Gold X2 Mining Delivers Preliminary Economic Assessment and Updated Mineral Resource Estimate for the Moss Gold Project

Rhea-AI Summary

Gold X2 Mining (OTCQB: GSHRF) released a PEA and updated MRE for the 100% owned Moss Gold Project (Ontario) effective Jan 2026. The PEA base case (US$2,750/oz) shows an after‑tax NPV5% of C$2.232B, IRR 22.1% and payback 3.2 years; a spot case (US$4,600/oz) yields NPV5% C$6.578B and IRR 48.6%. Average annual payable production is ~265,000 oz Au and 374,000 oz Ag over a 13.2‑year LOM. Initial capital is C$2.001B. Updated MRE reports Indicated 2.125 Moz Au and Inferred 3.91 Moz Au, with a 73% increase in Indicated ounces versus prior model.

Positive

- After‑tax NPV5% C$2.232B at US$2,750/oz gold

- Average annual production ~265,000 oz Au over 13.2 years

- Updated Indicated resources 2.125 Moz Au (73% increase)

- High recovery rates: Au recovery ~91.6%–91.7%

Negative

- Initial capital requirement C$2.001B

- Strip ratio of 5.3:1 increases waste mining volume

- PEA includes Inferred resources (economic uncertainty)

- All‑in sustaining cost US$1,188/oz (CAD $1,592/oz)

All Amounts are in Canadian dollars ("$") unless otherwise indicated

Vancouver, British Columbia--(Newsfile Corp. - January 26, 2026) - Gold X2 Mining Inc. (TSXV: AUXX) (OTCQB: GSHRF) (FSE: DF8) ("Gold X2" or the "Company") is pleased to announce the results of its Preliminary Economic Assessment1 (the "PEA") and updated Mineral Resource Estimate2 ("MRE") for its

Summary of PEA Results3

- Base Case (US

$2,750 /oz Au, US$35.00 /oz Ag,$1.34 USD/CAD): After-tax NPV5% of$2.23 2 billion, IRR of22.1% and payback of 3.2 years. - Long-Term Consensus Gold Price (US

$3,137 /oz, US$37.74 /oz Ag,$1.35 USD/CAD): After-tax NPV5% of$3.15 2 billion, IRR of28.1% and payback of 2.5 years. - Spot Gold Price (US

$4,600 /oz, US$90.00 /oz Ag,$1.35 USD/CAD): After-tax NPV5% of$6.57 8 billion, IRR of48.6% and payback of 1.0 years.

PEA and MRE Summary

- PEA results reflective of the potential for a top 10 producing gold mine in Canada: Estimated average annual payable gold production of approximately 265,000 ounces and silver production of 374,000 ounces respectively over an initial 13.2 year mine life1,4.

- Strong margins support rapid payback and significant free cash flow generation: All in Sustaining Costs ("AISC")5 of US

$1,188 /oz and Cash Costs of US$999 /oz rank the Moss Gold Project in the second quartile of the cost curve. The Project forecasts after-tax free cash flow of$4.03 5 billion over the life of mine ("LOM") at US$2,750 /oz gold and$10.46 6 billion at the current gold price of US$4,600 /oz. - Detailed capital and infrastructure costs: Initial capital costs of C

$2.00 1 billion (US$1.49 3 billion) including contingencies of$303 million and excluding working capital. - PEA represents a true base-case scenario at a gold price of US

$2,750 , silver price of US$35.0 , with a clear path to improving economic performance and mine life extension.- Optimizing mine scheduling using stockpile management to improve grade in early years of production.

- Potential for improved processing and metallurgical recoveries through evaluation of a gravity circuit.

- Potential to increase mine life through additional drilling of mineralized zones both within and immediately adjacent to the Reasonable Prospects of Eventual Economic Extraction ("RPEEE") open pit shell.

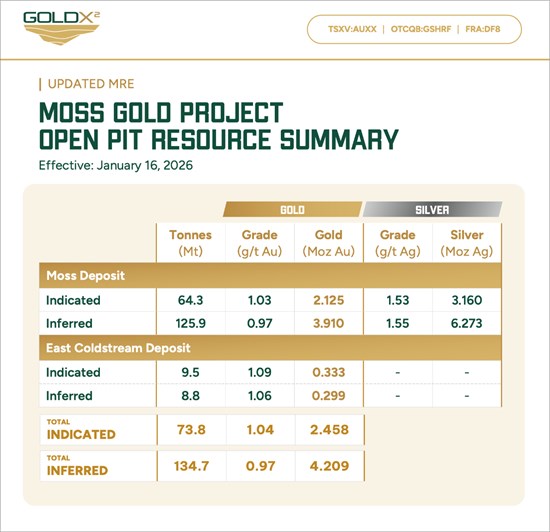

- Updated Mineral Resource Estimate for Moss Gold Deposit - improved geological model and resource confidence

- Indicated Resources of 2.125 Moz Au at 1.03 g/t Au, 3.160 Moz Ag at 1.53 g/t Ag contained within 64.3 Mt.

- Inferred Resources of 3.910 Moz Au at 0.97 g/t Au, 6.273 Moz Ag at 1.55 g/t Ag contained within 125.9 Mt.

73% increase in Indicated ounces following newly completed structural and lithological models and 2025 drilling.- Ten primary shear corridors contain

55% of resource within the Moss Deposit.

Gold X2 retained G Mining Services ("G Mining" or "GMS") to complete the PEA and prepare a technical report in in compliance with the guidelines of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101").

The PEA is derived using the Company's MRE effective as at January 16, 2026. The effective date of the PEA is January 26, 2026, and a NI 43-101 compliant technical report (the "Technical Report") will be filed on the Company's website and under its SEDAR+ profile within 45 days of this news release.

Michael Henrichsen, CEO of Gold X2, commented: "The Moss deposit MRE and PEA represents a major milestone for the Company as we have clearly demonstrated the potential for the Moss Deposit to be a top ten gold producer in Canada1,2. The Project benefits from exceptional infrastructure with the Trans-Canada highway and high-voltage powerlines within 12 kms of the proposed mine site. The PEA has outlined robust economics at a gold price of US

"The Company has done extensive work internally and with G Mining to ensure a realistic high-quality study underpinned by solid geological and engineering work. We look forward to advancing the Project towards a Feasibility Study and the formal permitting process in the second half of 2027."

PEA Summary

Property Description, Location and Access

Gold X2 Mining's Moss Gold Project is located approximately 110km west of Thunder Bay, the largest population centre in Northern Ontario with a population of over 110,000. Moss benefits from well-established infrastructure, including: (1) Trans-Canada highway connectivity to city of Thunder Bay; (2) low-cost high-voltage hydroelectric power line capacity within 12km of the Project; (3) deep-water port access in Thunder Bay; and (4) railway access.

The PEA is based on a conventional open pit mining and milling-flotation-leach operation with a nameplate processing capacity of 30,000 tonnes per day. The study illustrates average annual payable gold production of approximately 265,000 ounces and 374,000 ounces of silver, respectively, over an initial 13.2 year mine life. Table 1 presents the key operating and financial highlights from the PEA, using the base case assumptions of US

Source: Broker Consensus Estimates from CIBC Capital Markets on January 7, 2026: Gold US

Table 1: Operating and Financial Summary6

| PEA Results Summary | Units | |

| Production - Open Pit Mining | ||

| Total Waste Rock Tonnes Mined | kt | 668,255 |

| Total Overburden Tonnes Mined | kt | 72,208 |

| Total Mineralized Tonnes Mined | kt | 138,982 |

| Strip Ratio (total waste) | W:O | 5.3 |

| Total Tonnes Mined | kt | 879,445 |

| Total Mill Feed Tonnes | kt | 138,982 |

| Mill Feed Daily Production | t/d | 30,137 |

| Mill Feed Annual Production | Mt/y | 11 |

| Mill Head Grade Au | g/t | 0.88 |

| Mill Head Grade Ag | g/t | 1.37 |

| Mill Recovery Au | % | 91.6 |

| Mill Recovery Ag | % | 82.8 |

| Total Mill Ounces Recovered Au | koz | 3,589 |

| Total Mill Ounces Recovered Ag | koz | 5,053 |

| Total Average Annual Production Au | koz/y | 265 |

| Total Average Annual Production Ag | koz/y | 374 |

| Operating Costs | ||

| Mining Cost | CAD/t milled | |

| Processing Cost | CAD/t milled | |

| G&A Cost | CAD/t milled | |

| Total Site Cost | CAD/t milled | |

| Royalty | CAD/t milled | |

| Total Operating Cost | CAD/t milled | |

| Cash Cost | CAD/oz | |

| Cash Cost | USD/oz | |

| AISC | CAD/oz | |

| AISC | USD/oz | |

| Capital Costs | ||

| Initial Capital | CAD | |

| Sustaining Capital | CAD | |

| Closure Costs & Monitoring | CAD | |

| Working Capital during construction | CAD | |

| Salvage Value | CAD |

| PEA Results Summary | Units | Base Case | Long Term Consensus | Spot Price |

| General | ||||

| Gold Price | USD/oz | |||

| Silver Price | USD/oz | |||

| Exchange Rate | USD:CAD | 1.34 | 1.35 | 1.35 |

| Fuel Price | CAD/L | |||

| Mine Life | yrs | 13.22 | 13.22 | 13.22 |

| Financials - Pre-Tax | ||||

| Free Cash Flow | CAD | |||

| NPV @ | CAD | |||

| IRR | % | |||

| Payback | yrs | 2.6 | 1.9 | 0.9 |

| Financials - Post Tax | ||||

| Free Cash Flow | CAD | |||

| NPV @ | CAD | |||

| IRR | % | |||

| Payback | yrs | 3.2 | 2.5 | 1.0 |

Updated Mineral Resource Estimate

Figure 1: Moss Deposit and East Coldstream Deposit MRE (January 2026).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/281544_ca6b25b6d4633a0c_001full.jpg

Notes to the Mineral Resource statement:

- The mineral resources described above have been prepared in accordance with the CIM Standards (Canadian Institute of Mining, Metallurgy and Petroleum, 2014) and follow Best Practices outlined by the CIM (2019).

- The Qualified Person, as defined by NI 43-101, ("QP") for this MRE for both the Moss Deposit and the East Coldstream Deposit is Mr. Dominic Lussier, P.Geo., of G Mining Services Inc., who is responsible for the MRE. The effective date of the MRE is January 16, 2026, and is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the Mineral Resource estimate.

- Mineral resources that are not mineral reserves have no demonstrated economic viability. No mineral reserves have been calculated for the Project. There is no guarantee that any part of the mineral resources discussed herein will be converted to a mineral reserve in the future.

- The quantity and grade of reported Inferred Mineral Resources are uncertain, and there has not been sufficient work to define these Mineral Resources as Indicated or Measured. Further work may result in the upgrading of portions of the Inferred Mineral Resources. There is no certainty that Inferred Mineral Resources will be converted to Measured or Indicated Mineral Resources.

- The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, market, or other relevant factors.

- Known underground works at the Moss Deposit have been incorporated into the block model, and zero density has been assigned to the blocks located within the voids.

- Tonnage estimates are based on individually measured and calculated bulk densities for geological units ranging from 2.69 to 2.725 g/cm³. Overburden density is set at 1.8 g/cm³.

- A total of 122 mineralized zones for the Moss Deposit (used for both Au and Ag estimation) and 12 mineralized zones for the East Coldstream Deposit were modeled using Leapfrog geo. High-grade capping for gold estimation of between 15.0 and 55.0 g/t (Moss Deposit) and 12 g/t (East Coldstream Deposit) was applied before compositing. High grade capping for Ag estimation of 30.0 g/t (Moss Deposit) was applied before compositing.

- The MRE was completed using Leapfrog Edge with parent block size of 5 m x 5 m x 5 and a 1.25 m x 1.25 m x 1.25 m minimum sub block size for both the Moss Deposit and the East Coldstream Deposit. Interpolation method used for the Moss Deposit are Ordinary Kriging for the principal shears modeled and ID2 for the secondary shears. East Coldstream Deposit was interpolated using only Ordinary Kriging. Both estimations are using hard boundary between modeled domains.

- Open pit Mineral Resources are reported within an optimized Geovia Whittle pit shell generated at a surface cut-off of 0.35 g/t Au using a gold price of US

$2,200 /oz; a USD/CAD exchange rate of 1.33, a mining cost of 3.67/t and a G&A cost from$2.21 /t, processing cost of$12.04 /t, pit slope angles of 50° for bedrock and 27° for unconsolidated material. Mineral Resources are reported at a cut-off grade of 0.35 g/t Au within this pit shell and are reported as undiluted and in situ. - Tonnage has been expressed in the metric system, and gold metal content has been expressed in troy ounces.

- The tonnages have been rounded to the nearest 1,000 tonne, and the metal content has been rounded to the nearest 1,000 ounce. Totals may not sum due to rounding.

The MRE has focused on the open pit mineralization at the main deposits, being the Moss Deposit and the East Coldstream Deposit, and excludes any underground resources, as well as the Span Lake satellite deposit.

Structural domain modelling and grade interpolation utilises 357 historical diamond drill holes (105,445m) and 210 Gold X2 diamond drill holes (94,094m) at Moss, and 132 historical diamond drill holes (29,841m) and 15 Gold X2 diamond drill holes (7,479m) at East Coldstream Deposit. Both models use a parent block size of 5 x 5 x 5m - the selective mining unit (SMU) - to focus the construction of the resource on mineable block sizes. This is sub-celled to 1.25 x 1.25 x 1.25m to improve volumetric precision.

Both models are based on an updated, robust structural model that utilises oriented drill core measurements from Gold X2's drilling. Along with increased drill density at Moss, this has resulted in improved grade continuity and geostatistical metrics that have resulted in a

Resource categories uses an average 3DDH isotropic search of <45 meters for Indicated, which is manually edited to remove isolated pods, and an average 3DDH isotropic search of <90 meters for Inferred.

The Moss Deposit has sufficient silver mineralization for an estimate of silver to be included in the MRE. Silver concentrations are lower at East Coldstream and have not been modelled.

The PEA is based exclusively on the Mineral Resource defined at the Moss Deposit. The resource model has been regularised to the 5 x 5 x 5m SMU and a 1m dilution skin to contact blocks to account for mining dilution.

The PEA is preliminary in nature and includes Inferred Mineral Resources. Inferred Mineral Resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized.

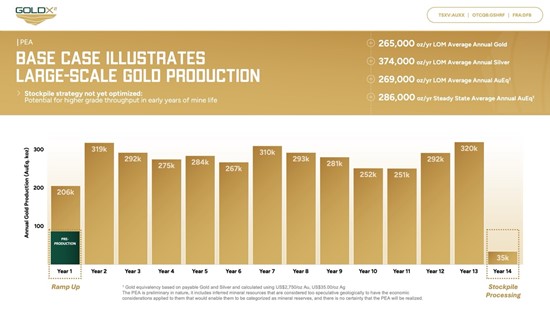

Production Profile

The PEA outlines an average annual production profile of approximately 265,000 ounces of gold and 374,000 ounces of silver respectively over an initial 13.2 year mine life. Total gold production is estimated to be 3.6 million ounces with an average milled grade of 0.88 g/t Au, and a total of 4.5 million ounces of silver at an average milled grade of 1.37 g/t Ag.

Figure 2: Illustrates the Gold Equivalent ounce production profile over the LOM based on payable Gold and Silver calculated using US

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/281544_figure_2.jpg

Mining

The mine plan is based on conventional open pit truck-and-shovel methods with a mill processing capacity of approximately 30,000 tpd over the 13.2 LOM. The pit optimization study used a gold price of US

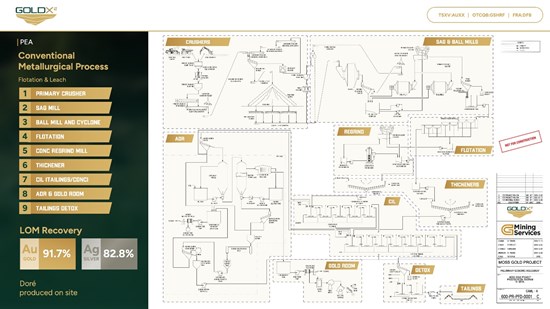

Processing and Recovery

The PEA envisions a 30,000 tonne-per-day processing facility based on a standard metallurgical flowsheet, consisting of grinding to p80=55 microns, rougher flotation, regrind of concentrate to p80=15 microns, carbon-in-leach (CIL) of flotation tailings and concentrate, and adsorption to produce gold doré. CIL tailings will be treated in a cyanide destruction circuit and pumped to a traditional tailings storage facility. Metallurgical testing indicates clean, non-refractory gold mineralization with an average gold recovery of

Figure 3: Moss Deposit Processing Flowsheet.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/281544_ca6b25b6d4633a0c_004full.jpg

Power

The process plant is contemplated to utilize 40 megawatts of power that can be supplied via a 12km power spur from the main Hydro One power line along Highway 11. Hydro One with its indigenous partners is currently installing the Waasigan power line that will add 350 megawatts capacity to the power corridor. Expected power costs are 11 cents/kilowatt hour based on discussions with Hydro One and a review of the Ontario power tariffs.

Operating Costs

LOM operating costs are estimated at US

Table 2 - Summary of Operating and Capital Costs8

| Base Case | Units | |

| Operating Costs | CAD/t milled | USD/t milled |

| Mining Cost | ||

| Processing Cost | ||

| G&A Cost | ||

| Total Site Cost | ||

| Royalty | ||

| Total Operating Cost | ||

| Operating Costs | C$/oz | USD/oz |

| Cash Cost | ||

| AISC | ||

| Capital Costs | CAD | USD |

| Initial Capital | ||

| Sustaining Capital | ||

| Closure Costs & Monitoring | ||

| Working Capital during construction | ||

| Salvage Value |

Project Royalties

Only mineralized blocks on the fringe of the deposit are subject to a net smelter returns ("NSR") royalty that is equivalent to an average LOM NSR of

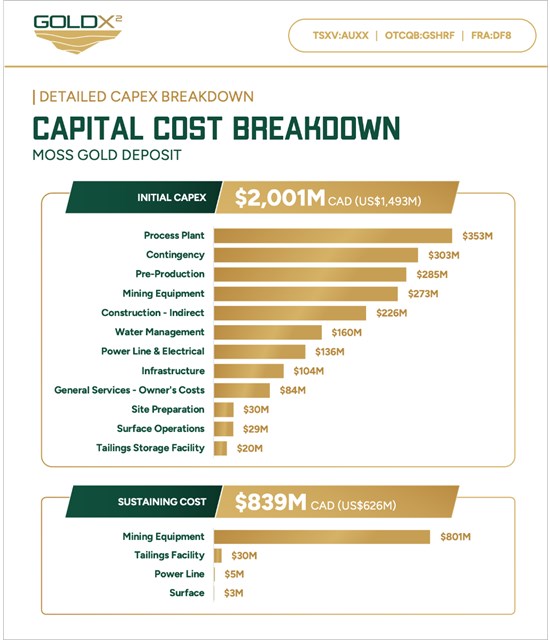

Capital Cost Estimates

The initial capital cost ("capex") is estimated to be

Figure 4: Illustrates the initial CAPEX and sustaining cost breakdown.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/281544_ca6b25b6d4633a0c_005full.jpg

The sustaining capex is estimated to be

Economic Analysis1,2

The PEA provides an after-tax NPV5% of

Table 3 - Base Case Sensitivity to Gold Price (Other Constant Assumptions Ag: US

| Gold Price (USD/oz) | NPV5% C$M | IRR ( %) | FCF C$M | Payback Years | |

| 558.2 | 6.30 | ||||

| 1,119.6 | 4.76 | ||||

| 1,675.9 | 3.78 | ||||

| Study Price | 2,231.5 | 3.16 | |||

| 2,787.1 | 2.70 | ||||

| 3,343.6 | 2.28 | ||||

| 3,900.4 | 1.84 |

Environmental and Permitting

Gold X2 has, through CSL Environmental & Geotechnical, conducted existing conditions environmental studies since mid-2021. In parallel, with the support of One-Eighty Consulting Group, Gold X2 has carried out early engagement with potentially affected Indigenous Nations. Since the start of 2025, this work has expanded in scope and scale and will support future engineering studies and collaborative efforts to manage potential environmental effects.

This ongoing work will also form the basis of a future environmental assessment ("EA") and relevant permitting processes. The Company has commenced, well ahead of entering these processes, a process to engage an experienced environmental consultant to evaluate the existing conditions studies and to support the EA for the Project. Based on available information and ongoing work, the Project is well positioned to advance toward the next stage of development.

Opportunities and Exploration Potential

The PEA presented represents a robust evaluation of a mining scenario at the Moss Deposit and will allow the Company to proceed directly to a Feasibility Study. While care has been taken to provide accurate estimates and realistic assumptions, additional analysis and collection of data will provide opportunities for further refinements of the proposed mining operation that could potentially improve the technical and financial performance of the deposit.

Resource Expansion and Exploration Potential

There is potential both within and adjacent to the RPEEE pit to convert unclassified mineralization with increased drill density that has the potential to increase the size of the deposit, the annual production profile and mine life.

In addition, the Moss Deposit remains open at depth with potential to delineate higher grade mineralization associated structural controls that could support a larger pit and/or underground mining scenario. Exploration drilling at depth is on-going with results expected in the coming months. Along strike, the deposit is open to the SW across a NNE trending fault that has offset the Moss Deposit to the south-southwest. This trend has been defined over approximately 10 km of strike length, across the claims recently acquired from Kesselrun Resources, and will be a focus of the Company's exploration plans in 2026 and 2027. In addition, gold mineralization has been defined over 5km along the Deaty trend, a parallel structure, located approximately 3km to the south of the Moss Deposit. Initial drill results from the first drill fence across the structure are anticipated within the coming months. The Company plans to continue drilling along this prospective structural corridor in 2026.

The Company has completed its grade control drilling programs at the Main and QES Zones. Results are expected in the coming months and will be used to reconcile the MRE against the closed paced drilling data. This will approximate a mining scale review of the model that the Company anticipates will significantly de-risk the project.

In addition to infill drilling to convert Inferred to Indicated Mineral Resources, the Company is planning geotechnical drilling around the proposed pit margin to assess the stability of wall rocks, which may lead to steeper pit slopes that would in turn reduce the stripping ratio. Sample from the grade control drilling will provide composites for Feasibility-scale metallurgical test work to optimise the current process flowsheet, including the potential inclusion of an ore sorting process for lower grade mineralization and a gravity recovery circuit.

Finally, the current mine schedule does not include any stockpile management, which has been proven in earlier scoping reviews to increase the grade of mill feed and annual gold production in the first five years of production. Additional engineering studies to assess steeper slopes and stockpile management will be conducted during 2026 as the supporting data is collected.

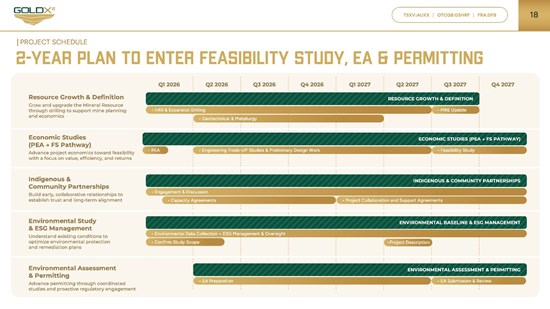

Project Timeline and Next Steps

Figure 5: Illustrates 2-year project schedule to enter FS, EA and Permitting.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/281544_ca6b25b6d4633a0c_006full.jpg

Qualified Assurance Program and Quality Control Measures ("QA/QC")

In this Mineral Resource Estimate both historical and modern assays were included. Quality assurance and quality control ("QA/QC") procedures were applied to modern drilling programs. QA/QC protocols included the systematic insertion of certified reference materials, blanks, and field duplicates into the sample stream at regular intervals. Samples from the modern drilling programs were prepared and analyzed by ALS Laboratories in Thunder Bay, ON, an independent and accredited laboratory, using industry-standard sample preparation procedures and fire assay methods with atomic absorption (Au-AA23) for gold and four acid digestion followed by ICP-MS measurement (ME-MS61) for silver. Samples assaying >10.0 g/t Au are re-analyzed with a gravimetric finish. QA/QC results were reviewed by the Qualified Person and are considered acceptable, with no material issues identified that would affect the reliability of the assay data.

Historical assays have been validated through extensive validation procedures and analyses. Re-assaying of historic drilling is ongoing with re-assayed values included in the resource estimate.

The Qualified Person is of the opinion that the historical and modern assay database is of sufficient quality to support Mineral Resource Estimate (MRE) and the PEA.

Technical Report Preparation and Qualified Persons

The PEA has an effective date of January 26th, 2026 and was issued on January 26th, 2026. It was authored by independent Qualified Persons and is in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

GMS was responsible for the overall report and PEA coordination, property description and location, accessibility, history, mineral processing and metallurgical testing, mineral resource estimation, mining methods, recovery methods, project infrastructures, operating costs, capex, economic analysis and project execution plan. For readers to fully understand the information in this news release, they should read the technical report in its entirety following publication, including all qualifications, assumptions, exclusions and risks. The technical report is intended to be read as a whole and sections should not be read or relied upon out of context.

The technical content of this press release has been reviewed and approved by the independent QPs who were involved with preparation of the PEA:

Dominic Lussier P. Geo, G Mining Services, Geology

Alexandre Dorval, P. Eng., G Mining Services, Mining

Charles Taschereau, P. Eng , G Mining Services, Processing and Recovery

Carl Michaud, ing., G Mining Services, Economic Analysis Mining

Nicolas Vanier-Larrivée, ing., G Mining Services, Infrastructure

Simon Shankie CSL Environmental & Geotechnical

Use of Non-GAAP Measures

Certain financial measures referred to in this news release are not measures recognized under International Financial Reporting Standards ("IFRS") and are referred to as non-GAAP financial measures or ratios. These measures have no standardized meaning under IFRS and may not be comparable to similar measures presented by other companies. The definitions established and calculations performed by Gold X2 are based on management's reasonable judgement and are consistently applied. These measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

The non-GAAP financial measures used in this news release and common to the gold mining industry are all-in sustaining cost per ounce of gold sold, and free cash flow. All-in sustaining cost per ounce of gold sold and free cash flow are non-GAAP financial measures or ratios and have no standardized meaning under IFRS and may not be comparable to similar measures used by other issuers. As the Moss Gold Project is not in production, the Company does not have historical non-GAAP financial measures nor historical comparable measures under IFRS, and therefore the foregoing prospective non-GAAP financial measures or ratios may not be reconciled to the nearest comparable measures under IFRS.

About Gold X2

Gold X2 is a growth-oriented gold company focused on delivering long-term shareholder and stakeholder value through the acquisition and advancement of primary gold assets in tier-one jurisdictions. It is led by the ex-global head of structural geology for the world's largest gold company and backed by one of Canada's pre-eminent private equity firms. The Company's current focus is the advanced stage

For More Information - Please Contact:

Michael Henrichsen

President, Chief Executive Officer and Director

Gold X2 Mining Inc.

E: mhenrichsen@goldx2.com

W: www.goldx2.com

T: 1-604-404-4335

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements

In this news release, forward-looking statements relate to, among other things, the results, interpretations and conclusions of the PEA, including projected mine life, throughput, production targets, grades, recoveries, operating and capital cost estimates, cash costs and all-in sustaining costs, net present value, internal rate of return and payback; the timing and filing of a technical report supporting the PEA and updated mineral resource estimate; the potential for project optimization, further drilling and exploration programs and their anticipated outcomes; the timing and outcome of future studies (including any prefeasibility or feasibility studies), permitting and regulatory approvals; the availability of infrastructure, power and water; project schedules and development plans; the potential ranking or positioning of the Moss Gold Project on industry cost curves; the Company's expectations regarding engagement with Indigenous Peoples and other rights-holders and stakeholders; and the availability and terms of financing required to advance and, if warranted, construct the Moss Gold Project. These forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to differ materially from those expressed or implied by the forward-looking statements. Forward-looking statements regarding production targets, economic results and mine life are derived from and subject to the assumptions and limitations of the PEA and are inherently uncertain.

Forward-looking statements are based on a number of assumptions that, while considered reasonable by the Company as of the date hereof, are inherently subject to significant business, economic, technical and competitive uncertainties and contingencies. Such assumptions include, without limitation: assumptions underlying the PEA mine plan and schedule, pit slope angles and geotechnical parameters; accuracy of mineral resource estimates (including grade, tonnage and geometry) and metallurgical recovery estimates from available testwork; the availability of contractors, equipment, materials and skilled labor when required and at estimated costs; cost inflation trends and the accuracy of capital and operating cost estimates; continued access to necessary infrastructure, power and water at estimated costs and timelines; assumptions regarding commodity prices (including gold and silver), foreign exchange rates and discount rates; the interpretation of drilling, sampling, metallurgical and other technical data; the timing of, and ability to obtain and maintain, required permits, licenses and approvals; successful completion of environmental and regulatory processes; constructive engagement and outcomes with Indigenous Peoples and other rights-holders and stakeholders; stable and supportive regulatory frameworks; availability of financing on acceptable terms; and the absence of material adverse changes in general economic, market or political conditions and in applicable law, including tax and royalty regimes.

Risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements include, without limitation: uncertainties inherent in preliminary economic assessments and in the estimation of mineral resources (including the inclusion of inferred mineral resources), metallurgical recoveries and geotechnical parameters; changes in mine plans, schedules and cost estimates; commodity price and foreign exchange volatility; inflationary pressures and supply chain disruptions; risks related to permitting, environmental assessment and other regulatory approvals and conditions; the outcome of engagement with Indigenous Peoples and other rights-holders and stakeholders and the potential for delays or conditions arising therefrom; availability and cost of power, water, infrastructure, equipment, materials and skilled labor; financing risks and access to capital on acceptable terms; climate, weather and other operating risks typical of mining projects; title, surface rights and access risks; environmental, health and safety risks; changes in laws, regulations, policies and enforcement (including taxes and royalties); potential litigation; and other risks set out in the Company's continuous disclosure filings available under the Company's profile on SEDAR+ in Canada. Readers are cautioned that the foregoing list of assumptions, risks and uncertainties is not exhaustive.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements. Forward-looking statements contained in this news release are made as of the date hereof. Gold X2 expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.

1 Preliminary Economic Assessment, Effective Date: January 26, 2026.

2 Mineral Resource Estimate, Effective Date: January 16, 2026.

3 The PEA is preliminary in nature and includes Inferred Mineral Resources. Inferred Mineral Resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized.

4 Mineral resources that are not mineral reserves have no demonstrated economic viability. No mineral reserves have been calculated for the Project. There is no guarantee that any part of the mineral resources discussed herein will be converted to a mineral reserve in the future.

5 Refer to the "Non-GAAP Financial Measures" section of this news release for more information.

6 Refer to the "Non-GAAP Financial Measures" section of this news release for more information.

7 https://www.gold.org/goldhub/data/aisc-gold

8 Refer to the "Non-GAAP Financial Measures" section of this news release for more information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281544