Hut 8 Announces Plans to Develop Four New Sites with More Than 1.5 GW of Total Capacity

Hut 8 Corp. (NASDAQ | TSX: HUT) has announced a major expansion plan to develop four new sites across the United States, adding 1,530 MW of capacity to its energy infrastructure platform. The expansion includes sites in Louisiana (300 MW), Texas (1,180 MW combined), and Illinois (50 MW).

The company is reclassifying this capacity from "Under Exclusivity" to "Under Development," which will increase its total platform to exceed 2.5 gigawatts across 19 sites upon commercialization. To finance the expansion, Hut 8 has secured significant resources, including 10,278 Bitcoin (valued at ~$1.2B), $330 million in credit facilities, and a new $1 billion ATM equity program.

Currently, Hut 8 has ~90% of its 1,020 MW platform contracted and maintains a total development pipeline of 10,620 MW across various stages of development.

Hut 8 Corp. (NASDAQ | TSX: HUT) ha annunciato un importante piano di espansione per sviluppare quattro nuovi siti negli Stati Uniti, aggiungendo 1.530 MW di capacità alla sua piattaforma energetica. I siti previsti sono in Louisiana (300 MW), Texas (1.180 MW complessivi) e Illinois (50 MW).

Questa capacità verrà riclassificata da "Under Exclusivity" a "Under Development", portando la piattaforma totale a superare i 2,5 gigawatt su 19 siti una volta commercializzata. Per finanziare l’espansione, Hut 8 ha messo in campo risorse importanti, tra cui 10.278 Bitcoin (valutati circa $1,2 miliardi), linee di credito per $330 milioni e un nuovo programma equity ATM da $1 miliardo.

Attualmente Hut 8 ha circa il 90% della sua piattaforma da 1.020 MW contrattualizzato e un pipeline di sviluppo complessivo di 10.620 MW in varie fasi di avanzamento.

Hut 8 Corp. (NASDAQ | TSX: HUT) ha anunciado un importante plan de expansión para desarrollar cuatro nuevos emplazamientos en Estados Unidos, añadiendo 1.530 MW de capacidad a su plataforma energética. Los sitios incluyen Louisiana (300 MW), Texas (1.180 MW en conjunto) e Illinois (50 MW).

Esta capacidad se reclasificará de "Under Exclusivity" a "Under Development", lo que hará que la plataforma total supere los 2,5 gigavatios en 19 sitios una vez comercializada. Para financiar la expansión, Hut 8 ha asegurado recursos significativos, entre ellos 10.278 Bitcoin (valorados en ~$1.200 millones), $330 millones en líneas de crédito y un nuevo programa de capital ATM por $1.000 millones.

Actualmente Hut 8 tiene aproximadamente el 90% de su plataforma de 1.020 MW contratada y mantiene una cartera de desarrollo total de 10.620 MW en distintas fases.

Hut 8 Corp. (NASDAQ | TSX: HUT)는 미국 전역에 걸쳐 4개 신규 사이트를 개발해 에너지 인프라에 1,530 MW의 용량을 추가하는 대규모 확장 계획을 발표했습니다. 확장 대상 지역은 루이지애나(300 MW), 텍사스(총 1,180 MW), 일리노이(50 MW)입니다.

해당 용량은 "Under Exclusivity"에서 "Under Development"로 재분류되어 상업화 시 총 19개 사이트에서 플랫폼 용량이 2.5 GW를 초과하게 됩니다. 확장 자금 확보를 위해 Hut 8은 10,278 비트코인(약 $12억 상당), $3.3억의 신용 한도, 그리고 신규 $10억 ATM 주식 프로그램 등 주요 자원을 마련했습니다.

현재 Hut 8는 1,020 MW 플랫폼의 약 90%를 계약 완료한 상태이며, 총 개발 파이프라인은 다양한 개발 단계에서 10,620 MW입니다.

Hut 8 Corp. (NASDAQ | TSX: HUT) a annoncé un important plan d’expansion pour développer quatre nouveaux sites aux États-Unis, ajoutant 1 530 MW de capacité à sa plateforme énergétique. Les sites sont situés en Louisiane (300 MW), au Texas (1 180 MW au total) et en Illinois (50 MW).

Cette capacité sera reclassée de « Under Exclusivity » à « Under Development », ce qui portera la plateforme totale à plus de 2,5 gigawatts répartis sur 19 sites une fois commercialisée. Pour financer l’expansion, Hut 8 a mobilisé des ressources importantes, notamment 10 278 Bitcoin (valeur ~1,2 Md$), 330 M$ de lignes de crédit et un nouveau programme d’actions ATM de 1 Md$.

Actuellement, Hut 8 a environ 90 % de sa plateforme de 1 020 MW sous contrat et dispose d’un pipeline de développement total de 10 620 MW à différents stades.

Hut 8 Corp. (NASDAQ | TSX: HUT) hat einen umfangreichen Expansionsplan angekündigt: vier neue Standorte in den USA sollen installiert werden und 1.530 MW Kapazität zur Energieinfrastruktur hinzufügen. Geplant sind Standorte in Louisiana (300 MW), Texas (insgesamt 1.180 MW) und Illinois (50 MW).

Diese Kapazität wird von "Under Exclusivity" auf "Under Development" umklassifiziert, wodurch die Gesamtplattform nach der Kommerzialisierung auf über 2,5 Gigawatt an 19 Standorten anwächst. Zur Finanzierung sicherte Hut 8 bedeutende Mittel, darunter 10.278 Bitcoin (wertmäßig ~$1,2 Mrd.), $330 Mio. Kreditlinien und ein neues $1 Mrd. ATM-Eigenkapitalprogramm.

Derzeit sind rund 90% der 1.020 MW Plattform von Hut 8 vertraglich gebunden, und die gesamte Entwicklungspipeline umfasst 10.620 MW in unterschiedlichen Entwicklungsstadien.

- Significant expansion adding 1,530 MW of capacity across strategic energy markets

- Strong financial position with $2.4B in available liquidity including Bitcoin holdings worth $1.2B

- 90% of current 1,020 MW platform is already contracted, indicating strong demand

- Secured $330M in non-dilutive credit facilities at 8.4% weighted average cost of capital

- Geographic diversification across multiple power markets (MISO, ERCOT, PJM)

- Potential dilution risk from new $1 billion ATM equity program

- Significant capital expenditure required for expansion

- Execution risk in developing multiple large-scale sites simultaneously

Insights

Hut 8's 1.5GW expansion significantly scales operations, diversifies geographically, and positions for high growth in energy-intensive computing markets.

Hut 8's announcement represents a transformative expansion that will more than double the company's capacity from 1,020 MW to over 2.5 GW across 19 sites. The advancement of 1,530 MW from exclusivity into development is particularly significant as it shows concrete progress along their growth pipeline rather than merely theoretical capacity.

The geographic diversification across three different power markets (MISO, ERCOT, and PJM) is strategically important as it: 1) reduces concentration risk in any single grid, 2) provides access to varying power price environments, and 3) positions Hut 8 closer to different regional customer bases. The heavy investment in Texas (1,180 MW across two sites) leverages ERCOT's relatively favorable regulatory environment for large power users.

With

Financially, Hut 8 has assembled a robust capital strategy with

This expansion positions Hut 8 to capitalize on accelerating demand for energy-intensive computing applications beyond just cryptocurrency mining, potentially creating a more diversified and stable business model over time.

With ~

New sites diversify Hut 8’s geographic footprint across the U.S. and position the Company to meet growing demand from prospective customers across energy-intensive use cases

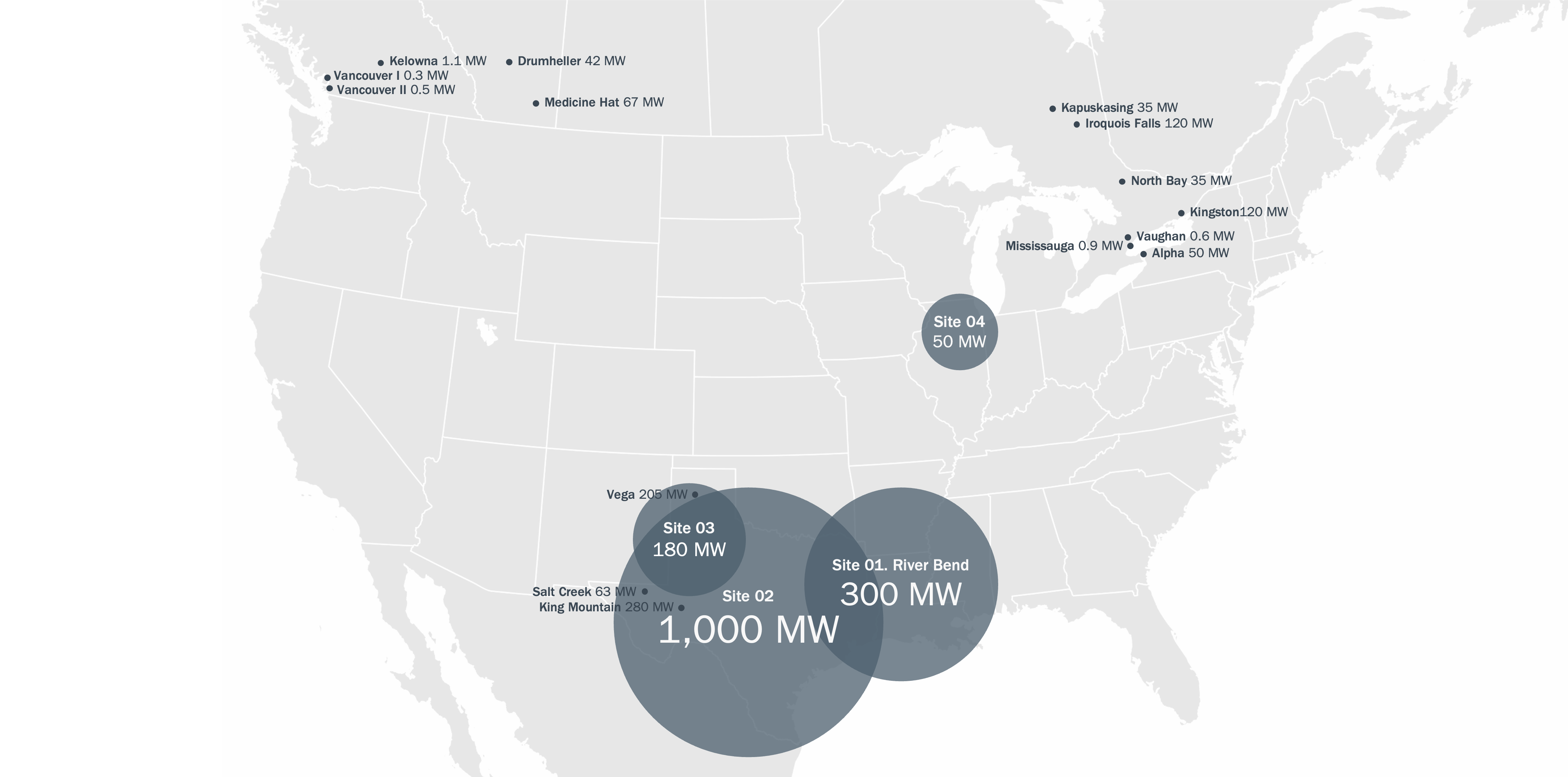

MIAMI, Aug. 26, 2025 (GLOBE NEWSWIRE) -- Hut 8 Corp. (Nasdaq | TSX: HUT) (“Hut 8” or the “Company”), an energy infrastructure platform integrating power, digital infrastructure, and compute at scale to fuel next-generation, energy-intensive use cases, today announced plans to develop four new sites across the United States. The expansion positions the Company to meet growing demand from energy-intensive use cases while scaling and diversifying its platform across strategic energy markets. Upon commercialization of the sites, Hut 8 expects its platform to exceed 2.5 gigawatts of capacity under management across 19 sites. In connection with the expansion, Hut 8 is reclassifying 1,530 megawatts (MW) of capacity related to these sites from Capacity Under Exclusivity into a new category: Capacity Under Development.

“This expansion marks a defining step in Hut 8’s evolution into one of the largest energy and digital infrastructure platforms in the world,” said Asher Genoot, CEO of Hut 8. “By advancing more than 1.5 gigawatts of capacity from exclusivity into development, we position ourselves to more than double the scale of our platform and address accelerating demand across energy-intensive use cases. In addition to driving scale, this expansion is designed to broaden our geographic footprint as we seek to capture opportunities in markets where we see energy demand rising most rapidly. Importantly, it represents just the first phase of execution against a multi-gigawatt energy origination pipeline that underpins our long-term growth trajectory.”

Expansion Sites: 1,530 MW of Capacity Under Development

The expansion sites range in scale from 50 MW to 1,000 MW of utility capacity, each selected for near-term power access and the potential to support commercialization across a range of advanced technologies. Guided by its first-principles approach to digital infrastructure, Hut 8 is actively advancing design and commercialization initiatives with prospective customers. Where appropriate, the sites will incorporate next-generation architecture that enables rapid, capital-efficient deployment and the flexibility to support a range of customer requirements. The sites detailed below comprise the 1,530 MW of capacity that has advanced from exclusivity into Capacity Under Development.

| Expansion Site | State | Regional Transmission Operator / Independent System Operator | Utility Capacity | |

| 1 | River Bend | Louisiana | Midcontinent Independent System Operator (MISO) | 300 MW |

| 2 | Project 2 | Texas | Electric Reliability Council of Texas (ERCOT) | 1,000 MW |

| 3 | Project 3 | Texas | Electric Reliability Council of Texas (ERCOT) | 180 MW |

| 4 | Project 4 | Illinois | Pennsylvania-New Jersey-Maryland Interconnection (PJM) | 50 MW |

| Total | 1,530 MW | |||

Development Pipeline Update

In conjunction with the launch of this expansion, Hut 8 has introduced a new category to its development framework: Capacity Under Development. This designation applies to late-stage projects that have advanced beyond exclusivity, where Hut 8 is actively investing in site development and commercialization by executing definitive land and power agreements, advancing site design and infrastructure buildout, and engaging with prospective customers. Projects in this category, including those announced today, will transition into Capacity Under Management once commercialized.

| Stage | Description | Capacity As of August 25, 2025 |

| Capacity Under Diligence | Sites identified for large-load use cases such as high-performance computing and Bitcoin mining, industrial applications such as next-generation manufacturing, and other energy-intensive technologies. At this stage, Hut 8 assesses site potential by engaging with utilities, landowners, and other stakeholders to evaluate critical factors, including power availability, infrastructure readiness, fiber connectivity, and overall commercial viability. | 6,815 MW |

| Capacity Under Exclusivity | Sites where Hut 8 has secured a clear path to ownership through either: (1) an exclusivity agreement that prevents the sale of designated power and/or land capacity to another party or (2) a tendered interconnection agreement, confirming a viable path to securing power and infrastructure for deployment. | 1,255 MW |

| Capacity Under Development | Sites where Hut 8 is actively investing in development and commercialization by executing definitive land and/or power agreements, advancing site design and infrastructure buildout, and engaging with prospective customers. | 1,530 MW |

| Capacity Under Management | Commercialized capacity. | 1,020 MW |

| Total | 10,620 MW | |

Investment and Partnerships

The expansion is expected to be financed through a disciplined capital strategy, with optionality across multiple funding sources. As of August 25, 2025, Hut 8 has assets and available financing arrangements supporting up to

- Strategic reserve assets: 10,278 Bitcoin with a market value of approximately

$1.2 billion as of August 25, 2025, providing a liquid asset base that can be actively managed to provide excess liquidity capacity through collateralized loans and generate yield through right-way-risk activities, such as covered call options. - Non-dilutive growth capital: A new revolving credit facility of up to

$200 million with Two Prime and an upsized, repriced$130 million credit facility with Coinbase, together providing$330 million of liquidity at a weighted average cost of capital of8.4% . - Equity flexibility: A new

$1 billion ATM equity program. As of August 22, 2025, in connection with the launch of this program, Hut 8 terminated its prior ATM program with40% of capacity unutilized, underscoring the Company’s disciplined approach to equity issuance. Shares under the prior program were issued at an average price of$27.83 per share, with just$21.1 million , or4% of total program capacity, issued between February 1, 2025 and retirement. - Project-level financing: Indicative interest from banking partners to provide project-level financing for data center developments, structured around specific customer profiles and counterparties.

“The strength of our balance sheet has been a critical differentiator in demonstrating our ability to minimize execution risk and deliver at scale to prospective customers,” said Asher Genoot, CEO of Hut 8. “Building on that foundation, our updated ATM program and new credit facility with TwoPrime expand liquidity and optionality as we seek to maximize risk-adjusted returns. Together, they reinforce a balance sheet that supports disciplined investment, capital efficiency, and long-term value creation.”

About Hut 8

Hut 8 Corp. is an energy infrastructure platform integrating power, digital infrastructure, and compute at scale to fuel next-generation, energy-intensive use cases. We take a power-first, innovation-driven approach to developing, commercializing, and operating the critical infrastructure that underpins the breakthrough technologies of today and tomorrow. Our platform spans 1,020 megawatts of energy capacity under management across 15 sites in the United States and Canada: five Bitcoin mining, hosting, and Managed Services sites in Alberta, New York, and Texas, five high performance computing data centers in British Columbia and Ontario, four power generation assets in Ontario, and one non-operational site in Alberta. For more information, visit www.hut8.com and follow us on X at @Hut8Corp.

Cautionary Note Regarding Forward–Looking Information

This press release includes “forward-looking information” and “forward-looking statements” within the meaning of Canadian securities laws and United States securities laws, respectively (collectively, “forward-looking information”). All information, other than statements of historical facts, included in this press release that address activities, events, or developments that Hut 8 expects or anticipates will or may occur in the future, including statements relating to Hut 8’s advancement of its development pipeline, including the diversification of its geographic footprint, its ability to meet growing demand from prospective customers, and its ability to transition sites through its pipeline to commercialization; Hut 8’s plans to develop four new sites across the United States, including the potential support to commercialize such sites and the next-generation architecture to be built at the sites, where appropriate; Hut 8’s access to capital, including its ability to actively manage its liquidity and generate yield, indicative interest from its partners, and its approach to equity issuances; and other such matters is forward-looking information. Forward-looking information is often identified by the words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”, “allow”, “believe”, “estimate”, “expect”, “predict”, “can”, “might”, “potential”, “predict”, “is designed to”, “likely,” or similar expressions.

Statements containing forward-looking information are not historical facts, but instead represent management’s expectations, estimates, and projections regarding future events based on certain material factors and assumptions at the time the statement was made. While considered reasonable by Hut 8 as of the date of this press release, such statements are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance, or achievements to be materially different from those expressed or implied by such forward-looking information, including, but not limited to, failure of critical systems; geopolitical, social, economic, and other events and circumstances; competition from current and future competitors; risks related to power requirements; cybersecurity threats and breaches; hazards and operational risks; changes in leasing arrangements; Internet-related disruptions; dependence on key personnel; having a limited operating history; attracting and retaining customers; entering into new offerings or lines of business; price fluctuations and rapidly changing technologies; construction of new data centers, data center expansions, or data center redevelopment; predicting facility requirements; strategic alliances or joint ventures; operating and expanding internationally; failing to grow hashrate; purchasing miners; relying on third-party mining pool service providers; uncertainty in the development and acceptance of the Bitcoin network; Bitcoin halving events; competition from other methods of investing in Bitcoin; concentration of Bitcoin holdings; hedging transactions; potential liquidity constraints; legal, regulatory, governmental, and technological uncertainties; physical risks related to climate change; involvement in legal proceedings; trading volatility; and other risks described from time to time in Company’s filings with the U.S. Securities and Exchange Commission. In particular, see the Company’s recent and upcoming annual and quarterly reports and other continuous disclosure documents, which are available under the Company’s EDGAR profile at www.sec.gov and SEDAR+ profile at www.sedarplus.ca.

Contacts

Hut 8 Investor Relations

Sue Ennis

ir@hut8.com

Hut 8 Public Relations

Gautier Lemyze-Young

media@hut8.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/29fd8321-be0d-4c73-85ef-14618ca00235