9.5 metres @ 13.8 g/t AuEq Intercepted at Great Pacific Gold's Wild Dog (12.61 g/t Au, 0.62% Cu, 14.63 g/t Ag)

Rhea-AI Summary

Great Pacific Gold (OTCQX: GPGCF) reported Phase 1 diamond drill results from the Wild Dog project, PNG, including a standout intercept in WDG-14 of 9.5 m @ 13.8 g/t AuEq from 200.77 m (including 3.9 m @ 32.16 g/t AuEq from 204.3 m).

The expanded program totals 28 holes (14 completed, WDG-15 in progress), camp expansion is near completion, and a second rig is scheduled to arrive in late January 2026 to enable ramped drilling across the 15 km structural corridor.

Positive

- WDG-14: 9.5 m @ 13.8 g/t AuEq from 200.77 m (including 3.9 m @ 32.16 g/t AuEq)

- Program expanded to 28 holes with continued drilling into early 2026

- Second drill rig arriving late January 2026 to increase coverage

- Camp expansion and new site infrastructure nearing completion

Negative

- Intercepts reported as core lengths; true widths not known

- No metallurgical testing has been carried out on Wild Dog samples

- AuEq uses specific price/recovery assumptions (Au $2,000/oz, Cu $4.50/lb, Ag $27.50/oz) which affect reported values

News Market Reaction

On the day this news was published, GPGCF gained 9.19%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 08 | Spinout court approval | Positive | +3.8% | Final court approval and effective date set for Walhalla 1:1 spinout. |

| Nov 27 | Spinout approval | Positive | +8.4% | Shareholders approve 1:1 spin-out of Walhalla Gold Corp and option plan. |

| Nov 10 | Wild Dog drilling | Positive | +8.2% | Phase 1 Wild Dog drill results with multiple high-grade AuEq intercepts. |

| Oct 31 | Kesar project update | Positive | -2.8% | Updated NI 43-101 and Phase 2 plans for Kesar after Phase 1 work. |

| Oct 08 | Spinout meeting set | Positive | +1.3% | Special meeting set to approve Walhalla 1:1 spinout and exploration plan. |

Recent positive corporate and exploration updates have generally coincided with upside moves, with 4 of the last 5 news events seeing aligned positive price reactions and one divergence on a project update.

This announcement continues a sequence of corporate and exploration milestones for Great Pacific Gold. Since October 2025, the company advanced a Walhalla 1:1 spinout from meeting date setting through shareholder approval to final court approval, each associated with positive single‑day moves. In parallel, it released multiple high‑grade drill results at Wild Dog and an update on the Kesar Project, where a technical report and Phase 2 drilling were outlined. Today’s Wild Dog intercepts build directly on the strong Phase 1 drill results reported on Nov 10, 2025.

Market Pulse Summary

The stock moved +9.2% in the session following this news. A strong positive reaction aligns with how Great Pacific Gold has often traded on high‑grade drill and corporate updates, as shown by four aligned moves out of the last five news events. The new WDG‑14 interval adds to a pattern of standout Wild Dog assays and a growing Phase 1 program. Investors may weigh how quickly further drilling, resource definition work, and project‑level studies follow, noting that enthusiasm after exploration results can fade between catalysts.

Key Terms

epithermal medical

porphyry medical

lidar technical

fire assay technical

aqua regia technical

atomic absorption technical

icp/aa technical

ni 43-101 regulatory

AI-generated analysis. Not financial advice.

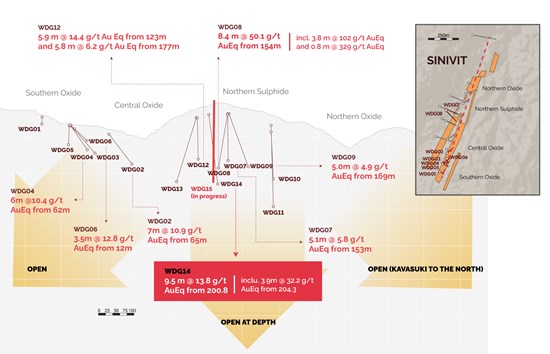

Vancouver, British Columbia--(Newsfile Corp. - December 10, 2025) - Great Pacific Gold Corp. (TSXV: GPAC) (OTCQX: GPGCF) (FSE: V3H) ("Great Pacific Gold," "GPAC," or the "Company") announces results from its expanded Phase 1 diamond drill program at its flagship Wild Dog Project ("Wild Dog" or the "Project"), located on the island of New Britain, East New Britain Province, Papua New Guinea ("PNG"). The Phase 1 program is focused on the Sinivit target, a portion of the 15 km Wild Dog epithermal structural corridor.

Key Highlights:

- WDG-14 intercepted:

- 9.5 m @ 13.8 g/t AuEq from 200.77 m (12.61 g/t Au,

0.62% Cu, 14.63 g/t Ag); - including: 3.9 m @ 32.16 g/t AuEq from 204.3 m (29.62 g/t Au,

1.39% Cu, 31.25 g/t Ag).

- 9.5 m @ 13.8 g/t AuEq from 200.77 m (12.61 g/t Au,

- Second drill rig scheduled to arrive in late January, enabling expanded drilling coverage across the 15 km Wild Dog structural corridor.

- Camp expansion and new site infrastructure is nearing completion, positioning GPAC for a significant ramp-up in drilling activity in 2026.

"Our geological confidence continues to strengthen as each drill hole refines the plunge, geometry, and true width of the northern sulphide zone. WDG-14 has delivered one of the most coherent and strongly mineralized intervals drilled at Wild Dog to date. The textures, sulphide intensity, and grade profile align exceptionally well with our growing model for a large, well-endowed epithermal system. Since commencing drilling in May, we have built a full exploration team, established critical infrastructure, and developed strong community support. With a second rig arriving in late January 2026 and several high-priority targets ready for testing, Wild Dog is positioned for an exciting and transformative year in 2026," stated Callum Spink, VP Exploration.

Wild Dog Phase 1 Diamond Drill Program

The Phase 1 program commenced in May 2025 and is designed to test the Sinivit target, a 1.5 km strike length within the 15 km Wild Dog epithermal vein structural corridor (Figure 1). The high-grade nature of the system has already been confirmed by multiple strong intercepts.

In addition, MobileMT geophysical data has highlighted the exceptional scale of the epithermal system and the potential for a major porphyry copper-gold system adjacent to the veins - a setting analogous to the Wafi-Golpu deposit in PNG (mineralization at Wafi-Golpu is not necessarily indicative of mineralization at Wild Dog).

The expanded program now totals 28 diamond drill holes and is expected to continue into early 2026. A second drill rig is in the process of being mobilized to site.

Figure 1: Long section through the Sinivit target area showing drilling completed to date with key intervals.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11018/277546_7e1590bc843edbaa_002full.jpg

Results

Since commencing in May 2025, GPAC has completed 14 drill holes at Sinivit with hole 15 in progress. Details of the drilling are shown in Table 1, with key assay results received to date shown in Table 2.

Table 1: Wild Dog Drill Hole Details (PNG94 UTM Zone 56 coordinates).

| Hole ID | Easting | Northing | RL | Dip | Azi | Max Depth (m) | Status |

| WDG-01 | 394358.3 | 9488853.5 | 945 | -50 | 115 | 40.1 | Abandoned |

| WDG-02 | 394426.0 | 9489024.2 | 900 | -53 | 050 | 124.6 | Completed |

| WDG-03 | 394384.9 | 9488926.5 | 924 | -50 | 053 | 127.6 | Completed |

| WDG-04 | 394384.8 | 9488926.5 | 924 | -50 | 75 | 120.6 | Completed |

| WDG-05 | 394384.8 | 9488926.5 | 924 | -50 | 116 | 105.9 | Completed |

| WDG-06 | 394428.6 | 9488923.1 | 911 | -50 | 352 | 69.0 | Completed |

| WDG-07 | 394457.5 | 9489375.0 | 993 | -61 | 114 | 201.3 | Completed |

| WDG-08 | 394455.5 | 9489373.0 | 993 | -57 | 127 | 224 | Completed |

| WDG-09 | 394459.5 | 9489374.0 | 993 | -58 | 85 | 203 | Completed |

| WDG-10 | 394475.1 | 9489484.0 | 965 | -58 | 111 | 220.1 | Completed |

| WDG-10A | 394476.1 | 9489484.0 | 965 | -57 | 114 | 200.4 | Completed |

| WDG-11 | 394474.1 | 9489484 | 965 | -68 | 114 | 253.4 | Completed |

| WDG-12 | 394413.7 | 9489301.5 | 982 | -52 | 113 | 235.2 | Completed |

| WDG-13 | 394408.5 | 9489301.2 | 983 | -63 | 102 | 261.3 | Completed |

| WDG-14 | 394389.2 | 9489995.9 | 1002 | -55 | 103 | 258.3 | Completed |

| WDG-15 | 394385.7 | 9489385.6 | 1003 | -60 | 115 | tbd | In progress |

Table 2: Wild Dog Drill Hole Key Assay Results (WDG-02 to WDG-12 results previously announced).

| Hole ID | From (m) | To (m) | Interval1 (m) | Gold (g/t) | Silver (g/t) | Copper (%) | Gold Eq.2 (g/t) |

| WDG-02 | 65.00 | 72.00 | 7.00 | 5.49 | 68.84 | 2.96 | 10.93 |

| including | 65.00 | 67.00 | 2.00 | 10.73 | 114.64 | 2.23 | 15.55 |

| WDG-03 | 102.00 | 104.30 | 2.30 | 1.68 | 6.48 | 0.12 | 1.94 |

| including | 103.55 | 104.30 | 0.75 | 4.05 | 10.90 | 0.17 | 4.45 |

| WDG-04 | 62.00 | 68.00 | 6.00 | 8.31 | 27.56 | 1.15 | 10.43 |

| including | 64.00 | 68.00 | 4.00 | 12.25 | 36.76 | 1.63 | 15.22 |

| including | 64.00 | 66.40 | 2.40 | 19.76 | 57.75 | 2.59 | 24.48 |

| WDG-05 | 72.00 | 77.00 | 5.00 | 1.32 | 11.71 | 0.25 | 1.85 |

| including | 72.00 | 75.00 | 3.00 | 1.97 | 15.36 | 0.31 | 2.64 |

| WDG-06 | 12.00 | 15.50 | 3.50 | 4.61 | 48.36 | 4.86 | 12.79 |

| including | 13.70 | 14.30 | 0.60 | 7.44 | 73.40 | 10.42 | 24.61 |

| WDG-07 | 153.00 | 163.00 | 10.00 | 2.99 | 10.92 | 0.32 | 3.61 |

| including | 153.00 | 158.10 | 5.10 | 4.77 | 14.54 | 0.54 | 5.79 |

| WDG-07 | 172.00 | 173.20 | 1.20 | 7.30 | 93.50 | 1.14 | 10.17 |

| including | 172.50 | 173.20 | 0.70 | 12.00 | 157.00 | 1.94 | 16.86 |

| WDG-08 | 154.00 | 162.40 | 8.40 | 46.46 | 59.63 | 1.90 | 50.12 |

| including | 154.00 | 157.80 | 3.80 | 93.31 | 128.72 | 4.08 | 101.19 |

| including | 157.00 | 157.80 | 0.80 | 322.00 | 84.50 | 12.89 | 343.17 |

| WDG-08 | 180.00 | 188.00 | 8.00 | 1.95 | 4.19 | 0.13 | 2.20 |

| including | 180.00 | 184.00 | 4.00 | 3.32 | 3.71 | 0.16 | 3.62 |

| WDG-09 | 169.00 | 174.00 | 5.00 | 4.49 | 7.98 | 0.22 | 4.93 |

| including | 169.00 | 171.00 | 2.00 | 10.31 | 15.35 | 0.42 | 11.14 |

| WDG-09 | 182.40 | 185.00 | 2.60 | 2.74 | 43.86 | 2.04 | 6.45 |

| including | 182.80 | 184.30 | 1.50 | 4.17 | 54.13 | 2.51 | 8.72 |

| WDG-10 | 173.60 | 175.60 | 2.00 | 1.73 | 28.12 | 0.63 | 3.04 |

| WDG-10 | 184.50 | 185.20 | 0.30 | 4.20 | 100.00 | 0.99 | 6.90 |

| WDG-12 | 123.20 | 129.10 | 5.90 | 13.96 | 12.41 | 0.18 | 14.38 |

| including | 126.60 | 129.10 | 2.50 | 31.29 | 24.68 | 0.28 | 32.02 |

| WDG-12 | 177.00 | 182.80 | 5.80 | 5.12 | 15.29 | 0.59 | 6.23 |

| including | 179.00 | 182.00 | 3.00 | 9.06 | 28.41 | 1.06 | 11.05 |

| WDG-13 | 134.50 | 139.60 | 5.10 | 3.38 | 8.20 | 0.23 | 3.83 |

| WDG-14 | 200.77 | 210.22 | 9.45 | 12.61 | 14.63 | 0.62 | 13.75 |

| including | 204.30 | 208.20 | 3.90 | 29.62 | 31.25 | 1.39 | 32.16 |

Notes:

- Drill highlights presented above are core lengths (true widths are not known at this time).

- Gold equivalent (AuEq) exploration results are calculated using longer-term commodity prices with a copper price of US

$4.50 /lb, a silver price of US$27.50 /oz and a gold price of US$2,000 /oz. No metallurgical testing has been carried out on Wild Dog mineralized samples. For AuEq calculations, recovery assumptions of Au92.6% , Ag78.0% , and Cu94.0% were used based on K92 Mining's stated recovery results in an Updated Definitive Feasibility Study for the Kainantu mine.

WDG-13 Overview

WDG-13 tested the south-western strike extension of the Wild Dog epithermal vein system. The hole intersected two distinct quartz-sulphide vein and breccia zones, confirming structural continuity and extending mineralization along the projected corridor.

Zone 1 intercepted 5.10 m @ 3.38 g/t Au, 8.20 g/t Ag, 0.23 % Cu (3.83g/t AuEq) from 134.50-139.60 m, and featured:

- Fractured to brecciated quartz-sulphide veining

- Crack-seal banding indicating repeated hydrothermal pulses

- Fine sulphide selvages with local chalcopyrite

Zone 2 (201.9 m to 204.6 m) was a narrower interval with strong brittle deformation and reflects the distal edge of the deeper mineralized shoot.

WDG-14 Overview

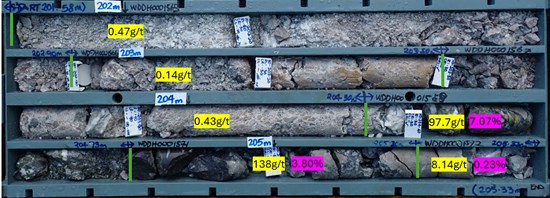

Hole WDG-14 was drilled as a deeper down-plunge step-out beneath WDG-08 to test the projected continuation of the high-grade shoot within the northern sulphide zone. The hole intersected the structure at the anticipated depth and orientation, returning one of the strongest mineralized intervals recorded at Wild Dog to date.

WDG-14 Main Vein Intercept:

- Thick quartz-pyrite-chalcopyrite mineralization

- Hydrothermal brecciation with sulphide-rich matrix

- Local bornite and chalcopyrite veinlets indicating strong fluid flow

Figure 2: WDG-14 core from 201.58-205.33 m showing the onset of the main breccia and sulphide rich zone with quartz-pyrite-chalcopyrite veining developed along the shear contact. (Au, g/t; yellow) and notable copper grades (Cu, %; purple) indicated.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11018/277546_7e1590bc843edbaa_003full.jpg

Figure 3: WDG-14 core from 205.33-208.90 m displaying hydrothermal breccias with pervasive disseminated sulphides and multiple vein events. (Au, g/t; yellow) and notable copper grades (Cu, %; purple) indicated.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11018/277546_7e1590bc843edbaa_004full.jpg

Figure 4: WDG-14 core fragment at 204.4 m showing semi-massive sulphide-rich breccia with strong chalcopyrite around angular quartz fragments (97.7g/t Au,

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11018/277546_7e1590bc843edbaa_005full.jpg

Figure 5: Highly mineralized interval in WDG-14 at 204.48 m, displaying chalcopyrite-rich hydrothermal breccia. (97.7g/t Au,

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11018/277546_7e1590bc843edbaa_006full.jpg

Figure 6: WDG-14 at 205.05 m showing matrix-supported hydrothermal breccia and dark sulphidic silica matrix. (138g/t Au,

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11018/277546_7e1590bc843edbaa_007full.jpg

Figure 7: Hydrothermal breccia vein in WDG-14 at 208.25 m with large vugs, angular clasts, chalcopyrite-pyrite infill and sulphidic silica (1.01g/t Au,

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11018/277546_7e1590bc843edbaa_008full.jpg

On behalf of Great Pacific Gold:

Greg McCunn

Chief Executive Officer and Director

For further information, visit gpacgold.com or contact:

Investor Relations

Phone +1-778-262-2331

Email: info@gpacgold.com

Qualified Person

The technical content of this news release has been reviewed, verified and approved by Callum Spink, the Company's Vice President, Exploration, who is a member of the Australian Institute of Geoscientists, MAIG, and a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Spink is responsible for the technical content of this news release. Mr. Spink is not independent of the Company.

Quality Assurance / Quality Control (QAQC)

The Company adheres to industry best practices for Quality Assurance and Quality Control. Drill core samples were sawed into equal halves and the selected one-half core was submitted to Intertek Minerals Ltd. in Lae, Papua New Guinea, an ISO 9001-certified laboratory. Samples were securely sealed in poly-weave bags with single-use tie-locks to maintain chain of custody. Analytical testing is completed using fire assay for gold, preliminary copper and silver assays are reported from results generated by aqua regia digestion and atomic absorption (AA) copper determination. The results are updated with assay results using MS48 (multi-element 4-acid digestion ICP/AA).

Diamond drill hole WDG-02 was drilled using a combination of HQ and PQ diameter core, while the holes WDG-03 to WDG-09 were drilled with PQ. Holes WDG-10 onwards were drilled with HQ diameter core. Certified reference materials (standards) and blanks were inserted into the sample stream in accordance with industry-standard protocols. Blanks were routinely inserted after high-grade intervals, and certified standards were included at a frequency of at least

About Great Pacific Gold

Great Pacific Gold's vision is to become the leading gold-copper development company in Papua New Guinea ("PNG"). The Company has a portfolio of exploration-stage projects in PNG, as follows:

Wild Dog Project: the Company's flagship project is located in the East New Britain province of PNG. The project consists of a large-scale epithermal target, the Wild Dog structural corridor, stretching 15 km in strike length and potentially over 1,000 metres deep based on a recent MobileMT geophysics survey. The survey also highlighted the Magiabe porphyry target, adjacent to the epithermal target and potentially 1,000 metres in diameter and over 2,000 metres deep. Drilling of the epithermal structure on the Sinivit target has yielded high-grade results, including WDG-08 which intercepted 8.4 metres at 50 g/t AuEq from 154 metres. The current drilling program will extend into 2026 with second drill rig expecting to be operational in late January 2026.

Kesar Project: located in the Eastern Highlands province of PNG and contiguous with the mine tenements of K92 Mining Inc. ("K92"), the Kesar Project is a greenfield exploration project with several high-priority targets in close proximity to the property boundary with K92. Multiple epithermal veins at Kesar are on strike and have the same orientation as key K92 deposits, such as Kora. Exploration work to date by the Company at the Kesar Project has shown that these veins have high grades of gold present in outcrop and very elevated gold in soil grades, coincident with aeromagnetic highs. The Company conducted a diamond drill program on key target areas at the Kesar Project from November 2024 to May 2025 and have developed a follow-up Phase 2 program for 2026.

- Arau Project: also located in the Eastern Highlands province of PNG, the Arau Project is south of and contiguous to the mine tenements of K92. Arau contains the highly prospective Mt. Victor exploration target with potential for a high sulphidation epithermal gold-base metal deposit. A Phase 1 Reverse Circulation drilling program was completed at Mt. Victor in August 2024, with encouraging results. The Arau Project includes the Elandora licence, which also contains various epithermal and copper-gold porphyry targets.

The Company also holds the Tinga Valley Project in PNG.

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. Great Pacific Gold cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by many material factors, most of which are beyond their respective control. Such factors include, among other things: risks and uncertainties relating to Great Pacific Gold's limited operating history, its exploration and development activities on its mineral properties and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Great Pacific Gold does not undertake to publicly update or revise forward-looking information.

Mineralization at the properties held by K92 Mining Inc. and at the Wafi-Golpu deposit is not necessarily indicative of mineralization at the Wild Dog Project.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/277546