Greenheart Gold Confirms Gold Mineralization at Majorodam and Provides an Exploration and Project Update

Greenheart Gold (OTCQX: GHRTF) reported results from an 11-hole diamond drill program (2,335.6 m) at Majorodam, Suriname, confirming a north–south mineralized system at Heuvel Main that extends at least 800 m and a second zone, Heuvel East, ~500 m long. Highlight intercepts include 11.5 m @ 1.34 g/t Au (incl. 5.0 m @ 2.77 g/t) and other intervals noted in the release. The company began a 3,000 m trenching program at Tosso Creek and completed extensive soils defining a >5 km anomaly. Greenheart entered an option to acquire 100% of Gold Hill (≈40 km2) in Guyana and dropped Tamakay and Abuya options. Further drilling at Majorodam is planned before end-November 2025.

Greenheart Gold (OTCQX: GHRTF) ha riportato i risultati di un programma di trivellazione con diamante di 11 pozzi (2.335,6 m) a Majorodam, Suriname, confermando un sistema mineralizzato nord-sud presso Heuvel Main che si estende almeno 800 m e una seconda zona, Heuvel East, lunga circa 500 m. Tra i giacimenti di rilievo ci sono 11,5 m a 1,34 g/t Au (inclusi 5,0 m a 2,77 g/t) e altre interintervalle menzionate nel comunicato. L'azienda ha avviato un programma di tracciamento di 3.000 m a Tosso Creek e ha completato estese definizioni di suolo che identificano una anomalia di circa 5 km. Greenheart ha stipulato un'opzione per acquisire il 100% di Gold Hill (circa 40 km2) in Guyana e ha rinunciato alle opzioni Tamakay e Abuya. Ulteriori trivellazioni a Majorodam sono previste entro la fine di novembre 2025.

Greenheart Gold (OTCQX: GHRTF) informó resultados de un programa de perforación con diamante de 11 hoyos (2.335,6 m) en Majorodam, Surinam, confirmando un sistema mineralizado norte-sur en Heuvel Main que se extiende al menos 800 m y una segunda zona, Heuvel East, de aproximadamente 500 m de longitud. Los interceptos destacados incluyen 11,5 m a 1,34 g/t Au (incluido 5,0 m a 2,77 g/t) y otros intervalos mencionados en el comunicado. La compañía inició un programa de zanjas de 3.000 m en Tosso Creek y completó definiciones de suelos extensas que identifican una anomalía de ~5 km. Greenheart pactó una opción para adquirir el 100% de Gold Hill (≈40 km2) en Guyana y descartó las opciones Tamakay y Abuya. Se planifican más perforaciones en Majorodam antes de finales de noviembre de 2025.

Greenheart Gold (OTCQX: GHRTF)는 Suriname의 Majorodam에서 11구멍의 다이아몬드 드릴 프로그램(2,335.6 m) 결과를 발표했으며 Heuvel Main에서 북-남 방향의 광물화 시스템이 확인되었고 최소 800 m 확장되며 두 번째 구역인 Heuvel East가 약 500 m 길이로 존재함을 확인했다. 하이라이트 인터셉트로는 11.5 m @ 1.34 g/t Au (포함된 5.0 m @ 2.77 g/t) 등이 있으며 보도자료에 언급된 다른 간격도 있습니다. 회사는 Tosso Creek에서 3,000 m 규모의 트렌칭 프로그램을 시작했고 약 5 km의 이상(이상)을 정의하는 광물시 정의를 완료했습니다. Greenheart는 Guyana의 Gold Hill(약 40 km2) 전체를 취득할 수 있는 옵션을 체결했고 Tamakay와 Abuya 옵션은 포기했습니다. Majorodam에 대한 추가 드릴링은 2025년 11월 말 이전에 계획되어 있습니다.

Greenheart Gold (OTCQX: GHRTF) a publié les résultats d'un programme de forage diamanté de 11 puits (2 335,6 m) à Majorodam, Suriname, confirmant un système minéralisé nord-sud à Heuvel Main qui s'étend sur au moins 800 m et une seconde zone, Heuvel East, d'environ 500 m de longueur. Les puits marquants incluent 11,5 m à 1,34 g/t Au (dont 5,0 m à 2,77 g/t) et d'autres intervalles mentionnés dans le communiqué. La société a lancé un programme de tranchage de 3 000 m à Tosso Creek et a effectué des définitions de sols étendues définissant une anomalie d'environ 5 km. Greenheart a conclu une option pour acquérir 100% de Gold Hill (environ 40 km2) en Guyana et a abandonné les options Tamakay et Abuya. D'autres forages sur Majorodam sont prévus avant fin novembre 2025.

Greenheart Gold (OTCQX: GHRTF) meldete Ergebnisse eines Diamond-Drill-Programms mit 11 Bohrlöchern (2.335,6 m) in Majorodam, Suriname, und bestätigte ein nord-südlich mineralisiertes System bei Heuvel Main, das sich mindestens über 800 m erstreckt, sowie eine zweite Zone, Heuvel East, etwa 500 m lang. HervorragendeIntercepts umfassen 11,5 m bei 1,34 g/t Au (einschließlich 5,0 m bei 2,77 g/t) und weitere Intervalle, die im Mitteilungsblatt genannt werden. Das Unternehmen begann ein 3.000 m langes Grabungsprogramm am Tosso Creek und hat umfangreiche Bodenuntersuchungen abgeschlossen, die eine ~5 km lange Anomalie definieren. Greenheart schloss eine Option ab, 100% von Gold Hill (ca. 40 km2) in Guyana zu erwerben, und verzichtete auf Tamakay- und Abuya-Optionen. Weitere Bohrungen in Majorodam sind vor Ende November 2025 geplant.

Greenheart Gold (OTCQX: GHRTF) أبلغت عن نتائج برنامج حفر ماسي من 11 بئراً (2,335.6 م) في Majorodam، سورينام، مؤكدة نظاماً معدنيًا شمال-جنوب في Heuvel Main يمتد على الأقل 800 م وموقع ثانٍ، Heuvel East، بطول نحو 500 م. تشمل الاعتراضات البارزة 11.5 م عند 1.34 ج/ط (تشمل 5.0 م عند 2.77 ج/ط) ومقاطع أخرى ذكرها البيان. بدأت الشركة برنامج خنادق بطول 3,000 م في Tosso Creek وأكملت تعريف التربة الواسعة التي تحدد منطقة شاذة بطول ~5 كم. دخلت Greenheart خياراً للاستحواذ على 100% من Gold Hill (حوالي 40 كم2) في غويانا وتركت خيارات Tamakay و Abuya. من المخطط إجراء مزيد من الحفر في Majorodam قبل نهاية نوفمبر 2025.

- Diamond drilling: 11 holes totalling 2,335.6 m

- Heuvel Main mineralized strike ≥800 m

- MAJD25-011: 11.5 m @ 1.34 g/t Au (incl. 5.0 m @ 2.77 g/t)

- Tosso Creek soil anomaly >5 km long

- 3,000 m trenching commenced at Tosso Creek

- Option to acquire 100% of Gold Hill (~40 km2)

- Some diamond drill grades did not match prior RC/trench results

- Structural complexity requires re-oriented drilling and modelling

- Tamakay and Abuya options dropped due to insufficient scale

- Mineralized intersections reported are not necessarily true widths

Diamond drilling at Majorodam, Suriname confirms the presence of a mineralized zone at least 800 m long at Heuvel Main in addition to a second zone at Heuvel East.

Greenheart Gold has entered into an option to acquire a

100% interest in the Gold Hill project in Guyana, and drops options on its Tamakay and Abuya projects.A 3,000 m trenching program has commenced on the Tosso Creek project in Suriname.

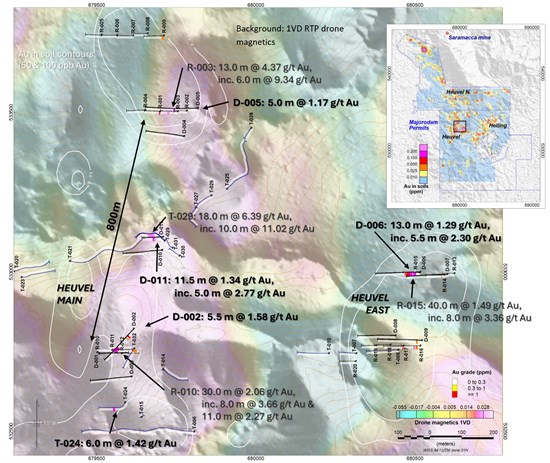

Longueuil, Québec--(Newsfile Corp. - November 10, 2025) - Greenheart Gold Inc. (TSXV: GHRT) (OTCQX: GHRTF) (the "Company" or "Greenheart Gold") is pleased to provide an update on the inaugural diamond drill program at its Majorodam project in Suriname, an update on exploration at its Tosso Creek project in Suriname, and updates on its exploration portfolio in Guyana. At Majorodam, which lies only 8 kilometers (km) south of Zijin's Saramacca mine, a satellite mine to Zijin's active Rosebel gold mine and mill, Greenheart Gold recently completed an 11-hole diamond drill program which totalled 2,335.6 meters (m). The program was designed to follow up and provide important additional geological and structural information on the four encouraging intercepts from Greenheart Gold's initial reverse circulation (RC) drilling completed in Q1 2025 and follow up on previously announced trench results. Two or three holes were drilled around each of these targets and results confirmed the presence of a North-South trending gold mineralized system at Heuvel that extends for at least 800 m as well as a second mineralized zone approximately 500 m east of the Heuvel Main zone called Heuvel East.

Highlight results from the program can be seen in Figure 1 and Table 1, along with the previously released results from the RC hole and trench results. Hole MAJD25-011 was drilled approximately at the mid-point of the Heuvel Main Zone and intersected approximately 50 m below the previously reported trench MAJT25-029 that had intersected 18.0 m @ 6.39 grams per tonne of gold (g/t Au). MAJD25-011 intersected 11.5 m grading 1.34 g/t Au, including 5.0 m grading 2.77 g/t Au.

Hole MAJD25-002 was drilled at the southern end of Heuvel Main at an oblique angle to hole MAJR25-010 and intersected 12.3 m grading 0.82 g/t Au, including 5.5 m grading 1.58 g/t Au. Hole MAJD25-005 was drilled at the north end of Heuvel Main, twinning hole MAJR25-003, and intersected 5.0 m grading 1.77 g/t Au.

Hole MAJD25-006, drilled as a twin hole to the previously reported RC hole MAJR25-015 intersected 13.0 m grading 1.29 g/t Au, including 5.5 m grading 2.3 g/t Au. This area, Heuvel East, lies 900 m east of the main zone and is associated with a gold in soil anomaly that extends approximately 500 m in length.

While gold mineralization in drill core was confirmed by at least one hole in each of the four target areas, the grade and tenor of some of the diamond drill intercepts did not match that of the targeted RC and trench results. The Company believes that the indicators of a mineralized system are present at Majorodam, although the structural controls on gold mineralization are more complex than the initial interpretation had suggested. Greenheart Gold's analysis of results, combined with structural measurements from drill core and detailed mapping (supported by high-resolution drone magnetics) indicate that gold mineralization may be controlled by shallow plunging fold hinges deformed within a north-south shear at the Heuvel Main zone. This interpretation is similar to those presented by others exploring the same greenstone belt in Suriname where drill orientations have played a crucial role in defining volumes of gold mineralization. The diamond drill rig remains at Majorodam and the Company intends to re-commence drilling to test the updated geologic model before the end of November.

Tosso Creek Update

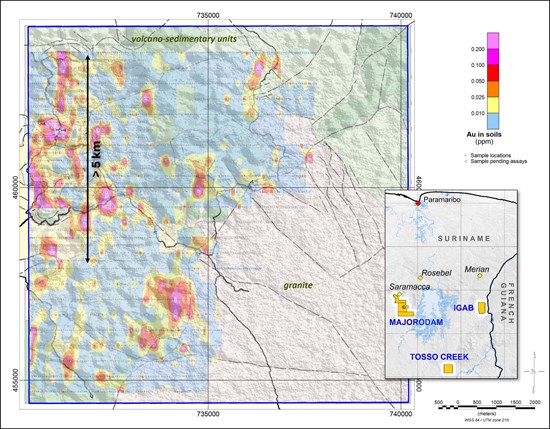

Exploration at Greenheart Gold's Tosso Creek project in Suriname continues to advance with infill soil sampling at a 400 m by 50 m sample spacing. Results from the soil program to date are shown in Figure 2, and continue to define several large gold anomalies, the largest extending over 5 km in length with widths of up to 500 m. This extensive soil anomaly aligns with the orientation of the volcano-sedimentary units located in the west and northwest of the project area, in addition to anomalies found along the granite contact that runs strikes northeast in the south. An excavator has been mobilized to the project and has commenced a 3,000 m trenching program over the strongest soil anomalies. In addition, a Lidar survey has been completed, and a high-resolution drone magnetics survey is anticipated to be completed by year end. Based on successful results, the Company would expect to commence drill testing in the first half of 2026.

Gold Hill, Guyana

The Company recently entered into an option agreement with arms' length third parties to acquire a

Termination of the Tamakay and Abuya Option Agreements

At the Tamakay project in Guyana, the programs carried out by the Company included detailed mapping, 276 grab samples and 7,794 soil samples. In addition, 7,606 m of trenching was completed in areas of interest uncovered by the initial programs. These activities were also supported by 85 line-km of ground based magnetic surveys and 50 line-km of gradient array Induced Polarization survey (IP). Following this activity, the Company completed a 1,473 m diamond drilling program to test several known occurrences of high-grade quartz veins, which have been the subject of historic artisanal mining activity. The drill program confirmed the high-grade nature and continuity of some of these veins; however, the intercepts in general were relatively narrow and showed little evidence of gold mineralization in the wall rock or the presence of more extensive sheeted type of vein system. The Company believes that the density of veining and the extent of gold mineralization are insufficient to suggest potential for an economic deposit of the size and scale required to justify development in such a remote area and has therefore elected to terminate its option with the various property owners.

At Abuya, after approximately 12 months of exploration work, the Company completed detailed mapping along with collecting 2,798 soil samples and 295 grab samples over the project area. Areas of interest arising out of these programs were followed up by 3,263 m of trenching and channel sampling with no meaningful results being reported. After completing these programs, the Company did not feel that the targets warranted follow-up drilling and has therefore also decided to drop its option on the project.

The acquisition of Gold Hill and the dropping of Tamakay and Abuya are consistent with Greenheart Gold's strategy to quickly assess projects and to be in a position to drill prospective targets in a 10 to 12-month timeframe or alternatively move on from projects that don't meet expectations and replace these with new opportunities. The Company feels that this strategy will continue to provide the highest possible chance of exploration success.

Sample Collection, Assaying and Data Management

Significant intervals in this press release have been calculated using a grade cut-off of 0.3 g/t Au, a minimum length of 5 m, and a maximum length of 5 m of consecutive internal waste. Included significant intervals have been calculated using a grade cut-off of 1.0 g/t Au, a minimum length of 3 m, and a maximum length of 2 m of consecutive internal waste. Gold grades are uncapped and mineralized intersection lengths are not necessarily true widths. RC drill samples are collected every meter and weighed in their entirety at the rig side to ensure consistent sample collection, then split, bagged, and tagged. Diamond drill core samples consist of half of either HQ or NQ core taken continuously at regular intervals averaging 1.4 m, bagged, and labelled at the site core shed. Samples are submitted to either Actlabs or Filab laboratories, both located in Paramaribo, Suriname, while respecting best-practice chain of custody procedures. Samples are dried, crushed to

Qualified Person

All scientific and technical information in this press release has been reviewed and approved by Justin van der Toorn, CGeol FGS, EurGeol, President and CEO of Greenheart Gold, and a Qualified Person under Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Greenheart Gold Inc.

Greenheart Gold is an exploration company that builds on a proven legacy of discoveries within the Guiana Shield, a highly prospective geological terrain that hosts numerous gold deposits yet remains relatively under-explored. The Company is led by former executives and members of the exploration group of Reunion Gold, a team that was most recently noted for the discovery and delineation of the multimillion-ounce Oko West deposit in Guyana. Greenheart Gold intends to build on its technical knowledge, strong contact base and previous success from exploring in the Guiana Shield to assemble, maintain and explore a portfolio of early-stage exploration projects in Guyana and Suriname that are prospective for orogenic gold deposits.

Additional information about the Company is available on SEDAR+ (www.sedarplus.ca) and the Company's website (www.greenheartgold.com).

For further information, please contact:

GREENHEART GOLD INC.

Justin van der Toorn, President and CEO, or

Doug Flegg CFA, Senior Vice President Corporate Development

Telephone: +1 450-800-2882

Cautionary Statement on Forward-Looking Information

All statements, other than statements of historical fact, contained in this press release constitute "forward-looking information" and "forward-looking statements" within the meaning of certain securities laws and are based on expectations and projections as of the date of this press release. Forward-looking statements contained in this press release include, without limitation, those related to the Company's plans and objectives, the timing of and execution of planned exploration activities, geological interpretation, potential favorable setting and mineralization, other statements relating to the business prospects of Greenheart Gold and, more generally, the section entitled "About Greenheart Gold Inc."

Forward-looking statements are based on beliefs, expectations, estimates and projections as of the time of this press release. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company as of the time of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates and assumptions may prove to be incorrect. Such assumptions include, without limitation, those underlying the statements in the section entitled "About Greenheart Gold Inc."

Many of these uncertainties and contingencies can directly or indirectly affect, and could cause, actual results to differ materially from those expressed or implied in any forward-looking statements. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific in nature, including among others, those risks and uncertainties set forth in the Company's audited consolidated financial statements and related notes for the initial period from April 19, 2024 to December 31, 2024 and the associated management's discussion & analysis, and other documents and reports filed by the Company with Canadian securities regulators available under the Company's profile on SEDAR+ at www.sedarplus.ca, and the risk that estimates, forecasts, projections and other forward-looking statements will not be achieved or that assumptions do not reflect future outcomes. Forward-looking statements are provided for the purpose of providing information about management's expectations and plans relating to the future. Readers are cautioned not to place undue reliance on these forward-looking statements as a number of important risk factors and future events could cause the actual outcomes to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, assumptions and intentions expressed in such forward-looking statements. The Company cautions that the list of factors set forth in the Company's filings that may affect future results is not exhaustive, and new, unforeseeable risks may arise from time to time. The Company disclaims any intention or obligation to update or revise any forward-looking statements or to explain any material difference between subsequent actual events and such forward-looking statements, except to the extent required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Figure 1 - Drill results from the Heuvel prospect at the Majorodam project in Suriname (new results shown in bold). Background shows the first vertical derivative product derived from drone magnetics RTP data; white contours define gold in soil anomalies. See press release text for significant interval parameters.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11642/273906_aefd75e4142c0935_002full.jpg

Table 1 - Full list of significant results from the Heuvel (Majorodam project) trench sampling, RC and core drilling completed to date.* Significant intervals in this press release have been calculated using a grade cut-off of 0.3 g/t Au, a minimum length of 5 m, and a maximum length of 5 m of consecutive internal waste. Included significant intervals have been calculated using a grade cut-off of 1.0 g/t Au, a minimum length of 3 m, and a maximum length of 2 m of consecutive internal waste.

| Hole ID | From (m) | To (m) | Interval (m) | Au Grade (g/t) | Grade x Thickness (gm/t) | Cutoff* (g/t Au) |

| MAJD25-002 | 41.50 | 49.50 | 8.00 | 0.70 | 5.59 | 0.3 |

| MAJD25-002 | 56.30 | 61.40 | 5.10 | 0.34 | 1.72 | 0.3 |

| MAJD25-002 | 118.50 | 130.80 | 12.30 | 0.82 | 10.05 | 0.3 |

| inc | 118.50 | 124.00 | 5.50 | 1.58 | 8.71 | 1 |

| MAJD25-005 | 129.00 | 134.00 | 5.00 | 1.17 | 5.84 | 0.3 |

| MAJD25-006 | 39.00 | 52.00 | 13.00 | 1.29 | 16.82 | 0.3 |

| inc | 44.50 | 50.00 | 5.50 | 2.30 | 12.62 | 1 |

| MAJD25-006 | 58.60 | 82.40 | 23.80 | 0.55 | 12.97 | 0.3 |

| inc | 88.90 | 92.80 | 3.90 | 1.48 | 5.77 | 1 |

| MAJD25-009 | 24.00 | 32.00 | 8.00 | 0.45 | 3.59 | 0.3 |

| MAJD25-011 | 39.70 | 51.20 | 11.50 | 1.34 | 15.46 | 0.3 |

| inc | 41.20 | 46.20 | 5.00 | 2.77 | 13.86 | 1 |

| MAJR25-001 | 1.00 | 7.00 | 6.00 | 0.73 | 4.38 | 0.3 |

| inc | 1.00 | 4.00 | 3.00 | 1.17 | 3.51 | 1 |

| MAJR25-003 | 53.00 | 66.00 | 13.00 | 4.37 | 56.81 | 0.3 |

| inc | 60.00 | 66.00 | 6.00 | 9.34 | 56.01 | 1 |

| MAJR25-009 | 1.00 | 14.00 | 13.00 | 0.40 | 5.15 | 0.3 |

| MAJR25-010 | 96.00 | 126.00 | 30.00 | 2.06 | 61.68 | 0.3 |

| inc | 96.00 | 104.00 | 8.00 | 3.66 | 29.27 | 1 |

| inc | 115.00 | 126.00 | 11.00 | 2.27 | 24.93 | 1 |

| MAJR25-015 | 24.00 | 42.00 | 18.00 | 1.47 | 26.39 | 0.3 |

| MAJR25-015 | 43.00 | 48.00 | 5.00 | 5.02 | 25.08 | 0.3 |

| inc | 43.00 | 48.00 | 5.00 | 5.02 | 25.08 | 1 |

| MAJR25-015 | 49.00 | 64.00 | 15.00 | 0.55 | 8.22 | 0.3 |

| MAJR25-015 | 83.00 | 90.00 | 7.00 | 0.39 | 2.72 | 0.3 |

| MAJR25-016 | 16.00 | 30.00 | 14.00 | 0.36 | 5.03 | 0.3 |

| MAJR25-016 | 37.00 | 42.00 | 5.00 | 1.42 | 7.12 | 0.3 |

| MAJR25-017 | 2.00 | 7.00 | 5.00 | 0.60 | 3.01 | 0.3 |

| MAJT25-024 | 40.00 | 46.00 | 6.00 | 1.42 | 8.50 | 0.3 |

| MAJT25-029 | 44.00 | 62.00 | 18.00 | 6.39 | 115.07 | 0.3 |

| inc | 50.00 | 60.00 | 10.00 | 11.02 | 110.22 | 1 |

| MAJT25-032 | 0.00 | 10.00 | 10.00 | 0.49 | 4.91 | 0.3 |

Figure 2 - Updated soil results from the Tosso Creek project in Suriname.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11642/273906_aefd75e4142c0935_003full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/273906