Green Bridge Metals Enters LOI to Option Large Bulk Tonnage Copper-Nickel-PGE Serpentine Project, Duluth Complex, Minnesota, USA

Rhea-AI Summary

Green Bridge Metals (GBMCF) has entered into a non-binding Letter of Intent with Encampment Minerals to option the Serpentine Project in Minnesota, USA. The project hosts a significant copper-nickel sulphide deposit with a historical resource estimate of 277Mt @ 0.37% Copper and 0.12% Nickel (Inferred) and 22Mt @ 0.47% copper and 0.16% nickel (Indicated).

Under the LOI terms, Green Bridge can acquire up to 70% interest in the project by issuing $6M in shares and funding $25M in expenditures. The Serpentine Project is strategically located in the Mesabi Range mining district, with access to essential infrastructure including roads, railways, and power. Early metallurgical test work showed strong recoveries of 95.3% Cu and 81.6% Ni.

Positive

- Strategic acquisition opportunity in a major mining district with significant copper-nickel resources

- Strong metallurgical recoveries: 95.3% Cu and 81.6% Ni from early test work

- Excellent infrastructure access including roads, railways, and power

- Low strip ratio with near-surface mineralization, potentially improving project economics

- Nine new exploration drill pads already permitted for 2025-26 season

Negative

- Non-binding LOI requires significant capital commitment ($25M in expenditures and $6M in shares) to earn 70% interest

- Historical resource estimate needs to be verified and updated

- Project requires additional work to reach pre-feasibility level

News Market Reaction

On the day this news was published, GBMCF declined 61.06%, reflecting a significant negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Option LOI coincides with the announcement of the Administration's Executive Order: "Immediate Measures to Increase American Mineral Production"

VANCOUVER, BC / ACCESS Newswire / May 8, 2025 / Green Bridge Metals Corporation (CSE:GRBM)(OTCQB:GBMCF)(FWB:J48) (WKN: A3EW4S) ("Green Bridge" or the "Company") is pleased to announce it has entered into a non-binding Letter of Intent ("LOI") with Encampment Minerals, Inc. ("EMI) with respect to the Serpentine Project (the "Project") located in northern St Louis County, Minnesota, 5 km southeast of the town of Babbitt. The LOI was signed May 8th, 2025. The project hosts a magmatic copper-nickel sulphide deposit, as described in a historical National Instrument (NI) 43-101 ("NI 43-101") Mineral Resource Estimate ("Historical Estimate") which was completed in 2020, with a bulk tonnage Inferred Resource of 277Mt @

Under the LOI, the parties will negotiate with a view to entering into a definitive agreement upon which Green Bridge would have the option to acquire up to a

Green Bridge would earn a

50% interest by issuing$2,000,000 worth of Green Bridge shares to EMI and funding expenditures equal to$10,000,000 within two years of entering the option agreement ("Closing Date")Green Bridge would earn an additional

20% interest, for a total interest of70% , by issuing an additional$4,000,000 worth of Green Bridge shares to EMI, and by funding additional expenditures in the amount of$15,000,000

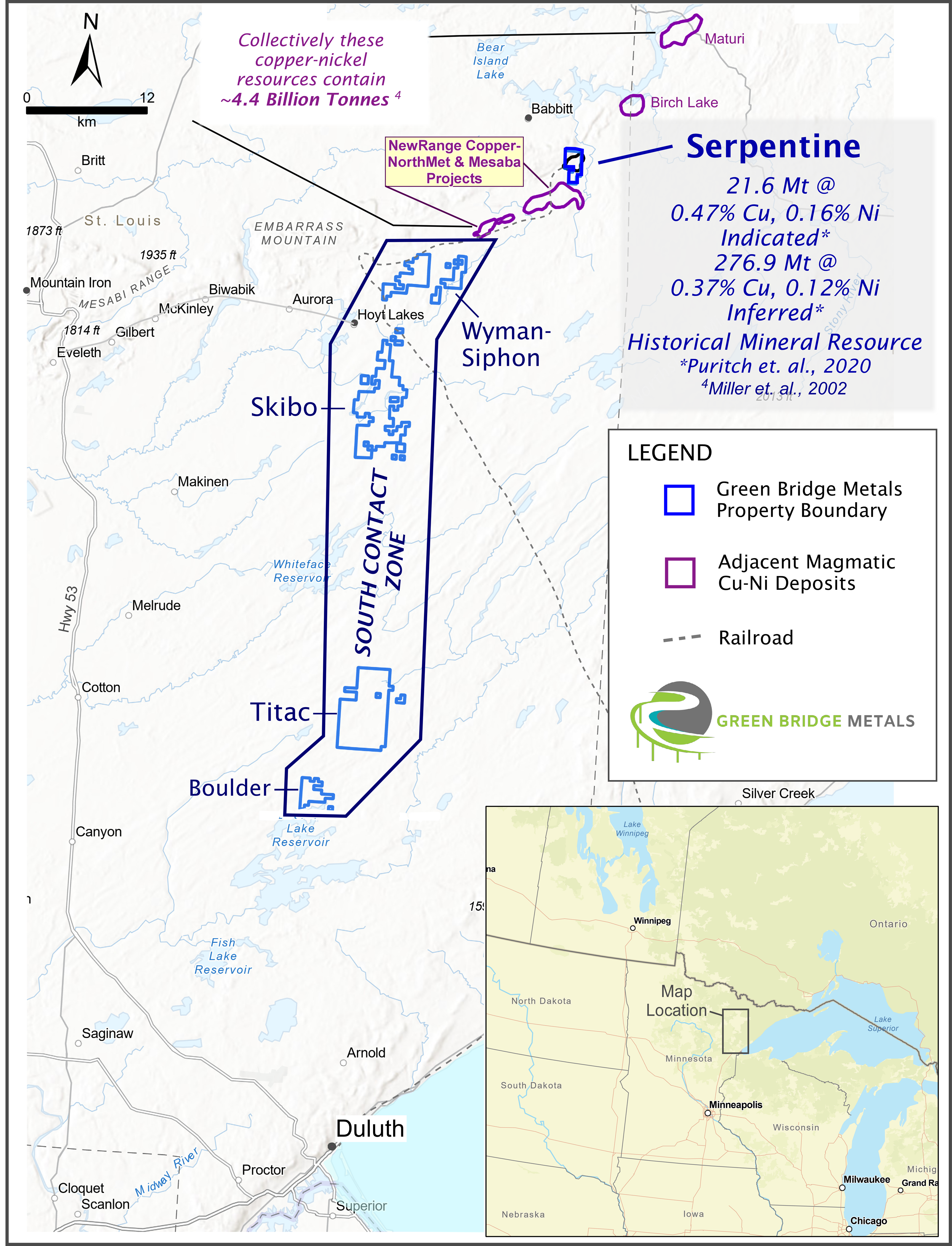

The Serpentine Project is located in the Mesabi Range mining district, along trend with several well-known significant deposits such as Maturi (1.8 Billion tonnes) (Barber et. al, 2014) and Mesaba (2.2 Billion tonnes) (Welhener and Crowie 2022) (Figure 1) and has access to roads, railways, and power immediately adjacent to the Project. The Company believes that an option in respect of the Serpentine Project would be a cornerstone for rapid value creation and will complement the existing high-potential exploration portfolio along the South Contact Zone.

* The estimates by Puritch et al. (2020) in this new release were completed to current CIM standards and use current classifications; however, they were completed on behalf of another issuer and have not been reviewed in the context of current metal prices and mining/processing costs and therefore are all considered historical in nature. A QP has not done sufficient work to evaluate these resources as current resources.

David Suda, CEO, stated: "Green Bridge is aggressively pursuing copper-nickel and other critical metals as set forth in our strategic plan since 2022. The potential for an option on the Serpentine Copper-Nickel asset in Minnesota, USA is a rare opportunity highlighting the company's technical and strategic acumen. Green Bridge's partnership with EMI and the Gilliam family, is rapidly growing from the existing exploration potential of the South Contact Zone to now potentially include the Serpentine Project. The geopolitical backdrop ensuing from recent announcements by The US Government is a major tailwind for American mining. Adding Serpentine to the Green Bridge portfolio will, we believe, put shareholders in a unique position of strength and leverage to rising commodity prices."

Figure 1. Location map for projects operated by Green Bridge Metals, including Serpentine. Also included are representative polygons for significant adjacent deposits.

Highlights of the Serpentine Deposit are:

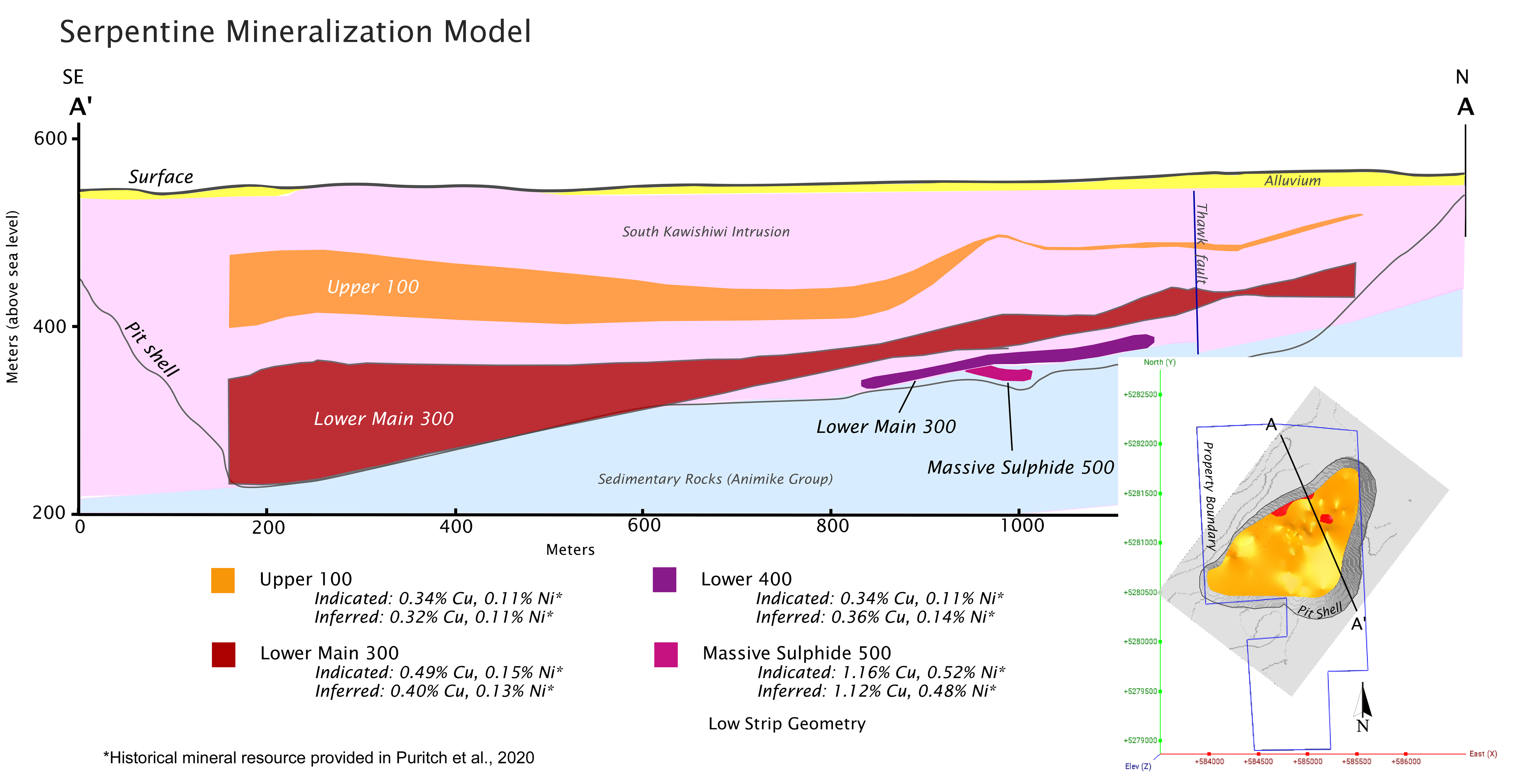

Low strip ratio with near surface mineralization exhibiting shallow dipping geometry that has the potential to contribute significantly to project economics (Figure 2).

Strong metallurgical recoveries underpinned by early metallurgical test work from a 2012 Scoping Study completed by EMI (referenced in Puritch et al. 2020) using flotation, which indicated high recoveries of copper and nickel at

95.3% Cu and81.6% Ni respectively.Project has access to infrastructure As the Project exists in the heart of a long-live mining jurisdiction, railways, roadways, processing facilities and other infrastructure are in good condition (Figure 3). In addition, the progress of adjacent deposits toward mine permitting and recent statements by the U.S. Administration trend toward a positive path forward for permitting at Serpentine. At present, the Minnesota Department of Natural Resources has permitted nine new exploration drill pads at the Serpentine project for the 2025-26 season which provides a solid pathway toward activities required for an envisaged Pre-Feasibility level study.

Figure 2: Simplified schematic cross-section (A-A') representing the intrusion that hosts mineralization as well as the footwall sedimentary rocks that host some of the relatively higher grade sulphide veins. The inset map shows the model of the resource in map view as well as the historical pit shell location relative to the project boundary, all labeled.

The full historical resource table is provided in a table at the end of this new release (Table 1).

Figure 3: Aerial image of the Serpentine deposit location (green circle) near the edge of the taconite mine pit. Active infrastructure (roads, railway, etc.) is evident in photo.

Suda further stated: "The Serpentine land position is strategically located in a region of rare geological endowment and vast infrastructure including power, roads, rail and seaports. Located adjacent to the NewRange Copper deposits, the Serpentine Copper-Nickel project could be a highly accretive cornerstone for Green Bridge."

References:

Barber, J., Parker H., Frost, D., Hartley, J., White, T., Martin, C., Sterrett, R., Poeck, J., Eggleston, T., Gormely, L., Allard, S., Annavarapu, S., Radue, T., Malgesini, M., Pierce, M. 2014. TWIN METALS MINNESOTA PROJECT ELY, MINNESOTA, USA NI 43-101 TECHNICAL REPORT ON PRE-FEASIBILITY STUDY. Duluth Metals. Project # 176916. 20 August 2014. p. 283

Welhener, H., Crowie, S., 2022. MESABA PROJECT FORM 43-101F1 TECHNICAL REPORT MINERAL RESOURCE STATEMENT, ST LOUIS COUNTY, MINNESOTA. Polyment Mining. Independent Mining Consultants Inc. 28 November 2022. p. 141.

Puritch, E, et al. 2020. TECHNICAL REPORT AND MINERAL RESOURCE ESTIMATE ON THE SERPENTINE COPPER-NICKEL PROPERTY, ST. LOUIS COUNTY, NORTHEASTERN MINNESOTA,U.S.A, Encampment Minerals Inc. Ni43-101 and 43-101F1 Technical Report. P&E Mining Consultants Inc. Report 385. September 4, 2020.

Miller Jr, J. D., Green, J. C., Severson, M. J., Chandler, V. W., Hauck, S. A., Peterson, D. M., & Wahl, T. E. 2002. GEOLOGY AND MINERAL POTENTIAL OF THE DULUTH COMPLEX AND RELATED ROCKS OF NORTHEASTERN MINNESOTA. University of Minnesota. Report of Investigations 58. 207p

TABLE 1 | ||||||

PIT-CONSTRAINED MINERAL RESOURCE AT | ||||||

Pit Area Classification | Tonnes (k) | Cu (%) | Ni (%) | Co (%) | S (%) | Cu-Eq (%) |

Upper 100 | ||||||

Indicated | 11,582 | 0.34 | 0.11 | 0.01 | 1.39 | 0.50 |

Inferred | 119,847 | 0.32 | 0.11 | 0.008 | 1.69 | 0.47 |

Lower 300 | ||||||

Indicated | 7,859 | 0.49 | 0.15 | 0.013 | 2.71 | 0.73 |

Inferred | 151,597 | 0.4 | 0.13 | 0.007 | 2.31 | 0.59 |

Lower 400 | ||||||

Indicated | 354 | 0.34 | 0.11 | 0.004 | 1.42 | 0.49 |

Inferred | 5,029 | 0.46 | 0.14 | 0.003 | 3.97 | 0.66 |

Massive Sulphide 500 | ||||||

Indicated | 1,774 | 1.16 | 0.52 | 0.051 | 13.57 | 2.08 |

Inferred | 445 | 1.12 | 0.48 | 0.055 | 12.91 | 1.98 |

Total | ||||||

Indicated | 21,568 | 0.47 | 0.16 | 0.014 | 2.87 | 0.72 |

Inferred | 276,918 | 0.37 | 0.12 | 0.008 | 2.09 | 0.54 |

Table 1. Historical Pit-Constrained Mineral Resource Estimate as provided by Puritch et al (2020)

Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

The Mineral Resources in this Technical Report were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

No Mineral Resources are classified as Measured.

Totals may not sum due to rounding.

Cut-off = NSR

$8.50 /t; Cu-Equivalent (Cu-Eq)% =NSR/49.92.Cu = copper, CuEq = copper equivalent, Ni = nickel, Co = cobalt, S = sulphur, NSR = net smelter return.

The Historical Estimate states that it was prepared pursuant to NI 43-101 and in conformity with generally accepted "CIM Estimation of Mineral Resource and Mineral Reserves Best Practices" guidelines. Mineral Resources have been classified in accordance with the "CIM Standards on Mineral Resources and Reserves: Definition and Guidelines". The historical Technical Report was done by a professional and well-respected agent in 2020, and the Company feels that the historical estimates produced by the author of that report are reliable and relevant to the deposit. The Company plans to conduct independent sampling of historically drilled core, as well as a site visit to verify drill hole location in order to independently verify results published in the historic Technical Report. At this time, the Company has had an independent group review the resource model and verify the validity of the results published in the historical Technical Report, giving the Company confidence in the historical resource values stated here. The Company will produce a new NI 43-101 Technical Report, which will include an independently prepared resource estimate that accurately reflects current market conditions.

A qualified person has not done sufficient work to classify the Historical Estimate as current mineral resources, and the Company is not treating the Historical Estimate as current mineral resources.

With respect to adjacent and regional projects, the Company clarifies that such disclosures relate solely to adjacent and regional projects in which the Company does not hold an interest, and that there can beno assurance that the Company will obtain similar information from its own projects regardless of proximity, nor is the Company implying that it will obtain similar results on its own projects.

All scientific and technical information, and written disclosure in this news release has been prepared or approved by Ajeet Milliard, Ph.D., CPG, Chief Geologist for Green Bridge Metals and a qualified person (QP) for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Green Bridge Metals

Green Bridge Metals Corporation is a Canadian based exploration company focused on acquiring 'critical mineral' rich assets and the development of the South Contact Zone (the "Property") along the basal contact of the Duluth Complex, north of Duluth, Minnesota. The South Contact Zone contains bulk-tonnage copper-nickel and titanium-vanadium in ilmenite hosted in ultramafic to oxide ultramafic intrusions. The Property has exploration targets for bulk-tonnage Ni mineralization, high grade Ni-Cu-PGE magmatic sulfide mineralization and titanium.

ON BEHALF OF GREEN BRIDGE METALS,

"David Suda"

President and Chief Executive Officer

For more information, please contact:

David Suda

President and Chief Executive Officer

Tel: 604.928-3101

investors@greenbridgemetals.com

Forward Looking Information

Certain statements and information herein, including all statements that are not historical facts, contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Such forward-looking statements or information include but are not limited to statements or information with respect to: the negotiation and completion of a definitive agreement and closing of the option to acquire the Serpentine Project; exploration and development of the Serpentine Project, and the potential for further exploration or development of the Project.

Although management of the Company believe that the assumptions made and the expectations represented by such statements or information are reasonable, there can be no assurance that forward-looking statements or information herein will prove to be accurate. Forward-looking statements and information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These risk factors include, but are not limited to: a definitive agreement and closing of the option to acquire the Serpentine Project may not occur as currently contemplated, or at all; the exploration and development of the Serpentine Project may not result in any commercially successful outcome for the Company; risks associated with the business of the Company; business and economic conditions in the mining industry generally; changes in general economic conditions or conditions in the financial markets; changes in laws (including regulations respecting mining concessions); and other risk factors as detailed from time to time.

The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE: Green Bridge Metals Corporation

View the original press release on ACCESS Newswire