Electrovaya Reports Q3 Fiscal Year 2025 Results

Electrovaya (NASDAQ:ELVA) reported strong Q3 FY2025 results with revenue increasing 67% year-over-year to $17.1M. The company achieved its ninth consecutive quarter of positive Adjusted EBITDA, which grew 387% to $2.9M, representing 17% of revenue. Net profit reached $0.9M with EPS of $0.02.

The company secured over $21M in new orders during Q3, bringing the nine-month total to $66M. Operational highlights include expanded manufacturing capacity with a second production shift in Mississauga and new assembly operations in Jamestown, NY. Electrovaya is diversifying into new markets including robotics, airport ground equipment, Class 8 trucks, and defense applications.

Management reaffirmed fiscal 2025 revenue guidance to exceed $60M, supported by strong order pipeline and maintained robust gross margins of 30.8%.

Electrovaya (NASDAQ:ELVA) ha riportato solidi risultati nel 3° trimestre dell'esercizio 2025 con i ricavi in aumento del 67% su base annua a $17.1M. L'azienda ha registrato il nono trimestre consecutivo di EBITDA rettificato positivo, che è cresciuto del 387% a $2.9M, pari al 17% dei ricavi. L'utile netto è stato di $0.9M con un EPS di $0.02.

Nel trimestre Electrovaya ha ottenuto oltre $21M di nuovi ordini, portando il totale nei nove mesi a $66M. Tra i principali sviluppi operativi figurano l'espansione della capacità produttiva con un secondo turno a Mississauga e nuove attività di assemblaggio a Jamestown, NY. L'azienda si sta diversificando in nuovi mercati, tra cui robotica, mezzi di servizio aeroportuale, camion Classe 8 e applicazioni per la difesa.

La direzione ha ribadito la guidance sui ricavi per il 2025 fiscale, prevedendo di superare i $60M, supportata da un solido portafoglio ordini e da margini lordi mantenuti al 30.8%.

Electrovaya (NASDAQ:ELVA) presentó sólidos resultados en el 3T del año fiscal 2025, con ingresos que aumentaron un 67% interanual hasta $17.1M. La compañía logró su noveno trimestre consecutivo de EBITDA ajustado positivo, que creció un 387% hasta $2.9M, representando el 17% de los ingresos. El beneficio neto alcanzó $0.9M con un BPA (EPS) de $0.02.

Durante el trimestre, la compañía aseguró más de $21M en nuevos pedidos, lo que eleva el total en nueve meses a $66M. Entre los hitos operativos se incluyen la ampliación de la capacidad de fabricación con un segundo turno en Mississauga y nuevas operaciones de ensamblaje en Jamestown, NY. Electrovaya se está diversificando hacia nuevos mercados, como la robótica, equipos de servicio en aeropuertos, camiones Clase 8 y aplicaciones de defensa.

La dirección reafirmó la previsión de ingresos para el ejercicio 2025 de superar los $60M, respaldada por una sólida cartera de pedidos y por unos márgenes brutos mantenidos del 30.8%.

Electrovaya (NASDAQ:ELVA)는 2025 회계연도 3분기 실적에서 매출이 전년 동기 대비 67% 증가한 $17.1M를 기록하는 등 강한 성과를 발표했습니다. 회사는 9분기 연속 보정(Adjusted) EBITDA 흑자를 달성했으며, 이는 387% 증가한 $2.9M로 매출의 17%에 해당합니다. 순이익은 $0.9M, 주당순이익(EPS) $0.02를 기록했습니다.

회사는 3분기 동안 $21M 이상 규모의 신규 수주를 확보해 9개월 누적 수주가 $66M에 이르렀습니다. 운영 측면의 주요 사항으로는 미시소가(Mississauga) 공장의 생산 능력 확대(두 번째 교대 근무 도입)와 뉴욕 잼스타운(Jamestown)에서의 신규 조립 작업 개시가 포함됩니다. Electrovaya는 로보틱스, 공항 지상 지원장비, Class 8 트럭, 방위(군사) 응용 분야 등으로 사업을 다각화하고 있습니다.

경영진은 강력한 수주 파이프라인을 바탕으로 2025 회계연도 매출 가이던스를 $60M 초과로 재확인했으며, 견조한 총마진 30.8%을 유지하고 있습니다.

Electrovaya (NASDAQ:ELVA) a publié de solides résultats pour le 3ᵉ trimestre de l'exercice 2025, avec un chiffre d'affaires en hausse de 67% d'une année sur l'autre à $17.1M. La société a enregistré son neuvième trimestre consécutif d'EBITDA ajusté positif, en hausse de 387% à $2.9M, soit 17% du chiffre d'affaires. Le bénéfice net s'est élevé à $0.9M avec un BPA (EPS) de $0.02.

La société a obtenu plus de $21M de nouvelles commandes au 3ᵉ trimestre, portant le total sur neuf mois à $66M. Les faits marquants opérationnels incluent l'extension de la capacité de production avec un deuxième quart à Mississauga et de nouvelles opérations d'assemblage à Jamestown, NY. Electrovaya se diversifie vers de nouveaux marchés, notamment la robotique, les équipements au sol pour aéroports, les camions de classe 8 et les applications de défense.

La direction a réaffirmé ses prévisions de chiffre d'affaires pour l'exercice 2025 visant à dépasser $60M, soutenues par un solide carnet de commandes et des marges brutes maintenues à 30.8%.

Electrovaya (NASDAQ:ELVA) meldete starke Ergebnisse für das 3. Quartal des Geschäftsjahres 2025: der Umsatz stieg gegenüber dem Vorjahr um 67% auf $17.1M. Das Unternehmen verzeichnete das neunte Quartal in Folge mit positivem bereinigtem EBITDA, das um 387% auf $2.9M wuchs und damit 17% des Umsatzes ausmacht. Der Nettogewinn belief sich auf $0.9M bei einem EPS von $0.02.

Im 3. Quartal sicherte sich das Unternehmen über $21M an Neuaufträgen, womit sich der Neun-Monats-Gesamtwert auf $66M erhöht. Zu den operativen Highlights zählen die Erweiterung der Fertigungskapazität durch eine zweite Schicht in Mississauga und neue Montageaktivitäten in Jamestown, NY. Electrovaya diversifiziert in neue Märkte, darunter Robotik, Bodenfahrzeuge für Flughäfen, Class‑8‑Lkw und Verteidigungsanwendungen.

Das Management bekräftigte die Umsatzprognose für das Geschäftsjahr 2025, die über $60M liegen soll, gestützt durch eine starke Auftragslage und stabile Bruttomargen von 30.8%.

- Revenue grew 67% year-over-year to $17.1M

- Adjusted EBITDA increased 387% to $2.9M, marking ninth consecutive profitable quarter

- Achieved net profit of $0.9M, compared to prior year loss of $0.3M

- Secured $21M in new orders in Q3, with $66M total orders in nine months

- Strong gross margins maintained at 30.8%

- Successfully expanded manufacturing capacity with second shift and new facility

- Diversified into multiple new market verticals including robotics and defense

- Cell manufacturing in Jamestown facility delayed until mid-2026

- Some anticipated revenue may be deferred to FY2026

Insights

Electrovaya's Q3 shows impressive 67% revenue growth with sustained profitability, indicating successful market expansion beyond its core business.

Electrovaya's Q3 FY2025 results showcase remarkable financial momentum, with revenue surging

The robust

The

What's particularly notable is the company's expansion beyond its core material handling market. Electrovaya is leveraging its Infinity technology to penetrate high-growth sectors including robotics, airport ground equipment, Class 8 trucks, construction/mining equipment, and defense applications. This strategic diversification could substantially expand their addressable market, while their partnership with Janus Electric for battery-swapping applications in heavy vehicles opens new revenue streams.

The planned Jamestown cell manufacturing facility, on track for mid-2026, represents a significant vertical integration opportunity that should improve margins and supply chain control while qualifying for tax benefits under the OBBB Act. With nine consecutive quarters of positive Adjusted EBITDA and two consecutive quarters of net profit, Electrovaya has established a solid financial foundation for continued expansion.

Revenue increased

Adjusted EBITDA1 increased

Net Profit for the quarter of

Reaffirms Fiscal 2025 Revenue Guidance Exceeding

TORONTO, ONTARIO / ACCESS Newswire / August 13, 2025 / Electrovaya Inc. ("Electrovaya" or the "Company") (Nasdaq:ELVA)(TSX:ELVA), a leading lithium-ion battery technology and manufacturing company, today reported its financial results for the third quarter of the fiscal year ending September 30, 2025 ("Q3 2025"). All dollar amounts are in U.S. dollars unless otherwise noted.

Financial Highlights:

Revenue for Q3 2025 was

$17.1 million , compared to$10.3 million in Q3 2024, an increase of67% . Year to date revenue was$43.3 million compared to$33.0 million in the prior year, an increase of31% Gross margin was

30.8% in Q3 2025. Battery system margins remained strong at30.9% for the quarter.Adjusted EBITDA1 was

$2.9 million or17% of revenue with growth of387% year over year.Net profit for the quarter was

$0.9 million , compared to a net loss in the prior year of$0.3 million . Year to date net profit was$1.3 million compared to a net loss of$1.4 million in the prior year.Earnings per share for the quarter was

$0.02 .

Key Operational and Strategic Highlights - Q3 2025

Continued Growth from OEM Partners and Leading End-Customers: Electrovaya maintained strong momentum with its key OEM partners and end customers in the material handling sector. In Q3, the Company secured more than

$21 million in orders, bringing total orders to over$66 million in the nine months ending June 30th 2025. The Company continues to expand its robust sales pipeline, leveraging long-standing relationships with major OEMs and top-tier end customers.Expanded Manufacturing Capacity and Output: To meet growing demand, Electrovaya implemented a second production shift at its Mississauga facility in mid-June and commenced assembly operations in Jamestown, NY in May. These initiatives will increase output for material handling battery systems and support the launch of new products for additional vertical markets

Infinity Technology Advancements: The Company continued to enhance its Infinity product line, achieving UL certification for more than 400 battery systems equipped with its latest high-capacity lithium-ion cells. New models feature improved ergonomics and AI-enabled capabilities, further strengthening Electrovaya's competitive edge.

Development of New Products for Emerging Verticals: Electrovaya is leveraging its industry-leading Infinity technology to expand into a broader range of high-growth applications, including:

Robots and Autonomous Vehicles: The Company has introduced multiple battery system products for new robotic vehicle platforms across three distinct OEM customers. Applications range from material handling to surveillance systems. This initiative is part of a major product development program aimed at capturing share in the rapidly growing robotics market.

Airport Ground Equipment: Recently, Electrovaya launched products targeting the airport ground support segment and plans to showcase these solutions at the upcoming GSE Expo in Las Vegas this September.

Class 8 Trucks: As one of the largest potential markets for electrification, this segment represents a significant growth opportunity. Electrovaya has entered into a partnership with Janus Electric Holdings Limited, an Australian pioneer in heavy-vehicle electrification. The Company is developing custom high-voltage battery systems for a unique battery-swapping application in both U.S. and Australian markets.

Construction and Mining Equipment: Through its partnership with Sumitomo Corporation Power and Mobility, Electrovaya is pursuing opportunities with multiple Japan-based OEMs in these sectors.

Defense Applications: The Company continues to expand its collaboration with a global defense contractor on various electrification projects. With its superior safety and cycle life advantages, combined with upcoming U.S.-based lithium-ion battery manufacturing, Electrovaya is positioned to target the defense sector on a larger scale in the near term.

Jamestown Cell Manufacturing Update: The Company remains on track for start of cell manufacturing in mid calendar year 2026. Output from the Jamestown facility will remain eligible for 45X under the OBBB Act (2025).

Management Commentary:

"Our Q3 FY2025 results reflect the strong momentum we've built, with continued growth in both revenue and profitability, while advancing our industry-leading Infinity technology into a broader range of applications," said Dr. Raj DasGupta, Electrovaya's CEO. "The market is increasingly recognizing the exceptional advantages of our innovations. Electrovaya's unique lithium-ion technology delivers the ideal solution for the most demanding equipment in the world. With the rise of AI and rapid expansion across sectors like e-commerce and robotics, we are well-positioned to provide superior battery solutions that power these high-growth industries."

"FY Q3 2025 quarter was our ninth consecutive quarter of positive adjusted EBITDA1 and also our second consecutive quarterly net profit. Margins remained robust at above

Positive Financial Outlook & Fiscal 2025 Guidance:

The Company anticipates strong growth into FY 2025 with estimated revenues to exceed

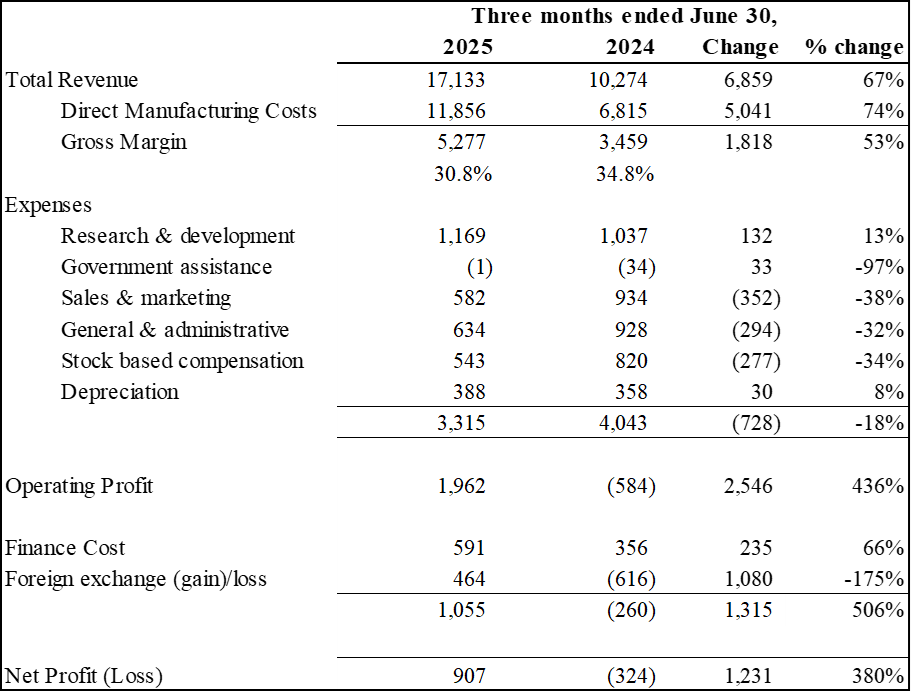

Selected Financial Information for the quarters ended June 30, 2025 and 2024:

Results of Operations

(Expressed in thousands of U.S. dollars)

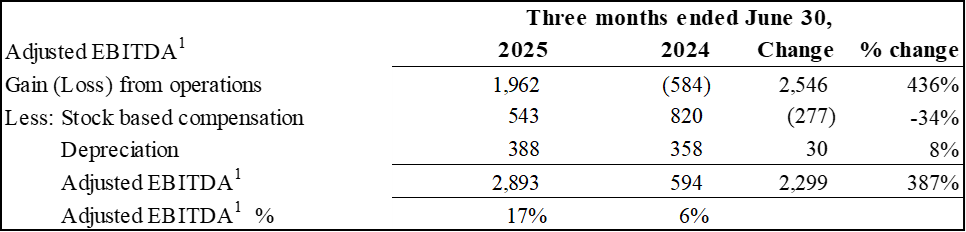

Adjusted EBITDA1

(Expressed in thousands of U.S. dollars)

1 Non-IFRS Measure: Adjusted EBITDA is defined as income/(loss) from operations, plus stock-based compensation costs and depreciation and amortization costs. Adjusted EBITDA does not have a standardized meaning under IFRS. Therefore it is unlikely to be comparable to similar measures presented by other issuers. Management believes that certain investors and analysts use adjusted EBITDA to measure the performance of the business and is an accepted measure of financial performance in our industry. It is not a measure of financial performance under IFRS, and may not be defined and calculated in the same manner by other companies and should not be considered in isolation or as an alternative to IFRS measures. The most directly comparable measure to Adjusted EBITDA calculated in accordance with IFRS is income (loss) from operations.

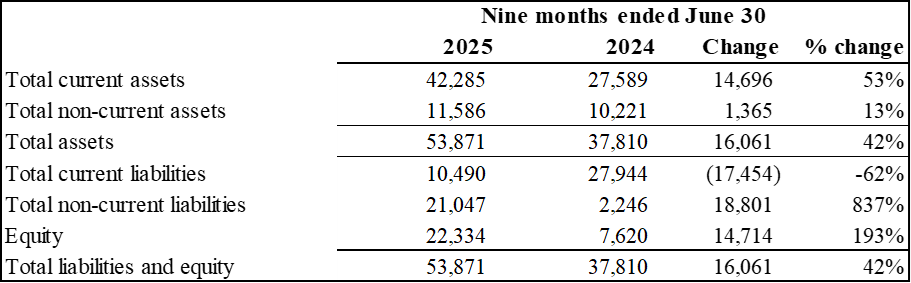

Summary Financial Position

(Expressed in thousands of U.S. dollars)

The Company's complete Financial Statements and Management Discussion and Analysis for the quarter and nine months ended June 30, 2025 are available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov, as well as on the Company's website at www.electrovaya.com.

Conference Call details:

Date: Wednesday, August 13, 2025

Time: 5:00 pm. Eastern Time (ET)

Toll Free: 888-506-0062

International: 973-528-0011

Participant Access Code: 264442

Webcast link: https://www.webcaster4.com/Webcast/Page/2975/52770

To help ensure that the conference begins in a timely manner, please dial in 10 minutes prior to the start of the call.

For those unable to participate in the conference call, a replay will be available for two weeks beginning on August 13, 2025 through August 27, 2025. To access the replay, the dial-in number is 877-481-4010 and 919-882-2331. The replay passcode is 52770.

Investor and Media Contact:

Jason Roy

VP, Corporate Development and Investor Relations

Electrovaya Inc.

jroy@electrovaya.com / 905-855-4618

About Electrovaya Inc.

Electrovaya Inc. (NASDAQ:ELVA)(TSX:ELVA) is a pioneering leader in the global energy transformation, focused on contributing to the prevention of climate change by supplying safe and long-lasting lithium-ion batteries without compromising energy and power. The Company has extensive IP and designs, develops and manufactures proprietary lithium-ion batteries, battery systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications. Electrovaya has two operating sites in Canada and a 52-acre site with a 135,000 square foot manufacturing facility in Jamestown New York state for its planned gigafactory. To learn more about how Electrovaya is powering mobility and energy storage, please explore www.electrovaya.com.

Forward-Looking Statements

This press release contains forward-looking statements, including statements that relate to, among other things, revenue growth and revenue guidance of approximately

Revenue guidance for FY2025 described herein constitutes future‐oriented financial information and financial outlooks (collectively, "FOFI"), and generally, is, without limitation, based on the assumptions and subject to the risks set out above under "Forward‐Looking Statements". Although management believes such assumptions to be reasonable, a number of such assumptions are beyond the Company's control and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. FOFI is provided for the purpose of providing information about management's current expectations and plans relating to the Company's future performance, and may not be appropriate for other purposes.

The FOFI does not purport to present the Company's financial condition in accordance with IFRS, and it is expected that there may be differences between audited results and preliminary results, and the differences may be material. The inclusion of the FOFI in this news release disclosure should not be regarded as an indication that the Company considers the FOFI to be a reliable prediction of future events, and the FOFI should not be relied upon as such.

SOURCE: Electrovaya, Inc.

View the original press release on ACCESS Newswire