GAMCO Investors, Inc. Reports Results for the First Quarter 2025

- Earnings per share increased 26.6% to $0.81 from $0.64 year-over-year

- Operating margin improved to 32.4% from 27.0% in Q1 2024

- Strategic partnership with Keeley added ~$1.0 billion in AUM

- Strong balance sheet with $175.4 million in cash and investments with zero debt

- The Gabelli Gold Fund performed exceptionally well with 32% return in Q1 2025

- Total AUM decreased 1.6% to $31.2 billion from $31.7 billion in Q4 2024

- Net outflows of $0.7 billion during the quarter

- Non-operating income decreased by $3.2 million compared to Q1 2024

- Investment advisory revenue from Institutional and Private Wealth Management declined

- Quarter End AUM of

$31.2 billion - Operating Margin of

32.4% for the First Quarter - First Quarter Earnings of

$0.81 per Share versus$0.64 per Share in the First Quarter of 2024 $175.4 million in Cash, Cash Equivalents, Seed Capital, and Investments, and No Debt- Entered Partnership with Keeley on May 1st of 4 Open-End Funds and ~500 Separately Managed Accounts from Keeley-Teton, Adding Close to

$1.0 billion in AUM - Opened an office in Zurich, Switzerland

GREENWICH, Conn., May 08, 2025 (GLOBE NEWSWIRE) -- GAMCO Investors, Inc. (“Gabelli”) (OTCQX: GAMI) today reported its operating results for the quarter ended March 31, 2025.

Financial Highlights

| (In thousands, except percentages and per share data) | |||||||||||||

| Three Months Ended | |||||||||||||

| March 31, 2025 | December 31, 2024 | March 31, 2024 | |||||||||||

| U.S. GAAP | |||||||||||||

| Revenue | $ | 57,328 | $ | 59,262 | $ | 56,945 | |||||||

| Expenses | 38,735 | 42,130 | 41,597 | ||||||||||

| Operating income | 18,593 | 17,132 | 15,348 | ||||||||||

| Non-operating income | 1,220 | 3,452 | 4,372 | ||||||||||

| Net income | 18,271 | 15,269 | 15,810 | ||||||||||

| Diluted earnings per share | $ | 0.81 | $ | 0.64 | $ | 0.64 | |||||||

| Operating margin | 32.4 | % | 28.9 | % | 27.0 | % | |||||||

Giving Back to Society -

Since our initial public offering in February 1999, our firm’s combined charitable donations total approximately

On August 6, 2024, Gabelli’s board of directors authorized the creation of a private foundation, headquartered in Reno, Nevada, to continue our charitable giving program with an initial contribution of

Revenue

| (In thousands) | Three Months Ended | |||||||

| March 31, 2025 | March 31, 2024 | |||||||

| Investment advisory and incentive fees | ||||||||

| Funds | $ | 38,681 | $ | 37,270 | ||||

| Institutional and Private Wealth Management | 15,101 | 15,196 | ||||||

| SICAV | 4 | 6 | ||||||

| Total | $ | 53,786 | $ | 52,472 | ||||

| Distribution fees and other income | 3,542 | 4,473 | ||||||

| Total revenue | $ | 57,328 | $ | 56,945 | ||||

The year over year increase in Funds revenues was primarily the result of higher average assets under management. The decrease in Institutional and Private Wealth Management revenues was primarily the result of lower beginning of the quarter equity assets under management, which are generally used to calculate the revenues. The decrease in distribution fees and other income was primarily the result of a decrease in equity mutual funds AUM that pay distribution fees.

Expenses

| (In thousands) | Three Months Ended | |||||||

| March 31, 2025 | March 31, 2024 | |||||||

| Compensation | $ | 26,616 | $ | 28,554 | ||||

| Management fee | 2,202 | 2,191 | ||||||

| Distribution costs | 5,138 | 5,950 | ||||||

| Other operating expenses | 4,779 | 4,902 | ||||||

| Total expenses | $ | 38,735 | $ | 41,597 | ||||

- The lower compensation expense in the first quarter of 2025 when compared to the prior year quarter reflected

$2.8 million of waived compensation partially offset by increased fixed compensation of$0.2 million and increased variable compensation of$0.6 million .

Operating Margin

The operating margin, which represents the ratio of operating income to revenue, was

Non-Operating Income

| (In thousands) | Three Months Ended | |||||||

| March 31, 2025 | March 31, 2024 | |||||||

| Gain/(loss) from investments, net | $ | (110 | ) | $ | 1,632 | |||

| Interest and dividend income | 1,622 | 3,033 | ||||||

| Interest expense (a) | (292 | ) | (293 | ) | ||||

| Total non-operating income | $ | 1,220 | $ | 4,372 | ||||

| (a) Related to GAAP accounting of finance lease. | ||||||||

Non-operating income decreased

Other Financial Highlights

The effective income tax rate (“ETR”) for the first quarter of 2025 was

Cash, cash equivalents, and investments were

Growth Initiatives: Lift-outs, Partnerships, Joint Ventures, New Markets

- Partnership with Keeley management will enhance our research and portfolio teams for small and mid-cap focused assets

On May 1, 2025, Gabelli completed partnership with the Keeley family for the management contracts of 4 open-end funds and approximately 500 separately managed accounts from Teton Advisors, LLC, adding close to

- Opened Zurich office with lift-out of research and sales teammates.

Assets Under Management

| (In millions) | As of | |||||||||||

| March 31, 2025 | December 31, 2024 | March 31, 2024 | ||||||||||

| Mutual Funds | $ | 7,959 | $ | 8,078 | $ | 8,235 | ||||||

| Closed-end Funds | 7,365 | 7,344 | 7,313 | |||||||||

| Institutional & PWM (a) (b) | 10,182 | 10,700 | 11,146 | |||||||||

| SICAV | 9 | 9 | 9 | |||||||||

| Total Equities | 25,515 | 26,131 | 26,703 | |||||||||

| 5,638 | 5,552 | 4,965 | ||||||||||

| Institutional & PWM Fixed Income | 32 | 32 | 32 | |||||||||

| Total Treasuries & Fixed Income | 5,670 | 5,584 | 4,997 | |||||||||

| Total Assets Under Management | $ | 31,185 | $ | 31,715 | $ | 31,700 | ||||||

| (a) Includes | ||||||||||||

| December 31, 2024, and March 31, 2024, respectively. | ||||||||||||

| (b) Includes | ||||||||||||

| December 31, 2024, and March 31, 2024, respectively. | ||||||||||||

Assets under management on March 31, 2025 were

Mutual Funds

Assets under management in Mutual Funds on March 31, 2025 were

- Distributions, net of reinvestment, of

$4 million ; - Net outflows of

$199 million ; and - Net market appreciation of

$84 million .

Closed-end Funds

Assets under management in Closed-end Funds on March 31, 2025 were

- Distributions, net of reinvestment, of

$138 million ; - Net outflows of

$40 million , including the redemption of$37 million of preferred shares, and the repurchase of$11 million of common stock partially offset by the issuance of$8 million preferred shares; and - Net market appreciation of

$199 million .

Institutional & PWM

Assets under management in Institutional & PWM on March 31, 2025 were

- Net outflows of

$481 million ; and - Net market depreciation of

$37 million .

SICAV

Assets under management were

Assets under management in our

The Gabelli Gold Fund – Up

Portfolio manager Caesar Bryan commented on The Gabelli Gold Fund’s 1st quarter 2025 performance:

The gold price performed strongly in the first quarter of 2025, building on its gains over the past two years. Gold ended the quarter at

Assets Under Administration

| (In millions) | As of | |||||||||||

| March 31, 2025 | December 31, 2024 | March 31, 2024 | ||||||||||

| Teton-Keeley Funds (a) | $ | 750 | $ | 809 | $ | 952 | ||||||

| SICAV | 401 | 408 | 580 | |||||||||

| Total Assets Under Administration | $ | 1,151 | $ | 1,217 | $ | 1,532 | ||||||

| (a) Includes | ||||||||||||

| March 31, 2025, December 31, 2024 and March 31, 2024, respectively. | ||||||||||||

AUA on March 31, 2025 were

Return to Shareholders

During the first quarter of 2025, Gabelli returned

On May 7, 2025, Gabelli’s board of directors declared a regular quarterly dividend of

Balance Sheet Information

As of March 31, 2025, cash, cash equivalents, and U.S Treasury Bills were

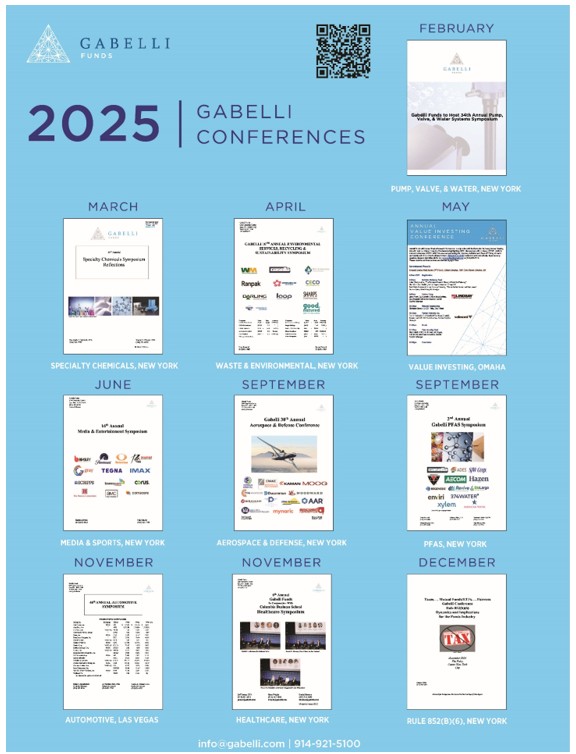

Symposiums/Conferences

- On February 27th, we hosted our 35th Annual Pump, Valve & Water Systems Symposium. The symposium focused on themes crucial to this industry, including infrastructure spending, resource security, conservation, and M&A.

- On March 20th, we hosted our 16th Annual Specialty Chemicals Symposium. The symposium featured presentations from senior management of leading specialty chemicals companies, with a focus on pricing power, margin recovery, interest rates, destocking, global supply chain, global demand trends, and the M&A environment.

- On May 2nd, GAMCO hosted its 19th annual Omaha Research Trip in conjunction with the Berkshire Hathaway Annual Meeting. This Value Investor Conference attracted a record number of participants with Gabelli portfolio managers anchoring panels with noted Berkshire experts and regional CEOs.

We are hosting the following symposiums and conferences in 2025:

About Gabelli

Gabelli (OTCQX: GAMI), established in 1977 and incorporated under the laws of Delaware, is a widely-recognized provider of investment advisory services to 24 open-end funds, 13 United States closed-end funds and one United Kingdom limited investment company, 5 actively managed exchange traded funds, one société d’investissement à capital variable, and approximately 1,400 institutional and private wealth management investors principally in the U.S. The Company’s revenues are based primarily on the levels of assets under management and fees associated with the various investment products.

In 1977, Gabelli launched its well-known All Cap Value equity strategy, Gabelli Value, in a separate account format and in 1986 entered the mutual fund business. Today, Gabelli offers a diverse set of client solutions across asset classes (e.g. Equities, Debt Instruments, Convertibles, non-market correlated Merger Arbitrage), regions, market capitalizations, sectors (e.g. Gold, Utilities) and investment styles (e.g. Value, Growth). Gabelli serves a broad client base, including institutions, intermediaries, offshore investors, private wealth, and direct retail investors.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Our disclosure and analysis in this press release, which do not present historical information, contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements convey our current expectations or forecasts of future events. You can identify these statements because they do not relate strictly to historical or current facts. They use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” and other words and terms of similar meaning. They also appear in any discussion of future operating or financial performance. In particular, these include statements relating to future actions, future performance of our products, expenses, the outcome of any legal proceedings, and financial results. Although we believe that we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know about our business and operations, the economy, and other conditions, there can be no assurance that our actual results will not differ materially from what we expect or believe. Therefore, you should proceed with caution in relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance.

Forward-looking statements involve a number of known and unknown risks, uncertainties and other important factors, some of which are listed below, that are difficult to predict and could cause actual results and outcomes to differ materially from any future results or outcomes expressed or implied by such forward-looking statements. Some of the factors that may cause our actual results to differ from our expectations include risks associated with the duration and scope of the ongoing coronavirus pandemic resulting in volatile market conditions, a decline in the securities markets that adversely affect our assets under management, negative performance of our products, the failure to perform as required under our investment management agreements, and a general downturn in the economy that negatively impacts our operations. We also direct your attention to the more specific discussions of these and other risks, uncertainties and other important factors contained in our Annual Report and other public filings. Other factors that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We do not undertake to update publicly any forward-looking statements if we subsequently learn that we are unlikely to achieve our expectations whether as a result of new information, future developments or otherwise, except as may be required by law.

Gabelli Funds, LLC is a registered investment adviser with the Securities and Exchange Commission and is a wholly owned subsidiary of GAMCO Investors, Inc. (OTCQX: GAMI).

Investors should carefully consider the investment objectives, risks, charges and expenses of the fund before investing. The prospectus, which contains more complete information about this and other matters, should be read carefully before investing. To obtain a prospectus, please call 800 GABELLI or visit www.gabelli.com

Fitch rating drivers include: credit quality, interest rate risk, liquid assets, maturity profiles, and the capabilities of the investment advisor

Money Market Fund

Investment in the fund is neither guaranteed nor insured by the Federal Deposit Insurance Corporation or any government agency. Although the fund seeks to preserve the value of your investment at

Gold

Investments related to gold and other precious metals and minerals are considered speculative and are affected by a variety of worldwide economic, financial, and political factors. Investing in foreign securities involves risks not ordinarily associated with investment in domestic issues. Funds concentrating in specific sectors may experience greater fluctuations in value than funds that are more diversified. Not FDIC Insured. Not Bank Guaranteed. May Lose Value.

As of March 31, 2025, GAMI and affiliates owned less than one percent of all stocks mentioned in the Gold Fund.

Returns represent past performance and do not guarantee future results. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.gabelli.com for performance information as of the most recent month end.

| GAMCO Investors, Inc. and Subsidiaries | ||||||||||||

| Condensed Consolidated Statements of Operations (Unaudited) | ||||||||||||

| (in thousands, except per share data) | ||||||||||||

| Three Months Ended | ||||||||||||

| March 31, 2025 | December 31, 2024 | March 31, 2024 | ||||||||||

| Revenue: | ||||||||||||

| Investment advisory and incentive fees | $ | 53,786 | $ | 55,502 | $ | 52,472 | ||||||

| Distribution fees and other income | 3,542 | 3,760 | 4,473 | |||||||||

| Total revenue | 57,328 | 59,262 | 56,945 | |||||||||

| Expenses: | ||||||||||||

| Compensation | 26,616 | 28,839 | 28,554 | |||||||||

| Management fee | 2,202 | 2,287 | 2,191 | |||||||||

| Distribution costs | 5,138 | 5,634 | 5,950 | |||||||||

| Other operating expenses | 4,779 | 5,370 | 4,902 | |||||||||

| Total expenses | 38,735 | 42,130 | 41,597 | |||||||||

| Operating income | 18,593 | 17,132 | 15,348 | |||||||||

| Non-operating income: | ||||||||||||

| Gain/(loss) from investments, net | (110 | ) | 644 | 1,632 | ||||||||

| Interest and dividend income | 1,622 | 3,090 | 3,033 | |||||||||

| Interest expense | (292 | ) | (282 | ) | (293 | ) | ||||||

| Total non-operating income | 1,220 | 3,452 | 4,372 | |||||||||

| Income before provision for income taxes | 19,813 | 20,584 | 19,720 | |||||||||

| Provision for income taxes | 1,542 | 5,315 | 3,910 | |||||||||

| Net income | $ | 18,271 | $ | 15,269 | $ | 15,810 | ||||||

| Earnings per share attributable to common | ||||||||||||

| stockholders: | ||||||||||||

| Basic | $ | 0.81 | $ | 0.64 | $ | 0.64 | ||||||

| Diluted | $ | 0.81 | $ | 0.64 | $ | 0.64 | ||||||

| Weighted average shares outstanding: | ||||||||||||

| Basic | 22,632 | 23,971 | 24,808 | |||||||||

| Diluted | 22,632 | 23,971 | 24,808 | |||||||||

| Shares outstanding | 22,431 | 22,930 | 24,585 | |||||||||

| GAMCO Investors, Inc. and Subsidiaries | ||||||||||||

| Condensed Consolidated Statements of Financial Condition (Unaudited) | ||||||||||||

| (in thousands) | ||||||||||||

| March 31, | December 31, | March 31, | ||||||||||

| 2025 | 2024 | 2024 | ||||||||||

| Assets | ||||||||||||

| Cash and cash equivalents | $ | 53,596 | $ | 17,254 | $ | 65,467 | ||||||

| Short-term investments in U.S. Treasury Bills | 49,900 | 99,216 | 99,073 | |||||||||

| Investments in securities | 43,117 | 36,855 | 30,351 | |||||||||

| Seed capital investments | 28,772 | 29,452 | 26,184 | |||||||||

| Receivable from brokers | 3,030 | 3,103 | 1,111 | |||||||||

| Other receivables | 20,062 | 21,246 | 23,576 | |||||||||

| Deferred tax asset and income tax receivable | 9,420 | 8,042 | 8,384 | |||||||||

| Other assets | 10,207 | 9,509 | 9,614 | |||||||||

| Total assets | $ | 218,104 | $ | 224,677 | $ | 263,760 | ||||||

| Liabilities and stockholders' equity | ||||||||||||

| Income taxes payable | $ | 9,902 | $ | 193 | $ | 3,464 | ||||||

| Compensation payable | 26,915 | 40,633 | 25,100 | |||||||||

| Accrued expenses and other liabilities | 39,713 | 46,546 | 45,910 | |||||||||

| Total liabilities | 76,530 | 87,372 | 74,474 | |||||||||

| Stockholders' equity | 141,574 | 137,305 | 189,286 | |||||||||

| Total liabilities and stockholders' equity | $ | 218,104 | $ | 224,677 | $ | 263,760 | ||||||

| GAMCO Investors, Inc. and Subsidiaries | ||||||||||||||||||

| Assets Under Management | ||||||||||||||||||

| By investment vehicle | ||||||||||||||||||

| (in millions) | ||||||||||||||||||

| Three Months Ended | % Changed From | |||||||||||||||||

| March 31, | December 31, | March 31, | December 31, | March 31, | ||||||||||||||

| 2025 | 2024 | 2024 | 2024 | 2024 | ||||||||||||||

| Equities: | ||||||||||||||||||

| Mutual Funds | ||||||||||||||||||

| Beginning of period assets | $ | 8,078 | $ | 8,440 | $ | 7,973 | ||||||||||||

| Inflows | 190 | 211 | 176 | |||||||||||||||

| Outflows | (389 | ) | (420 | ) | (432 | ) | ||||||||||||

| Net inflows (outflows) | (199 | ) | (209 | ) | (256 | ) | ||||||||||||

| Market appreciation (depreciation) | 84 | (126 | ) | 523 | ||||||||||||||

| Fund distributions, net of reinvestment | (4 | ) | (27 | ) | (5 | ) | ||||||||||||

| Total increase (decrease) | (119 | ) | (362 | ) | 262 | |||||||||||||

| Assets under management, end of period | $ | 7,959 | $ | 8,078 | $ | 8,235 | -1.5 | % | -3.4 | % | ||||||||

| Percentage of total assets under management | 25.5 | % | 25.5 | % | 26.0 | % | ||||||||||||

| Average assets under management | $ | 8,176 | $ | 8,447 | $ | 7,965 | -3.2 | % | 2.6 | % | ||||||||

| Closed-end Funds | ||||||||||||||||||

| Beginning of period assets | $ | 7,344 | $ | 7,459 | $ | 7,097 | ||||||||||||

| Inflows | 8 | 212 | 41 | |||||||||||||||

| Outflows | (48 | ) | (43 | ) | (103 | ) | ||||||||||||

| Net inflows (outflows) | (40 | ) | 169 | (62 | ) | |||||||||||||

| Market appreciation (depreciation) | 199 | (155 | ) | 404 | ||||||||||||||

| Fund distributions, net of reinvestment | (138 | ) | (129 | ) | (126 | ) | ||||||||||||

| Total increase (decrease) | 21 | (115 | ) | 216 | ||||||||||||||

| Assets under management, end of period | 7,365 | $ | 7,344 | $ | 7,313 | 0.3 | % | 0.7 | % | |||||||||

| Percentage of total assets under management | 23.6 | % | 23.2 | % | 23.1 | % | ||||||||||||

| Average assets under management | $ | 7,505 | $ | 7,610 | $ | 7,060 | -1.4 | % | 6.3 | % | ||||||||

| Institutional & PWM | ||||||||||||||||||

| Beginning of period assets | $ | 10,700 | $ | 10,984 | $ | 10,738 | ||||||||||||

| Inflows | 120 | 62 | 66 | |||||||||||||||

| Outflows | (601 | ) | (407 | ) | (428 | ) | ||||||||||||

| Net inflows (outflows) | (481 | ) | (345 | ) | (362 | ) | ||||||||||||

| Market appreciation (depreciation) | (37 | ) | 61 | 770 | ||||||||||||||

| Total increase (decrease) | (518 | ) | (284 | ) | 408 | |||||||||||||

| Assets under management, end of period | $ | 10,182 | $ | 10,700 | $ | 11,146 | -4.8 | % | -8.6 | % | ||||||||

| Percentage of total assets under management | 32.7 | % | 33.7 | % | 35.2 | % | ||||||||||||

| Average assets under management | $ | 10,772 | $ | 11,085 | $ | 10,798 | -2.8 | % | -0.2 | % | ||||||||

| SICAV | ||||||||||||||||||

| Beginning of period assets | $ | 9 | $ | 9 | $ | 631 | ||||||||||||

| Inflows | - | - | - | |||||||||||||||

| Outflows | - | - | (2 | ) | ||||||||||||||

| Net inflows (outflows) | - | - | (2 | ) | ||||||||||||||

| Market appreciation (depreciation) | - | - | - | |||||||||||||||

| Reclassification to AUA | - | - | (620 | ) | ||||||||||||||

| Total increase (decrease) | - | - | (622 | ) | ||||||||||||||

| Assets under management, end of period | $ | 9 | $ | 9 | $ | 9 | 0.0 | % | 0.0 | % | ||||||||

| Percentage of total assets under management | 0.0 | % | 0.0 | % | 0.0 | % | ||||||||||||

| Average assets under management | $ | 9 | $ | 9 | $ | 10 | 0.0 | % | -10.0 | % | ||||||||

| Total Equities | ||||||||||||||||||

| Beginning of period assets | $ | 26,131 | $ | 26,892 | $ | 26,439 | ||||||||||||

| Inflows | 318 | 485 | 283 | |||||||||||||||

| Outflows | (1,038 | ) | (870 | ) | (965 | ) | ||||||||||||

| Net inflows (outflows) | (720 | ) | (385 | ) | (682 | ) | ||||||||||||

| Market appreciation (depreciation) | 246 | (220 | ) | 1,697 | ||||||||||||||

| Fund distributions, net of reinvestment | (142 | ) | (156 | ) | (131 | ) | ||||||||||||

| Reclassification to AUA | - | - | (620 | ) | ||||||||||||||

| Total increase (decrease) | (616 | ) | (761 | ) | 264 | |||||||||||||

| Assets under management, end of period | $ | 25,515 | $ | 26,131 | $ | 26,703 | -2.4 | % | -4.4 | % | ||||||||

| Percentage of total assets under management | 81.8 | % | 82.4 | % | 84.2 | % | ||||||||||||

| Average assets under management | $ | 26,462 | $ | 27,151 | $ | 25,833 | -2.5 | % | 2.4 | % | ||||||||

| GAMCO Investors, Inc. and Subsidiaries | ||||||||||||||||||

| Assets Under Management | ||||||||||||||||||

| By investment vehicle - continued | ||||||||||||||||||

| (in millions) | ||||||||||||||||||

| Three Months Ended | % Changed From | |||||||||||||||||

| March 31, | December 31, | March 31, | December 31, | March 31, | ||||||||||||||

| 2025 | 2024 | 2024 | 2024 | 2024 | ||||||||||||||

| Fixed Income: | ||||||||||||||||||

| Beginning of period assets | $ | 5,552 | $ | 5,268 | $ | 4,615 | ||||||||||||

| Inflows | 1,372 | 1,656 | 1,605 | |||||||||||||||

| Outflows | (1,341 | ) | (1,440 | ) | (1,315 | ) | ||||||||||||

| Net inflows (outflows) | 31 | 216 | 290 | |||||||||||||||

| Market appreciation (depreciation) | 55 | 68 | 60 | |||||||||||||||

| Total increase (decrease) | 86 | 284 | 350 | |||||||||||||||

| Assets under management, end of period | $ | 5,638 | $ | 5,552 | $ | 4,965 | 1.5 | % | 13.6 | % | ||||||||

| Percentage of total assets under management | 18.1 | % | 17.5 | % | 15.7 | % | ||||||||||||

| Average assets under management | $ | 5,552 | $ | 5,415 | $ | 4,832 | 2.5 | % | 14.9 | % | ||||||||

| Institutional & PWM Fixed Income | ||||||||||||||||||

| Beginning of period assets | $ | 32 | $ | 32 | $ | 32 | ||||||||||||

| Inflows | - | - | - | |||||||||||||||

| Outflows | - | - | - | |||||||||||||||

| Net inflows (outflows) | - | - | - | |||||||||||||||

| Market appreciation (depreciation) | - | - | - | |||||||||||||||

| Total increase (decrease) | - | - | - | |||||||||||||||

| Assets under management, end of period | $ | 32 | $ | 32 | $ | 32 | 0.0 | % | 0.0 | % | ||||||||

| Percentage of total assets under management | 0.1 | % | 0.1 | % | 0.1 | % | ||||||||||||

| Average assets under management | $ | 32 | $ | 32 | $ | 32 | 0.0 | % | 0.0 | % | ||||||||

| Total Treasuries & Fixed Income | ||||||||||||||||||

| Beginning of period assets | $ | 5,584 | $ | 5,300 | $ | 4,647 | ||||||||||||

| Inflows | 1,372 | 1,656 | 1,605 | |||||||||||||||

| Outflows | (1,341 | ) | (1,440 | ) | (1,315 | ) | ||||||||||||

| Net inflows (outflows) | 31 | 216 | 290 | |||||||||||||||

| Market appreciation (depreciation) | 55 | 68 | 60 | |||||||||||||||

| Total increase (decrease) | 86 | 284 | 350 | |||||||||||||||

| Assets under management, end of period | $ | 5,670 | $ | 5,584 | $ | 4,997 | 1.5 | % | 13.5 | % | ||||||||

| Percentage of total assets under management | 18.2 | % | 17.6 | % | 15.8 | % | ||||||||||||

| Average assets under management | $ | 5,584 | $ | 5,447 | $ | 4,864 | 2.5 | % | 14.8 | % | ||||||||

| Total AUM | ||||||||||||||||||

| Beginning of period assets | $ | 31,715 | $ | 32,192 | $ | 31,086 | ||||||||||||

| Inflows | 1,690 | 2,141 | 1,888 | |||||||||||||||

| Outflows | (2,379 | ) | (2,310 | ) | (2,280 | ) | ||||||||||||

| Net inflows (outflows) | (689 | ) | (169 | ) | (392 | ) | ||||||||||||

| Market appreciation (depreciation) | 301 | (152 | ) | 1,757 | ||||||||||||||

| Fund distributions, net of reinvestment | (142 | ) | (156 | ) | (131 | ) | ||||||||||||

| Reclassification to AUA | - | - | (620 | ) | ||||||||||||||

| Total increase (decrease) | (530 | ) | (477 | ) | 614 | |||||||||||||

| Assets under management, end of period | $ | 31,185 | $ | 31,715 | $ | 31,700 | -1.7 | % | -1.6 | % | ||||||||

| Average assets under management | $ | 32,046 | $ | 32,598 | $ | 30,697 | -1.7 | % | 4.4 | % | ||||||||

| Contact: | Kieran Caterina |

| Chief Accounting Officer | |

| (914) 921-5149 | |

| For further information please visit | |

| www.gabelli.com | |

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/fdf70333-2c19-43f2-ac7e-f41e523355c5

https://www.globenewswire.com/NewsRoom/AttachmentNg/14973722-0885-4fca-8e88-5fad950be53c