Galiano Gold Advances Towards a Maiden Underground Resource at Abore with Additional High-Grade Results Encountered Including 4.7 g/t Au over 28m and 3.5 g/t Au over 17m

Rhea-AI Summary

Galiano Gold (TSX/NYSE American: GAU) reported expanded 2025 drilling at the Abore deposit with new high‑grade intercepts including 4.7 g/t Au over 28.3m and 3.5 g/t Au over 16.7m. The Board approved an additional $3.1M to fund a further 11,000m of drilling to be completed by end of 2025. Results to date (over 22,000m drilled in 2025) show continuous high‑grade ore shoots below Main, South and North pits and in the saddle zone, open at depth and along strike.

Galiano plans to incorporate drilling completed before the Jan 5, 2026 cut‑off into a maiden underground Mineral Resource to be published as part of an updated MRMR in February 2026. Current published Abore resources: 638,000 oz M&I at 1.24 g/t and 78,000 oz Inferred at 1.17 g/t (effective Dec 31, 2024).

Positive

- 4.7 g/t Au over 28.3m (ABDD25-414)

- Board approved $3.1M for an additional 11,000m of drilling

- 22,000m drilled at Abore since January 2025

- Maiden underground Mineral Resource targeted for February 2026

Negative

- Qualified Person (Chris Pettman) is not independent

- Photon assay used has a reported higher detection limit (~0.02 ppm) versus fire assay

News Market Reaction

On the day this news was published, GAU declined 1.38%, reflecting a mild negative market reaction. This price movement removed approximately $8M from the company's valuation, bringing the market cap to $559M at that time.

Data tracked by StockTitan Argus on the day of publication.

New high grade drilling intercepts to be included in maiden underground Mineral Resource

Vancouver, British Columbia--(Newsfile Corp. - November 17, 2025) - Galiano Gold Inc. (TSX: GAU) (NYSE American: GAU) ("Galiano" or the "Company") is pleased to provide an update on the 2025 Abore drilling program, currently underway at the Asanko Gold Mine ("AGM"), in Ghana, West Africa. The latest drilling results continue to confirm multiple significant high-grade intercepts, demonstrating continuity of mineralization within new ore shoots identified in 2025 that lie below the existing Mineral Reserve and Mineral Resource. Continued drilling success has prompted an expansion of the 2025 Abore drilling program by a further 11,000 meters ("m") demonstrating the Company's strategic focus on increasing Abore's Mineral Resource.

Selected Drill Highlights (see notes 4,5,6 from Table 1):

Main Pit:

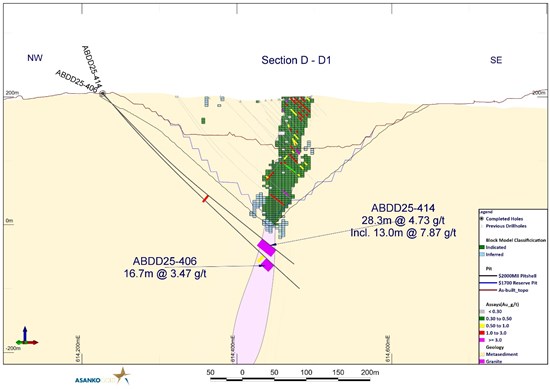

4.7 grams per tonne ("g/t") gold ("Au") over 28m from 339m, and 3.3 g/t Au over 3m from 236m (Hole ABDD25-414)

2.6 g/t Au over 25.5 from 344m (Hole ABDD25-410)

3.5 g/t Au over 17m from 364m (Hole ABPC25-406)

South Pit:

3.5 g/t Au over 20m from 233m (Hole ABPC25-419)

3.1 g/t Au over 16m from 223m, and 2.7 g/t Au over 5m from 243m (Hole ABPC25-418)

3.4 g/t Au over 14m from 347m (Hole ABDD25-403)

2.3 g/t Au over 14m from 335m (Hole ABPC25-397)

3.6 g/t Au over 20m from 178m (Hole ABDD25-425)

Saddle Zone:

- 2.2 g/t Au over 28m from 158m, and 2.3 g/t Au over 4.6m from 192m (Hole ABDD25-426)

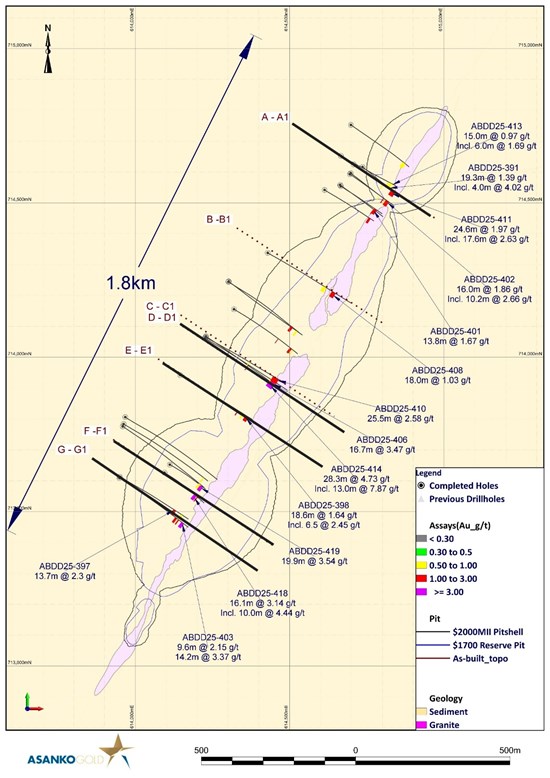

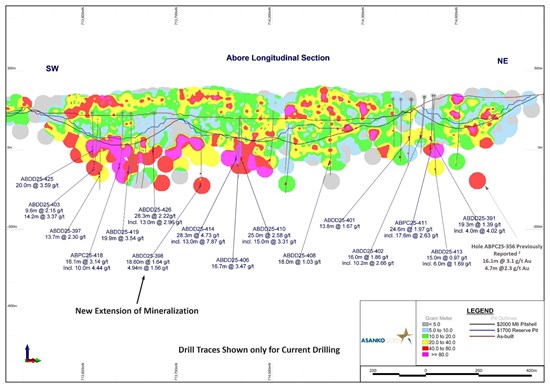

Figure 1: Long section through the Abore deposit showing gram meter contours of Au intercepts with highlights of current drilling labelled.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/274733_22379d46d470fb4b_001full.jpg

Chris Pettman, Galiano Gold's Vice President of Exploration, stated: "We are very pleased with the progress at Abore as we continue to intercept high-grade mineralization across the deposit. These latest drill results further confirm the potential for Abore to host meaningful underground Mineral Resources and therefore redefine the long-term future of the AGM. These results, along with the expanded infill and step out drilling program, will be used to define a maiden Mineral Resource, expected in February 2026."

Current Results

The most recent results are part of the ongoing Abore drilling campaign that began in Q2 2025 and will now continue through the end of Q4 2025 and into 2026.

Based on the positive drilling results to date1,2,3 the current Abore drill program is focused on rapidly infilling areas immediately below the Abore Mineral Reserve and Mineral Resource to expand the Inferred and Indicated Mineral Resource, as well as to test for further continuations of mineralization down plunge and below known mineralized zones.

- Continuity of High Grades below Main and South Pits and within the saddle zone

- The most recent drilling at Abore is focused on infilling gaps within the recently discovered ore-shoots below the Mineral Resource. Current results have confirmed high-grade mineralization has excellent continuity within the north plunging ore shoots below both the South pit and Main pit, as well as within the saddle zone between the two pits where a conjugate south plunging structure also carries high grade mineralization. These zones combined have been confirmed to span approximately 800m in strike length and carry grades expected to support underground mining.

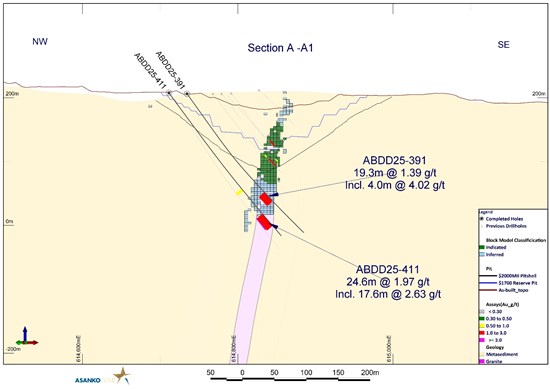

- North High Grade Zone

- Step out drilling in the vicinity of previously announced hole ABDD25-388 which intercepted high grade mineralization at North pit has also intercepted additional high-grade mineralization in hole ABDD25-411 returning 24.6m @ 2.0 g/t, including 17.6m @ 2.63 g/t and providing valuable structural information which will help inform further drilling designed to expand this high-grade zone.

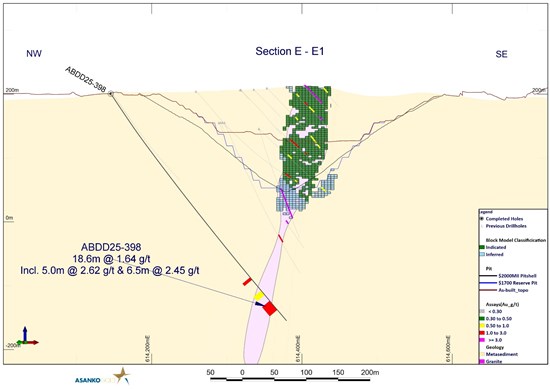

- Extension at Depth

- In addition to infill drilling within the known mineralized zones, the current program aims to test for extensions of mineralization below these zones. Hole ABDD25-398 was designed to test the area below the Main pit ore shoot and successfully intercepted 60.5m of granite with strong mineralization returning 18.6m @ 1.6 g/t Au from 409m and 5m @ 1.6 g/t Au from 361m at the granite-sediment contact along with strong alteration and quartz veining known to accompany high-grade mineralization at Abore. This mineralization remains open in all directions and is very encouraging as the current drilling continues to test deeper underground Resource targets.

Next Steps

The Board of Directors has approved an additional budget of

- Further delineate continuity of high-grade mineralized zones identified in Q3 2025.

- Increase drilling density to convert zones of Inferred Resources to the Indicated category.

- Test for further extensions of mineralization along strike and plunge of known ore zones below the Mineral Resource.

- Step-out drilling below known mineralization to test for further expansions of the Abore mineralizing system.

- Resource Expansion:

- Cut-off date of January 5,2026 has been set for delivery of new exploration data to support updated Mineral Resource and Mineral Reserve statement ("MRMR") to be released in February 2026.

- Maiden Underground Resource:

- Drilling completed ahead of MRMR cut-off date will be incorporated into a maiden underground Mineral Resource at Abore to be released as part of the updated MRMR in February 2026.

Abore 2025 Drilling Overview

Since January 2025, over 22,000m of drilling has been completed at Abore and includes:

- Phase 1: consisted of 5,543m and was completed in May 2025, designed to test for extensions of mineralization immediately below the existing Mineral Resource. This initial drilling resulted in the discovery of a new high-grade zone under Main pit as well as multiple new high-grade intercepts under South pit.1

- First Deep Test: An initial test for deeper mineralization consisting of 1,907m was completed in July, 2025. These four holes all intersected mineralized granite with three holes returning significant widths and grades.2

- Phase 2: Following positive results from Phase 1, a Phase 2 program commenced in June 2025 consisting of 10,000m of drilling designed to test for extensions of mineralization identified in Phase 1 and expand drilling across the entire 1,800m strike length. This drilling returned exceptional results, identifying multiple high-grade ore shoots under South and Main pits, as well as the discovery of a new high-grade zone under North pit. The initial drill plan for this phase was subsequently expanded to a total of 14,687m drilled.3

Background

Abore is located approximately 13 kilometers north of the AGM's processing plant, directly along the haul road, and has current Measured and Indicated Mineral Resources of 638,000 ounces at 1.24 g/t Au and Inferred Mineral Resources of 78,000 ounces at 1.17 g/t Au, as published in the Company's most recent Mineral Reserve and Mineral Resource estimates effective December 31, 20244.

The Abore deposit sits along the Esaase shear corridor, which also hosts the Esaase deposit, and forms part of the northeast striking Asankrangwa gold belt. The geology of Abore is characterized by a sedimentary sequence composed primarily of siltstones, shales and thickly bedded sandstones that has been intruded by a granite, which lies parallel to the shear and dipping steeply to the northwest. The majority of mineralization is constrained to the granite, hosted in west dipping quartz vein areas developed primarily along the eastern margin of the granite/sediment contact.

Figure 2: Abore plan map showing current drilling locations and highlighted intercepts. Select cross sections (A,D,E,F,G shown with black lines above) are included in this press release. Additional cross sections available on Galiano's website: https://galianogold.com/operations/exploration/

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/274733_22379d46d470fb4b_002full.jpg

Step-out at Abore North

Figure 3: Cross Section A-A1 showing holes ABDD25-391 and ABDD25-411 at Abore North pit below the Mineral Resource with high-grade mineralization open at depth.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/274733_22379d46d470fb4b_003full.jpg

High-Grade Continuity at Abore Main Pit

Figure 4: Cross section D-D1 showing holes ABDD25-414 and ABDD25-406 within the high-grade ore shoot under Abore Main pit showing the continuity of high-grade mineralization within this portion of the mineralized zone which remains open at depth.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/274733_22379d46d470fb4b_004full.jpg

Step-out at Depth at Abore Main Pit

Figure 5: Cross section E-E1 showing hole ABDD25-398 illustrating the presence of high-grade mineralization 150m below the Mineral Resource and 80m below known mineralization at Abore Main pit.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/274733_22379d46d470fb4b_005full.jpg

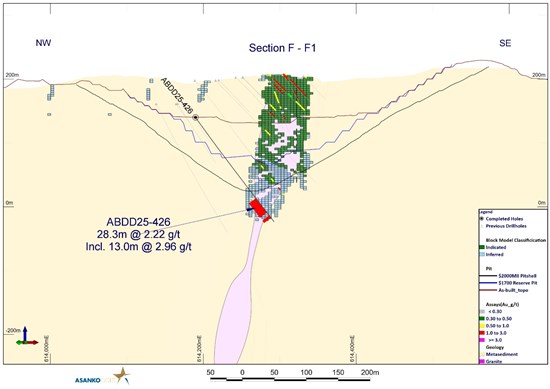

South Pit Ore shoot

Figure 6: Cross section F-F1 showing hole ABDD25-426 located within the saddle zone between Abore Main and South pits which has confirmed good continuity of high grades within this mineralized zone.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/274733_22379d46d470fb4b_006full.jpg

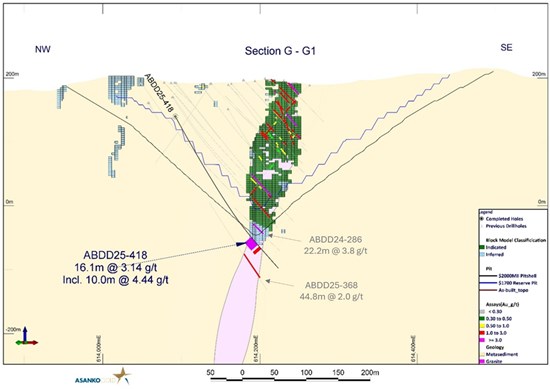

Continuity of High Grades

Figure 7: Cross section G-G1 showing hole ABDD25-418 drilled as an infill within the high-grade ore shoot below South pit showing an example of continuity of high-grade mineralization between previous drill holes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/274733_22379d46d470fb4b_007full.jpg

Table 1: Current Abore Drilling Intercepts Table4,5,6

| Hole ID | From (m) | To (m) | Width (m) | Grade (g/t Au) | Intercept Description |

| ABDD25-390 | 242.8 | 247.0 | 4.2 | 1.2 | 4.2m @ 1.2 g/t |

| ABDD25-391 | 196.0 | 215.3 | 19.3 | 1.4 | 19.3m @ 1.4 g/t |

| ABDD25-392 | 418.0 | 431.2 | 13.2 | 1.2 | 13.23m @ 1.2 g/t |

| ABDD25-393 | 200.0 | 204.0 | 4.0 | 0.9 | 4.0m @ 0.9 g/t |

| and | 237.0 | 242.0 | 5.0 | 0.6 | 4.95m @ 0.6 g/t |

| ABDD25-396 | 274.0 | 285.0 | 11.0 | 1.4 | 10.97m @ 1.4 g/t |

| ABDD25-397 | 335.3 | 349.0 | 13.7 | 2.3 | 13.67m @ 2.3 g/t |

| and | 379.0 | 388.6 | 9.6 | 0.6 | 9.6m @ 0.6 g/t |

| ABDD25-398 | 361.1 | 366.0 | 4.9 | 1.6 | 4.94m @ 1.6 g/t |

| and | 377.0 | 382.4 | 5.4 | 0.4 | 5.40m @ 0.4 g/t |

| and | 388.0 | 397.0 | 9.0 | 0.6 | 9.0m @ 0.6 g/t |

| and | 408.9 | 427.5 | 18.6 | 1.6 | 18.6m @ 1.6 g/t |

| ABDD25-399 | 429.0 | 442.0 | 13.0 | 1.0 | 13.0m @ 1.0 g/t |

| ABDD25-400 | 324.3 | 341.0 | 16.7 | 0.9 | 16.7m @ 0.9 g/t |

| ABDD25-401 | 191.9 | 205.7 | 13.8 | 1.7 | 13.8m @ 1.7 g/t |

| ABDD25-402 | 189.0 | 193.0 | 4.0 | 1.3 | 4.0m @ 1.3 g/t |

| and | 203.0 | 219.0 | 16.0 | 1.9 | 16.0m @ 1.9 g/t |

| ABDD25-403 | 314.3 | 323.9 | 9.6 | 2.2 | 9.6m @ 2.2 g/t |

| and | 329.8 | 335.0 | 5.2 | 1.8 | 5.2 m @ 1.8 g/t |

| and | 347.0 | 361.2 | 14.2 | 3.4 | 14.2m @ 3.4 g/t |

| ABDD25-404 | 381.9 | 390.0 | 8.1 | 0.7 | 8.1m @ 0.7 g/t |

| ABDD25-406 | 356.0 | 360.5 | 4.5 | 0.9 | 4.5m @ 0.9 g/t |

| and | 364.0 | 380.7 | 16.7 | 3.5 | 16.7m @ 3.5 g/t |

| ABDD25-408 | 307.0 | 322.8 | 15.8 | 1.0 | 15.8m @ 1.0 g/t |

| and | 350.0 | 368.0 | 18.0 | 1.0 | 18.0m @ 1.0 g/t |

| ABDD25-410 | 228.0 | 231.0 | 3.0 | 0.6 | 3.0m @ 0.6 g/t |

| and | 237.0 | 242.0 | 5.0 | 0.4 | 5.0m @ 0.4 g/t |

| and | 344.0 | 369.5 | 25.5 | 2.6 | 25.5m @ 2.6 g/t |

| ABDD25-411 | 188.0 | 192.7 | 4.7 | 0.9 | 4.7m @ 0.9 g/t |

| and | 239.4 | 264.0 | 24.6 | 2.0 | 24.6m @ 2.0 g/t |

| ABDD25-412 | 441.0 | 446.0 | 5.0 | 0.9 | 5.0m @ 0.9 g/t |

| ABDD25-414 | 229.0 | 232.1 | 3.1 | 1.4 | 3.1m @ 1.4 g/t |

| and | 236.0 | 239.0 | 3.0 | 3.3 | 3.0m @ 3.3 g/t |

| and | 339.0 | 367.3 | 28.3 | 4.7 | 28.3m @ 4.7 g/t |

| ABDD25-417 | 252.0 | 255.0 | 3.0 | 1.2 | 3.0m @ 1.2 g/t |

| and | 321.0 | 332.0 | 11.0 | 1.5 | 11.0m @ 1.5 g/t |

| and | 337.0 | 341.1 | 4.1 | 1.0 | 4.12m @ 1.0 g/t |

| ABDD25-418 | 223.6 | 239.6 | 16.1 | 3.1 | 16.05m @ 3.14g/t |

| and | 243.0 | 248.0 | 5.0 | 2.7 | 5.0m @ 2.7 g/t |

| ABDD25-419 | 233.0 | 252.9 | 19.9 | 3.5 | 19.9m @ 3.5 g/t |

| ABDD25-422 | 168.9 | 175.2 | 6.3 | 1.9 | 6.3m @ 1.9 g/t |

| and | 211.0 | 219.0 | 8.0 | 0.6 | 8.0m @ 0.6 g/t |

| ABDD25-425 | 165.5 | 170.0 | 4.5 | 1.1 | 4.5m @ 1.0 g/t |

| and | 178.0 | 198.0 | 20.0 | 3.6 | 20.0m @ 3.6 g/t |

| and | 201.5 | 206.8 | 5.3 | 1.6 | 5.3m @ 1.6 g/t |

| ABDD25-426 | 158.0 | 186.3 | 28.3 | 2.2 | 28.3m @ 2.2 g/t |

| and | 192.1 | 196.7 | 4.6 | 2.3 | 4.6m @ 2.3 g/t |

Notes:

4. Intervals reported are hole lengths with true width estimated to be

5. Intervals are not top cut and are calculated with the assumptions of > 0.5 g/t and < 3m of internal waste.

6. All samples are taken from diamond core.

Qualified Person and QA/QC

Chris Pettman, P. Geo, Vice President Exploration of Galiano, is a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, and has supervised the preparation of the scientific and technical information that forms the basis for this news release. Mr. Pettman is responsible for all aspects of the work, including the Data Verification and Quality Control/Quality Assurance programs and has verified the data disclosed, by reviewing all data and supervising its compilation. There are no known factors that could materially affect the reliability of data collected and verified under his supervision. No quality assurance/quality control issues have been identified to date. Mr. Pettman is not independent of Galiano.

Certified Reference Materials and Blanks are inserted by Galiano into the sample stream at the rate of 1:14 samples. Field duplicates are collected at the rate of 1:30 samples. All samples have been analyzed by Photon assay by Intertek Minerals Ltd. ("Intertek") in Tarkwa, Ghana with standard preparation methods. ChrysosTM Photon assay uses high energy X-ray to activate gold nuclei in a large sample ca. 500g. Photon assay uses a larger sample, thus the variance on the sampling error is less. Crushing the sample to 2-3mm is required in many cases. Photon assay tends to have a higher detection limit than fire assay (0.02ppm). Intertek does its own introduction of QA/QC samples into the sample stream and reports them to Galiano for double checking. Higher grade samples are re-analyzed from pulp or reject material or both. Intertek is an international company operating in 100 countries and is independent of Galiano. It provides testing for a wide range of industries including the mining, metals, and oil sectors.

Contact Information

Krista Muhr

Toll-Free (N. America): 1-855-246-7341

Telephone: 1-778-239-0446

Email: info@galianogold.com

About Galiano Gold Inc.

Galiano is focused on creating a sustainable business capable of value creation for all stakeholders through production, exploration and disciplined deployment of its financial resources. The Company owns and operates the Asanko Gold Mine, which is located in Ghana, West Africa. Galiano is committed to the highest standards for environmental management, social responsibility, and the health and safety of its employees and neighbouring communities. For more information, please visit www.galianogold.com.

Cautionary Note Regarding Forward-Looking Statements

Certain statements and information contained in this news release constitute "forward-looking statements" within the meaning of applicable U.S. securities laws and "forward-looking information" within the meaning of applicable Canadian securities laws, which we refer to collectively as "forward-looking statements". Forward-looking statements are statements and information regarding possible events, conditions or results of operations that are based upon assumptions about future conditions and courses of action. All statements and information other than statements of historical fact may be forward-looking statements. In some cases, forward-looking statements can be identified by the use of words such as "seek", "expect", "anticipate", "budget", "plan", "estimate", "continue", "forecast", "intend", "believe", "predict", "potential", "target", "may", "could", "would", "might", "will" and similar words or phrases (including negative variations) suggesting future outcomes or statements regarding an outlook.

Forward-looking statements in this news release include, but are not limited to statements regarding the Company's expectations and timing with respect to current and planned drilling programs at Abore, and the results thereof; the potential to optimize and/or expand the Abore Reserve pit and the resulting impact on mineral reserves and ore delivery; the Company's belief in the potential of Abore; the Company's plan to report a maiden underground Mineral Resource at Abore, and the Company's plans to update the mineral resources and mineral reserves. Such forward-looking statements are based on a number of material factors and assumptions, including, but not limited to: development plans and capital expenditures; the price of gold will not decline significantly or for a protracted period of time; the accuracy of the estimates and assumptions underlying mineral reserve and mineral resource estimates; the Company's ability to raise sufficient funds from future equity financings to support its operations, and general business and economic conditions; the global financial markets and general economic conditions will be stable and prosperous in the future; the ability of the Company to comply with applicable governmental regulations and standards; the mining laws, tax laws and other laws in Ghana applicable to the AGM will not change, and there will be no imposition of additional exchange controls in Ghana; the success of the Company in implementing its development strategies and achieving its business objectives; the Company will have sufficient working capital necessary to sustain its operations on an ongoing basis and the Company will continue to have sufficient working capital to fund its operations; and the key personnel of the Company will continue their employment.

The foregoing list of assumptions cannot be considered exhaustive.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to differ materially from those anticipated in such forward-looking statements. The Company believes the expectations reflected in such forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and you are cautioned not to place undue reliance on forward-looking statements contained herein. Some of the risks and other factors which could cause actual results to differ materially from those expressed in the forward-looking statements contained in this news release, include, but are not limited to: mineral reserve and mineral resource estimates may change and may prove to be inaccurate; metallurgical recoveries may not be economically viable; life of mine estimates are based on a number of factors and assumptions and may prove to be incorrect; actual production, costs, returns and other economic and financial performance may vary from the Company's estimates in response to a variety of factors, many of which are not within the Company's control; inflationary pressures and the effects thereof; the AGM has a limited operating history and is subject to risks associated with establishing new mining operations; sustained increases in costs, or decreases in the availability, of commodities consumed or otherwise used by the Company may adversely affect the Company; adverse geotechnical and geological conditions (including geotechnical failures) may result in operating delays and lower throughput or recovery, closures or damage to mine infrastructure; the ability of the Company to treat the number of tonnes planned, recover valuable materials, remove deleterious materials and process ore, concentrate and tailings as planned is dependent on a number of factors and assumptions which may not be present or occur as expected; the Company's mineral properties may experience a loss of ore due to illegal mining activities; the Company's operations may encounter delays in or losses of production due to equipment delays or the availability of equipment; outbreaks of COVID-19 and other infectious diseases may have a negative impact on global financial conditions, demand for commodities and supply chains and could adversely affect the Company's business, financial condition and results of operations and the market price of the common shares of the Company; the Company's operations are subject to continuously evolving legislation, compliance with which may be difficult, uneconomic or require significant expenditures; the Company may be unsuccessful in attracting and retaining key personnel; labour disruptions could adversely affect the Company's operations; recoveries may be lower in the future and have a negative impact on the Company's financial results; the lower recoveries may persist and be detrimental to the AGM and the Company; the Company's business is subject to risks associated with operating in a foreign country; risks related to the Company's use of contractors; the hazards and risks normally encountered in the exploration, development and production of gold; the Company's operations are subject to environmental hazards and compliance with applicable environmental laws and regulations; the effects of climate change or extreme weather events may cause prolonged disruption to the delivery of essential commodities which could negatively affect production efficiency; the Company's operations and workforce are exposed to health and safety risks; unexpected costs and delays related to, or the failure of the Company to obtain, necessary permits could impede the Company's operations; the Company's title to exploration, development and mining interests can be uncertain and may be contested; geotechnical risks associated with the design and operation of a mine and related civil structures; the Company's properties may be subject to claims by various community stakeholders; risks related to limited access to infrastructure and water; risks associated with establishing new mining operations; the Company's revenues are dependent on the market prices for gold, which have experienced significant recent fluctuations; the Company may not be able to secure additional financing when needed or on acceptable terms; the Company's shareholders may be subject to future dilution; risks related to changes in interest rates and foreign currency exchange rates; risks relating to credit rating downgrades; changes to taxation laws applicable to the Company may affect the Company's profitability and ability to repatriate funds; risks related to the Company's internal controls over financial reporting and compliance with applicable accounting regulations and securities laws; risks related to information systems security threats; non-compliance with public disclosure obligations could have an adverse effect on the Company's stock price; the carrying value of the Company's assets may change and these assets may be subject to impairment charges; risks associated with changes in reporting standards; the Company may be liable for uninsured or partially insured losses; the Company may be subject to litigation; damage to the Company's reputation could result in decreased investor confidence and increased challenges in developing and maintaining community relations which may have adverse effects on the business, results of operations and financial conditions of the Company and the Company's share price; the Company may be unsuccessful in identifying targets for acquisition or completing suitable corporate transactions, and any such transactions may not be beneficial to the Company or its shareholders; the Company must compete with other mining companies and individuals for mining interests; the Company's growth, future profitability and ability to obtain financing may be impacted by global financial conditions; the Company's common shares may experience price and trading volume volatility; the Company has never paid dividends and does not expect to do so in the foreseeable future; the Company's shareholders may be unable to sell significant quantities of the Company's common shares into the public trading markets without a significant reduction in the price of its common shares, or at all; and the risk factors described under the heading "Risk Factors" in the Company's Annual Information Form.

Although the Company has attempted to identify important factors that could cause actual results or events to differ materially from those described in the forward-looking statements, you are cautioned that this list is not exhaustive and there may be other factors that the Company has not identified. Furthermore, the Company undertakes no obligation to update or revise any forward-looking statements included in, or incorporated by reference in, this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

1 See press release "Galiano Gold Announces Discovery Of New High-Grade Zone At Abore With Intercept Of 50m @ 3.2 g/t Au & Results Of Infill Drilling Program" dated May 5, 2025.

2 See press release "Galiano Gold Announces Positive Initial Deep Drilling Results At Abore Including 36m @ 2.5 g/t Au" dated July 14, 2025.

3 See press release "Galiano Gold Reports Exceptional Drill Results At Abore, Including 23m @ 6.8 g/t Au And 16.4m @ 5.3 g/t Au, With Multiple Ore Shoots And New High-Grade Zone Identified" dated August 20, 2025.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/274733