GFG Drills High-Grade Gold at Aljo including 6.62 g/t Gold over 11.2 m Confirms Continuity and Expands HW Zone at Depth

Rhea-AI Summary

GFG Resources (OTCQB: GFGSF) has reported significant drilling results from its Aljo Mine Target in Ontario's Timmins Gold District. Key highlights include intersection ALJ-24-020 yielding 32.70 g/t Au over 0.5m and 6.62 g/t Au over 11.2m, while ALJ-24-017 returned 1.74 g/t Au over 13.2m near surface.

The drilling program has successfully extended the Hangingwall (HW) and Main Zones both at depth and near surface, with the strike length of the Aljo system now reaching 600m. The company completed 12 holes totaling 2,600m in late 2024 and early 2025, with results pending for an additional 9 drill holes.

A follow-up 4,000m drill program is planned for the second half of 2025. Additionally, GFG has launched an inaugural drill program at the Muskego target area, completing 8 of 10-12 planned holes totaling 2,021m, supported by sonic till sampling and an IP survey.

Positive

- High-grade gold intersections with significant grades (32.70 g/t Au over 0.5m)

- Successful extension of mineralized zones with 600m strike length

- Strong continuity observed in Hangingwall Zones

- Multiple new zones of gold mineralization discovered with visible gold

Negative

- Results for 9 additional drill holes still pending

- Follow-up drilling program delayed until second half of 2025

News Market Reaction

On the day this news was published, GFGSF gained 5.46%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

KEY HIGHLIGHTS:

- ALJ-24-020 intersected multiple high-grade intervals returning 32.70 grams of gold per tonne (“g/t Au”) over 0.5 metres (“m”) and 6.62 g/t Au over 11.2 m including 7.24 g/t Au over 10.2 m.

- ALJ-24-017 returned a broad gold zone near-surface in the Hangingwall (“HW”) Zone of 1.74 g/t Au over 13.2 m including 24.20 g/t Au over 0.5 m, and expanded the Footwall (“FW”) Zones down to 430 m with 1.51 g/t Au over 5.2 m including 4.68 g/t Au over 1.5 m.

- ALJ-24-018 demonstrated the stacked vein nature of the system with highlights of 4.13 g/t Au over 5.2 m including 8.98 g/t Au over 2.2 m, and 5.90 g/t Au over 1.4 m, extending the strike length of the Aljo system to 600 m and supporting an extension to the east.

- Pending results for an additional 9 drill holes at Aljo, an aggressive follow-up drill program will commence in the second half of 2025 focused on targeting the depth and strike extensions of the FW, Main and HW Zones.

- Inaugural drill program at Muskego is on-going, testing several targets with the goal of making a new greenfield discovery. Additional target development is being supported by a broad sonic till sampling program and an Induced Polarization (“IP”) survey over the Muskego target area.

SASKATOON, Saskatchewan, March 17, 2025 (GLOBE NEWSWIRE) -- GFG Resources Inc. (TSXV: GFG) (OTCQB: GFGSF) (“GFG” or the “Company”) reports assay results from on-going drill programs at its

Brian Skanderbeg, CEO and President of GFG stated, “We are very pleased with the results from our recent drill program at Aljo, particularly in the successful extension of the HW and Main Zones both at depth and near surface. The strong continuity observed in the HW Zones, which remains open, is an exciting growth opportunity at shallow depths. In addition, the convergence of multiple vein orientations in the promising footwall environment near the Kingswood shear reinforces the potential of the gold system at depth and paves the way for further exploration. Further drilling in the Main, HW, and FW Zones, as well as the North West target area, yielded multiple veined intervals that are at the lab pending assay, boosting our confidence to continue to aggressively advance Aljo.”

Skanderbeg added, “We made significant progress at the new Muskego target area in the first quarter with the construction of multiple roads and drill pads that allowed us to test several greenfield targets of which we have now completed 8 of the proposed 10-12 hole program. In addition to the drill program, we completed a sonic till sampling program and are currently completing a significant IP survey over the majority of the Muskego target area.”

Drilling Overview

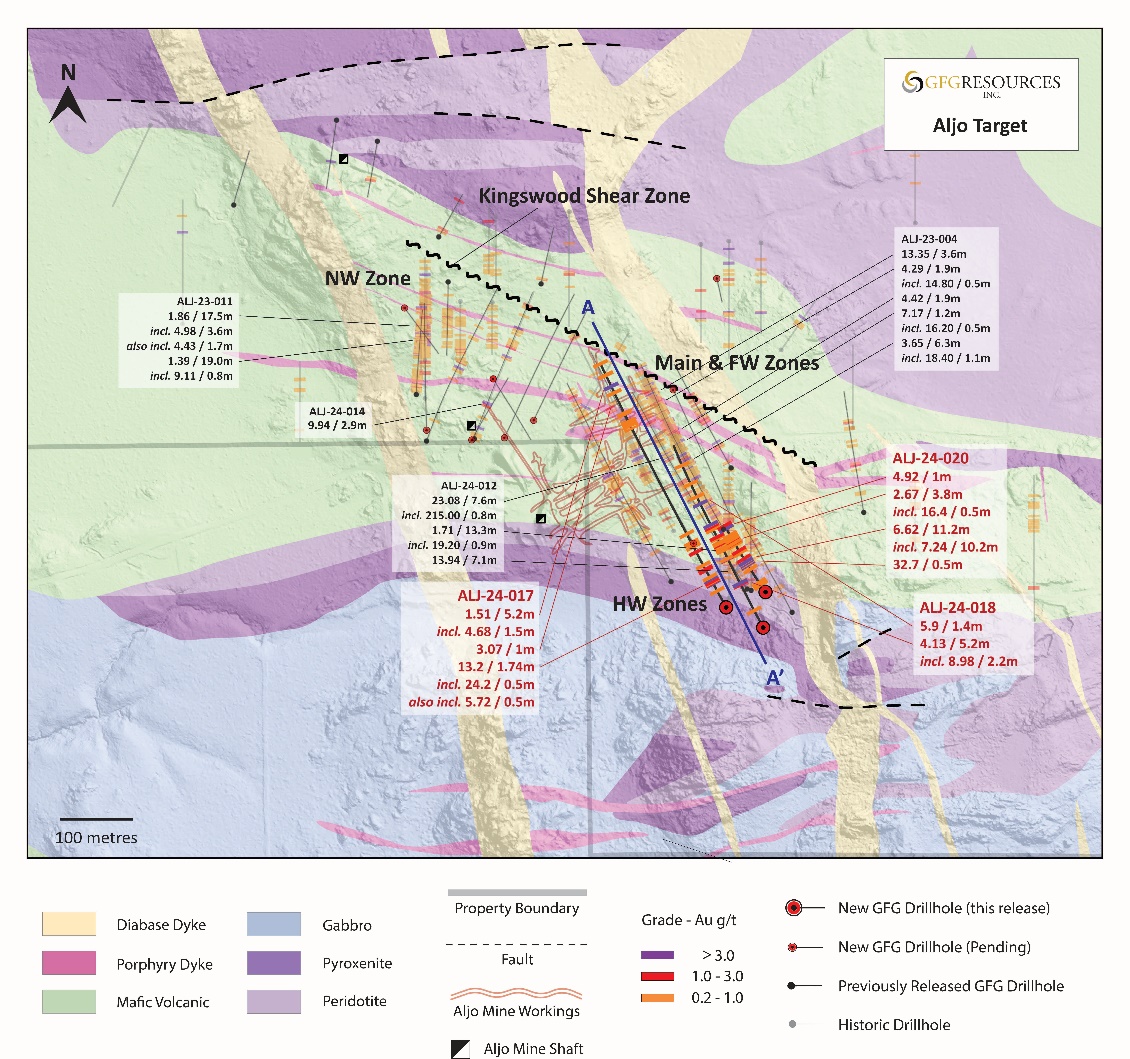

In late 2024 and early 2025, the Company completed a total of 12 holes (2,600 m) focused on testing the downdip and lateral extensions at Aljo and completed step-out holes that tested the North West target (See Figures 2-4 and Table 1). Drilling was successful in expanding known mineralized zones and identifying new zones of gold mineralization which host significant visible gold. Follow-up drilling at Aljo is planned to start in the second half of 2025 with approximately 4,000 m.

ALJ-24-017

This hole was successful in demonstrating continuity of the HW and FW Zones within the Aljo gold system. The HW Zone yielded an intercept of 1.74 g/t Au over 13.2 m including 24.2 g/t Au over 0.5 m and 5.72 g/t Au over 0.5 m. This zone represents a 30 m step-out from previous drilling showing good continuity of the quartz-carbonate veins with coarse visible gold. The Main Zone was observed yielding a lower grade zone of 0.81 g/t Au over 4.3 m. A FW Zone grading 1.51 g/t Au over 5.2 m including 4.68 g/t Au over 1.5 m was intersected, successfully extending the FW zone down-dip and along strike by 55 m from a previously drilled high-grade intercept of 13.35 g/t Au over 3.6 m in ALJ-23-004 (see release dated February 15, 2024).

ALJ-24-018

This hole is the deepest drilled to date at Aljo and successfully extended the HW Zone down-dip by 50 m yielding an intercept of 4.13 g/t Au over 5.2 m including a high-grade interval of 8.98 g/t Au over 2.2 m at a vertical depth of 115 m. This zone generally lies along the mafic-ultramafic contact, consistent with what is observed in other drill intercepts and surface trenches. The Main zone intercept of 5.9 g/t Au over 1.4 m successfully extends the gold mineralization by 100 m down-dip from the previously drilled high-grade intercept of 23.08 g/t Au over 7.6 m in ALJ-24-012 (see release dated August 19, 2024).

ALJ-24-020

An important part of the Aljo drill program was to investigate the overall continuity of the HW Zone with 25-50 m step-outs. This hole was successful in yielding one of the highest gram-metre products ever at Aljo yielding a zone of 6.62 g/t Au over 11.2 m including 7.24 g/t Au over 10.2 m with coarse visible gold. This zone represents a 25 m step-out from the previously released high-grade zone of 13.94 g/t Au over 7.1 m in ALJ-24-012 (see release dated August 19, 2024) showing a similar gram-metre product and extending the zone to the east. Additional moderate to high-grade intervals within the greater HW Zone also yielded zones of 32.7 g/t Au over 0.5 m, 2.67 g/t Au over 3.8 m including 16.4 g/t Au over 0.5 m and 4.92 g/t Au over 1.0 m.

All mineralized zones continue to show strong spatial association to early feldspar porphyry dykes and strongly-altered mafic volcanic stratigraphy. The HW Zone, which shows the thickest zones to-date, is unique in that it generally lies along or proximal to the mafic-ultramafic contact near the south margin of the Aljo gold system. Gold mineralization is typically observed in quartz-carbonate veins with 1

Anders Carlson, Vice President, Exploration commented, “We are very pleased to see continued high-grade intercepts at Aljo, where all zones have been extended successfully to depth in a system adjacent to significant mining infrastructure in the Timmins Gold Camp. At Muskego, it’s exciting to see first drillcore from a portion of the Western Abitibi Greenstone Belt that has seen no exploration, and where we expect to generate positive results and new targets across this highly prospective region.”

Table 1: Aljo Mine Target Assay Results (1)

| Hole ID | From (m) | To (m) | Length (m) | Au (g/t) | Zone | Visible Gold |

| ALJ-24-017 | 45.8 | 59.0 | 13.2 | 1.74 | Aljo HW | VG |

| incl. | 45.8 | 46.3 | 0.5 | 24.20 | Aljo HW | VG |

| also incl. | 54.5 | 55.0 | 0.5 | 5.72 | Aljo HW | VG |

| and | 71.5 | 74.5 | 3.0 | 1.74 | Aljo HW | |

| and | 107.0 | 108.5 | 1.5 | 1.79 | Aljo HW | |

| and | 170.3 | 171.3 | 1.0 | 2.24 | Aljo HW | |

| and | 374.6 | 378.9 | 4.3 | 0.81 | Aljo Main | |

| and | 392.0 | 393.0 | 1.0 | 3.07 | Aljo FW | |

| and | 426.0 | 431.2 | 5.2 | 1.51 | Aljo FW | |

| incl. | 426.0 | 427.5 | 1.5 | 4.68 | Aljo FW | |

| ALJ-24-018 | 115.5 | 120.7 | 5.2 | 4.13 | Aljo HW | VG |

| incl. | 118.5 | 120.7 | 2.2 | 8.98 | Aljo HW | VG |

| and | 183.2 | 186.0 | 2.8 | 2.16 | Aljo HW | |

| incl. | 184.2 | 185.2 | 1.0 | 3.84 | Aljo HW | |

| and | 214.1 | 227.8 | 13.8 | 0.43 | Aljo Main | |

| and | 272.9 | 274.3 | 1.4 | 2.26 | Aljo Main | |

| incl. | 273.4 | 274.3 | 0.9 | 3.33 | Aljo Main | |

| and | 327.2 | 328.7 | 1.4 | 5.90 | Aljo Main | |

| ALJ-24-020 | 49.3 | 49.8 | 0.5 | 32.70 | Aljo HW | VG |

| and | 70.7 | 81.9 | 11.2 | 6.62 | Aljo HW | VG |

| incl. | 71.7 | 81.9 | 10.2 | 7.24 | Aljo HW | VG |

| and | 109.5 | 111.0 | 1.5 | 1.92 | Aljo HW | |

| and | 129.5 | 133.3 | 3.8 | 2.67 | Aljo HW | VG |

| incl. | 132.2 | 132.7 | 0.5 | 16.40 | Aljo HW | VG |

| and | 137.5 | 142.0 | 4.5 | 0.85 | Aljo HW | |

| and | 167.0 | 168.0 | 1.0 | 4.92 | Aljo HW |

*Drill intercepts are presented using a 0.20 g/t Au cut-off and as drilled length with a minimum 1 gram-metre product. Composites include internal dilution of up to 3 m at grades less than 0.20 g/t Au. Included intervals are calculated using a 3 g/t cut-off at a minimum 1 gram-metre product unless otherwise stated. True width is estimated to be 30 to 90% drilled length.

Muskego Update

In February, the Company launched its inaugural drill program to test several greenfield targets across the 30 square kilometre Muskego target area. To date, the Company has tested 3 targets with 8 holes totaling 2,021 m. Drilling is on-going with the plan of completing up to 4 more holes. All assay results remain pending and will be announced once received.

In addition to the drilling program, GFG has completed a sonic drill program focused on the western portion of the Muskego target area. The purpose of the sonic drill program is to gain till and bedrock samples to generate additional drill targets in this underexplored region. Further, the Company is currently completing a 54 line-kilometre IP survey over the main portion of the Muskego target. The IP survey will support exploration efforts by refining current targets and potentially outline new targets.

All three programs are expected to be completed by Apil 2025. Following receipt of all the results from these programs, the Company will analyze and refine targets with the objective of resuming exploration activities in the second half of 2025.

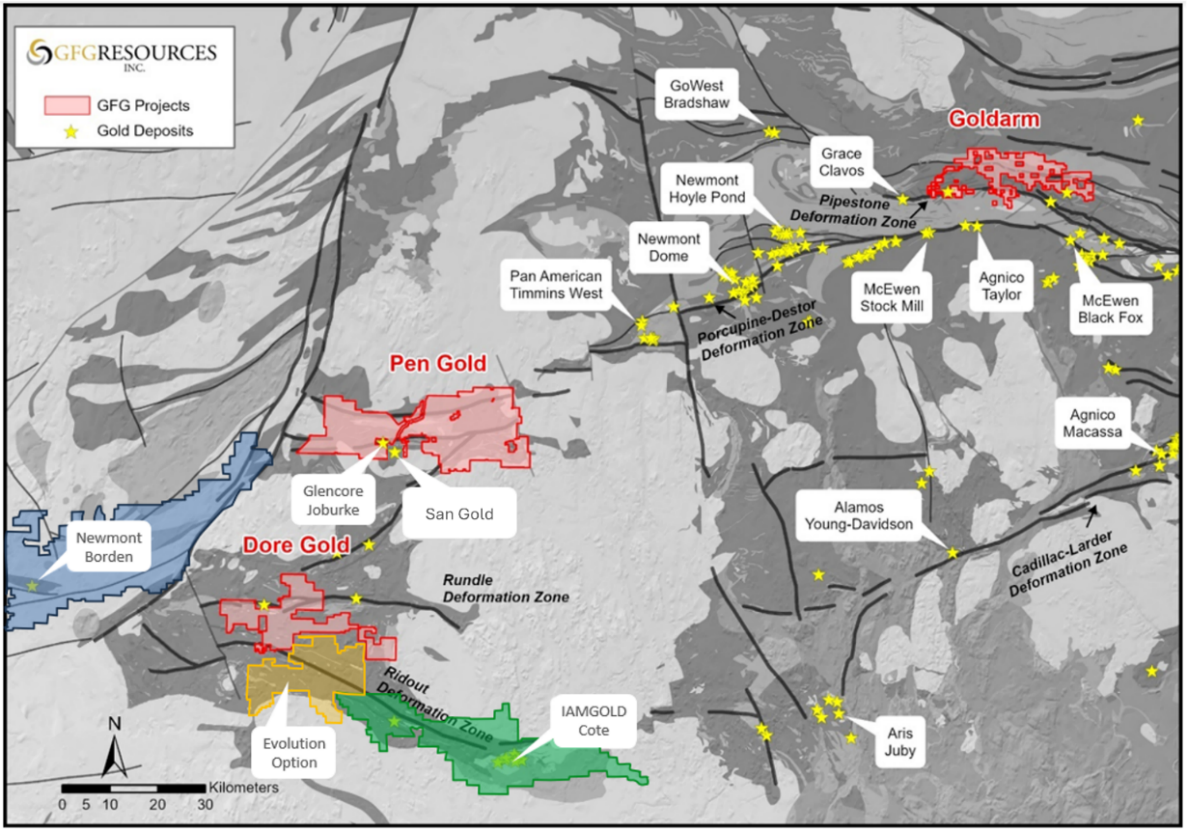

Figure 1: Regional Map of GFG Gold Projects in the Timmins Gold District

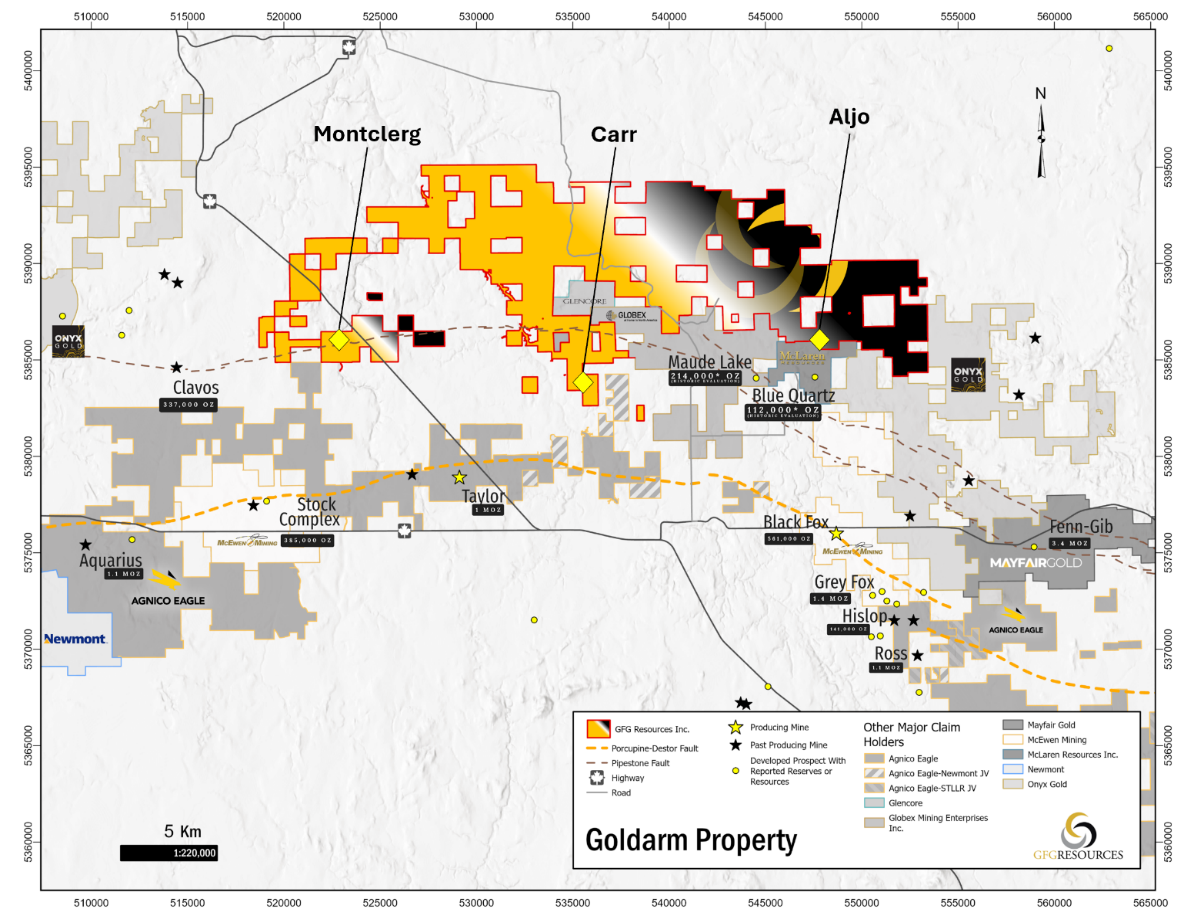

Figure 2: Goldarm Property Plan View Map

Figure 3: Aljo Target Plan View Map(2)

Figure 4: Aljo Target Cross Section(2)

About GFG Resources Inc.

GFG is a North American precious metals exploration company focused on district scale gold projects in tier one mining jurisdictions. The Company operates three gold projects, each hosting large and highly prospective gold properties within the prolific gold district of Timmins, Ontario, Canada. The projects have similar geological settings that host most of the gold deposits found in the Timmins Gold Camp which have produced over 70 million ounces of gold.

For further information, please contact:

Brian Skanderbeg, President & CEO

or

Marc Lepage, Vice President, Business Development

Phone: (306) 931-0930

Email: info@gfgresources.com

Website: www.gfgresources.com

Stay Connected with Us

X (Twitter): @GFGResources

LinkedIn: https://www.linkedin.com/company/gfgresources/

Facebook: https://www.facebook.com/GFGResourcesInc/

Footnote:

(1) Drill intercepts are historical and GFG’s QP has not verified the laboratory accreditation, analytical method, sample size or QA/QC procedures utilized for the historic drill results. True widths have not been estimated.

(2) Historical drill intercepts are referenced from the 1989 Kingswood Explorations Ltd. assessment report # 42A09NW0568 authored by Ken Lapierre.

Sampling and Quality Control

All scientific and technical information contained in this press release has been prepared under the supervision of Anders Carlson, P.Geo. and Vice President, Exploration of GFG, a qualified person within the meaning of National Instrument 43-101.

Drill core samples are being analyzed for gold by Activation Laboratories Ltd. in Timmins, Ontario. Gold analysis consists of the preparation of a 500-gram pulp and an assay of a 50-gram aliquot by Pb collection fire assay with an Atomic Absorption Spectrometry finish (Package 1A2-50. Samples assaying above 5 ppm Au are routinely re-run using a gravimetric finish (Package 1A3-50). Selected samples are also undergoing multi-element analysis for 59 other elements using a four-acid digestion and an ICP-MS finish (Package MA250) by Bureau Veritas Commodities Canada Ltd. in Vancouver, British Columbia. Quality control and assurance measures include the monitoring of results for inserted certified reference materials, coarse blanks and preparation duplicates of drill core.

Drill intercepts are presented using a 0.20 g/t Au cut-off and as drilled length. Composites include internal dilution of up to 3 m at grades less than 0.2 g/t Au. True width is estimated to be 30 to

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

All statements, other than statements of historical fact, contained in this news release constitute “forward-looking information” within the meaning of applicable Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (referred to herein as “forward-looking statements”). Forward-looking statements include, but are not limited to, the Company’s future exploration plans with respect to its property interests and the timing thereof, the prospective nature of the projects, future price of gold, success of exploration activities and metallurgical test work, permitting time lines, currency exchange rate fluctuations, requirements for additional capital, government regulation of exploration work, environmental risks, unanticipated reclamation expenses, title disputes or claims and limitations on insurance coverage. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes”, or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results, “may”, “could”, “would”, “will”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof.

All forward-looking statements are based on various assumptions, including, without limitation, the expectations and beliefs of management, the assumed long-term price of gold, that the Company will receive required permits and access to surface rights, that the Company can access financing, appropriate equipment and sufficient labour, and that the political environment within Canada will continue to support the development of mining projects. In addition, the similarity or proximity of other gold deposits to the Company’s projects is not necessary indicative of the geological setting, alteration and mineralization of the Goldarm Property, the Pen Gold Project and the Dore Gold Project.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of GFG to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: actual results of current exploration activities; environmental risks; future prices of gold; operating risks; accidents, labour issues and other risks of the mining industry; availability of capital, delays in obtaining government approvals or financing; and other risks and uncertainties. These risks and uncertainties and the additional risks described in the Company’s most recently filed annual and interim MD&A are not and should not be construed as being exhaustive.

Although GFG has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. In addition, forward-looking statements are provided solely for the purpose of providing information about management’s current expectations and plans and allowing investors and others to get a better understanding of our operating environment. Accordingly, readers should not place undue reliance on forward-looking statements.

Forward-looking statements in this news release are made as of the date hereof and GFG assumes no obligation to update any forward-looking statements, except as required by applicable laws.

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/ca7dc118-2870-41ff-b132-da638f9f8b03

https://www.globenewswire.com/NewsRoom/AttachmentNg/b829ec1f-103a-409a-a913-23d8209ba749

https://www.globenewswire.com/NewsRoom/AttachmentNg/0490077f-d657-4d89-8115-42ec63466984

https://www.globenewswire.com/NewsRoom/AttachmentNg/2152c841-c81c-48c4-82fb-e425b104a8e3