Homeland Closes Skull Creek Project Acquisition

Homeland Uranium (OTCQB: HLUCF) closed its acquisition of the Skull Creek Uranium Project in Moffat and Rio Blanco Counties, Colorado on October 3, 2025.

Homeland paid US$300,000 cash and issued 750,000 common shares to Hightest to acquire 100% of 154 mining claims plus one state SEP parcel. Hightest retains a 2% NSR royalty (reduced to 1.5% on SEP Lands) with an option to buy the NSR down to 1% for US$1.5M before notice of commercial production. Contingent payments: at 10M lbs U3O8 Homeland pays US$250,000 cash + US$250,000 in shares; at ≥30M lbs U3O8 total payments equal US$500,000 cash + US$500,000 in shares (pro rata between thresholds).

Skull Creek lies ~20 miles (33 km) west of Homeland's Coyote Basin and adjacent to Red Wash, enabling potential operational synergies and planned drilling to upgrade historical deposits.

Homeland Uranium (OTCQB: HLUCF) ha chiuso l'acquisizione del Skull Creek Uranium Project nelle contee di Moffat e Rio Blanco, in Colorado, il 3 ottobre 2025.

Homeland ha pagato US$300.000 in contanti e ha emesso 750.000 azioni ordinarie a Hightest per acquisire il 100% di 154 diritti minerari più un lotto SEP statale. Hightest conserva una royalty NSR del 2% (ridotta al 1,5% sui terreni SEP) con l'opzione di acquistare l'NSR fino all'1% per US$1,5 milioni prima della notifica di produzione commerciale. Pagamenti contingent: a 10 milioni di libbre U3O8 Homeland paga US$250.000 in contanti + US$250.000 in azioni; a ≥30 milioni di libbre U3O8 i pagamenti totali ammontano a US$500.000 in contanti + US$500.000 in azioni (pro quota tra le soglie).

Skull Creek si trova a circa 20 miglia (33 km) a ovest del Coyote Basin di Homeland e adiacente a Red Wash, consentendo potenziali sinergie operative e piani di perforazione per aggiornare i giacimenti storici.

Homeland Uranium (OTCQB: HLUCF) cerró la adquisición del Skull Creek Uranium Project en los condados de Moffat y Rio Blanco, Colorado, el 3 de octubre de 2025.

Homeland pagó US$300.000 en efectivo y emitió 750.000 acciones comunes a Hightest para obtener el 100% de 154 derechos mineros más un lote SEP estatal. Hightest mantiene una regalía NSR del 2% (reducida al 1,5% en tierras SEP) con la opción de comprar el NSR hasta 1% por US$1,5 millones antes de la notificación de producción comercial. Pagos contingentes: a 10M libras de U3O8 Homeland paga US$250.000 en efectivo + US$250.000 en acciones; a ≥30M libras de U3O8 los pagos totales ascienden a US$500.000 en efectivo + US$500.000 en acciones (prorrateados entre los umbrales).

Skull Creek se encuentra a ~20 millas (33 km) al oeste de Coyote Basin de Homeland y adyacente a Red Wash, lo que facilita posibles sinergias operativas y la perforación planificada para mejorar los depósitos históricos.

Homeland Uranium (OTCQB: HLUCF)은 2025년 10월 3일 콜로라도주 모핏카운티와 리오블랑코카운티의 Skull Creek Uranium Project 인수를 완료했습니다.

Homeland는 미화 30만 달러를 현금으로 지불하고 75만 주의 보통주를 Hightest에 발행하여 154개의 광권과 주 государственной SEP 토지를 100% 취득했습니다. Hightest는 SEP 토지에 대해 2%의 NSR 로열티를 보유하며, 상업 생산 통지 이전에 1.5%로 축소될 수 있는 옵션이 있습니다. 조건부 지불: U3O8 1000만 파운드 달성 시 Homeland는 현금 25만 달러 + 주식 25만 달러를 지불하고, U3O8 3000만 파운드 이상 달성 시 총 지불은 현금 50만 달러 + 주식 50만 달러로 산정되며 임계치 간 비례 배분됩니다.

Skull Creek는 Homeland의 Coyote Basin에서 약 20마일(33km) 떨어진 서쪽에 위치하며 Red Wash와 인접하여 운영 시너지를 낼 수 있는 가능성과 역사적 매장량을 업그래이드하기 위한 시추 계획이 있습니다.

Homeland Uranium (OTCQB: HLUCF) a clôturé l'acquisition du Skull Creek Uranium Project dans les comtés de Moffat et Rio Blanco, Colorado, le 3 octobre 2025.

Homeland a versé US$300 000 en cash et a émis 750 000 actions ordinaires à Hightest pour acquérir 100% de 154 droits miniers plus un lot SEP étatique. Hightest conserve une redevance NSR de 2% (réduite à 1,5% sur les terres SEP) avec une option d'acheter le NSR jusqu'à 1% pour US$1,5M avant la notification de production commerciale. Paiements conditionnels : à 10M lbs U3O8 Homeland paie US$250 000 en espèces + US$250 000 en actions ; à ≥30M lbs U3O8 le total des paiements s'élève à US$500 000 en espèces + US$500 000 en actions (au prorata entre les seuils).

Skull Creek se situe à environ 20 miles (33 km) à l'ouest du Coyote Basin de Homeland et adjacent à Red Wash, permettant d'éventuelles synergies opérationnelles et des forages prévus pour améliorer les dépôts historiques.

Homeland Uranium (OTCQB: HLUCF) hat den Erwerb des Skull Creek Uranium Project in den Countys Moffat und Rio Blanco, Colorado, am 3. Oktober 2025 abgeschlossen.

Homeland zahlte US$300.000 in bar und emittierte 750.000 Stammaktien an Hightest, um 100% der 154 Bergbaurechte plus eine staatliche SEP-Parzelle zu erwerben. Hightest behält eine NSR-Royalty von 2% (auf SEP-Liegenschaften auf 1,5% reduziert) mit der Option, die NSR bis auf 1% für US$1,5 Mio. vor der Mitteilung über kommerzielle Produktion zu kaufen. Konditionale Zahlungen: bei 10M Pfund U3O8 zahlt Homeland US$250.000 bar + US$250.000 in Aktien; bei ≥30M Pfund U3O8 betragen die Gesamtauszahlungen US$500.000 bar + US$500.000 in Aktien (anteilig zwischen den Schwellen).

Skull Creek liegt ca. 20 Meilen (33 km) westlich des Homeland-Coyote Basin und angrenzend an Red Wash, was potenzielle operative Synergien und geplante Bohrungen zur Aufwertung historischer Lagerstätten ermöglicht.

Homeland Uranium (OTCQB: HLUCF) أنهى صفقة استحواذ على مشروع Skull Creek Uranium في مقاطعات موفّات ورود بلانكو، كولورادو في 3 أكتوبر 2025.

دفعت US$300,000 نقداً وأصدرت 750,000 سهماً عادياً إلى Hightest للاستحواذ على 100% من 154 مطلبي/mining rights إلى جانب قطعة SEP حكومية. تحتفظ Hightest بحقworthy NSR 2% (مخفضة إلى 1.5% على أراضي SEP) مع خيار شراء NSR حتى 1% مقابل US$1.5 مليون قبل إشعار الإنتاج التجاري. دفعات مشروطة: عند وصول 10 ملايين رطل من U3O8 تدفع Homeland US$250,000 نقداً + US$250,000 سلفاً بالأسهم؛ عند ≥30 مليون رطل من U3O8 تكون المدفوعات الإجمالية US$500,000 نقداً + US$500,000 بالأسهم (نسبة prorata بين العتبات).

يقع Skull Creek على نحو ~20 ميلاً (33 كم) غرب حوض Coyote التابع ل Homeland ومتجاور لـ Red Wash، مما يتيح تآزرًا تشغيليًا محتملًا وخطة حفر لترقية الاحتياطات التاريخية.

Homeland Uranium (OTCQB: HLUCF) 已于2025年10月3日完成对 Skull Creek Uranium Project 的收购,地点位于科罗拉多州的莫法特县和里奥布兰科县。

Homeland 以 US$30万美元现金并发行 75万股普通股给 Hightest,以获得 154个矿权以及一个州级 SEP 土地。Hightest 保留 2% 的 NSR royalty(在 SEP 土地上降至 1.5%),并在商业生产通知前有将 NSR 购买至 1% 的选项,价格为 US$150万美元。若有条件支付:达到 1000万磅 U3O8 时,Homeland 以现金 US$250,000 + 以股权 US$250,000 进行支付;达到 ≥3000万磅 U3O8 时,总支付为现金 US$500,000 + 股权 US$500,000(在各门槛之间按比例分配)。

Skull Creek 距 Homeland 的 Coyote Basin 约 20英里(33公里),并毗邻 Red Wash,有潜在的运营协同作用,并计划进行钻探以提升历史性矿床。

- Acquired 154 federal mining claims plus 1 SEP parcel

- Proximity: Skull Creek ~20 miles (33 km) from Coyote Basin

- Low upfront cash: US$300,000 paid at closing

- Issued 750,000 shares to complete acquisition

- Hightest retains up to a 2% NSR royalty on the Property

- SEP Lands royalty fixed at 1.5%, convertible to 1% for US$1.5M

- Contingent payments up to US$500,000 cash and US$500,000 shares

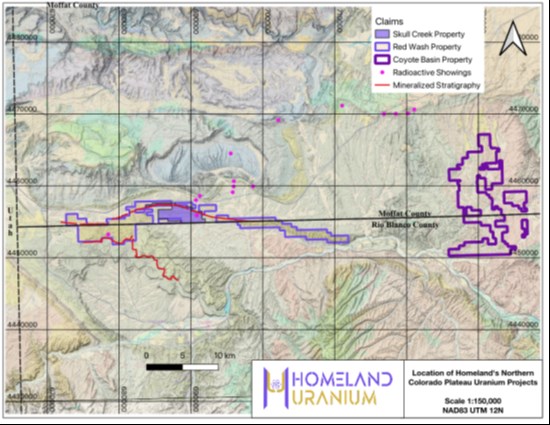

Vancouver, British Columbia--(Newsfile Corp. - October 3, 2025) - Homeland Uranium Corp. (TSXV: HLU) (OTCQB: HLUCF) (FSE: D3U) ("Homeland" or the "Company") is pleased to announce that it has completed its previously announced transaction with Hightest Resources ("Hightest") to acquire the Skull Creek Uranium Project ("Skull Creek" or 'the Property") in Moffat and Rio Blanco Counties, Colorado. Skull Creek is located adjacent to the Company's Red Wash Project and is approximately 20 miles (33 km) west of Homeland's flagship Coyote Basin Uranium Project (see Figure 1). For more details about the Property and the transaction, please see the news release dated September 22, 2025 on the Homeland website at www.homeland-uranium.com or on the Company's profile on SEDARplus.ca).

The Skull Creek Property is comprised of 154 mining claims all located on federal Bureau of Land Management-administered lands and one single state exploration permit administered by the State of Colorado (the "SEP Lands").

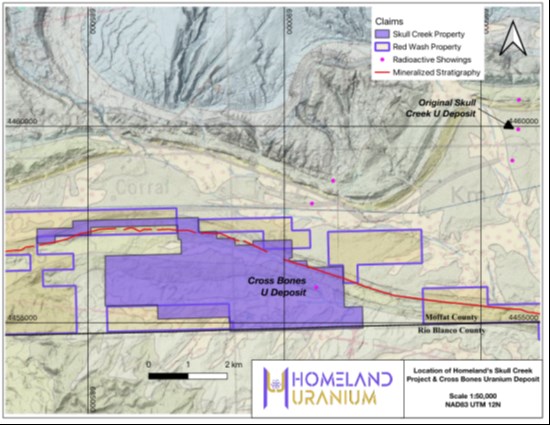

"The addition of the Cross Bones Uranium Deposit on the Skull Creek Property is a tremendously exciting acquisition for Homeland. Strategically located in close proximity to our Coyote Basin Project in mining-friendly Colorado, we anticipate Skull Creek providing significant potential operational synergies with Coyote Basin and further strengthens our position in the district. With a dominant land package containing two considerable historical uranium deposits with outstanding expansion potential, Homeland is eager to start drilling at both Coyote and Skull Creek to systematically upgrade these deposits to modern standards and become a key part of the urgently needed resurgence of domestic uranium supply chain in the United States," stated Roger Lemaitre, President & CEO of Homeland.

As part of the transaction, Homeland paid Hightest US

Hightest will also receive potential contingency payments based upon the size of any uranium resource defined on the Property consistent with NI 43-101 standards in the future. Should a mineral resource equal to 10 million pounds U3O8 be defined, Homeland will pay to Hightest an additional U.S.

About Homeland Uranium Corp.

Homeland Uranium is a mineral exploration company focused on becoming a premier US-focused and resource-bearing uranium explorer and developer. The Company is the

Qualified Person

Roger Lemaitre. P.Eng., P.Geo., the Company's President and CEO, is a Qualified Person as defined in NI 43-101, and has reviewed and approved the technical content of this news release.

For further information, please contact:

Roger Lemaitre

President & Chief Executive Officer

Homeland Uranium Corp.

Tel: 306-713-1401

Email: info@homeland-uranium.com

Investor Relations

Kin Communications Inc.

Tel: 604-684-6730

Email: HLU@kincommunications.com

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" and "forward-looking information" (collectively, "forward-looking statements") within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements in this news release relate to, among other things: the completion of the transaction, confirmation of the historical resource estimates, the Company's expectations and strategic plans in relation to the exploration of the Company's uranium mineral properties, including all phases of the exploration program at the Coyote Basin and Red Wash uranium projects in Colorado, and receipt of applicable regulatory approvals to complete the transaction as contemplated.

These forward-looking statements reflect the Company's current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include, among other things: the availability of funds; the ability to complete the transaction; receipt of applicable regulatory approvals conditions in general economic and financial markets; accuracy of assay results; geological interpretations from drilling results, timing and amount of capital expenditures; performance of available laboratory and other related services; future operating costs; future demand for energy; the historical basis for current estimates of potential quantities and grades of target zones; the availability of skilled labour and no labour related disruptions at any of the Company's operations; no unplanned delays or interruptions in scheduled activities; all necessary permits, licenses and regulatory approvals for operations are received in a timely manner; the ability to secure and maintain title and ownership to properties and the surface rights necessary for operations; and the Company's ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

The Company cautions the reader that forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the availability of funds; the ability to complete the transaction as contemplated; receipt of applicable regulatory approvals; the timing and content of work programs; results of exploration activities and development of mineral properties; receipt of applicable regulatory approvals the interpretation and uncertainties of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project costs overruns or unanticipated costs and expenses; availability of funds; failure to delineate potential quantities and grades of the target zones based on historical data; general market and industry conditions; and those factors identified under the captions "Risks Factors" and "Risks and Uncertainties" in the Company's disclosure materials filed on SEDAR+ at www.sedarplus.ca.

Forward-looking statements are based on the expectations and opinions of the Company's management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Figure 1: Homeland Uranium's uranium holdings in the Northern Colorado Plateau

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10583/269005_2c34b49a2460bbef_002full.jpg

Figure 2: The location of the Skull Creek Property and the Cross Bones Uranium Deposit.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10583/269005_2c34b49a2460bbef_003full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/269005