IAMGOLD Signs Agreement to Acquire Mines D'Or Orbec Inc.

Rhea-AI Summary

IAMGOLD (NYSE: IAG) signed a definitive arrangement agreement to acquire Mines D'Or Orbec (TSXV: BLUE) by way of a court-approved plan of arrangement, adding the Muus Project adjacent to IAMGOLD's Nelligan and Monster Lake projects in Chibougamau, Quebec.

Consideration is C$0.125 per Orbec share (C$0.0625 cash + 0.003466 IAMGOLD share), implying a C$17.2M equity value and ~25% premium to Orbec's Oct 17, 2025 close. IAMGOLD currently owns ~6.70% of Orbec and expects to issue ~369,341 IAMGOLD shares; closing is expected in Q4 2025.

Positive

- Adds 24,979 ha at Muus adjacent to IAMGOLD holdings

- Consolidates land into a 38,403 ha combined camp

- Combined Nelligan+Monster Lake: 3.2 Moz M&I gold

- Combined Nelligan+Monster Lake: 5.6 Moz inferred gold

- Transaction implies C$17.2M equity value at closing assumptions

Negative

- Transaction requires shareholder, court and regulatory approvals

- Orbec relied on MI 61-101 exemption—no formal valuation

- IAMGOLD may issue ~369,341 shares, creating shareholder dilution

- Convertible debenture of C$500,000 could increase IAMGOLD's Orbec stake to ~10.08%

News Market Reaction

On the day this news was published, IAG gained 2.32%, reflecting a moderate positive market reaction. Argus tracked a trough of -8.0% from its starting point during tracking. Our momentum scanner triggered 58 alerts that day, indicating high trading interest and price volatility. This price movement added approximately $178M to the company's valuation, bringing the market cap to $7.86B at that time.

Data tracked by StockTitan Argus on the day of publication.

All monetary amounts are expressed in U.S. dollars, unless otherwise indicated.

Toronto, Ontario--(Newsfile Corp. - October 20, 2025) - IAMGOLD Corporation (NYSE: IAG) (TSX: IMG) ("IAMGOLD" or the "Company") is pleased to announce that the Company has signed a definitive arrangement agreement (the "Arrangement Agreement") with Mines D'Or Orbec Inc. (TSXV: BLUE) ("Orbec") pursuant to which IAMGOLD has agreed to acquire all of the issued and outstanding common shares of Orbec (each, an "Orbec Share") by way of a court-approved plan of arrangement under the Business Corporations Act (Ontario) (the "Transaction"). The acquisition will consolidate IAMGOLD's existing ownership of Orbec Shares through which the Company will add the highly prospective Muus Project, which is adjacent to the Company's Nelligan and Monster Lake Projects in the Chibougamau region of Quebec, Canada.

Pursuant to the Arrangement Agreement, Orbec shareholders will receive total consideration representing a value of C

Highlights of the Transaction

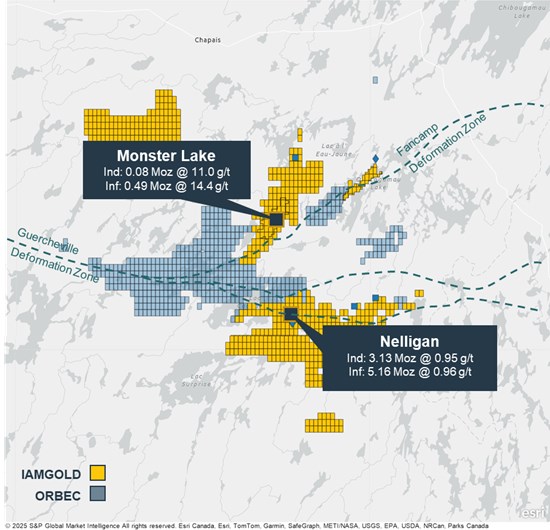

- Consolidation of IAMGOLD's land position in the Chibougamau district, a rapidly growing premier mining jurisdiction in Quebec, where the Company's Nelligan and Monster Lake assets are located.

- The Nelligan and Monster Lake Projects have combined estimated Measured and Indicated Mineral Resources of 3.2 million ounces of gold ("Moz Au") and Inferred Mineral Resources of 5.6 Moz Au positioning the consolidated camp among the largest pre-production projects in Canada1.

- The Muus Project would contribute 24,979 hectares ("ha") of mineral rights within the immediate area of IAMGOLD's properties which total 38,403 ha.

- The Muus Project is at the intersection of two mineralized structural breaks: the northeast trending Fancamp Deformation Zone (FDZ), which hosts IAMGOLD's Monster Lake deposit and the East-West trending Guercheville Deformation Zone (GDZ), which hosts IAMGOLD's Nelligan deposit, as well as historical resources at Philibert, Meston and Joe Mann.

- An immediate premium of

25% to Orbec shareholders based on the closing price of Orbec's common shares on October 17, 2025.

"The addition of the Muus Project provides a highly prospective land package to our rapidly expanding Nelligan Mining Complex Project," said Renaud Adams, President and Chief Executive Officer of IAMGOLD. "The Chibougamau region is quickly advancing to become one of the most exciting gold mining districts in Canada. We look forward to expanding our exploration program in the region with a goal of further expansion and extension of the mineralization at Nelligan and Monster Lake, while continuing the exploration efforts of the Orbec team."

The Muus Project

Orbec controls 24,979 hectares of mineral rights approximately 50 kilometers SW of Chibougamau, Quebec. The properties are highly prospective for gold and base-metals at the intersection of two major mineralized structural breaks: including the northeast trending Fancamp Deformation Zone (FDZ), which hosts IAMGOLD's Monster Lake deposit and Orbec's Fancamp Property; and the East-West trending Guercheville Deformation Zone (GDZ), which hosts IAMGOLD's Nelligan deposit. Exploration activities have been limited since the mid-1990s with past focus primarily targeting east-west oriented conductors in volcanic units for base-metals, with little effort drilling broad disseminated gold systems hosted within sediments, like Nelligan, or structural gold targets similar to Monster Lake.

Figure 1 - Nelligan Mining Complex & Muus Project Land Package

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6077/271033_a5bfbaeb24f5bb34_001full.jpg

Transaction Details

Directors and executive officers of Orbec have entered into voting support agreements with IAMGOLD pursuant to which they have agreed, subject to the terms of such agreements, to vote their Orbec Shares in favour of the Transaction.

Full details of the Transaction will be included in a management information circular of Orbec that is expected to be mailed to Orbec's shareholders in November 2025 (the "Circular").

In addition to the cash and share consideration of the Transaction, (i) each "in-the-money" Orbec option ("Orbec Option") outstanding on the completion of the Transaction, whether vested or unvested, will be deemed to be surrendered, assigned and transferred for a cash payment made by or on behalf of Orbec, equal to the amount by which the consideration exceeds the exercise price payable under such Orbec Option for an Orbec Share, multiplied by the number of Orbec Shares such Orbec Option entitles the holder thereof to purchase; (ii) all Orbec Options (other than "in-the-money" Orbec Options) will be cancelled without any payment therefor; (iii) each issued and outstanding "in-the-money" warrant to purchase Orbec Shares ("Orbec Warrant") will be deemed to be surrendered, assigned and transferred for a cash payment made by or on behalf of Orbec, equal to the amount by which the consideration exceeds the exercise price for such Orbec Warrant, multiplied by the number of Orbec Shares such Orbec Warrant entitles the holder thereof to purchase; and (iv) all Orbec Warrants (other than "in-the-money" Orbec Warrants) will be cancelled without any payment therefor.

The Transaction will be effected by way of a court-approved plan of arrangement under the Business Corporations Act (Ontario), will constitute a "business combination" for purposes of Multilateral Instrument 61-101 — Protection of Minority Security Holders in Special Transactions ("MI 61-101"), and will require the approval of at least (i) 66 2/

Orbec is relying on the "Issuer Not Listed on Specified Markets" exemption from the requirement under MI 61-101 to obtain a formal valuation of the Orbec Shares. Further details of this exemption will be provided in the Circular.

In addition to shareholder and court approvals, the Transaction is subject to applicable regulatory approvals and the satisfaction of certain other closing conditions customary in transactions of this nature. The Transaction is expected to close in the fourth quarter of 2025.

None of the securities to be issued pursuant to the Transaction have been or will be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and any securities issuable in the Transaction are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act and applicable exemptions under state securities laws. This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Further details of the Transaction are set out in the Arrangement Agreement and the Circular, both of which will be made available on Orbec's SEDAR+ profile at www.sedarplus.ca.

Laurentian Bank Securities Inc. is acting as special advisor and Norton Rose Fulbright Canada LLP is acting as legal advisor to IAMGOLD in connection with this Transaction.

Early Warning Disclosure

In connection with the Arrangement Agreement and concurrently with the execution thereof, Orbec issued to the Company an unsecured convertible debenture (the "Debenture") in the aggregate principal amount of C

Prior to the issuance of the Debenture, the Company directly or indirectly, owned or controlled, 7,142,857 Orbec Shares, representing approximately

Following the issuance of the Debenture, based on the number of the issued and outstanding Orbec Shares and without additional issuance or conversion of securities (including the Debenture), the security holdings of the Company in Orbec have not changed, except that the Company now owns the Debenture.

The Principal Amount is convertible into a number of Orbec Shares equal to the quotient obtained by dividing (i) the Principal Amount by (ii) the closing price of the Orbec Shares on the TSX Venture Exchange ("TSXV") (rounded up to the nearest C

The participation by the Company in the issuance of the Debenture was undertaken to assist Orbec with funding working capital requirements during the interim period. The Company may, from time to time, acquire additional securities of Orbec for investment purposes, such as contemplated in the Arrangement Agreement, and may, from time to time, increase or decrease its beneficial ownership or control of Orbec depending on market or other conditions.

This section of this news release is being issued as required by National Instrument 62-103 — The Early Warning System and Related Take-Over Bid and Insider Reporting Issues and National Instrument 62-104 — Take-Over Bids and Issuer Bids and relates to: Mines D'Or Orbec Inc., whose head office is located at 2000 rue de l'Éclipse, Suite 500, Brossard, Québec J4Z 0S2. A copy of the early warning report with additional information in respect of the foregoing matters will be available under Orbec's profile on the SEDAR+ website at www.sedarplus.ca.

QUALIFIED PERSON AND TECHNICAL INFORMATION

The technical and scientific information in the news release was also reviewed and approved by Marie-France Bugnon, P.Geo. Vice-President, Exploration for IAMGOLD, who is a qualified person ("QP"), as defined in National Instrument 43-101 - Standard of Disclosure for Mineral Projects, with respect to the technical information being reported on in this news release. The technical information has been included herein with the consent and prior review of Ms. Bugnon.

About IAMGOLD

IAMGOLD is an intermediate gold producer and developer based in Canada with operating mines in North America and West Africa, including Côté Gold (Canada), Westwood (Canada) and Essakane (Burkina Faso). The Côté Gold Mine achieved full nameplate in June 2025 and has the potential to be among the largest gold mines in Canada. IAMGOLD operates Côté in partnership with Sumitomo Metal Mining Co. Ltd. In addition, the Company has an established portfolio of early stage and advanced exploration projects within high potential mining districts. IAMGOLD employs approximately 3,700 people and is committed to maintaining its culture of accountable mining through high standards of Environmental, Social and Governance practices. IAMGOLD is listed on the New York Stock Exchange (NYSE: IAG) and the Toronto Stock Exchange (TSX: IMG).

IAMGOLD Contact Information

Graeme Jennings, Vice President, Investor Relations

Tel: 416 360 4743 | Mobile: 416 388 6883

Toll-free: 1 888 464 9999

info@iamgold.com

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

All information included in this news release, including any information as to the Company's vision, strategy, future financial or operating performance and other statements that express management's expectations or estimates of future performance or impact, including statements in respect of the prospects and/or development of the Company's projects, other than statements of historical fact, constitutes forward-looking information or forward-looking statements within the meaning of applicable securities laws (collectively referred to herein as "forward-looking statements") and such forward-looking statements are based on expectations, estimates and projections as of the date of this news release. Forward-looking statements are generally identifiable by the use of words such as "may", "will", "should", "would", "could", "continue", "expect", "budget", "aim", "can", "focus", "forecast", "anticipate", "estimate", "believe", "intend", "plan", "schedule", "guidance", "outlook", "potential", "seek", "targets", "cover", "strategy", "during", "ongoing", "subject to", "future", "objectives", "opportunities", "committed", "prospective", "preliminary", "likely", "progress", "strive", "sustain", "effort", "extend", "on track", "remain", "pursue", "predict", or "project" or the negative of these words or other variations on these words or comparable terminology. For example, forward-looking statements in this news release include, but are not limited to, statements with respect to: the Transaction, the approval and closing thereof and the anticipated benefits from integrating the Muus Project.

The Company cautions the reader that forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, financial, operational and other risks, uncertainties, contingencies and other factors, including those described below, which could cause actual results, performance or achievements of the Company to be materially different from results, performance or achievements expressed or implied by such forward-looking statements and, as such, undue reliance must not be placed on them. Forward-looking statements are also based on numerous material factors and assumptions, including as described in this news release, including with respect to: the Company's present and future business strategies; operations performance within expected ranges; anticipated future production and cash flows; local and global economic conditions and the environment in which the Company will operate in the future; the price of precious metals, other minerals and key commodities; projected mineral grades; international exchanges rates; anticipated capital and operating costs; the availability and timing of required governmental and other approvals for the construction of the Company's projects.

Risks, uncertainties, contingencies and other factors that could cause actual results, performance or achievements of the Company to be materially different from results, performance or achievements expressed or implied by such forward-looking statements include, without limitation: the Company's business strategies and its ability to execute thereon; the development and execution of implementing strategies to meet the Company's sustainability vision and targets; security risks, including civil unrest, war or terrorism and disruptions to the Company's supply chain and transit routes as a result of such security risks, particularly in Burkina Faso and the Sahel region surrounding the Company's Essakane mine; the availability of labour and qualified contractors; the availability of key inputs for the Company's operations and disruptions in global supply chains; the volatility of the Company's securities; litigation; contests over title to properties, particularly title to undeveloped properties; mine closure and rehabilitation risks; management of certain of the Company's assets by other companies or joint venture partners; the lack of availability of insurance covering all of the risks associated with a mining company's operations; unexpected geological conditions; competition and consolidation in the mining sector; the profitability of the Company being highly dependent on the condition and results of the mining industry as a whole, and the gold mining industry in particular; changes in the global prices for gold, and commodities used in the operation of the Company's business (including, but not limited to diesel, fuel oil and electricity); legal, litigation, legislative, political or economic risks and new developments in the jurisdictions in which the Company carries on business; including the imposition of tariffs by the United States on Canadian products; changes in taxes, including mining tax regimes; the failure to obtain in a timely manner from authorities key permits, authorizations or approvals necessary for transactions, exploration, development or operation, operating or technical difficulties in connection with mining or development activities, including geotechnical difficulties and major equipment failure; the availability of capital; the level of liquidity and capital resources; access to capital markets and financing; the Company's level of indebtedness; the Company's ability to satisfy covenants under its credit facilities; changes in interest rates; adverse changes in the Company's credit rating; the Company's choices in capital allocation; effectiveness of the Company's ongoing cost containment efforts; the Company's ability to execute on de-risking activities and measures to improve operations; availability of specific assets to meet contractual obligations; risks related to third-party contractors, including reduced control over aspects of the Company's operations and/or the failure and/or the effectiveness of contractors to perform; risks arising from holding derivative instruments; changes in U.S. dollar and other currency exchange rates or gold lease rates; capital and currency controls in foreign jurisdictions; assessment of carrying values for the Company's assets, including the ongoing potential for material impairment and/or write-downs of such assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; the fact that reserves and resources, expected metallurgical recoveries, capital and operating costs are estimates which may require revision; the presence of unfavourable content in ore deposits, including clay and coarse gold; inaccuracies in life of mine plans; failure to meet operational targets; equipment malfunctions; information systems security threats and cybersecurity; laws and regulations governing the protection of the environment (including greenhouse gas emission reduction and other decarbonization requirements and the uncertainty surrounding the interpretation of omnibus Bill C-59 and the related amendments to the Competition Act (Canada)); employee relations and labour disputes; the maintenance of tailings storage facilities and the potential for a major spill or failure of the tailings facilities due to uncontrollable events, lack of reliable infrastructure, including access to roads, bridges, power sources and water supplies; physical and regulatory risks related to climate change; unpredictable weather patterns and challenging weather conditions at mine sites; disruptions from weather related events resulting in limited or no productivity such as forest fires, severe storms, flooding, drought, heavy snowfall, poor air quality, and extreme heat or cold; attraction and retention of key employees and other qualified personnel; availability and increasing costs associated with mining inputs and labour, negotiations with respect to new, reasonable collective labour agreements and/or collective bargaining agreements may not be agreed to; the ability of contractors to timely complete projects on acceptable terms; the relationship with the communities surrounding the Company's operations and projects; indigenous rights or claims; illegal mining; the potential direct or indirect operational impacts resulting from external factors, including infectious diseases, pandemics, or other public health emergencies; and the inherent risks involved in the exploration, development and mining business generally. Please see the Company's Annual Information Form or Form 40-F available on www.sedarplus.ca or www.sec.gov/edgar for a comprehensive discussion of the risks faced by the Company and which may cause actual results, performance or achievements of the Company to be materially different from results, performance or achievements expressed or implied by forward-looking statements.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as required by applicable law.

All material information on IAMGOLD can be found at www.sedarplus.ca or at www.sec.gov.

Si vous désirez obtenir la version française de ce communiqué, veuillez consulter le: www.iamgold.com/French/accueil/default.aspx.

1 Refer to the news release dated February 20, 2025 titled "lAMGOLD Announces Significant Increase in Nelligan Ounces & Update of Global Mineral Reserves and Resources".

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/271033