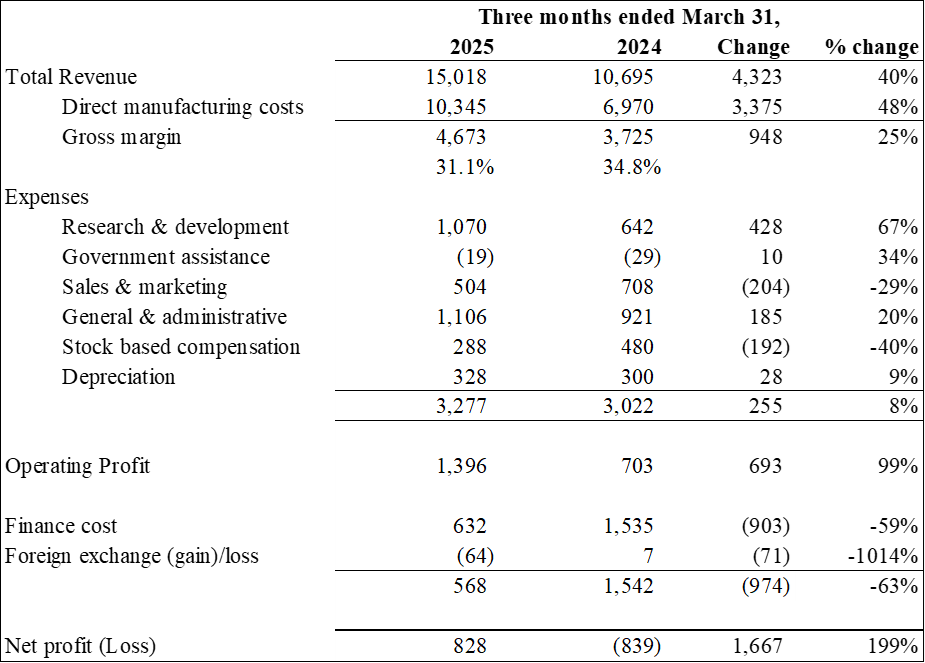

Selected Financial Information for the quarters ended March 31, 2025 and 2024:

Results of Operations

(Expressed in thousands of U.S. dollars)

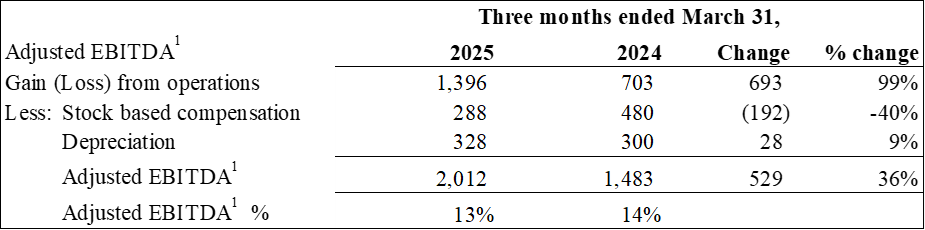

Adjusted EBITDA1

(Expressed in thousands of U.S. dollars)

1 Non-IFRS Measure: Adjusted EBITDA is defined as income/(loss) from operations, plus stock-based compensation costs and depreciation and amortization costs. Adjusted EBITDA does not have a standardized meaning under IFRS. Therefore it is unlikely to be comparable to similar measures presented by other issuers. Management believes that certain investors and analysts use adjusted EBITDA to measure the performance of the business and is an accepted measure of financial performance in our industry. It is not a measure of financial performance under IFRS, and may not be defined and calculated in the same manner by other companies and should not be considered in isolation or as an alternative to IFRS measures. The most directly comparable measure to Adjusted EBITDA calculated in accordance with IFRS is income (loss) from operations.

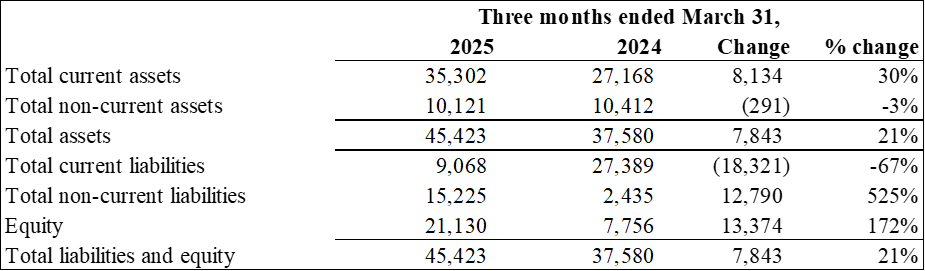

Summary Financial Position

(Expressed in thousands of U.S. dollars)

The Company's complete Financial Statements and Management Discussion and Analysis for the quarter ended March 31, 2025 are available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov, as well as on the Company's website at www.electrovaya.com.

Conference Call details:

Date: Wednesday, May 14, 2025

Time: 5:00 pm. Eastern Time (ET)

Toll Free: 888-506-0062

International: 973-528-0011

Participant Access Code: 929779

To help ensure that the conference begins in a timely manner, please dial in 10 minutes prior to the start of the call.

For those unable to participate in the conference call, a replay will be available for two weeks beginning on May 14, 2025 through May 28, 2025. To access the replay, the dial-in number is 877-481-4010 and 919-882-2331. The replay passcode is 52379.

Investor and Media Contact:

Jason Roy

VP, Corporate Development and Investor Relations

Electrovaya Inc.

jroy@electrovaya.com / 905-855-4618

About Electrovaya Inc.

Electrovaya Inc. (NASDAQ:ELVA)(TSX:ELVA) is a pioneering leader in the global energy transformation, focused on contributing to the prevention of climate change by supplying safe and long-lasting lithium-ion batteries without compromising energy and power. The Company has extensive IP and designs, develops and manufactures proprietary lithium-ion batteries, battery systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications. Electrovaya has two operating sites in Canada and a 52-acre site with a 135,000 square foot manufacturing facility in Jamestown New York state for its planned gigafactory. To learn more about how Electrovaya is powering mobility and energy storage, please explore www.electrovaya.com.

Forward-Looking Statements

This press release contains forward-looking statements, including statements that relate to, among other things, revenue growth and revenue guidance of approximately

Revenue guidance for FY2025 described herein constitutes future‐oriented financial information and financial outlooks (collectively, "FOFI"), and generally, is, without limitation, based on the assumptions and subject to the risks set out above under "Forward‐Looking Statements". Although management believes such assumptions to be reasonable, a number of such assumptions are beyond the Company's control and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. FOFI is provided for the purpose of providing information about management's current expectations and plans relating to the Company's future performance, and may not be appropriate for other purposes.

The FOFI does not purport to present the Company's financial condition in accordance with IFRS, and it is expected that there may be differences between audited results and preliminary results, and the differences may be material. The inclusion of the FOFI in this news release disclosure should not be regarded as an indication that the Company considers the FOFI to be a reliable prediction of future events, and the FOFI should not be relied upon as such.

SOURCE: Electrovaya, Inc.

View the original press release on ACCESS Newswire