Grid Battery Metals Provides a CEO Update

- Fully funded for 2025 mineral exploration season

- Strategic acquisition of 275 km² of copper-gold tenures in mining-friendly British Columbia

- Successful completion of five-hole drill program at Clayton Valley with promising lithium concentrations

- Diversified portfolio with both copper-gold and lithium assets in favorable jurisdictions

- Clayton Valley drill results showed relatively low-grade lithium (298 ppm average) compared to typical economic grades (800-850 ppm)

- Lithium assays diminishing to the north at Clayton Valley property

- Early-stage exploration status with no defined resources yet

COQUITLAM, BC / ACCESS Newswire / May 7, 2025 / Grid Battery Metals Inc. (the "Company" or "Grid Battery") (TSXV:CELL)(OTCQB:EVKRF)(FRA:NMK2) provides the following update to its Shareholders.

TO OUR SHAREHOLDERS

First off, I would like to thank you for your support of our Company. Your continued support of our team and the development of our world class North American-based copper-gold and lithium properties is impressive.

We have spoken many times in the past about the undeniable consumer trend towards the use of Electric Vehicles (EV) in North America and throughout the globe. Auto manufacturers worldwide are producing more EVs for sale each year, both in terms of the number of car and truck model options available for consumers but also in terms of the numbers of cars produced. Governments are stepping up with EV subsidies for both consumers and manufacturers, and auto manufacturers are increasing their manufacturing capacity. In the USA alone, estimates as high as

A key component in the production of EVs is the exploration, mining and refining of key battery metals like Copper and Lithium. Both Canada and the US have committed to supporting the mining industry for these key battery metals and recent legislation like the US Inflation Reduction Act confirms both financial and functional support to the mining industry as part of an overall long term strategy for clean technology and progressive solutions to climate change.

The Copper Market

The copper market is currently facing a significant supply-demand imbalance. The global push towards electrification, particularly in EVs and renewable energy infrastructure, has dramatically increased copper demand.

Copper is indispensable in various industries beyond EVs. Here are some key examples:

Construction: Nearly half of all copper supply is used in building construction. An average single-family home contains about 200 kg of copper. With the reconstruction efforts in California due to wildfires and the post-war rebuilding of Ukraine, the demand for copper in construction is set to increase significantly.

Electronics: Copper's high electrical conductivity makes it vital for electronics. It is used in wiring, circuit boards, and various electronic components.

Renewable energy: Copper is essential for wind turbines, solar panels, and battery storage systems. A wind turbine uses around 3 metric tons of copper for every megawatt of power produced.

Investing in copper now is crucial for several reasons:

Energy transition: Copper is a key component in renewable energy technologies and electric vehicles. The shift towards a greener future will drive copper demand.

Infrastructure development: The global push for infrastructure modernization, including the reconstruction of homes and buildings, will require substantial amounts of copper.

Supply constraints: The looming supply shortfall presents an opportunity for investors to capitalize on rising copper prices.

It has been reported that the copper mining industry needs to invest US

Minimal Impact of Tariffs on Copper

Amid the uncertainty of ongoing tariff wars, the global demand for copper remains, and is set to surge, driven by the energy transition, infrastructure development, and technological advancements. According to the International Energy Agency (IEA), even under the most optimistic mining forecasts, we are facing a significant copper supply shortfall by the end of this decade, and by 2035, the demand for copper could reach almost 50 million metric tons annually. For perspective, copper mine production in 2024 was estimated at 23 million metric tons.

Company Exploration Plans for 2025

I am proud to say that we are fully funded for the 2025 mineral exploration season. We plan to carry out a mindful and meticulous exploration of our mineral assets in 2025, building on our work in 2024.

Our Recently Acquired Large Copper - Gold Exploration Property

We're excited that we have acquired approximately 275 km2 of tenures in such a favourable mining region within British Columbia, Canada. This area of the Province has already generated several promising projects, and our land package is strategically situated to exploit the high copper-gold values of the region. NorthWest Copper Corp. (TSXV: NWST) on the nearby Kwanika project intercepted 400 metres of 1.01 Copper equivalent (News Release: January 16, 2023 Northwest Copper Corp). British Columbia is a mining-friendly jurisdiction with reasonable processes, good infrastructure and potential First Nation partners.

We propose to carry out a preliminary exploration program on two of the five claim blocks recently acquired as part of our Exploration Phase 1. Here a large assaying, trenching, sampling and geophysics program is planned for the Jupiter and Starlight claim blocks. We are planning this work during the summer exploration season and expect to have assay results by the fall with next exploration steps identified on the various claim blocks shortly thereafter.

Nevada Lithium Exploration Plan

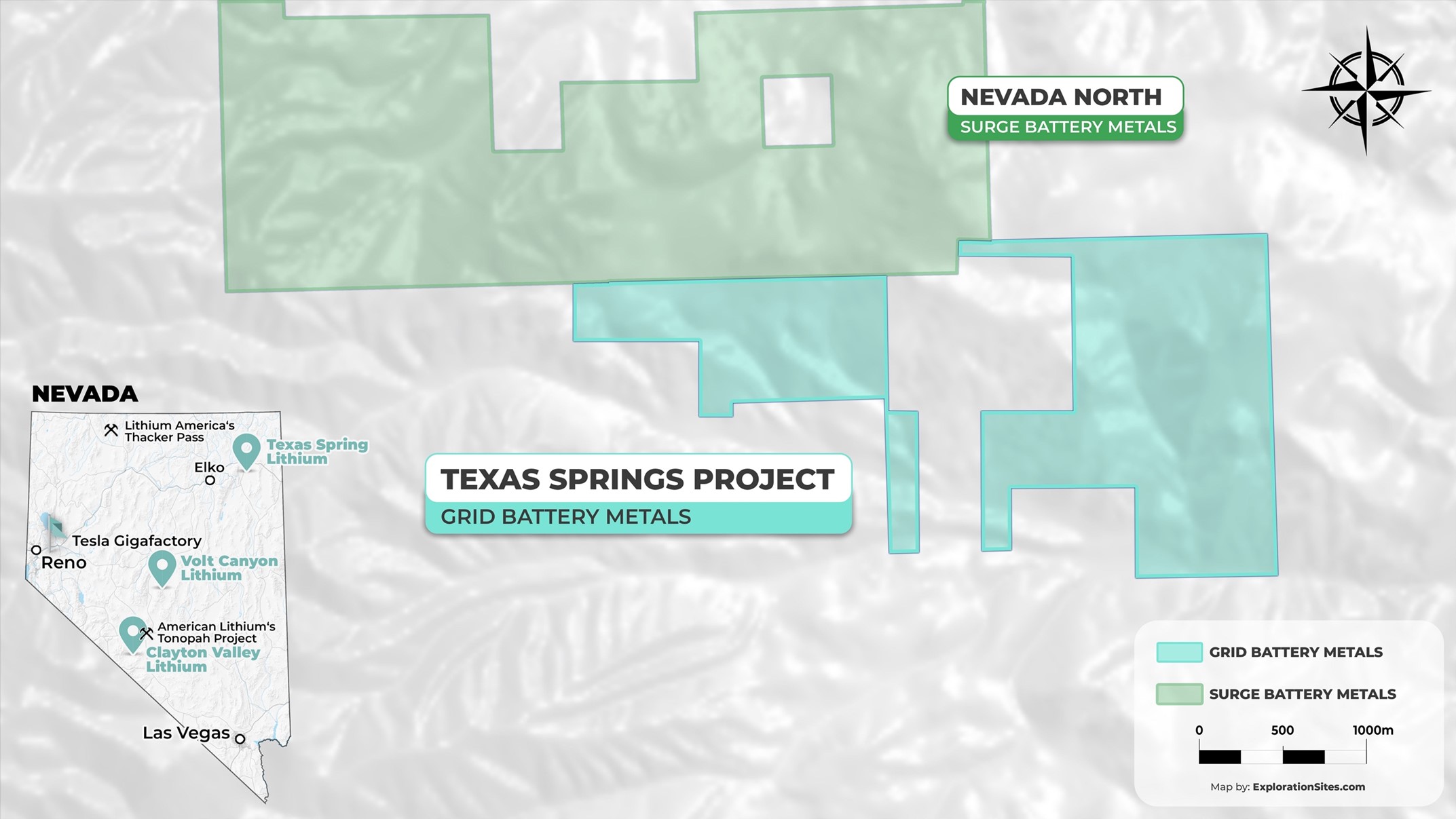

Within the past two years, we have added two new and highly prospective lithium properties to our asset portfolio in Nevada.The Texas Springs Property and the Volt Canyon Property been added to our existing Clayton Valley Lithium assets in Nevada. Our team recently completed a multi-phased exploration program on both the Clayton Valley Lithium Property and the Texas Springs Property which included diamond drilling at Clayton Valley and both a CSAMT geophysical survey and a detailed soil sampling on a 50 m X 100 m spacing at Texas Spring. The CSAMT survey is a method for obtaining information about subsurface resistivity and geology, which can help predict geological structure and locations for lithium, while the detailed surface sampling will allow us to determine lithium values at surface. Results from these two exploration programs will be key to determining our 2025 exploration plan and possible drilling locations for additional clay-based lithium targets.

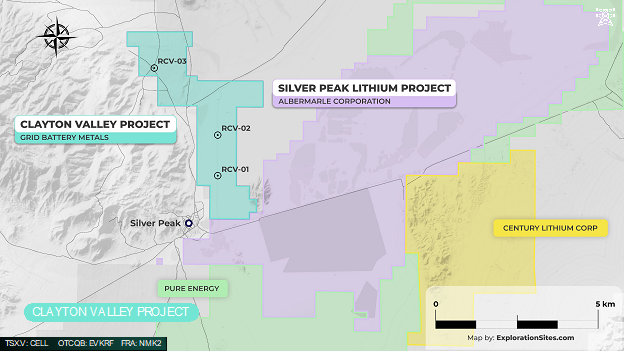

Summary of the Recently Completed Exploration Program at Clayton Valley

Grid Battery Metals completed a five-hole drill program in late October 2024. A total of 4735 feet were drilled to test for economic lithium clay and lithium brines with the Company landholdings located 1.2 miles northeast of Silver Peak, Nevada.

As mentioned in our January 21, 2025 News Release on results of this drilling, lithium concentrations in water samples were determined in all holes. The best drill-cutting intercept occurs in RCV-04 in tuffaceous sediments between 80 and 250 feet with an average of 298 ppm Li that includes grades to 741 ppm and is worthy of further exploration. Published low-grade clay-hosted lithium assays are approximately 800-850 ppm. While lithium assays generally diminish to the north, there is still untested property to the south to explore for shallow, but higher-grade lithium which is of considerable interest to the Grid Exploration Team. This is where we will focus our next exploration program at Clayton Valley.

Our aim is to advance these lithium and copper exploration projects as quickly as possible and build them into long-term robust assets benefiting all shareholders.

Thank you for your support and we look forward to creating new value each and every day for our shareholders.

Sincerely,

Tim Fernback

President & CEO

Qualified Person

Jeremy Hanson, P.Geo., a qualified person as defined by NI 43 - 101, is responsible for the technical information contained in this release.

About Grid Battery Metals Inc. www.gridbatterymetals.com.

Grid Battery Metals Inc. is a Canadian based exploration company whose primary listing is on the TSX Venture Exchange. The Company's maintains a focus on exploration for high value battery metals required for the electric vehicle (EV) market.

About the Copper Property

The Company acquired a

The Company's claims are also located between Centerra Gold Inc.'s (TSX: CG, NYSE: CGAU) prominent Copper/Gold assets, the Kemess North project and the operating Mount Milligan mine, which has produced over 1.8 million ounces of gold and 742 million pounds of copper (Technical Report on the Mount Milligan Mine, November 7, 2022, Borntrager. B, et al.).

B.C. Minfile assessment report data indicates that most of the area covered by the Copper Property was at one time or another covered by staking during surges of exploration in B.C. dating from the 1940's to present day. Largely the claims appear to have been minimally explored with little follow-up. However, some work was recorded on several claims with results for stream sediment sampling showing anomalous to highly anomalous results for gold in a few areas. These areas were recommended for detailed follow-up, however due to a downturn no further work was recorded

The Omineca Group claim areas are within the northern Quesnel Trough underlain by Cache Creek Terrane and lies close to the Pinchi Fault. The Quesnel Trough hosts numerous porphyry copper-gold deposits. The Pinchi Fault can be traced for 600 km through north-central B.C and separates Cache Creek rocks from the Jurassic Hogem Batholith and Triassic-Jurassic Takla rocks to the west. Rocks have a north-northwest strike trend typical of the entire Intermontane Belt in which the Cache Creek Terrane lies (Gabrielse and Yorath, 1992). A wide range of Jurassic to Tertiary intrusions cuts the Cache Creek Assemblage and many of these are emplaced along the prominent NW-trending structures and stratigraphic breaks. Numerous mercury occurrences are present along the length of the Pinchi fault (Albino, 1987) and a few gold and base metal occurrences are present near the Pinchi fault including the Lustdust, Lorraine, Indata and Axelgold properties. There are at least two alkalic gold-copper Porphyry systems in the immediate Lustdust (now known as Stardust) area: J49 and Axel Properties (Schiarrizza, 2000).

About Texas Springs Property

The Company owns a

The Texas Spring property adjoins the southern border of the Nevada North Lithium Project - owned by Surge Battery Metals Inc. ("Surge") (TSXV: NILI, OTC: NILIF) and comprised of 725 mineral claims. Surge's first round of drilling identified strongly mineralized lithium bearing clays. The average lithium content within all near surface clay zones intersected in the 2022 drilling program, applying a 1000 ppm cut-off, was 3254 ppm. (Press release March 29, 2023). More recent results have shown higher grade lithium up to 8070 ppm on this property after initial drilling (Press release September 12, 2023). Our exploration results are on-trend with these results.

About Clayton Valley Lithium Project

The Company owns a

About the Volt Canyon Lithium Property

The Company owns a

On Behalf of the Board of Directors

"Tim Fernback"

Tim Fernback, President & CEO

Contact Information:

Email: info@gridbatterymetals.com

Phone: 604- 428-5690

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to vary materially from forward-looking statements. It should be noted that results from any adjacent property(s) are not an indication of what may be found on the Company's property(s).

SOURCE: Grid Battery Metals Inc.

View the original press release on ACCESS Newswire