Formation Metals Announces $6,000,000 Private Placement is Fully Allocated

Rhea-AI Summary

Formation Metals (OTCQB:FOMTF) has announced that its previously announced $6 million private placement offering is now fully allocated. The offering consists of 10,810,810 LIFE Units at $0.37 per unit for $4 million and 4,878,049 flow-through units at $0.41 per unit for $2 million.

The company is currently executing a 20,000-metre drill program at its flagship N2 Gold Project in Quebec, which hosts a historic resource of ~870,000 ounces of gold. Phase 1, comprising 10,000 metres, began on September 25, 2025. The company has ~C$5.0M working capital with zero debt, and the new financing would increase working capital to ~$10.5M.

Positive

- Fully allocated $6M private placement strengthens financial position

- Strong working capital position of ~C$5.0M with zero debt

- Significant historic gold resource of ~870,000 ounces at N2 Gold Project

- Additional base metal potential with copper and zinc intercepts discovered

- Quebec location provides provincial tax credits for exploration

Negative

- Completion of offering still subject to regulatory approvals and conditions

- Historic resource estimates need to be updated to NI 43-101 compliance

- Potential dilution from new share issuance

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Highlights:

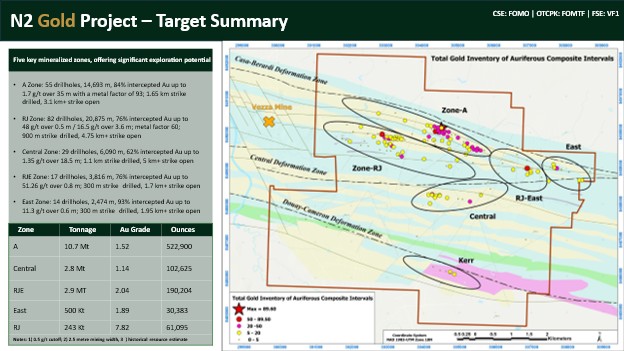

Formation has planned a 20,000 metre total multi-phase drill program at its flagship N2 Gold Project in Quebec, host to a global historic resource of ~870,000 ounces comprised of 18 Mt grading 1.4 g/t Au (~809,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~61,000 oz Au) across the RJ zone2,4.

Phase 1, consisting of a fully funded 10,000 metres, commenced on September 25, 2025. Phase 1 will target the "A" zone, a shallow, highly continuous, low-variability historic gold deposit with ~522,900 ounces of which only ~

35% of strike has been drilled (>3.1 km open), and the "RJ" zone, host to high-grade intercepts from historical drill holes as high as 51 g/t Au over 0.8 metres2, which was expanded by Agnico Eagle Mines in 2008 in the most recent drilling at the Property.The Company has working capital of ~C

$5.0M with zero debt prior to the financing, putting it in a very strong financial position to execute its exploration programs. Inclusive of provincial tax credits from the Quebec government, Formation's exploration budget for 2025-2026 is set at ~$5.7M . The financings, if fully subscribed, would increase Formation's working capital to ~$10.5M .

VANCOUVER, BC / ACCESS Newswire / October 1, 2025 / Formation Metals Inc. ("Formation" or the "Company") (CSE:FOMO)(FSE:VF1)(OTCQB:FOMTF), a North American mineral acquisition and exploration company, is pleased to announce that its previously announced offering of up to 10,810,810 units (each, a "LIFE Unit") of the Company at

Deepak Varshney, CEO of the Company, commented: "We are very pleased with the strong response to our financing, which has been fully allocated. We believe that the support from new potential investors is a strong endorsement of our projects and strategy. We look forward to completing the closing in the coming week and putting this capital to work to advance our exploration and development plans."

Completion of the offering remains subject to a number of customary closing conditions, including receipt of approval of the Canadian Securities Exchange and execution of subscription agreements.

Project Summary

Comprising 87 claims totaling ~4,400 ha within the Abitibi sub province of Northwestern Quebec, Formation's flagship N2 Gold Project is an advanced gold project with a global historic resource of 877,000 ounces. There are six primary auriferous mineralized zones in total, each open for expansion along strike and at depth. Compilation and geophysical work by Balmoral Resources Ltd. (now Wallbridge Mining) from 2010 to 2018 generated numerous targets that have not yet been investigated with diamond drilling.

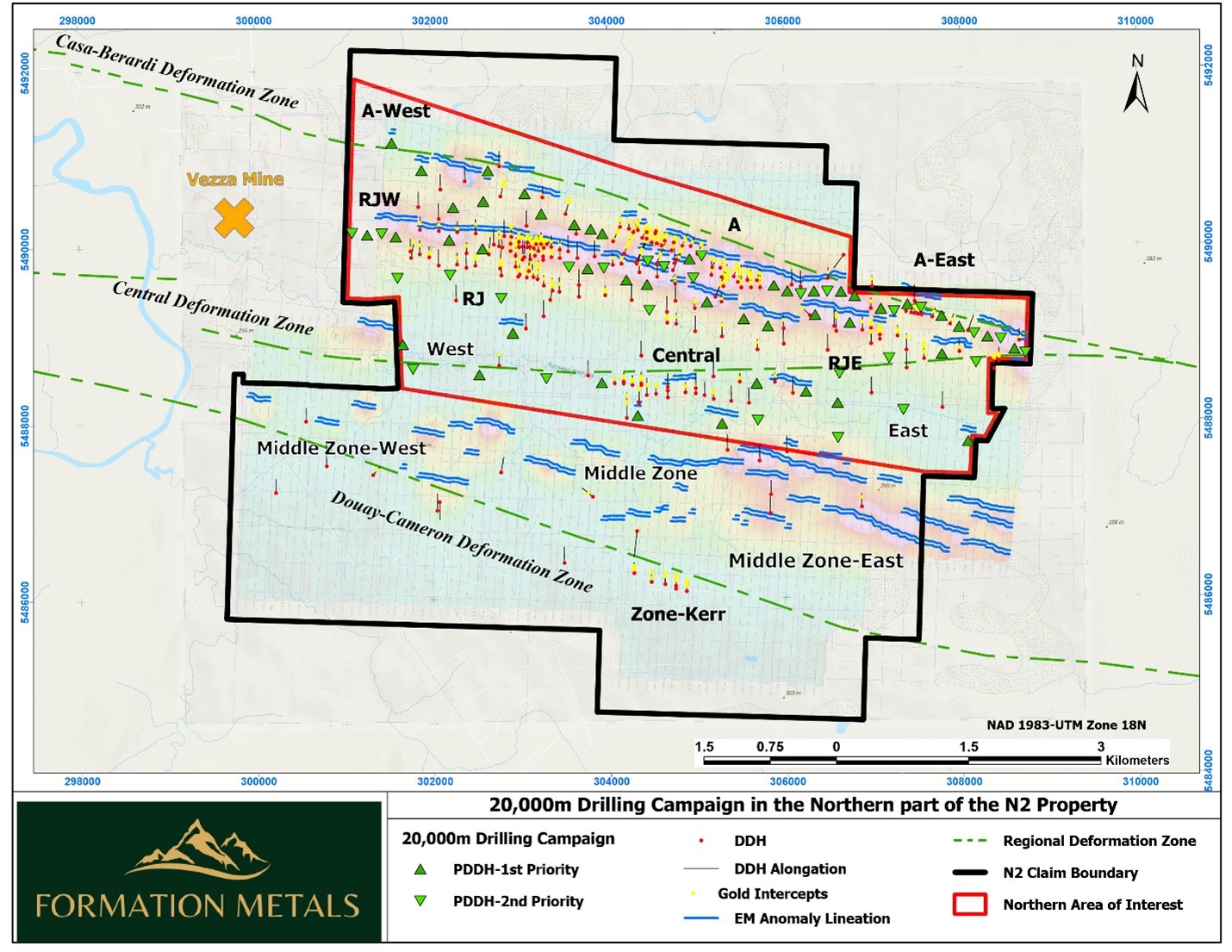

The drill program is designed to focus on discovery drilling at new high-potential targets along the mineralization strikes at the "A", "RJ" and "Central" zones in the northern part of the Property in order to discover new auriferous trends and unlock new zones of gold mineralization. The program will also focus on high-priority infilling and expansion targets in these zones to significantly enhance the auriferous zones identified to-date (Figure 1).

Historical highlights from the top two priority zones include:

A Zone: A shallow, highly continuous, low-variability historic gold deposit with ~522,900 ounces identified at a grade of 1.52 g/t Au. ~15,000 metres have been drilled historically across 1.65 km of strike, with over 3.1 km of strike remaining to be tested.

84% of historical drillholes intercepted auriferous intervals including up 1.7 g/t over

35 m.RJ Zone: a high-grade historic gold deposit with ~61,100 ounces identified at a grade of 7.82 g/t Au, with high-grade intercepts from historical drill holes as high as 51 g/t Au over 0.8 metres and 16.5 g/t Au over 3.5 metres2. This zone was the target of the most recently drilling at the Property by Agnico-Eagle Mines in 2008, when the price of gold was ~US

$800 /oz. Only ~900 metres of strike has been drilled, with 4.75+ km of strike remaining to be tested.

The Company also believes that N2 has significant base metal potential, where it recently completed a revaluation process which revealed significant copper and zinc intercepts within historic drillholes known to have significant gold grades (>1 g/t Au). Assay results range from 200 to 4,750 ppm and 203 ppm to 6,700 ppm, for copper and zinc, respectively, indicating strong potential for elevated base metal (Cu-Zn) concentrations across the property, specifically at the A and RJ zones. Property wide geology at N2 features volcanic and sedimentary rocks formed in regional anticlinal and synclinal flexures. Three principal deformation structures (Figure 1), oriented along the known NW-SE to WNW-ESE structural trends typical of VMS deposits in the Matagami region, function as critical geologic controls for mineralization on the property.

For the 2025 exploration season, Formation plans to concentrate its efforts on the northern part of N2, targeting gold deposit expansion and discovery along identified zones and fault systems associated with the main deformation features (specifically WNW-ESE trend), with IP surveys and drilling planned to model mineralized zones that will hopefully contribute to an updated NI-43 101 compliant resource. Formation will also look to further review historic base metal assays from older drill core and undertake additional work in 2025 to assess the property's copper and zinc potential.

Qualified person

The technical content of this news release has been reviewed and approved by Mr. Babak Vakili Azar, P.Geo., an independent contractor and a qualified person as defined by National Instrument 43-101. Historical reports provided by the optionor were reviewed by the qualified person. The information provided has not been verified and is being treated as historic.

About Formation Metals Inc.

Formation Metals Inc. is a North American mineral acquisition and exploration company focused on the development of quality properties that are drill-ready with high-upside and expansion potential. Formation's flagship asset is the N2 Gold Project, an advanced gold project with a global historic resource of ~870,000 ounces (18 Mt grading 1.4 g/t Au (~809,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~61,000 oz Au) across the RJ zone2,4) and six mineralized zones, each open for expansion along strike and at depth including the "A" zone, of which only ~

FORMATION METALS INC.

Deepak Varshney, CEO and Director

For more information, please call 778-899-1780, email dvarshney@formationmetalsinc.com or visit www.formationmetalsinc.com.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Notes and References:

Readers are cautioned that the geology of nearby properties is not necessarily indicative of the geology of the Property.

The above referenced resource estimates do not have a category, are considered historical in nature, and are based on prior data prepared by a previous property owner, and do not conform to current CIM categories.

While the Company considers the estimates to be reliable, a qualified person has not done sufficient work to classify the historical estimates as current resources in accordance with current CIM categories and the Company is not treating the historical estimates as a current resource. A 0.5 g/t Au cut-off was used in the preparation of the historical estimates with a minimum 2.5 metre mining width.

Significant data compilation, re-drilling, re-sampling and data verification may be required by a qualified person before the historical estimates can be classified as current resources. There can be no assurance that any of the historical mineral resources, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. The Company is not aware of any more recent estimates prepared for the N2 Property.

Needham, B. (1994), 1993 Diamond Drill Report, Northway Joint Venture, Northway Property; Cypress Canada Inc.; 492 pages.

Guy K. (1991), Exploration Summary May 1, 1990 to May 1, 1991 Vezza Joint Venture Northway Property; Total Energold; 227 pages.

Forward-looking statements:

This news release includes "forward-looking statements" under applicable Canadian securities legislation, including statements respecting: the Company's plans for the Property and the expected timing and scope of the 2025 drilling program at the Property; the Company's goal of delivering a near-surface multi-million-ounce deposit the Property; the Company's anticipated timeline with respect to the Application for Autorisation de Travaux d'exploration à Impacts (ATI) to the Ministère des Ressources naturelles et des Forets (MERN); the Company's view that the Property has the potential for over three million ounces of gold; the 7,500-metre drilling program marking the beginning of the Company's pursuit of that goal; and statements respecting the Offerings, the timing thereof andthe expected use of proceeds therefrom. Such forward-looking information reflects management's current beliefs and is based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Readers are cautioned that such forward-looking statements are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

No Offer or Solicitation to Purchase Securities in the United States

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the "Securities Act"), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act ("Regulation S"), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.

Not for distribution to United States newswire services or for dissemination in the United States. This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available. This news release shall not constitute an offer to sell or the solicitation of an offer to buy in the United States or to, or for the account or benefit of, persons in the United States or U.S. Persons nor shall there by any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

SOURCE: Formation Metals

View the original press release on ACCESS Newswire