Galway Metals Confirms Improved Au and Sb Recovery with Process Optimization

Rhea-AI Summary

Positive

- Gold extraction rates of 89-95% achieved in low-antimony samples

- Strong gold recovery of 85-94% in high-antimony mineralization

- Significant antimony recovery of 55-85% as potential valuable by-product

- Antimony prices have tripled from $5 to $15 per pound

- Large resource base of 922,000 oz Au Indicated and 1.334M oz Au Inferred

- Project contains over 25 million pounds of antimony as potential by-product

Negative

- Process requires secondary treatment of gold-antimony concentrate

- Lower gold recovery in high-antimony mineralization compared to low-antimony samples

News Market Reaction

On the day this news was published, GAYMF declined 2.54%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

TORONTO, ON / ACCESS Newswire / May 14, 2025 / Galway Metals Inc. (TSXV:GWM)(OTCQB:GAYMF) (the "Company" or "Galway") is pleased to report improved gold recovery, and the capture of antimony as a potential bi-product following the recent completion of Q1 2025 test work on diamond drill hole samples from the Southwest, South and North Deposits at the Company's

The Clarence Stream Gold Project has district-scale potential with approximately 65-kilometre strike length of highly prospective gold showings and anomalies; and a 2022 MRE of 12.4 Mt @ 2.3 g/t Au Indicated for 922,000 M ozs Au, and 16.0 Mt @ 2.6 g/t Au Inferred for 1.334 M ozs Au (at

Rob Hinchcliffe, President and CEO of Galway Metals, commented, "We're very encouraged by the strong gold recoveries from both low-grade and high-grade antimony mineralization at Clarence Stream, demonstrating the robustness of our new processing strategy. Working with Steve Haggarty, in just under a year we've made great progress advancing our hybrid flowsheet. These results highlight the potential to capture additional value from antimony. With two rigs drilling, we're focused on expanding high-quality gold ounces and improving metallurgical recoveries. Together, these efforts are building a stronger foundation to support future economic assessments of Clarence Stream."

Metallurgical Highlights

Gold extraction of 89

-95% achieved in samples with low antimony content (<100 ppm Sb) via direct cyanidationGold extraction of 85

-94% realized in high-antimony mineralization (up to5% Sb) using hybrid cyanidation-flotation processAntimony recoveries of 55

-85% achieved to a gold-antimony flotation concentrate suitable for off-site processing

Studies to Improve Overall Gold Recovery and Target Antimony Recovery

Recent test work evaluated a novel hybrid process configuration that is applicable to all material types within the deposit over a range in Au, Sb and sulfide content. Realized Au recoveries varied from 85 to

This is particularly significant given Clarence Stream hosts over 25 million pounds of antimony (2022 MRE), and recent Chinese export restrictions have driven antimony prices up from roughly US

The process strategy maximizes Au recovery to doré bullion, with an ability to recover antimony to an Au-Sb concentrate for secondary processing. Associated test work was pursued by Galway Metals, involving Haggarty Technical Services (Burlington, Ontario), and was completed at SGS-Lakefield.

Process Metallurgy Optimization

The amenability of Clarence Stream mineralization to cyanidation has been confirmed with 89

The passivating influence of antimony on gold cyanidation is well known in the mining industry at antimony levels greater than 100 ppm Sb. The hybrid process scheme provides the flexibility required to pursue the recovery of soluble Au values in cyanidation, followed by cyanide destruction and the flotation of remnant values to a low tonnage gold-antimony concentrate for secondary processing. Secondary treatment of the gold-antimony concentrate is often pursued with off-site smelting. Alternatives for the Clarence Stream project could consider on-site, low pressure, low temperature alkaline sulfide leaching to yield incremental Au recovery to doré bullion, and a marketable crystalline sodium antimonate biproduct. As a technology, alkaline sulfide leaching has been successfully applied on an industrial scale since 1942 treating similar concentrates.

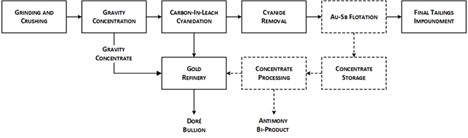

Depicted in the simplified process schematic, the hybrid process involves conventional technology, with a focus on maximizing Au recovery to doré bullion, while enabling the potential for bi-product recovery of Sb values from secondary treatment of an Au-Sb concentrate.

Additional test work is in progress by Galway Metals over a range in Sb head grade to confirm the potential upside and incremental Au and Sb recovery that could be expected from the hybrid process strategy which will benefit project financials.

Clarence Stream Project - simplified hybrid process schematic

Geology and Mineralization

The Clarence Stream deposits can be characterized as intrusion-related, structurally controlled, quartz-vein hosted gold deposits. These deposits consist of quartz veins and quartz stockwork within brittle-ductile fault zones that include adjacent crushed, altered wall rocks and veinlet material. The mineralized systems are hosted in intrusive and metasedimentary rocks within high strain zones controlled by regional fault systems. Pyrite, base metal sulphides, and stibnite occur in these deposits along with anomalous concentrations of bismuth, arsenic, antimony and tungsten. Alteration in the host rocks is confined within a few metres of quartz veins and occurs mainly in the form of sericitization and chloritization. A more complete description of Clarence Stream's geology and mineralization can be found at www.galwaymetalsinc.com.

New Brunswick Junior Mining Assistance Program

Galway would like to acknowledge financial support from the New Brunswick Junior Mining Assistance Program, which will contribute up to

Review by Qualified Person

Jesse Fisher, P.Geo., Project Manager for Galway Metals, is the Qualified Person who supervised the preparation of the scientific and technical disclosure in this news release on behalf of Galway Metals Inc. Metallurgical test work was reviewed and approved by Steve Haggarty, P. Eng., Managing Director of Haggarty Technical Services Corp.

Quality Control and Reports

All core, chip/boulder samples, and soil samples are assayed by Activation Laboratories, located at 41 Bittern Street, Ancaster, Ontario, Canada, Agat Laboratories, located at 5623 McAdam Road, Mississauga Ontario, Canada L4Z 1N9 and 35 General Aviation Road, Timmins, ON P4P 7C3, and/or Swastika Laboratories situated in Swastika, ON. All four labs have ISO/IEC 17025 accreditation. All core is under watch from the drill site to the core processing facility. Drill core is NQ size and sample intervals range from 0.5 meters to 1.5 meters in length. All samples are assayed for gold by Fire Assay, with gravimetric finish, and other elements assayed using ICP. The Company's QA/QC program includes the regular insertion of blanks and standards into the sample shipments, as well as instructions for duplication. Standards, blanks and duplicates are inserted at one per 20 samples. Approximately five percent (

About Galway Metals Inc.

Galway Metals is a Canadian mineral exploration and development company focused on advancing its

For additional Information on Galway Metals Inc., Please contact:

Robert Hinchcliffe President & Chief Executive Officer

Telephone: 1-800-771-0680

Email: info@galwaymetalsinc.com

Website: www.galwaymetalsinc.com

Look us up on Facebook, Twitter or LinkedIn

Cautionary Statement

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Toronto Stock Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

This News Release includes certain "forward-looking statements" and "forward-looking information" which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company's objectives, goals or future plans, information with respect to the OTCQB listing, DTC eligibility, and broadening U.S. institutional and retail investors.

Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to changes in economic conditions or financial markets, political and competitive developments, operation or exploration difficulties, changes in equity markets, changes in exchange rates, fluctuations in commodity prices capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development, and those risks set out in the Company's public documents filed on SEDAR+ at sedarplus.ca. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

SOURCE: Galway Metals Inc.

View the original press release on ACCESS Newswire