Genius Group Adopts Bitcoin Treasury Reserve Strategy

Rhea-AI Summary

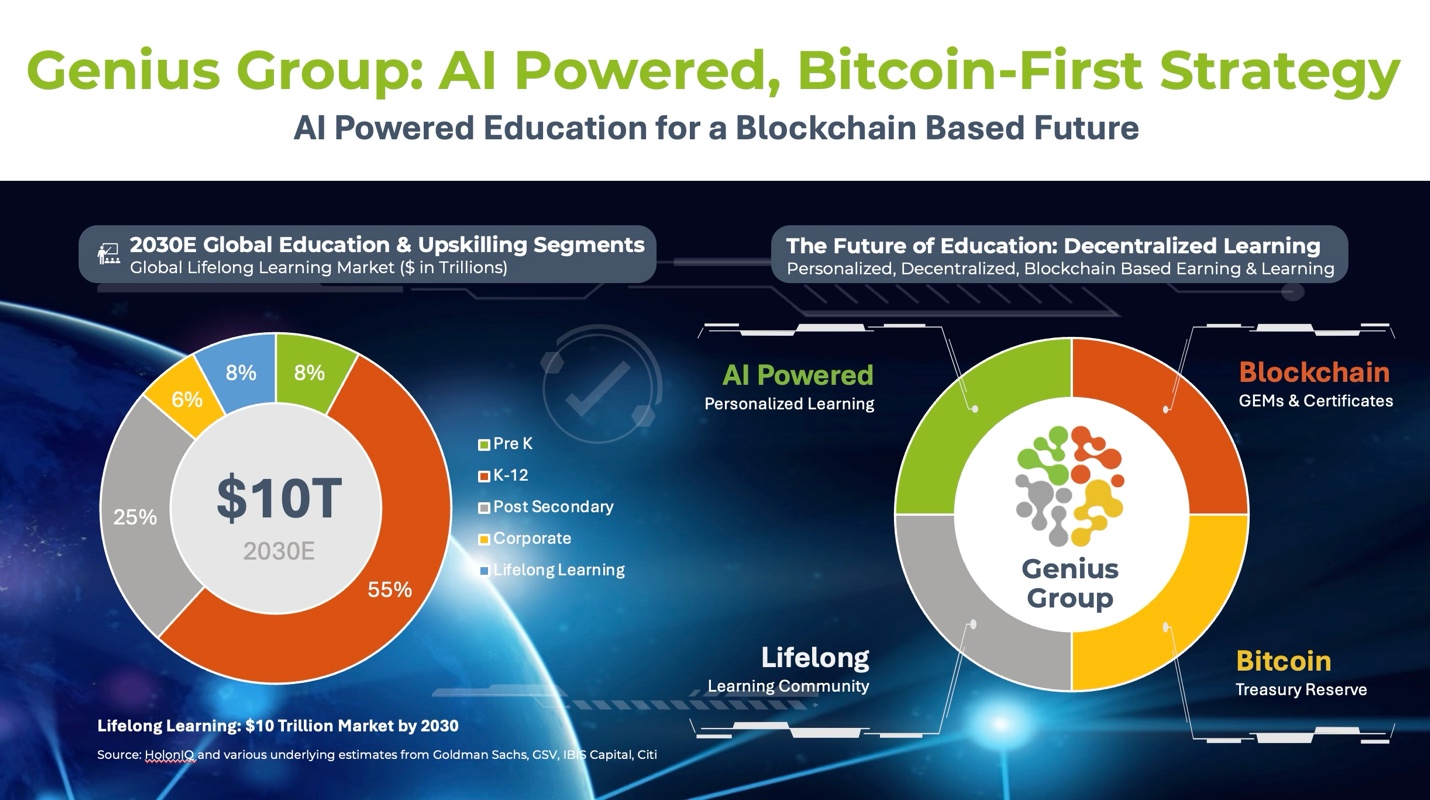

Genius Group (NYSE American: GNS) has announced a new 'Bitcoin-first' strategy, committing to hold 90% or more of its reserves in Bitcoin. The company plans to utilize its $150 million ATM facility to acquire an initial $120 million in Bitcoin as its primary treasury reserve asset. The strategy includes launching a Web3 Wealth Renaissance education series and enabling Bitcoin payments on their Edtech platform. The company reports $23 million in audited annual revenue for 2023 and total assets of $43 million, while currently facing a market capitalization of $12 million. Genius Group has pending litigation against alleged market manipulators, with estimated damages over $250 million.

Positive

- Plans to acquire $120 million in Bitcoin using existing ATM facility

- Reported $23 million in annual revenue for 2023

- Total assets of $43 million

- Strategic expansion into blockchain technology and cryptocurrency education

- 0% capital gains tax advantage due to Singapore incorporation

Negative

- Current market capitalization of only $12 million, significantly below reported assets

- Share price dropped to under $0.60

- Ongoing legal battle against market manipulators

News Market Reaction – GNS

On the day this news was published, GNS gained 66.40%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

SINGAPORE, Nov. 12, 2024 (GLOBE NEWSWIRE) -- Genius Group Limited (NYSE American: GNS) (“Genius Group” or the “Company”), a leading AI-powered education and acceleration group, today announced that its Board has adopted a global “Bitcoin-first” strategy with Bitcoin to be the primary treasury reserve asset. The Board’s adoption of this new policy follows the recent restructuring of its Board to include experts in Blockchain and Web3 technologies.

The Company’s Board of Directors have approved the following Bitcoin-first strategy:

- To commit

90% or more of our current and future reserves to be held in Bitcoin - Commence utilizing our

$150 million ATM1to acquire an initial target of$120 million in Bitcoin, to be held for the long term as its primary treasury reserve asset - Launch our Web3 Wealth Renaissance education series for students to accelerate their understanding of Bitcoin, Cryptocurrency and Blockchain with Genius Group’s AI-powered guides.

- Enable Bitcoin payments globally on the Company’s Edtech platform.

Thomas Power, Genius Group Director and previously Board Director at Team Blockchain and the Blockchain Industry Compliance and Regulation Association (BICRA), said “Genius Group is focused on educating students for the exponential technologies of the future. We see Bitcoin as being the primary store of value that will power these exponential technologies. The compelling case that we believe Michael Saylor and Microstrategy have made for public companies to invest in Bitcoin as their primary treasury reserve asset is one that we fully endorse.”

“We believe with our Bitcoin-first strategy, we will be among the first NYSE American listed companies to fully embrace Microstrategy’s Bitcoin strategy, for the benefit of our shareholders.”

Ian Putter, Genius Group Director and previously Head of Blockchain Domain at Standard Bank and founder of the Blockchain Research Institute Africa, a think tank that collaborated with research institutes across the globe to identify blockchain use-cases relevant to Africa, said “Genius Group has an approved

Roger Hamilton, Genius Group’s CEO, said “Genius Group has been in a two-year public battle against market manipulators, in which it has seen its share price drop to under

“The Company has pending litigation against alleged market manipulators, led by Wes Christian, with alleged damages estimated at over

“We believe a new type of future-focused, AI-driven, blockchain-based public listed companies can bridge the divide for investors between the current, centralized and regulated world of NYSE, NASDAQ and other stock markets with the future promise of decentralized, exponential economies. Genius Group’s unique position of already educating for the future gives us an opportunity to bring a layer of added value through education, where we prepare the next generation for a world in which how they earn and learn are dramatically different.”

Genius Group will be holding a GeniusLIVE podcast featuring Roger Hamilton, Thomas Power and Ian Putter which will go into detail on Genius Group’s AI-powered, Bitcoin-first plan at 9am ET on Tuesday, 19 November 2024. To register, visit https://www.geniusgroup.ai/

About Genius Group

Genius Group (NYSE: GNS) is a leading provider of AI powered, digital-first education and acceleration solutions for the future of work. Genius Group serves 5.4 million users in over 100 countries through its Genius City model and online digital marketplace of AI training, AI tools and AI talent. It provides personalized, entrepreneurial AI pathways combining human talent with AI skills and AI solutions at the individual, enterprise and government level. To learn more, please visit www.geniusgroup.net.

For more information, please visit https://www.geniusgroup.net/

Forward-Looking Statements

Statements made in this press release include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the use of words such as “may,” “will”, “plan,” “should,” “expect,” “anticipate,” “estimate,” “continue,” or comparable terminology. Such forward-looking statements are inherently subject to certain risks, trends and uncertainties, many of which the Company cannot predict with accuracy and some of which the Company might not even anticipate and involve factors that may cause actual results to differ materially from those projected or suggested. Readers are cautioned not to place undue reliance on these forward-looking statements and are advised to consider the factors listed above together with the additional factors under the heading “Risk Factors” in the Company's Annual Reports on Form 20-F, as may be supplemented or amended by the Company's Reports of a Foreign Private Issuer on Form 6-K. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events, new information or otherwise. No information in this press release should be construed as any indication whatsoever of the Company’s future revenues, results of operations, or stock price.

Contacts

MZ Group - MZ North America

(949) 259-4987

GNS@mzgroup.us

www.mzgroup.us

1 Availability under the Form F-3 “shelf” is subject to limitations under Instruction 1.B.6. of Form F-3 until the Company reaches a market capitalization of