J.D. Power Recognizes Fifth Third as No. 1 for Banking Mobile App User Satisfaction Among Regional Banks

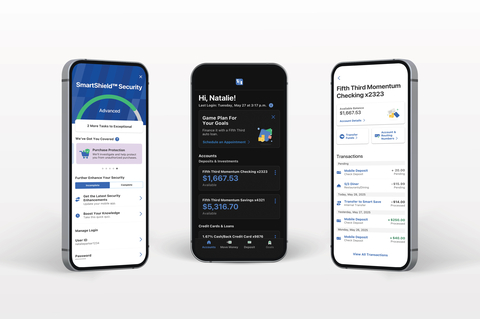

Fifth Third's mobile app.

“We’re honored by this recognition from our customers,” said Ben Hoffman, chief strategy officer and head of consumer products at Fifth Third. “Our digital teams are dedicated to delivering seamless, high-quality experiences that align with how our customers choose to bank—whether in a branch or through our app. With millions of users engaging with our digital platforms over a billion times annually, we remain committed to listening, learning, and evolving our app to meet our customers’ needs and power their financial journeys.”

Fifth Third launched its next-generation mobile app in 2022, and today, more than 2.4 million users rely on it each month for seamless, everyday banking. Built to simplify financial life, the app delivers a powerful combination of innovation, usability, and personalization through industry-leading features:

- Early access to pay and secure, real-time person-to-person payments, giving customers more control over their money.

- A clean, modern interface with intuitive navigation, including dark mode and app theming tailored to specific customer segments.

- A streamlined onboarding experience that makes switching direct deposit effortless—so customers can quickly start receiving paychecks into their Fifth Third account.

- SmartShield®1, a first-of-its-kind in-app security experience that gamifies digital safety, empowering users to protect their finances through interactive learning and proactive engagement.

- Instant card controls that allow users to quickly lock or unlock their credit cards, adding flexibility and peace of mind in moments that matter.

- Real-time card tracking that keeps customers informed on the status of their debit card orders—from processing to delivery—bringing added transparency to the experience.

With a relentless focus on innovation, the Bank delivered hundreds of app enhancements in 2024, reinforcing its commitment to delivering more intelligent, responsive, and user-centric digital banking experiences.

“This recognition is a testament to the deep collaboration between product, technology and design at Fifth Third,” said Jude Schramm, chief information officer at Fifth Third. “Our teams are focused on delivering digital experiences that truly serve our customers. We’re continuously evolving through thoughtful, rapid innovation to make banking simpler, more intuitive, and—ultimately—a Fifth Third better.”

Fifth Third also earned the top spot for Retail Banking Customer Satisfaction in

About Fifth Third

Fifth Third is a bank that’s as long on innovation as it is on history. Since 1858, we’ve been helping individuals, families, businesses and communities grow through smart financial services that improve lives. Our list of firsts is extensive, and it’s one that continues to expand as we explore the intersection of tech-driven innovation, dedicated people and focused community impact. Fifth Third is one of the few

Fifth Third Bank, National Association is a federally chartered institution. Fifth Third Bancorp is the indirect parent company of Fifth Third Bank and its common stock is traded on the NASDAQ® Global Select Market under the symbol "FITB." Investor information and press releases can be viewed at www.53.com. Deposit and credit products provided by Fifth Third Bank, National Association. Member FDIC.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in

Fifth Third Bank received the highest score among regional banks (

Fifth Third Bank received the highest score in

Download and use of Fifth Third mobile app is subject to Digital Services User Agreement terms and conditions.

______________________________ |

1 Fifth Third employs a number of fraud protection measures to help protect your account. Your SmartShield dashboard is a free tool to customize alerts and help further secure your information. You may also enroll in Fifth Third Identity Alert, an optional, non-FDIC insured product with enhanced features, subject to additional fees, provided by Fifth Third’s vendor, Trilegiant.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250529460312/en/

Sophie Isherwood (Media Relations)

sophie.isherwood@53.com

Matt Curoe (Investor Relations)

matthew.curoe@53.com | 513-534-2345

Source: Fifth Third Bank