Heliostar to Restart Mining Operations and Invest in Growth at Its San Agustin Mine, Durango

Heliostar Metals (OTCQX: HSTXF) announced the restart of mining operations at its San Agustin Mine in Durango, Mexico, with initial production expected in Q4 2025. The project demonstrates strong economics with a post-tax NPV5% of US$35.25M and IRR of 548% at a US$3,000/oz gold price. The operation requires US$4.2M in CAPEX and is expected to produce 45,000 gold ounces.

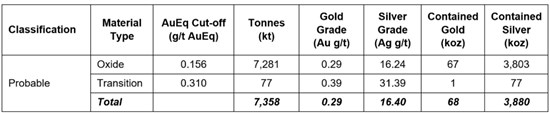

The company, with US$30M in cash, plans to shift from residual leaching to active mining, particularly in the Corner Area. The project has a probable mineral reserve of 68,000 gold ounces with a 1.2-year mine life at an AISC of US$1,990/oz Au. Heliostar will also commence drilling programs targeting oxide expansion and exploring sulphide porphyry/breccia targets.

Heliostar Metals (OTCQX: HSTXF) ha annunciato la ripresa delle operazioni minerarie presso la sua miniera San Agustin a Durango, in Messico, con la produzione iniziale prevista per il quarto trimestre del 2025. Il progetto presenta solide prospettive economiche con un NPV post-tasse al 5% di 35,25 milioni di dollari USA e un IRR del 548% considerando un prezzo dell'oro di 3.000 USD/oz. L'operazione richiede un CAPEX di 4,2 milioni di dollari USA e si prevede una produzione di 45.000 once d'oro.

L'azienda, con 30 milioni di dollari USA in liquidità, intende passare dall'estrazione residua alla miniera attiva, in particolare nell'area Corner. Il progetto dispone di una riserva minerale probabile di 68.000 once d'oro con una vita utile della miniera di 1,2 anni e un AISC di 1.990 USD/oz Au. Heliostar avvierà inoltre programmi di perforazione per espandere la zona di ossidi e per esplorare obiettivi di porfido/sulfuri brecciati.

Heliostar Metals (OTCQX: HSTXF) anunció la reanudación de las operaciones mineras en su mina San Agustin en Durango, México, con producción inicial prevista para el cuarto trimestre de 2025. El proyecto muestra una fuerte economía con un VPN post-impuestos al 5% de 35,25 millones de USD y una TIR del 548% a un precio del oro de 3.000 USD/oz. La operación requiere un CAPEX de 4,2 millones de USD y se espera producir 45.000 onzas de oro.

La empresa, con 30 millones de USD en efectivo, planea pasar de la lixiviación residual a la minería activa, especialmente en la zona Corner. El proyecto cuenta con una reserva mineral probable de 68.000 onzas de oro con una vida útil de la mina de 1,2 años y un AISC de 1.990 USD/oz Au. Heliostar también iniciará programas de perforación para expandir los óxidos y explorar objetivos de pórfido/breccha de sulfuros.

Heliostar Metals (OTCQX: HSTXF)는 멕시코 두랑고에 위치한 San Agustin 광산의 채굴 작업 재개를 발표했으며, 초기 생산은 2025년 4분기에 예상됩니다. 이 프로젝트는 금 가격 온스당 3,000달러 기준으로 세후 NPV 5% 할인율 3,525만 달러 및 IRR 548%의 우수한 경제성을 보여줍니다. 운영에는 420만 달러의 자본 지출(CAPEX)이 필요하며, 45,000 온스의 금 생산이 기대됩니다.

회사는 3,000만 달러의 현금을 보유하고 있으며, 특히 Corner 지역에서 잔류 침출 방식에서 적극적인 채굴 방식으로 전환할 계획입니다. 이 프로젝트는 68,000 온스의 금에 대한 추정 광물 매장량을 보유하고 있으며, 광산 수명은 1.2년, AISC는 온스당 1,990달러입니다. 또한 Heliostar는 산화물 확장과 황화물 포피리/브레치 목표 탐사를 위한 시추 프로그램도 시작할 예정입니다.

Heliostar Metals (OTCQX: HSTXF) a annoncé la reprise des opérations minières de sa mine San Agustin à Durango, au Mexique, avec une production initiale prévue au quatrième trimestre 2025. Le projet présente une forte rentabilité avec une VAN après impôt à 5% de 35,25 millions USD et un TRI de 548% à un prix de l'or de 3 000 USD/oz. L'opération nécessite un CAPEX de 4,2 millions USD et devrait produire 45 000 onces d'or.

L'entreprise, disposant de 30 millions USD en liquidités, prévoit de passer de la lixiviation résiduelle à l'exploitation minière active, notamment dans la zone Corner. Le projet possède une réserve minérale probable de 68 000 onces d'or avec une durée de vie de mine de 1,2 an et un AISC de 1 990 USD/oz Au. Heliostar lancera également des programmes de forage visant à étendre la zone d'oxydes et à explorer des cibles de porphyre/breccia sulfurés.

Heliostar Metals (OTCQX: HSTXF) gab die Wiederaufnahme der Bergbauaktivitäten in seiner San Agustin Mine in Durango, Mexiko, bekannt, mit einer erwarteten ersten Produktion im vierten Quartal 2025. Das Projekt weist eine starke Wirtschaftlichkeit mit einem post-steuerlichen NPV5% von 35,25 Mio. USD und einer IRR von 548% bei einem Goldpreis von 3.000 USD/oz auf. Der Betrieb erfordert 4,2 Mio. USD an CAPEX und soll 45.000 Unzen Gold produzieren.

Das Unternehmen, mit 30 Mio. USD in bar, plant den Übergang von Restlaugung zu aktivem Bergbau, insbesondere im Corner-Bereich. Das Projekt verfügt über eine wahrscheinliche Mineralreserve von 68.000 Unzen Gold mit einer Minenlaufzeit von 1,2 Jahren und einem AISC von 1.990 USD/oz Au. Heliostar wird zudem Bohrprogramme starten, die auf die Erweiterung der Oxidzone und die Erkundung von Sulfid-Porphyr-/Breccia-Zielen abzielen.

- Strong project economics with 548% IRR and US$35.25M NPV5%

- Low initial CAPEX of US$4.2M with quick 0.2-year payback period

- Robust cash position of US$30M to fund operations

- All necessary permits and approvals obtained for mining restart

- Potential for resource expansion through identified oxide and sulphide targets

- Short mine life of only 1.2 years based on current reserves

- High AISC of US$1,990/oz Au

- Project economics heavily dependent on high gold price assumption of US$3,000/oz

- Current sulphide mineralization grades not economically viable at present prices

Highlights:

- Mining operations to restart at the San Agustin Mine in H2, 2025, with initial production expected in Q4

- Operations analysis supports a post-tax NPV

5% of US$35.25M , IRR of548% , CAPEX of US$4.2M and an output of 45,000 total gold ounces produced at a US$3,000 /oz gold price - Restart provides confidence for the first significant Heliostar investment into the future of San Agustin, aimed at extending mine life

- Drilling will commence immediately in H2, 2025, on oxide expansion targets, followed by sulphide porphyry/breccia exploration

Vancouver, British Columbia--(Newsfile Corp. - July 22, 2025) - Heliostar Metals Ltd. (TSXV: HSTR) (OTCQX: HSTXF) (FSE: RGG1) ("Heliostar" or the "Company") is pleased to announce the restart of mining operations at San Agustin, located in the state of Durango. Heliostar presently produces gold from residual leaching at the San Agustin Mine. The Company will increase production by mining the mineral reserve, principally in an area the Company describes as the Corner Area. This is a key milestone to unlock increased value from San Agustin.

"Heliostar is pleased to have met its forecast timelines to recommence mining at San Agustin," commented Heliostar CEO, Charles Funk. "Mining the Corner Area will produce 45,000 ounces of gold from the current reserve. It will generate US

"As the largest local employer, this milestone provides job stability and provides for expanded economic opportunities for our nearby communities and throughout the state of Durango. For Heliostar, it marks a shift from residual leaching to active mining, increasing production and improving cash flow through 2026. It also provides the confidence to begin new investment in growth at San Agustin. This will include drilling aimed at converting oxide resources to reserves and testing sulphide targets that share characteristics with deposits such as Peñasquito and Camino Rojo."

Technical Report Summary

On January 14, 2025, the Company filed an amended and restated technical report titled "San Agustin Operations, Durango State, Mexico, NI 43-101 Technical Report" prepared by Mr. Todd Wakefield, RM SME, Mine Technical Services, Mr. David Thomas, P.Geo., Mine Technical Services, Mr. Jeffrey Choquette, P.E., Hard Rock Consulting, Mr. Carl Defilippi, RM SME, Kappes Cassiday and Associates and Ms. Dawn Garcia, CPG, Stantec with an effective date of November 30, 2024 (the "Technical Report").

The life-of-mine (LOM) plan set out in the Technical Report indicates that a probable mineral reserve of 68,000 ounces of gold can be exploited over a 1.2 year mine life at an all-in sustaining cost (AISC) of US

The Technical Report demonstrates a post-tax NPV

The mineral reserve estimate included in the Technical Report is based on the operation of the existing crusher and conveyor system having a nameplate throughput capacity of about 30,000 tonnes/day and continued operation of the heap leach and carbon-in-column (CIC) process circuit to processing ore from the expanded open pit. The mineral reserve estimate included in the Technical Report is presented below. The expected operating performance and cost forecasts were compiled with the benefit of benchmarking historical performance at San Agustin. This was supplemented with the input of seasoned professionals knowledgeable of the conventional technologies being used at San Agustin, the expected consumption quantities of key supplies, and commercial pricing for goods and services in Mexico.

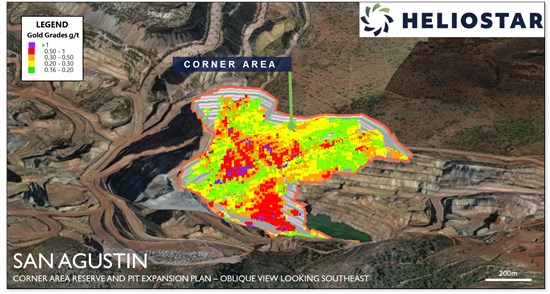

Figure 1: View of Corner Area looking to southeast showing the current reserve model and planned pitshell.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/259590_ccc95ec664b4ea3f_003full.jpg

Restart Steps

In 2022, the previous operator of the San Agustin mine reached a private surface rights agreement to access a portion of the deposit referred to as the Corner Area. Despite this, mining operations ceased at the mine in late 2023 due to a lack of permit accessible mineral reserves.

In July 2025, Heliostar complied with all required applications and received the required approval to undertake this open pit expansion. The relevant application was submitted in Q4, 2024. Further, the Company has also received a variance to its environmental impact assessment (MIA) to increase the height of the San Agustin leachpad from 77 to 88 metres in height. This variation will save approximately US

Heliostar's restart plan will include selecting civil, drilling and mining contractors, moving of a power transmission line, establishing additional access roads on site and removing and stockpiling the vegetation and topsoil present over the Corner Area. This work is anticipated to be undertaken in Q3 and Q4, allowing for the first stacking of new ore and subsequent new gold production from the Corner Area in Q4, 2025.

Oxide Growth Targets

The restart of mining at the Corner Area expands the mine life at San Agustin. With the longer production timeline and confidence in the ability to convert resources to gold production, Heliostar will commence a drilling program seeking further mine life extensions.

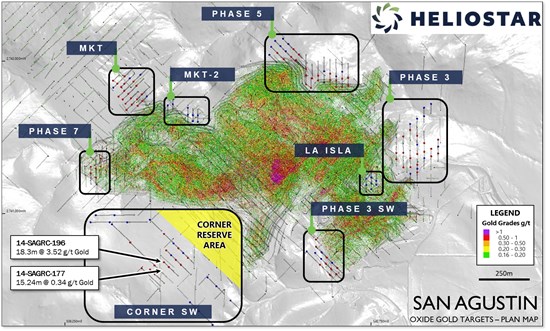

The immediate focus for growth is on near-surface oxide material that could be processed through the existing facilities. The Company recognized several growth targets at the margins of the current pit and at the edge of the Corner Area reserve.

Higher-grade oxide results from the priority Corner SW target area include,

- Hole 14-SAGRC-196 grading 3.52 grames per tonne (g/t) Gold over 18.3 metres from 32.0 metres downhole

- Hole 14-SAGRC-177 grading 0.34 g/t Gold over 15.24 metres from 27.4 metres downhole

The targets are the extensions of mineralized corridors defined by grade control drilling and through a comprehensive re-logging and multi-element re-assaying program undertaken by Heliostar geologists in H1, 2025. The higher gold price environment has also increased the potential of certain lower-grade areas that were not previously a focus at San Agustin.

Figure 2: Plan map of San Agustin showing oxide gold growth targets with drilling and blasthole data shown.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/259590_ccc95ec664b4ea3f_004full.jpg

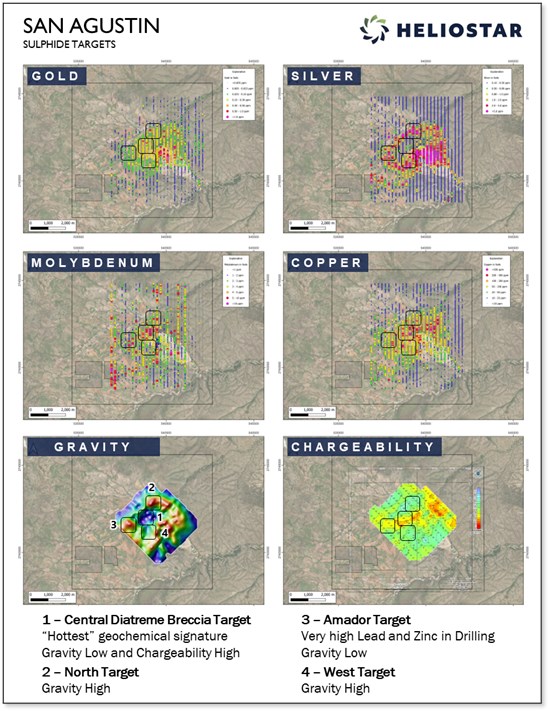

Sulphide Exploration Targets

San Agustin is a very large mineralized system that hosts a significant volume of gold, silver, lead and zinc mineralization immediately beneath and adjacent to the current pit.

This mineralization is not amenable to conventional heap leaching, and metallurgical work undertaken by the Company has indicated grades are not high enough for economic extraction at present prices.

However, higher-grade results have been returned from within the sulphide domain at San Agustin, including,

- Hole SA-133 grading 0.49 g/t Gold, 25 g/t Silver,

0.2% Lead and1.0% Zinc over 297 metres from 16.5 metres downhole - Hole SA-184 grading 0.60 g/t Gold, 15 g/t Silver,

0.1% Lead and1.0% Zinc over 196 metres from 172 metres downhole

Figure 3: Geochemical and Geophysical footprints at San Agustin with the four sulphide targets labelled.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/259590_ccc95ec664b4ea3f_005full.jpg

Similar to central Mexican, gold-rich polymetallic, intrusive-related deposits, including the Peñasquito and Camino Rojo Mines, also contain higher grade zones of gold and silver mineralization, demonstrating the potential for defining high-grade mineralization within the San Agustin system. Investors are cautioned that mineral deposits on other properties are not indicative of mineral deposits on the Company's properties.

In H1 2025, Heliostar geologists built the most detailed geological model completed to date of the San Agustin deposit. This model proposes that the bulk of the gold and silver mined to date is from an intermediate sulphidation vein system that sits above intrusive related breccias and to the southeast of an interpreted intrusive/breccia centre that is believed to have a porphyry source.

This interpretation generated four significant new porphyry/breccia targets beyond the previously drilled mineralization. These four zones are adjacent to and northwest from the San Agustin pit. These targets are supported by geology, alteration vectors, geophysical signatures and significant geochemical footprints. The Company believes they have strong similarities to those at the Peñasquito deposit.

Upon completion of the oxide drilling, the Company intends to test these new sulphide targets, looking for high-grade mineralization at San Agustin.

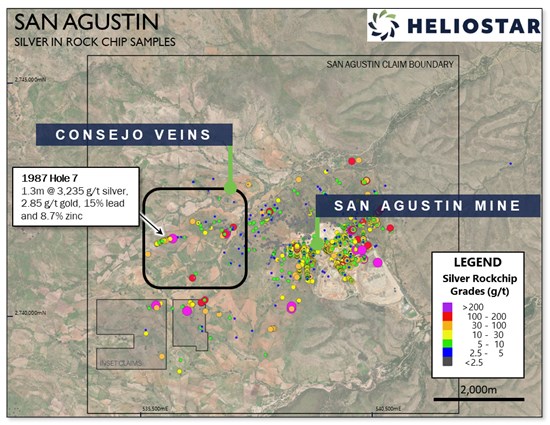

Silver Vein Targets

Figure 4: Silver in rockchips at San Agustin with Consejo Vein target and selected drill hole labelled.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/259590_ccc95ec664b4ea3f_006full.jpg

In 2021, the previous operator acquired a large claim block from Fresnillo Plc to support an expansion of the open pit. This increased the San Agustin land package to 5,884 hectares. Since this acquisition, no significant regional exploration has been undertaken on these acquired claims.

The regional exploration targets at San Agustin include the Consejo vein prospect. Last drilled in 1987, these veins include intercepts such as 1.3 m grading 3,235 g/t silver, 2.85 g/t gold,

Note: A qualified person has not been able to independently verify the assay results in the drill intersections presented here, and Heliostar plans on conducting additional work at San Agustin to establish the grades and widths of targets on the property.

San Agustin Reserve Table from Technical Report

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7729/259590_ccc95ec664b4ea3f_007full.jpg

Notes to accompany Mineral Reserves table:

- Mineral Reserves are reported at the point of delivery to the process plant, using the 2014 CIM Definition Standards.

- Mineral Reserves have an effective date of 30 November 2024. The Qualified Person for the estimate is Mr. Jeffrey Choquette, PE, of Hard Rock Consulting, LLC.

- A 0.156 g/t AuEq cut-off is used for reporting the Mineral Reserves in oxide, and a 0.310 g/t AuEq cut-off is used for reporting Mineral Reserves in transitional material. Cut-offs were calculated based on a gold price of US

$1,900 /oz Au, silver price of US$23 /oz Ag, processing costs of US$4.23 /t for oxide, processing costs of US$5.14 /t for transitional, general and administrative costs of US$1.40 /t, refining and selling costs of US$0.66 /t, gold recovery of66% for oxide and38% for transitional and a silver recovery of10% for oxide and transitional. The AuEq calculation uses the formula AuEq = (Au + Ag/equivalency factor), where equivalency factor = ((Au price in US$/g * Au recovery) / (Ag price in US$/g * Ag recovery)). - Mineral Reserves are reported within the ultimate reserve pit design. An external dilution factor of

5% and a metal loss of3% have been factored into the Mineral Reserve estimate. - Tonnage and grade estimates are in metric units.

- Mineral Reserve tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding.

Qualified Persons

Gregg Bush, P.Eng., Mike Gingles, MBA, Stewart Harris, P.Geo, and Sam Anderson, CPG, the Company's Qualified Persons, as such term is defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects, have reviewed the scientific and technical information that forms the basis for this news release and have approved the disclosure herein.

About Heliostar Metals Ltd.

Heliostar aims to grow to become a mid-tier gold producer. The Company is focused on increasing production and developing new resources at the

FOR ADDITIONAL INFORMATION PLEASE CONTACT:

| Charles Funk President and Chief Executive Officer Heliostar Metals Limited Email: charles.funk@heliostarmetals.com Phone: +1 844-753-0045 | Rob Grey Investor Relations Manager Heliostar Metals Limited Email: rob.grey@heliostarmetals.com Phone: +1 844-753-0045 |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward-looking statements or information. These forward-looking statements or information relate to, among other things, the Company's exploration and development plans including the restart plan at San Augustin the completion of drilling activities and the testing of targets.

These statements reflect the Company's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements or forward-looking information and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: precious metals price volatility; risks associated with the conduct of the Company's mining activities in foreign jurisdictions; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; risks regarding exploration and mining activities; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of public health crises; the economic and financial implications of public health crises, ongoing military conflicts and general economic factors to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption "Risk Factors" in the Company's public disclosure documents. Readers are cautioned against attributing undue certainty to forward-looking statements or forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

This news release includes certain non-International Financial Reporting Standards (IFRS) measures. The Company has included these measures, in addition to conventional measures conforming with IFRS, to provide investors with an improved ability to evaluate the project and provide comparability between projects. The non-IFRS measures, which are generally considered standard measures within the mining industry albeit with non-standard definitions, are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Cash costs (Cash Costs) are a common financial performance measure in the gold mining industry but with no standard meaning under IFRS. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate each project's economic results in the technical reports and each project's potential to generate operating earnings and cash flow. All-in Sustaining Costs (AISC) more fully defines the total costs associated with producing precious metals. The AISC is calculated based on guidelines published by the World Gold Council (WGC), which were first issued in 2013. In light of new accounting standards and to support further consistency of application, the WGC published an updated Guidance Note in 2018. Other companies may calculate this measure differently because of differences in underlying principles and policies applied. Differences may also arise due to a different definition of sustaining versus growth capital. Note that in respect of AISC metrics within the technical reports because such economics are disclosed at the project level, corporate general and administrative expenses were not included in the AISC calculations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/259590