Homerun Resources Inc. Signs Binding LOI for the Acquisition of Additional Mineral Rights in the Santa Maria Eterna Silica Sand District

Homerun Resources (OTCQB: HMRFF) has signed a binding Letter of Intent to acquire exploitation rights for the Pedreiras mining tenement in Brazil's Santa Maria Eterna Silica Sand District. The acquisition includes a 32 million tonne measured resource that has been drilled to 8 metres and is fully permitted.

The transaction, valued at US$1.4 million (US$1.2M in shares at CA$1.00 and US$200K in warrants), represents Homerun's third CBPM lease acquisition. This strategic move gives the company complete control over the district, with a total target resource exceeding 200 million tonnes. The consolidation has been achieved for a total capital outlay of US$2.1 million, significantly below the implied value based on the US$150 per tonne transfer price for the planned Solar Glass Manufacturing facility.

The Pedreiras concession comes with a favorable royalty rate of R$30.17 per extracted tonne payable to CBPM.Homerun Resources (OTCQB: HMRFF) ha firmato una Lettera d’Intenti vincolante per acquisire i diritti di sfruttamento del tenement estrattivo Pedreiras nelDistretto di sabbia silicea di Santa Maria Eterna, in Brasile. L’acquisizione comprende una risorsa misurata di 32 milioni di tonnellate che è stata trivellata fino a 8 metri ed è integralmente autorizzata.

La transazione, valutata US$1,4 milioni (US$1,2 milioni in azioni a CA$1,00 e US$200k in warrant), rappresenta la terza acquisizione di una locazione CBPM da parte di Homerun. Questa mossa strategica conferisce alla società il controllo completo sul distretto, con una risorsa totale bersaglio superiore a 200 milioni di tonnellate. La consolidazione è stata realizzata con una spesa in capitale totale di US$2,1 milioni, significativamente inferiore al valore implicito basato sul prezzo di trasferimento di US$150 per tonnellata per l’imminente impianto Solar Glass Manufacturing.

La concessione Pedreiras comporta un’aliquota di royalty favorevole di R$30,17 per tonnellata estratta pagabile a CBPM.

Homerun Resources (OTCQB: HMRFF) ha firmado una Carta de Intención vinculante para convertirse en la propietaria de los derechos de explotación del tenement de minería Pedreiras en el Distrito de Arena Silícea Santa Maria Eterna, Brasil. La adquisición incluye un recurso medido de 32 millones de toneladas que ha sido perforado hasta 8 metros y está totalmente autorizado.

La operación, valorada en US$1,4 millones (US$1,2 millones en acciones a CA$1,00 y US$200K en warrants), representa la tercera adquisición de arrendamientos CBPM de Homerun. Este movimiento estratégico otorga a la empresa control total sobre el distrito, con un recurso objetivo total superior a 200 millones de toneladas. La consolidación se ha logrado con un gasto total de US$2,1 millones, significativamente por debajo del valor implícito basado en un precio de transferencia de US$150 por tonelada para la futura instalación de Solar Glass Manufacturing.

La concesión de Pedreiras tiene una royalty favorable de R$30,17 por tonelada extraída pagadera a CBPM.

Homerun Resources (OTCQB: HMRFF)가 브라질 산타 마리아 에터나 규사모래 지구의 Pedreiras 채굴 용지에 대한 개발권 양도를 위한 구속력 있는 의향서를 서명했습니다. 인수에는 8m까지 시추된 فع 3200만 톤의 측정 가능한 자원이 포함되며 허가를 모두 받았습니다.

거래 가치는 미화 140만 달러이며(CA$1.00의 주식으로 120만 달러, 미국 달러 20만 달러의 워런트 포함), Homerun의 세 번째 CBPM 임대 획득에 해당합니다. 이 전략적 조치는 지구 전체에 대한 회사의 지배권을 부여하며, 총 목표 자원이 2억 톤을 초과합니다. 이번 통합은 총 자본 지출 미화 210만 달러로 달성되었으며, 계획된 Solar Glass Manufacturing 시설의 물량당 전달가 미화 150달러/톤에 따른 암시된 가치보다 크게 낮습니다.

Pedreiras 현권은 CBPM에 지불되는 추출 톤당 R$30.17의 우호적인 로열티를 수반합니다.

Homerun Resources (OTCQB: HMRFF) a signé une lettre d’intention contraignante pour acquérir les droits d’exploitation du foncier minier Pedreiras dans le district de sable siliceux Santa Maria Eterna au Brésil. L’acquisition comprend une ressource mesurée de 32 millions de tonnes qui a été forée à 8 mètres et est entièrement autorisée.

La transaction, évaluée à US$1,4 million (US$1,2 million en actions à CA$1,00 et US$200K en warrants), représente la troisième acquisition de bail CBPM par Homerun. Cette démarche stratégique donne au groupe un contrôle total sur le district, avec une ressource cible totale dépassant les 200 millions de tonnes. La consolidation a été réalisée pour une dépense en capital totale de US$2,1 millions, nettement en dessous de la valeur implicite basée sur le prix de transfert de US$150 par tonne pour l’usine Solar Glass Manufacturing prévue.

La concession Pedreiras bénéficie d’un taux de redevance favorable de R$30,17 par tonne extrait payable à CBPM.

Homerun Resources (OTCQB: HMRFF) hat eine bindende Absichtserklärung unterschrieben, um die Explorationsrechte für den Pedreiras-Abbaurechtsstreifen im Santa Maria Eterna Silica-Sand-Distrikt Brasiliens zu erwerben. Die Übernahme umfasst eine gemessene Ressource von 32 Millionen Tonnen, die bis zu 8 Meter gebohrt wurde und vollständig genehmigt ist.

Die Transaktion, mit einem Wert von US$1,4 Millionen (US$1,2 Mio. in Aktien zu CA$1,00 und US$200k in Warrants), stellt die dritte CBPM-Pachtakquisition von Homerun dar. Dieser strategische Schritt gibt dem Unternehmen die vollständige Kontrolle über den Distrikt, mit einer Gesamtrressource von über 200 Millionen Tonnen. Die Konsolidierung wurde mit Gesamtkapitalausgaben von US$2,1 Millionen realisiert, deutlich unter dem implizierten Wert basierend auf dem Transferpreis von US$150 pro Tonne für die geplante Solar Glass Manufacturing-Anlage.

Die Pedreiras-Lizenz kommt mit einer günstigen Royalty-Rate von R$30,17 pro extrahierter Tonne, zahlbar an CBPM.

Homerun Resources (OTCQB: HMRFF) قد وقعت مذكرة تفاهم ملزمة للاستحواذ على حقوق الاستغلال لـأرض التعدين Pedreiras في منطقة رمال السيليكا Santa Maria Eterna في البرازيل. يتضمن الاستحواذ موارد مقاسة تبلغ 32 مليون طن تم حفرها حتى عمق 8 أمتار ومسموح بها بالكامل.

تبلغ قيمة الصفقة 1.4 مليون دولار أمريكي (1.2 مليون دولار في أسهم عند CA$1.00 و200 ألف دولار أمريكي في ضمانات warrants)، وتُمثل الاستحواذ الثالث لمعارض CBPM من Homerun. هذه الخطوة الاستراتيجية تمنح الشركة سيطرة كاملة على المقاطعة، مع إجمالي موارد مستهدفة يتجاوز 200 مليون طن. تم تحقيق التوحيد بتكاليف رأسمالية إجمالية قدرها 2.1 مليون دولار أمريكي، وهي أدنى بكثير من القيمة المفترضة بناءً على سعر نقل 150 دولارًا أمريكيًا للطن للمرفق المخطط Solar Glass Manufacturing.

تأتي امتياز Pedreiras مع معدل امتيازي ميسر قدره R$30.17 لكل طن مستخرج يدفع لـ CBPM.

Homerun Resources (OTCQB: HMRFF) 已签署具约束力的意向书,以获取位于巴西圣玛利亚永恒石英砂区的Pedreiras 采矿地块的勘探开发权。该收购包括一项3200万吨的测量资源,已钻探至8米并已获得全部许可。

交易估值为140万美元(其中CA$1.00的股票占1.2百万美元,另有20万美元的认股权证),代表Homerun的第三笔CBPM租赁收购。此次战略举措使公司对该区拥有完全控制权,目标资源总量> 2亿吨。整合的总资本支出为210万美元,远低于基于计划中的Solar Glass Manufacturing设施每吨150美元的隐含价值。

Pedreiras 估license伴随对CBPM的有利特许权税率,按每提取吨计收R$30.17。

- None.

- Share dilution from US$1.2M in new shares being issued

- Additional warrant dilution potential of US$200K

- Resource drilling limited to only 8 metres depth

News Release Highlights:

- Homerun has now secured ownership and supply agreements covering the entire Santa Maria Eterna Silica Sand District.

- The new Pedreiras concession is fully permitted with a low royalty rate of R

$ 30.17 per extracted tonne. - The Pedreiras concessions have been drilled to a depth of 8 metres with a 32 million tonne resource filed at the Agência Nacional de Mineração (ANM).

- The Company's target resource under the three CBPM Lease acquisitions now exceeds 200 million tonnes.

Vancouver, British Columbia--(Newsfile Corp. - September 12, 2025) - Homerun Resources Inc. (TSXV: HMR) (OTCQB: HMRFF) ("Homerun" or the "Company") is pleased to announce it has signed a binding Letter of Intent (LOI) with Pedreiras do Brasil S.A. ("Pedreiras") a company controlled by Vitoria Stone, dated September 10, 2025, securing the rights to exploit the Pedreiras mining tenement (871.721/2021, 246.36 hectares) at the Santa Maria Eterna Silica Sand District in the municipality of Belmonte, Bahia, Brazil, granted under a lease agreement with Companhia Bahiana de Pesquisa Mineral (CBPM).

This LOI enables Homerun to acquire all exploitation rights and obligations currently held by Pedreiras under the CBPM Lease, on a measured resource of 32 million tonnes (auger drilled to 8 metres) filed at the ANM and is fully permitted with a royalty payment to CBPM of R

This is now the third CBPM lease acquisition by Homerun marking a significant step in the continuing strategic plan to consolidate control over the Santa Maria Eterna Silica Sand District. By controlling the district, Homerun secures uninterrupted access to a unique large-tonnage high-purity silica sand district, solidifying supply chains, enabling a competitive advantage in vertical integration, achieving pricing power and removing market competition. It also strengthens Homerun's position when seeking funding or strategic partners as the Company can offer certainty of secure long-life supply and scale. The Company's target resource over the areas of the three acquisitions now exceeds 200 million tonnes, including a current NI 43-101 mineral resource estimate of 63 million tonnes. This strategic consolidation has been achieved for total capital outlay of US

Brian Leeners, CEO of Homerun stated, "This marks a major milestone for Homerun. With district control we are positioned to unlock the full potential of Santa Maria Eterna. Our team has delivered this consolidation with minimal capital, laying the foundation for significant value creation as we advance towards production. We want to thank our management team for this effort in strategically building significant asset value for Homerun and its shareholders."

The transaction will be settled with US

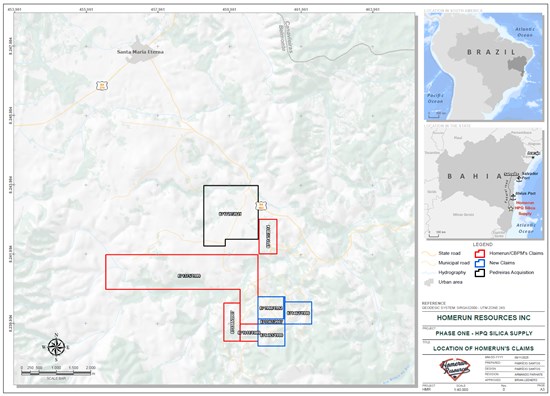

Figure 1: location of existing Homerun controlled claims via CBPM Lease Agreement (red and blue) and the new claims under the Pedreiras Agreement (in black).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4082/266168_b188dd55f4d37bab_001full.jpg

About Homerun (www.homerunresources.com)

Homerun (TSXV: HMR) is a vertically integrated materials leader revolutionizing green energy solutions through advanced silica technologies. As an emerging force outside of China for high-purity quartz (HPQ) silica innovation, the Company controls the full industrial vertical from raw material extraction to cutting-edge solar, battery and energy storage solutions. Our dual-engine vertical integration strategy combines:

Homerun Advanced Materials

- Utilizing Homerun's robust supply of high purity silica sand and quartz silica materials to facilitate domestic and international sales of processed silica through the development of a 120,000 tpy processing plant.

- Pioneering zero-waste thermoelectric purification and advanced materials processing technologies with University of California - Davis.

Homerun Energy Solutions

- Building Latin America's first dedicated high-efficiency, 365,000 tpy solar glass manufacturing facility and pioneering new solar technologies based on years of experience as an industry leader in developing photovoltaic technologies with a specialization in perovskite photovoltaics.

- European leader in the marketing, distribution and sales of alternative energy solutions into the commercial and industrial segments (B2B).

- Commercializing Artificial Intelligence (AI) Energy Management and Control System Solutions (hardware and software) for energy capture, energy storage and efficient energy use.

- Partnering with U.S. Dept. of Energy/NREL on the development of the Enduring long-duration energy storage system utilizing the Company's high-purity silica sand for industrial heat and electricity arbitrage and complementary silica purification.

With multiple profit centers built within the vertical strategy and all gaining economic advantage utilizing the Company's HPQ silica, across, solar, battery and energy storage solutions, Homerun is positioned to capitalize on high-growth global energy transition markets. The 3-phase development plan has achieved all key milestones in a timely manner, including government partnerships, scalable logistical market access, and breakthrough IP in advanced materials processing and energy solutions.

Homerun maintains an uncompromising commitment to ESG principles, deploying the cleanest and most sustainable production technologies across all operations while benefiting the people in the communities where the Company operates. As we advance revenue generation and vertical integration in 2025, the Company continues to deliver shareholder value through strategic execution within the unstoppable global energy transition.

On behalf of the Board of Directors of

Homerun Resources Inc.

"Brian Leeners"

Brian Leeners, CEO & Director

brianleeners@gmail.com / +1 604-862-4184 (WhatsApp)

Tyler Muir, Investor Relations

info@homerunresources.com / +1 306-690-8886 (WhatsApp)

FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements".

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/266168