Neural Concept Closes $100M Funding Round Led by Growth Equity at Goldman Sachs Alternatives to Scale AI-Native Engineering

Key Terms

series c funding round financial

cad-native technical

physics-aware ai technical

generative cad capability technical

ai-native engineering technical

- New capital accelerates Neural Concept’s ability to deliver transformative technologies and enterprise-wide AI impact across advanced industrial workflows.

-

Platform delivers CAD-native, physics-aware AI and deep reasoning for engineering, saving customers

$50 million -50% and accelerating time to market by up to two years. - The company has generated a fourfold increase in enterprise revenue over the past 18 months.

- More than 50 global companies are actively relying on the platform, including General Motors, General Electric Vernova, Leonardo Aerospace, Eaton, Safran, Renault Group and multiple Formula 1 teams.

LAUSANNE,

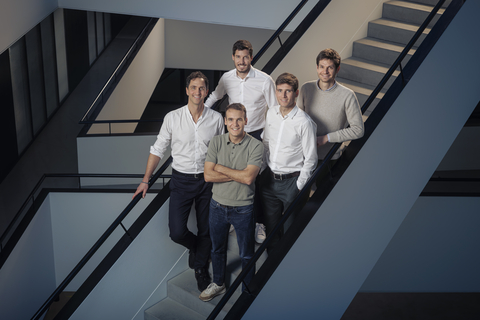

Image courtesy of Neural Concept (L-R clockwise from top) Jonathan Donier, CSO & Co-founder; Thomas von Tschammer, Managing Director US & Co-founder; Théophile Allard, CTO & Co-founder; Pierre Baqué CEO & Co-founder; Philippe Cuendet, COO

Neural Concept is redefining engineering workflows with CAD-native enterprise AI that understands geometry, constraints and design intent. By helping its customers build and deploy physics-aware design copilots, the platform enables teams to explore millions of design options earlier and avoid costly late-stage changes, accelerating the entire product development cycle, helping companies bring better products to market faster.

The investment round underscores the surging demand for enterprise AI that drives real-world impact. As engineering teams move from AI experimentation to full-scale deployment, Neural Concept has emerged as the leader in AI-native engineering, combining cutting-edge technology with an enterprise-focused approach, fueling fast, sustained growth across major industries, including automotive, aerospace and defense, energy, semiconductors and consumer electronics.

“Neural Concept’s technology represents a rare leap forward in enterprise engineering AI,” said Lambert Diacono, Executive Director Growth Equity at Goldman Sachs Alternatives. “As demand accelerates for AI that drives real impact in complex industrial workflows, Neural Concept is emerging as one of the leading companies in the market,” affirmed Christian Resch, Partner, Head of EMEA Growth Equity at Goldman Sachs Alternatives.

The team will use the funding to accelerate product development, including unveiling a breakthrough generative CAD capability in early 2026, expand global GTM teams and strengthen its position as the intelligence layer across engineering systems, deepening partnerships with industry leaders such as Nvidia, Siemens, Ansys, Microsoft and AWS.

“We founded Neural Concept with the ambition to enable complete AI-driven design of advanced systems like tomorrow’s cars and spacecrafts,” said Dr. Pierre Baqué, CEO and founder of Neural Concept. “Advances in AI are transforming engineering from a process of trial and error into a data-driven workflow where tradeoffs and constraints can be understood and optimized from the start. This investment enables us to fast-track our progress toward establishing the intelligence layer powering every engineering team, worldwide.”

Neural Concept’s Series C marks the company’s latest funding milestone following its

About Neural Concept

Founded in 2019, Neural Concept provides the leading AI-first engineering platform for product development. By embedding AI natively into design and simulation workflows, Neural Concept empowers engineering teams to compress development cycles from months to days, improve product performance across efficiency, safety, and sustainability, and scale AI adoption without costly, years-long integration.

The company drives product development across major industries, including automotive, aerospace, energy, consumer electronics, semiconductors and defense, working with the world’s leading global OEMs and component suppliers. Neural Concept was spun out of the Swiss Federal Institute of Technology in Lausanne (EPFL) and is backed by global investors, including Forestay Capital and D. E. Shaw Ventures. Visit https://www.neuralconcept.com

About Goldman Sachs Alternatives

Goldman Sachs (NYSE: GS) is one of the leading investors in alternatives globally, with over

The business is driven by a focus on partnership and shared success with its clients, seeking to deliver long-term investment performance drawing on its global network and deep expertise across industries and markets.

The alternative investments platform is part of Goldman Sachs Asset Management, which delivers investment and advisory services across public and private markets for the world’s leading institutions, financial advisors and individuals. Goldman Sachs has approximately

Follow us on LinkedIn.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251218764112/en/

For US media enquiries, contact Mary Athridge, Goldman Sachs Media, on +1 212-934-0567 / mary.athridge@gs.com

For EU & RoW media enquiries, contact Alex McLaren, ThoughtLDR, on +447516623249 / alex.mclaren@thoughtldr.com

Source: Neural Concept