Founders Metals Completes 36,000 Hectare Acquisition & Expands Upper Antino Gold Mineralization to 2.5 Kilometres

Rhea-AI Summary

Founders Metals (OTCQX: FDMIF) signed a Definitive Agreement to acquire 100% of a 36,000 hectare exploration concession west of its Antino gold project, expanding the project to 56,000 ha. Consideration was US$5.0 million cash (US$139/ha) plus defined contingent payments tied to a ≥1Moz resource, feasibility recoverable ounces, and production.

Founders reported drill results extending Upper Antino mineralization to >2,500 m strike, including 17.0 m @ 3.06 g/t Au (incl. 4.0 m @ 10.44 g/t) and 60.0 m @ 0.85 g/t Au from 8.1 m. The company also closed a C$50 million strategic investment from Gold Fields.

Positive

- Project area expanded to 56,000 hectares

- Acquisition price US$5.0M cash (US$139/ha) with defined contingents

- Drilling extends Upper Antino strike to >2,500 m

- High-grade intercept 17.0 m @ 3.06 g/t Au (incl. 4.0 m @ 10.44 g/t)

- Near-surface width 60.0 m @ 0.85 g/t Au from 8.1 m

- Closed C$50M strategic investment from Gold Fields

Negative

- Contingent payments include US$2.50/oz at feasibility and production

- Average grades reported are un-capped due to insufficient drilling

- Resource escalation requires ≥1Moz trigger for milestone payment

News Market Reaction

On the day this news was published, FDMIF declined 1.19%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - November 20, 2025) - Founders Metals Inc. (TSXV: FDR) (OTCQX: FDMIF) (FSE: 9DL0) ("Founders" or the "Company") announces that it has signed the Definitive Agreement to acquire

Founders also announces drill core assay results from its ongoing 60,000 metre (m) drill program. The results extend Upper Antino gold mineralization to a total strike length of over 2,500 m, and include intervals of 17.0 m of 3.06 g/t Au in hole FR157 and a broader, near-surface interval of 60.0 m of 0.85 g/t Au from a depth of only 8.1 m in hole FR172.

Colin Padget, Founders' President & CEO, commented: "This is a transformational period for Founders - over the past two weeks, we've closed a C

With a strong cash position, a proven exploration team, and clear ability to operate efficiently in Suriname, Founders is well positioned to systematically explore our ever-growing land package of highly prospective geology with the proven potential to host multi-million-ounce gold deposits. Our four drills are currently turning at Da Vinci, Lower Antino, Parbo, and Upper Antino, with Van Gogh drilling planned to begin shortly. Results from Maria Geralda and Parbo are expected in the coming weeks, followed by results from other priority targets through Q4 and into early 2026."

Drilling Highlights:

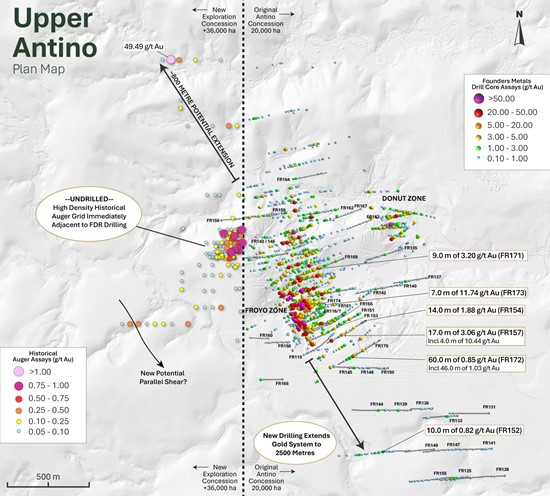

250-metre Extension Along Parallel Gold Mineralization Continues Between Froyo and Donut

- 17.0 m of 3.06 g/t Au, including 4.0 m of 10.44 g/t Au from 195.0 m (FR157), confirming mineralization continues along strike to the southeast (Figure 2 & 3)

- 46.0 m of 1.03 g/t Au, within a broader 60.0 m interval of 0.85 g/t Au from 8.1 m (FR172), demonstrating near-surface mineralization with significant widths

- 14.0 m of 1.88 g/t Au from 225.0 m (FR154)

Main Froyo Zone Drilling Demonstrates Vertical Continuity Along Multiple Structures

- 7.0 m of 11.74 g/t Au from 197.0 m, 19.0 m of 1.18 g/t Au from 133.0 m, and 4.0 m of 5.10 g/t Au from 109.0 m (FR173)

Definitive Agreement

Founders has signed a Definitive Agreement and closed the transaction announced on October 31, 2025 to acquire

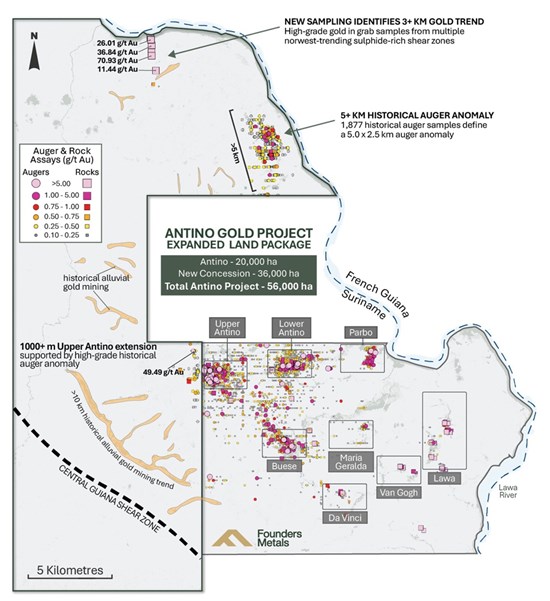

Figure 1: Antino Gold Project Property Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7574/275298_83fa948994944ab4_001full.jpg

Figure 2: Upper Antino Plan Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7574/275298_figure%202.png

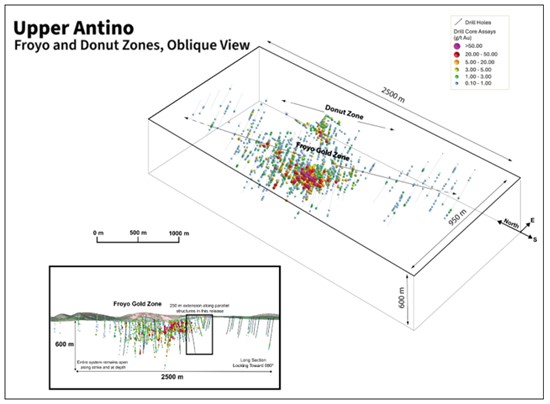

Figure 3: Oblique View & Long-Section of Upper Antino Drilling by Founders to Date

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7574/275298_figure3.png

Table 1: Upper Antino Assay Results

| Drillhole | From (m) | To (m) | Interval (m) | Au (g/t) |

| FR174 | 0.0 | 8.1 | 8.1 | 0.84 |

| and | 18.6 | 29.1 | 10.5 | 1.85 |

| and | 35.1 | 38.1 | 3.0 | 1.32 |

| and | 166.0 | 172.0 | 6.0 | 0.61 |

| FR173 | 0.0 | 12.6 | 12.6 | 0.66 |

| and | 109.0 | 113.0 | 4.0 | 5.10 |

| and | 133.0 | 152.0 | 19.0 | 1.18 |

| and | 197.0 | 204.0 | 7.0 | 11.74 |

| FR172 | 8.1 | 68.1 | 60.0 | 0.85 |

| incl. | 14.1 | 45.6 | 46.0 | 1.03 |

| and | 77.1 | 83.1 | 6.0 | 0.69 |

| and | 89.1 | 105.6 | 16.5 | 0.34 |

| FR171 | 140.0 | 153.0 | 13.0 | 0.53 |

| and | 194.0 | 203.0 | 9.0 | 3.20 |

| and | 236.0 | 252.0 | 16.0 | 0.93 |

| and | 275.0 | 277.0 | 2.0 | 1.89 |

| and | 306.0 | 314.0 | 8.0 | 0.58 |

| and | 327.0 | 329.0 | 2.0 | 7.28 |

| and | 387.0 | 390.0 | 3.0 | 1.45 |

| FR170 | 36.6 | 48.6 | 12.0 | 0.17 |

| and | 171.0 | 173.0 | 2.0 | 6.52 |

| and | 247.0 | 258.0 | 11.0 | 0.30 |

| and | 271.0 | 278.0 | 7.0 | 1.38 |

| and | 309.0 | 316.0 | 7.0 | 0.37 |

| FR169 | 206.0 | 217.0 | 11.0 | 0.24 |

| and | 224.0 | 231.0 | 7.0 | 0.32 |

| and | 374.0 | 376.0 | 2.0 | 4.27 |

| and | 388.0 | 392.0 | 4.0 | 0.56 |

| and | 452.0 | 466.0 | 14.0 | 0.69 |

| FR168 | 137.0 | 145.0 | 8.0 | 0.23 |

| and | 305.0 | 312.0 | 7.0 | 3.52 |

| and | 335.0 | 338.0 | 3.0 | 1.14 |

| and | 389.0 | 394.0 | 5.0 | 0.80 |

| FR167 | NSA | |||

| FR166 | 186.0 | 198.0 | 12.0 | 0.25 |

| FR165 | 0.0 | 26.1 | 26.1 | 0.20 |

| and | 84.0 | 86.0 | 2.0 | 0.79 |

| and | 104.0 | 106.0 | 2.0 | 0.72 |

| and | 138.0 | 145.0 | 7.0 | 0.55 |

| and | 151.0 | 171.0 | 20.0 | 0.68 |

| and | 202.0 | 224.0 | 22.0 | 0.41 |

| and | 254.0 | 256.0 | 2.0 | 0.58 |

| FR164 | 12.6 | 23.1 | 10.5 | 0.43 |

| and | 71.0 | 74.0 | 3.0 | 0.49 |

| FR163 | NSA | |||

| FR162 | 0.0 | 8.1 | 8.1 | 0.72 |

| and | 14.1 | 18.6 | 4.5 | 1.37 |

| and | 297.0 | 309.0 | 12.0 | 0.39 |

| FR161 | 0.0 | 17.1 | 17.1 | 0.58 |

| and | 72.6 | 77.0 | 4.4 | 0.95 |

| and | 105.0 | 125.0 | 20.0 | 0.14 |

| and | 137.0 | 143.0 | 6.0 | 2.12 |

| FR160 | NSA | |||

| FR159 | 100.0 | 122.0 | 22.0 | 0.45 |

| and | 129.0 | 136.0 | 7.0 | 0.32 |

| and | 240.0 | 243.0 | 3.0 | 1.56 |

| and | 249.0 | 259.0 | 10.0 | 0.18 |

| FR158 | 171.0 | 173.0 | 2.0 | 0.53 |

| FR157 | 0.0 | 36.6 | 36.6 | 0.14 |

| and | 119.1 | 135.0 | 15.9 | 0.11 |

| and | 195.0 | 212.0 | 17.0 | 3.06 |

| incl. | 208.0 | 212.0 | 4.0 | 10.44 |

| FR156 | 71.1 | 86.0 | 14.9 | 0.37 |

| and | 196.0 | 198.0 | 2.0 | 4.19 |

| FR155 | 164.1 | 171.6 | 7.5 | 0.16 |

| and | 197.0 | 205.0 | 8.0 | 0.30 |

| and | 260.0 | 264.0 | 4.0 | 0.53 |

| FR154 | 0.0 | 30.6 | 30.6 | 0.23 |

| and | 113.0 | 117.0 | 4.0 | 1.34 |

| and | 182.0 | 186.0 | 4.0 | 1.18 |

| and | 225.0 | 239.0 | 14.0 | 1.88 |

| and | 248.0 | 253.0 | 5.0 | 0.22 |

| FR153 | 69.6 | 84.6 | 15.0 | 0.56 |

| and | 143.0 | 147.0 | 4.0 | 0.92 |

| FR152 | 131.0 | 135.0 | 4.0 | 0.29 |

| and | 162.0 | 174.0 | 12.0 | 0.21 |

| and | 222.0 | 232.0 | 10.0 | 0.82 |

| FR151 | 0.0 | 12.6 | 12.6 | 0.43 |

| and | 18.6 | 21.6 | 3.0 | 0.90 |

| and | 101.0 | 107.0 | 6.0 | 3.88 |

| and | 156.0 | 162.0 | 6.0 | 0.48 |

| and | 205.0 | 215.0 | 10.0 | 0.66 |

| and | 232.0 | 234.0 | 2.0 | 0.56 |

| FR150 | 12.6 | 24.6 | 12.0 | 0.30 |

| and | 51.6 | 60.6 | 9.0 | 0.15 |

| and | 68.1 | 86.1 | 18.0 | 0.23 |

| FR149 | NSA | |||

| FR148 | 1.5 | 9.6 | 8.1 | 0.14 |

| and | 45.6 | 54.6 | 9.0 | 0.37 |

| and | 144.0 | 148.0 | 4.0 | 1.42 |

| FR147 | NSA | |||

| FR146 | 185.0 | 187.0 | 2.0 | 0.56 |

| and | 193.0 | 196.0 | 3.0 | 1.21 |

| and | 310.0 | 322.0 | 12.0 | 0.59 |

| and | 328.0 | 339.0 | 11.0 | 0.14 |

| FR145 | NSA | |||

| FR144 | 53.1 | 56.1 | 3.0 | 0.59 |

| FR143 | 242.0 | 245.0 | 3.0 | 0.68 |

| and | 331.0 | 340.0 | 9.0 | 0.13 |

| FR142 | NSA | |||

| FR141 | 56.1 | 72.6 | 16.5 | 0.21 |

| FR140 | 0.0 | 12.6 | 12.6 | 0.23 |

| and | 85.0 | 87.0 | 2.0 | 0.58 |

| and | 235.0 | 237.0 | 2.0 | 1.76 |

| FR139 | 100.0 | 115.0 | 15.0 | 0.38 |

| FR137 | 173.0 | 195.0 | 22.0 | 0.20 |

| and | 211.0 | 235.0 | 24.0 | 0.16 |

| FR136 | 96.6 | 101.1 | 4.5 | 0.25 |

| FR135 | 14.1 | 30.6 | 16.5 | 0.14 |

| and | 136.0 | 151.0 | 15.0 | 0.20 |

| and | 199.0 | 211.0 | 12.0 | 0.18 |

| and | 267.0 | 271.0 | 4.0 | 0.32 |

| FR133 | 80.1 | 98.1 | 18.0 | 0.37 |

| and | 260.0 | 269.0 | 9.0 | 0.12 |

| FR131 | NSA | |||

| FR128 | 287.0 | 296.0 | 9.0 | 0.30 |

| and | 434.0 | 443.0 | 9.0 | 0.36 |

| and | 464.0 | 468.0 | 4.0 | 0.60 |

| and | 499.0 | 501.0 | 2.0 | 0.84 |

| FR125 | 68.1 | 89.1 | 21.0 | 0.15 |

| FR119 | 0.0 | 20.1 | 20.1 | 0.14 |

| and | 41.1 | 48.6 | 7.5 | 0.14 |

| FR117 | 0.0 | 20.1 | 20.1 | 0.47 |

| and | 32.0 | 34.0 | 2.0 | 0.74 |

| FR116 | 0.0 | 15.6 | 15.6 | 0.60 |

| and | 90.0 | 100.0 | 10.0 | 0.34 |

| and | 384.0 | 406.0 | 22.0 | 0.24 |

* Intervals are down-hole depths. True widths of mineralization are estimated to be approximately

Table 2: Upper Antino Drill Hole Locations

| Hole ID | Easting (m) | Northing (m) | Elevation (m) | Azimuth (°) | Dip (°) | Depth (m) |

| FR174 | 817152.32 | 401033.17 | 153.10 | 235.20 | -50.30 | 305.00 |

| FR173 | 817150.50 | 401036.04 | 153.11 | 280.30 | -60.20 | 300.50 |

| FR172 | 817360.90 | 400743.63 | 214.27 | 240.20 | -50.30 | 200.00 |

| FR171 | 817279.74 | 401321.61 | 175.01 | 249.50 | -50.30 | 405.00 |

| FR170 | 817498.60 | 400824.54 | 210.37 | 240.10 | -50.30 | 323.01 |

| FR169 | 817280.06 | 401321.72 | 174.93 | 249.90 | -70.00 | 487.13 |

| FR168 | 817352.17 | 401142.64 | 158.03 | 259.70 | -55.30 | 452.00 |

| FR167 | 817387.24 | 401615.58 | 155.73 | 249.7 | -50.30 | 251.00 |

| FR166 | 816910.55 | 400589.80 | 220.85 | 270.40 | -50.10 | 199.95 |

| FR165 | 817290.04 | 400981.86 | 168.28 | 240.10 | -70.10 | 308.00 |

| FR164 | 816972.57 | 401799.60 | 163.18 | 80.00 | -50.00 | 308.00 |

| FR163 | 817449.12 | 401548.35 | 196.88 | 249.90 | -50.30 | 252.62 |

| FR162 | 817248.65 | 401620.98 | 150.93 | 260.00 | -50.40 | 322.96 |

| FR161 | 817289.64 | 400981.64 | 168.26 | 239.90 | -50.30 | 371.00 |

| FR160 | 816819.74 | 400824.49 | 220.68 | 270.00 | -50.00 | 201.50 |

| FR159 | 816889.04 | 401594.43 | 178.62 | 260.10 | -70.50 | 519.54 |

| FR158 | 816950.53 | 400815.48 | 210.36 | 270.00 | -49.90 | 221.00 |

| FR157 | 817327.97 | 400887.57 | 209.87 | 240.10 | -50.00 | 269.00 |

| FR156 | 816888.50 | 401593.00 | 179.62 | 260.10 | -50.30 | 435.60 |

| FR155 | 817872.05 | 399983.62 | 202.59 | 270.20 | -50.00 | 302.00 |

| FR154 | 817413.32 | 400942.87 | 194.36 | 240.10 | -50.00 | 258.38 |

| FR153 | 817278.66 | 400924.86 | 178.20 | 240.00 | -50.40 | 374.00 |

| FR152 | 817676.96 | 400156.07 | 200.63 | 270.00 | -49.80 | 251.00 |

| FR151 | 817382.22 | 400989.82 | 185.59 | 240.40 | -50.40 | 240.54 |

| FR150 | 817548.70 | 400656.37 | 214.14 | 270.00 | -50.00 | 200.00 |

| FR149 | 817826.05 | 400163.99 | 208.00 | 269.90 | -49.90 | 275.00 |

| FR148 | 817435.67 | 400658.27 | 215.47 | 270.10 | -49.90 | 227.00 |

| FR147 | 817954.52 | 400164.04 | 200.21 | 270.30 | -50.20 | 299.00 |

| FR146 | 816941.02 | 401353.16 | 233.14 | 260.40 | -75.00 | 551.01 |

| FR145 | 817324.83 | 400661.86 | 216.61 | 269.90 | -50.20 | 200.00 |

| FR144 | 817533.32 | 400403.47 | 208.31 | 269.90 | -50.00 | 302.00 |

| FR143 | 816941.28 | 401353.08 | 233.14 | 260.10 | -65.10 | 501.00 |

| FR142 | 817454.89 | 401131.61 | 164.13 | 260.00 | -50.20 | 173.03 |

| FR141 | 818176.07 | 400167.63 | 203.00 | 270.00 | -50.10 | 349.87 |

| FR140 | 817636.75 | 401164.46 | 155.35 | 259.80 | -50.20 | 272.09 |

| FR139 | 817687.97 | 400402.89 | 205.99 | 270.20 | -49.90 | 250.59 |

| FR137 | 817786.58 | 401205.06 | 156.50 | 259.80 | -50.00 | 301.98 |

| FR136 | 817816.78 | 400411.92 | 204.83 | 270.30 | -49.80 | 202.96 |

| FR135 | 817639.22 | 401381.32 | 155.97 | 250.20 | -50.10 | 322.98 |

| FR133 | 817969.65 | 400366.88 | 206.16 | 270.30 | -50.00 | 304.95 |

| FR131 | 818160.06 | 400381.95 | 204.98 | 270.00 | -50.30 | 357.53 |

| FR128 | 818254.31 | 400003.46 | 194.77 | 270.10 | -50.20 | 560.08 |

| FR125 | 818029.09 | 399996.97 | 176.43 | 270.40 | -50.10 | 290.20 |

| FR119 | 817221.99 | 400866.81 | 179.97 | 229.80 | -65.00 | 476.00 |

| FR117 | 817162.88 | 400985.76 | 154.05 | 245.00 | -60.00 | 414.82 |

| FR116 | 817163.00 | 400986.16 | 153.99 | 250.20 | -69.80 | 464.00 |

*The coordinate reference system is WGS 84, UTM zone 21N (EPSG 32621)

About Founders Metals Inc.

Founders Metals is a Canadian-based exploration company focused on advancing the Antino Gold Project located in Suriname, South America, in the heart of the Guiana Shield. Antino is 56,000 hectares and has produced over 500,000 ounces of gold from historical surface and alluvial mining to date1. The Company is systematically advancing one of Suriname's most promising gold exploration and development opportunities with drill-confirmed, district-scale potential. Founders is committed to responsible exploration, community engagement, and delivering long-term value to shareholders through technical excellence and strategic growth in the Guiana Shield.

12022 Technical Report - Antino Project; Suriname, South America. K. Raffle, BSc, P. Geo & Rock Lefrançois, BSc, P.Geo.

ON BEHALF OF THE BOARD OF DIRECTORS,

Per: "Colin Padget"

Colin Padget

President, Chief Executive Officer, and Director

Contact Information

Katie MacKenzie, Vice President, Corporate Development

Tel: 306 537 8903 | katiem@fdrmetals.com

Harp Gosal, Director, Investor Relations

Tel: 236 301 4211 | harpg@fdrmetals.com

Qualified Persons

The technical content of this news release has been reviewed and approved by Michael Dufresne, M.Sc., P.Geol., P.Geo., an independent qualified person as defined by National Instrument 43-101.

Quality Assurance and Control

Samples were analyzed at FILAB Suriname, a Bureau Veritas Certified Laboratory in Paramaribo, Suriname (a commercial certified laboratory under ISO 9001:2015). Samples are crushed to

Cautionary Statement Regarding Forward-Looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation, including statements regarding the use of proceeds from the Company's recently completed financings and the Company's prospects. Forward-looking information can generally be identified by words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", or variations indicating that certain actions, events or results "may", "could", "would", "might" or "will" occur or be achieved.

Forward-looking statements are based on management's current expectations and reasonable assumptions but are subject to business, market, and economic risks, uncertainties, and contingencies that may cause actual results to differ materially from those expressed or implied, including: general business and economic uncertainties; exploration results; mining industry risks; and other factors described in the Company's most recent annual management discussion and analysis. Although the Company has attempted to identify important factors that could cause actual results to differ materially, other factors may cause results not to be as anticipated. There can be no assurance that forward-looking information will prove accurate, as actual results and future events could differ materially from those anticipated. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information except in accordance with applicable securities laws. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

All material information on Founders Metals can be found at www.sedarplus.ca.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/275298