FONAR Announces Financial Results for Fiscal 2025

Rhea-AI Summary

FONAR Corporation (NASDAQ: FONR), a pioneer in MRI technology, reported mixed financial results for fiscal 2025. Total revenues increased 1% to $104.4 million, while net income decreased 24% to $10.7 million. The company's diagnostic imaging subsidiary, HMCA, achieved record scan volume of 216,317 scans, up 3.3% from the previous year.

Key financial metrics include diluted EPS of $1.23 (down 20%), cash and equivalents of $56.3 million, and working capital growth of 4% to $127.5 million. HMCA expanded its operations by adding two MRI scanners, bringing the total to 44 managed scanners across New York and Florida. The company's stock repurchase plan has acquired 373,942 shares for $6.07 million but is temporarily suspended due to a potential "Take Private" transaction.

Positive

- Record scan volume of 216,317 in Fiscal 2025, up 3.3% year-over-year

- Total revenues increased 1% to $104.4 million

- Working capital grew 4% to $127.5 million

- Added two new HMCA-managed MRI scanners, expanding to 44 total locations

- Strong balance sheet with $56.3 million in cash and cash equivalents

- New York scan volume grew 4.4% to 133,663 scans

Negative

- Net income decreased 24% to $10.7 million

- Income from Operations fell 30% to $11.6 million

- Diluted EPS declined 20% to $1.23

- SG&A expenses increased 11% to $29.7 million

- Required $2.3 million additional reserve due to insurance carrier risk exposure

- Florida scan volume growth limited to 1.6% due to tort reform impact

News Market Reaction

On the day this news was published, FONR declined 0.06%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Cash and Cash Equivalents was

$56.3 million at June 30, 2025 and the previous fiscal year.Total Revenues - Net increased

1% to$104.4 million for the fiscal year ended June 30, 2025 versus the previous fiscal year.Income from Operations decreased

30% to$11.6 million for the fiscal year ended June 30, 2025 versus the previous fiscal year.Net Income decreased

24% to$10.7 million for the fiscal year ended June 30, 2025 versus the previous fiscal year.Diluted Net Income per Common Share decreased

20% to$1.23 for the fiscal year ended June 30, 2025 versus the previous fiscal year.Working Capital increased by

4% to$127.5 million for the fiscal year ended June 30, 2025 versus the previous fiscal year.Book Value per Share for the fiscal year ended June 30, 2025 increased to

$25.26 per share.On September 13, 2022, the Company adopted a stock repurchase plan of up to

$9 million .Two HMCA-managed MRI scanners were added in fiscal 2025, bringing the total number to 44. A scanner was added in Melville, NY and in Naples, FL.

Melville, New York--(Newsfile Corp. - September 12, 2025) - FONAR Corporation (NASDAQ: FONR), The Inventor of MR Scanning™, today reported its Fiscal 2025 results. FONAR's primary source of income is attributable to its wholly-owned diagnostic imaging management subsidiary, Health Management Company of America (HMCA). In 2009, HMCA managed 9 MRI scanners. Currently, HMCA manages 44 MRI scanners in New York and in Florida.

Financial Results

Total Revenues - Net increased by

Total Costs and Expenses for the fiscal year ended June 30, 2025 increased by

Revenues, from the management of the diagnostic imaging center segment, consisting of Patient Fee Revenue Net of Contractual Allowances and Discounts, and Management and Other Fees of Related and Non-related Medical Practices, increased

Revenues from Product Sales and Upgrades and Service and Repair Fees for related and non-related medical parties, were

Research and Development expenses decreased

Selling, General and Administrative (SG&A) expenses increased

Income from Operations decreased

Net Income decreased

Diluted Net Income per Common Share Available to Common Shareholders decreased

The weighted average diluted shares outstanding for the fiscal year ended June 30, 2025 was 6.3 million versus 6.5 million for the fiscal year ended June 30, 2024.

Balance Sheet Items

Total Cash and Cash Equivalents and Short Term Investments at June 30, 2025 and June 30, 2024 were

Total Assets at June 30, 2025 were

Total Current Assets at June 30, 2025 were

Working Capital was

The ratio of Total Assets/Total Liabilities was 3.8 at June 30, 2025, as compared to 3.7 at June 30, 2024.

Stockholders' Equity

Total Stockholders' Equity was

Net Book Value per Common Share (Total Assets minus Total Liabilities divided by Weighted average diluted shares outstanding) was

Cash Flow Item

Operating Cash Flow was

Management Discussion

Timothy Damadian, Chairman and CEO of FONAR, said, "I am pleased to report that our diagnostic imaging management subsidiary, Health Management Company of America (HMCA), the Company's primary source of revenue and profit, continues to grow. Scan volume at HMCA-managed sites has increased every fiscal year since COVID in Fiscal 2020. We reached a record of 216,317 scans in Fiscal 2025, which was

"Scan volume in our New York regions grew by

"HMCA currently manages 44 MRI scanners, 26 in New York and 18 in Florida. In Fiscal 2025, we added high-field MRIs to two existing Stand-Up MRI facilities – one in Naples, Florida and one in Melville, New York. A high-field MRI is a perfect complement to the Stand-Up® MRI. The Stand-Up® MRI is the most "non-claustrophobic," patient-friendly MRI; it's the only MRI that can scan patients in weight-bearing positions, which enables the detection of pathology that could be underestimated or missed entirely on conventional lie-down-only MRIs; and it's the only MRI that can scan the cervical and lumbar spines in flexion and extension. For instances where high-resolution MRI images or a special high-field protocol is required, the high-field MRI scanner handily addresses those needs. From the referring physicians' point of view, these centers offer "the best of both MRI worlds."

Mr. Damadian continued, "At the moment we're installing a high-field MRI in a Stand-Up® MRI facility in Nassau County, Long Island, which we expect will be operational in the first half of Fiscal 2026. We're also planning for an additional HMCA-managed center in Nassau County later in the fiscal year. As always, we continue to search for locations where the introduction of Stand-Up® MRI technology would profitably enhance our existing New York and Florida networks."

"While Company revenue increased by

"Our September 13, 2022 FONAR stock repurchase plan of up to

Mr. Damadian concluded, "I remain grateful for our management team and all the FONAR and HCMA employees whose hard work and commitment continue to make the Company successful.

FONAR Legacy: The Inventor and the U.S. Patent

In 1970, Raymond V. Damadian, M.D., then a faculty member at Downstate Medical Center, Brooklyn, NY made the discovery that is the basis for MRI scanning – that there is a marked difference in Nuclear Magnetic Resonance (NMR) relaxation times between normal and abnormal tissues of the same type, as well as between different types of normal tissues. This seminal discovery, which remains the basis for the making of every MRI image ever produced, is the foundation of the MRI industry. Dr. Damadian published his discovery in his milestone 1971 paper in the journal Science. Many academic researchers focus on making discoveries and writing papers and not on patents and commercialization, leaving that to others. Thankfully, Dr. Damadian decided to seek a patent. In 1972, he filed to patent the practical use of his discovery, which he called "The Cancer Detection Patent."

Crucial to enticing investors to provide the capital to start a new business was to assign "The Cancer Detection Patent" to the fledgling company. Soon after having made the world's first MRI scan on July 3, 1977, he was able to start FONAR, raise

FONAR sold and installed the first commercial MRI in 1980 using a scanning method named Field fOcused Nuclear mAgnetic Resonance, or the alternating acronym FONAR. Following in FONAR's footsteps, competitors soon produced their own MRI scanners. Every competitor infringed FONAR's patent. In response, FONAR sued Technicare, a Johnson and Johnson subsidiary. A jury found FONAR's patent valid and infringed by Technicare. However, the judge overturned the finding of infringement, ruling that Technicare's MRI scanner did not meet the specific technical criteria of 'standards' outlined in the patent.

Years later, when FONAR sued General Electric for infringing "The Cancer Detection Patent," so much had transpired in the technology that the understanding of the technical criteria regarding the use of 'standards' as indicated in the patent was well understood by the MRI community. The victory in the courts, where GE, one of the most powerful companies in the world, lost to FONAR, cemented Dr. Damadian's image as the one who made the crucial discovery in MRI. See the FONAR press release: 20 YEARS TO THE DAY FROM THE WORLD'S FIRST MR SCAN FONAR RECEIVES

Other researchers have been recognized for their contributions to the development of MRI, however, Dr. Damadian's discovery of the differences in NMR relaxation times between tissues and his pioneering patent laid the groundwork for the practical application of NMR in medicine. While using gradient magnetic fields to spatially encode NMR signal data is a clever way to make an NMR image, it is the relaxation time differences of neighboring tissues that produce the pixel contrast necessary to make an MRI image. This is the essence of "The Cancer Detection Patent."

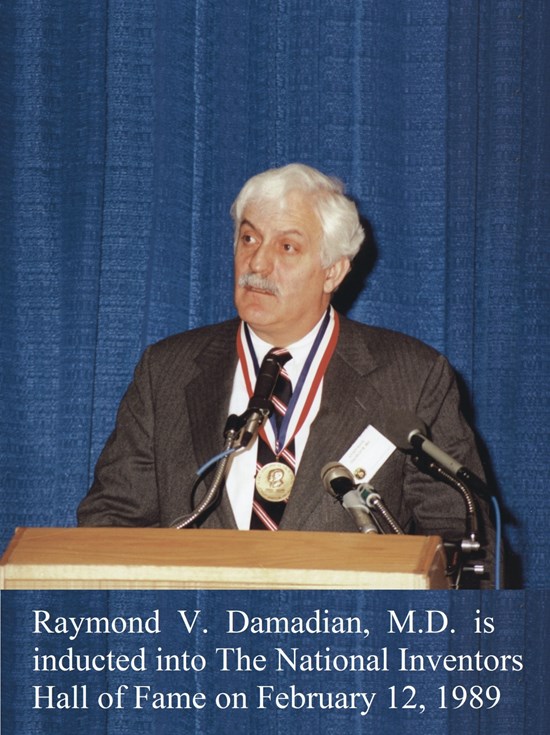

On February 12, 1989, Raymond V. Damadian, M.D. was inducted into the National Inventors Hall of Fame (NIHF) at the U.S. Patent and Trademark Office in Arlington, Virginia. Honored for his U.S. Patent No. 3,789,832 for the invention of MRI scanning, which revolutionized medical diagnostics through non-invasive imaging, Dr. Damadian joined luminaries like John Deere, Irving Langmuir, and George Westinghouse, Jr. His contributions are featured at the NIHF Museum at 600 Dulany Street, Alexandria, Virginia. There is an online biography at http://www.invent.org/inductees/raymond-v-damadian.

On June 11, 2007, at the Cannon House Office Building in Washington, D.C., Dr. Raymond Damadian received an award from the Intellectual Property Owners Education Foundation (IPOEF), for the invention of the FONAR UPRIGHT® Multi-Position™ MRI. To be eligible for the award, the inventor's invention must be protected by a U.S. Patent, have originated in the U.S., and was either commercialized recently or patented since 2004. A press release of the event can be found at https://fonar.com/news/061907.htm. Once again the patent lead to fame and success for Dr. Raymond V. Damadian, M.D., Founder of FONAR and the Inventor of the MRI scanner.

During the 1990s, Dr. Damadian became aware of attempts in Congress to weaken the U.S. patent system, that had enabled him to create FONAR and commercialize MRI. In 1997 and 1998, he testified before Congress against bills like the Omnibus Patent Act of 1997 (H.R. 400) and the Patent Fairness Act of 1998 (H.R. 3460), which he recognized favored large corporations over small inventors. He organized and led about 100 citizens, mostly FONAR employees, in a demonstration outside the U.S. Capitol in Washington, DC, calling for the protection of patent rights critical to companies like FONAR that need a strong and fair patent system in order to compete.

The medals and awards can be seen at the Raymond V. Damadian, M.D. Memorial Museum at FONAR Corporation, Melville, NY. The museum features a life-size display of Dr. Damadian, his assistants, and Indomitable in the process of conducting the world's first MRI scan on July 2-3, 1977. It includes other prestigious awards, an interactive display, some of Dr. Damadian's personal items, and many historical artifacts. The public is invited to visit the museum at FONAR in Melville. To make an appointment, contact Daniel Culver, Director of Communications, at RVDmuseum@fonar.com.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7879/266134_203330c2a4d4aa3c_001full.jpg

About FONAR

FONAR, The Inventor of MR Scanning™, located in Melville, NY, was incorporated in 1978, and is the first, oldest and most experienced MRI Company in the industry. FONAR went public in 1981 (NASDAQ: FONR). FONAR sold the world's first commercial MRI to Ronald J. Ross, MD, Cleveland, Ohio. It was installed in 1980. Dr. Ross and his team began the world's first clinical MRI trials in January 1981. The results were reported in the June 1981 edition of Radiology/Nuclear Medicine Magazine and the April 1982 peer-reviewed article in the Journal Radiology. The technique used for obtaining T1 and T2 values was the FONAR technique (Field fOcusing Nuclear mAgnetic Resonance), not the back projection technique. www.fonar.com/innovations-timeline.html.

FONAR's signature product is the FONAR UPRIGHT® Multi-Position™ MRI (also known as the STAND-UP® MRI), the only whole-body MRI that performs Position™ Imaging (pMRI™) and scans patients in numerous weight-bearing positions, i.e. standing, sitting, in flexion and extension, as well as the conventional lie-down position. The FONAR UPRIGHT® Multi-Position™ MRI often detects patient problems that other MRI scanners cannot because they are lie-down, "weightless-only" scanners. The patient-friendly UPRIGHT® MRI has a near-zero patient claustrophobic rejection rate. As a FONAR customer states, "If the patient is claustrophobic in this scanner, they'll be claustrophobic in my parking lot." Approximately

FONAR has new works-in-progress technology for visualizing and quantifying the cerebral hydraulics of the central nervous system, the flow of cerebrospinal fluid (CSF), which circulates throughout the brain and vertebral column at the rate of 32 quarts per day. This imaging and quantifying of the dynamics of this vital life-sustaining physiology of the body's neurologic system has been made possible first by FONAR's introduction of the MRI and now by this latest works-in-progress method for quantifying CSF in all the normal positions of the body, particularly in its upright flow against gravity. Patients with whiplash or other neck injuries are among those who will benefit from this new understanding.

FONAR's primary source of income and growth is attributable to its wholly-owned diagnostic imaging management subsidiary, Health Management Company of America (HMCA) www.hmca.com.

FONAR's substantial list of patents includes recent patents for its technology enabling full weight-bearing MRI imaging of all the gravity sensitive regions of the human anatomy, especially the brain, extremities and spine. It includes its newest technology for measuring the Upright cerebral hydraulics of the cerebrospinal fluid (CSF) of the central nervous system. FONAR's UPRIGHT® Multi-Position™ MRI is the only scanner licensed under these patents.

#

UPRIGHT®, and STAND-UP® are registered trademarks. The Inventor of MR Scanning™, CSP™, MultiPosition™, UPRIGHT RADIOLOGY™, pMRI™, CFS Videography™, Dynamic™ and The Proof is in the Picture™, are trademarks of FONAR Corporation.

This release may include forward-looking statements from the company that may or may not materialize. Additional information on factors that could potentially affect the company's financial results may be found in the company's filings with the Securities and Exchange Commission.

Fonar Corporation

The Inventor of MR Scanning™

An ISO 9001 Company

Melville, New York 11747

Phone: (631) 694-2929

Fax: (631) 390-1772

NEWS

Contact: Daniel Culver

Director of Communications

E-mail: investor@fonar.com

www.fonar.com

FONAR CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

ASSETS

| June 30, | ||||||

| 2025 | 2024 | |||||

| Current Assets: | ||||||

| Cash and cash equivalents | $ | 56,333,636 | $ | 56,341,193 | ||

| Short-term investments | 120,494 | 136,102 | ||||

| Accounts receivable – net of allowances for credit losses of | 5,304,698 | 4,035,336 | ||||

| Medical receivables | 24,489,808 | 23,991,533 | ||||

| Management and other fees receivable - net of allowances for credit losses of | 43,401,252 | 41,953,657 | ||||

| Management and other fees receivable - related party medical practices - net of allowances for credit losses of | 9,748,521 | 9,865,061 | ||||

| Inventories - net | 2,812,682 | 2,715,441 | ||||

| Prepaid expenses and other current assets - related party | 410,659 | - | ||||

| Prepaid expenses and other current assets | 2,050,060 | 1,285,962 | ||||

| Total Current Assets | 144,671,810 | 140,324,285 | ||||

| Accounts receivable - long term | 3,549,956 | 829,473 | ||||

| Note receivable - related party | 554,857 | 581,183 | ||||

| Deferred income tax asset | 6,349,194 | 7,223,255 | ||||

| Property and equipment - net | 18,531,919 | 18,708,920 | ||||

| Right-of-use-asset - operating leases | 35,136,412 | 38,427,757 | ||||

| Right-of-use-asset - financing lease | 376,569 | 530,348 | ||||

| Goodwill | 4,269,277 | 4,269,277 | ||||

| Other intangible assets - net | 2,992,203 | 2,870,324 | ||||

| Other assets | 475,680 | 481,147 | ||||

| Total Assets | $ | 216,907,877 | $ | 214,245,969 | ||

FONAR CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

LIABILITIES

| June 30, | ||||||

| 2025 | 2024 | |||||

| Current Liabilities: | ||||||

| Current portion of long-term debt | $ | - | $ | 47,002 | ||

| Accounts payable | 1,302,317 | 1,855,879 | ||||

| Other current liabilities | 6,974,997 | 7,941,039 | ||||

| Operating lease liabilities - current portion | 3,382,675 | 3,473,674 | ||||

| Financing lease liability - current portion | 244,237 | 225,786 | ||||

| Unearned revenue on service contracts | 4,865,936 | 3,870,229 | ||||

| Customer deposits | 354,244 | 443,471 | ||||

| Total Current Liabilities | 17,124,406 | 17,857,080 | ||||

| Long-Term Liabilities: | ||||||

| Unearned revenue on service contracts | 3,800,746 | 1,174,844 | ||||

| Deferred income tax liability | 321,159 | 371,560 | ||||

| Due to related party medical practices | 92,663 | 92,663 | ||||

| Operating lease liabilities - net of current portion | 35,148,907 | 37,467,746 | ||||

| Financing lease liability - net of current portion | 142,523 | 394,723 | ||||

| Long-term debt, less current portion | - | 66,938 | ||||

| Other liabilities | 172,853 | 32,026 | ||||

| Total Long-Term Liabilities | 39,678,851 | 39,600,500 | ||||

| Total Liabilities | $ | 56,803,257 | $ | 57,457,580 | ||

FONAR CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

EQUITY

| June 30, | ||||||

| 2025 | 2024 | |||||

| Equity: | ||||||

| Class A non-voting preferred stock $.0001 par value; 453,000 shares authorized at June 30, 2025 and 2024, 313,438 issued and outstanding at June 30, 2025 and 2024 | $ | 31 | $ | 31 | ||

| Preferred stock $.001 par value; 567,000 shares authorized at June 30, 2025 and 2024, issued and outstanding - none | - | - | ||||

| Common stock $.0001 par value; 8,500,000 shares authorized at June 30, 2025 and 2024, 6,203,465 and 6,328,494 issued at June 30, 2025 and 2024, respectively 6,168,625 and 6,283,213 outstanding at June 30, 2025 and 2024, respectively | 622 | 635 | ||||

| Class B convertible common stock (10 votes per share) $.0001 par value; 227,000 shares authorized at June 30, 2025 and 2024, 146 issued and outstanding at June 30, 2025 and 2024 | - | - | ||||

| Class C common stock (25 votes per share) $.0001 par value; 567,000 shares authorized at June 30, 2025 and 2024, 382,513 issued and outstanding at June 30, 2025 and 2024 | 38 | 38 | ||||

| Paid-in capital in excess of par value | 178,756,712 | 180,607,510 | ||||

| Accumulated deficit | (5,289,324 | ) | (13,623,585 | ) | ||

| Treasury stock, at cost - 34,840 and 45,081 shares of common stock at June 30, 2025 and 2024, respectively | (859,893 | ) | (1,016,632 | ) | ||

| Total Fonar Corporation's Stockholders' Equity | 172,608,186 | 165,967,997 | ||||

| Noncontrolling interests | (12,503,566 | ) | (9,179,608 | ) | ||

| Total Equity | 160,104,620 | 156,788,389 | ||||

| Total Liabilities and Equity | $ | 216,907,877 | $ | 214,245,969 | ||

FONAR CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

| For the Years Ended June 30, | ||||||

| 2025 | 2024 | |||||

| Revenues | ||||||

| Patient fee revenue - net of contractual allowances and discounts | $ | 33,179,446 | $ | 33,815,796 | ||

| Product sales | 563,296 | 737,727 | ||||

| Service and repair fees | 8,234,053 | 7,452,212 | ||||

| Service and repair fees - related parties | 180,000 | 139,167 | ||||

| Management and other fees | 49,900,555 | 48,789,287 | ||||

| Management and other fees - related medical practices | 12,293,968 | 11,949,900 | ||||

| Total Revenues - Net | 104,351,318 | 102,884,089 | ||||

| Costs and Expenses | ||||||

| Costs related to product sales | 1,018,029 | 1,052,159 | ||||

| Costs related to service and repair fees | 4,508,518 | 3,577,570 | ||||

| Costs related to service and repair fees - related parties | 323,504 | 144,413 | ||||

| Costs related to patient fee revenue | 19,130,935 | 18,199,579 | ||||

| Costs related to management and other fees | 30,073,045 | 28,626,595 | ||||

| Costs related to management and other fees - related medical practices | 6,388,281 | 6,143,728 | ||||

| Research and development | 1,576,086 | 1,735,949 | ||||

| Selling, general and administrative expenses | 29,734,163 | 26,868,732 | ||||

| Total Costs and Expenses | 92,752,561 | 86,348,725 | ||||

| Income from Operations | 11,598,757 | 16,535,364 | ||||

| Other Income and (Expenses): | ||||||

| Interest expense | (25,611 | ) | (76,997 | |||

| Interest income - related party | 51,917 | 25,959 | ||||

| Investment income | 2,118,980 | 2,126,439 | ||||

| Other income - related party | - | 576,857 | ||||

| Other income | 36,195 | 78,763 | ||||

| Income before Provision for Income Taxes and Noncontrolling Interests | 13,780,238 | 19,266,385 | ||||

| Provision for Income Taxes | (3,106,805 | ) | (5,168,968 | ) | ||

| Consolidated Net Income | $ | 10,673,433 | $ | 14,097,417 | ||

| Net Income - Noncontrolling Interests | (2,339,172 | ) | (3,530,021 | ) | ||

| Net Income - Attributable to FONAR | $ | 8,334,261 | $ | 10,567,396 | ||

FONAR CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (Continued)

| For the Years Ended June 30, | ||||||

| 2025 | 2024 | |||||

| Net Income Available to Common Stockholders | $ | 7,802,351 | $ | 9,908,920 | ||

| Net Income Available to Class A Non -Voting Preferred Stockholders | $ | 396,443 | $ | 490,776 | ||

| Net Income Available to Class C Common Stockholders | $ | 135,467 | $ | 167,700 | ||

| Basic Net Income Per Common Share Available to Common Stockholders | $ | 1.26 | $ | 1.56 | ||

| Diluted Net Income Per Common Share Available to Common Stockholders | $ | 1.23 | $ | 1.53 | ||

| Basic and Diluted Income Per Share - Class C Common | $ | 0.35 | $ | 0.44 | ||

| Weighted Average Basic Shares Outstanding - Common Stockholders | 6,210,852 | 6,350,862 | ||||

| Weighted Average Diluted Shares Outstanding - Common Stockholders | 6,338,356 | 6,478,366 | ||||

| Weighted Average Basic and Diluted Shares Outstanding - Class C Common | 382,513 | 382,513 | ||||

FONAR CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

| For the Years Ended June 30, | ||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | 2025 | 2024 | ||||

| Consolidated Net Income | $ | 10,673,433 | $ | 14,097,417 | ||

| Adjustments to reconcile consolidated net income to net cash provided by operating activities: | ||||||

| Depreciation and amortization | 4,698,321 | 4,596,421 | ||||

| Provision for credit losses | 3,206,756 | 1,882,061 | ||||

| Deferred income tax - net | 823,660 | 2,795,507 | ||||

| Net change in operating right-of-use assets and lease liabilities | (493 | ) | (229,590 | ) | ||

| Gain on sale of equipment - related party | - | (581,183 | ) | |||

| (Gain)Loss on disposition of fixed assets | - | (75,411 | ) | |||

| Abandoned patents | 55,707 | 225,419 | ||||

| Changes in operating assets and liabilities, net: | ||||||

| Accounts, medical and management fee receivable(s) | (9,005,766 | ) | (11,676,139 | ) | ||

| Notes receivable | - | 55,200 | ||||

| Notes receivable - related party | 26,326 | - | ||||

| Inventories | (97,241 | ) | (145,775 | ) | ||

| Prepaid expenses and other current assets | (1,194,922 | ) | 266,606 | |||

| Other assets | 5,467 | 42,359 | ||||

| Accounts payable | (553,562 | ) | 276,669 | |||

| Other current liabilities | 2,655,567 | 2,949,962 | ||||

| Customer advances | (89,227 | ) | (158,906 | ) | ||

| Financing lease liabilities | (79,970 | ) | (217,569 | ) | ||

| Other liabilities | 140,826 | (9,724 | ) | |||

| NET CASH PROVIDED BY OPERATING ACTIVITIES | 11,264,882 | 14,093,294 | ||||

FONAR CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

| For the Years Ended June 30, | ||||||

| 2025 | 2024 | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||

| Purchases of property and equipment | (3,791,581 | ) | (789,961 | ) | ||

| Proceeds (Purchase) from short-term investment | 15,608 | (103,303 | ) | |||

| Proceeds from sale of equipment | - | 75,411 | ||||

| Cost of patents | (25,325 | ) | (32,885 | ) | ||

| NET CASH USED IN INVESTING ACTIVITIES | (3,801,298 | ) | (850,738 | ) | ||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||

| Repayment of borrowings and finance obligations | (113,940 | ) | (44,902 | ) | ||

| Sale of noncontrolling interest | 132,000 | - | ||||

| Purchase of treasury stock | (1,806,646 | ) | (2,505,832 | ) | ||

| Distributions to noncontrolling interests | (5,682,555 | ) | (5,630,336 | ) | ||

| NET CASH USED IN FINANCING ACTIVITIES | (7,471,141 | ) | (8,181,070 | ) | ||

| NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS | (7,557 | ) | 5,061,486 | |||

| CASH AND CASH EQUIVALENTS - BEGINNING OF YEAR | 56,341,193 | 51,279,707 | ||||

| CASH AND CASH EQUIVALENTS - END OF YEAR | $ | 56,333,636 | $ | 56,341,193 | ||

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/266134