FICO UK Credit Card Market Report: January 2024

Consumer spending and payments followed typical seasonal patterns for the start of the new year

Average

Highlights

-

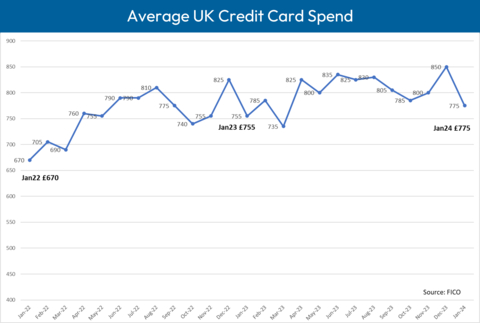

Average card spend dropped by

8.6% month-on-month, equating to an average spend of£775 -

Reflecting continued high prices, year-on-year spend in January was

2.4% higher than 2023 -

Increased payments to balance led to a

0.7% drop in average card balances, which now stands at£1,770 - Fewer cardholders missed one card payment in January compared to December

-

There was an increase in the number of cardholders who missed two and three payments in January -

12.6% and1.4% - respectively - The percentage of accounts using the cash limit decreased for the fourth month in a row after peaking in September

Key Trend Indicators –

Metric |

Amount |

Month-on-Month

|

Year-on-Year

|

Average |

|

- |

+ |

Average Card Balance |

|

- |

+ |

Percentage of Payments to Balance |

|

+ |

- |

Accounts with One Missed Payment |

|

- |

- |

Accounts with Two Missed Payments |

|

+ |

+ |

Accounts with Three Missed Payments |

|

+ |

+ |

Average Credit Limit |

|

+ |

+ |

Average Overlimit Spend |

|

- |

- |

Percentage of Customers using Credit Cards to Take Out Cash |

|

- |

+ |

Source: FICO

FICO Comment

After increased activity in the lead-up to Christmas, there is usually a drop in spending at the start of the new year; 2024 has followed this trend. What credit card providers will now be looking at is how well card users will manage the increased debt incurred over the festive season and the FICO data suggests that consumers focused on paying off credit card balances in January.

Alongside an

Historical FICO data shows that the percentage of payments to balance usually drops in February; it will therefore be interesting to see whether payments continue to trend back down to pre-COVID levels of around

When it comes to missed payments, the percentage of customers missing one card payment was

The average balance on accounts with missed payments is another important trend lenders will want to track over the coming months and one which currently appears to be influenced by the continued high cost of living. The average balance of customers missing one payment increased by

The other spending pattern lenders will want to monitor closely over the coming months is the percentage of customers using the cash limit on their cards. This decreased for the fourth month in a row after peaking in September.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956, the company is a pioneer in the use of predictive analytics and data science to improve operational decisions. FICO holds more than 200 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, insurance, telecommunications, health care, retail and many other industries. Using FICO solutions, businesses in more than 100 countries do everything from protecting 2.6 billion payment cards from fraud, to improving financial inclusion, to increasing supply chain resiliency. The FICO® Score, used by

FICO and TRIAD are registered trademarks of Fair Isaac Corporation in the

View source version on businesswire.com: https://www.businesswire.com/news/home/20240325386987/en/

For further comment on the FICO

FICO

Wendy Harrison/Parm Heer

ficoteam@harrisonsadler.com

0208 977 9132

Source: FICO