Idaho Strategic Announces Multiple High-Grade Drill Results from Three Different Target Areas at the Golden Chest Mine

Rhea-AI Summary

Positive

- Multiple high-grade gold intercepts discovered across three different target areas, with grades up to 31.40 g/t Au

- Paymaster Veins advanced to pre-development stage for conceptual mine planning

- Bush and Jumbo Veins located near existing infrastructure, enabling future operational efficiencies

- Company expanding operations with 7 geologists on staff and development of second underground drill station

- Drilling results support planned buildout of paste backfill plant and new Murray Mill

Negative

- Additional drilling needed for Claggett vein grade-thickness estimation

- Timeline for Murray Mill buildout remains undefined

- Development of second underground drill station will take approximately two months to complete

News Market Reaction – IDR

On the day this news was published, IDR declined 2.79%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

COEUR D'ALENE, IDAHO / ACCESS Newswire / June 10, 2025 / Idaho Strategic Resources (NYSE American:IDR) ("IDR" or the "Company") is pleased to announce high-grade gold drill results from multiple areas at its

Drill intercepts are reported in grams of gold per tonne and in drilled thickness, as indicated in the tables below:

Hole | Target: Paymaster | From (m) | To (m) | Drilled Thickness (m) | Gold Assay (gpt) |

GC 24-273 | Paymaster Vein | 174.4 | 176.4 | 2.0 | 4.85 |

including | 175.9 | 176.4 | 0.5 | 18.50 | |

GC 25-304 | Paymaster Vein | 235.6 | 236.9 | 1.3 | 9.60 |

including | 236.1 | 236.9 | 0.8 | 14.98 |

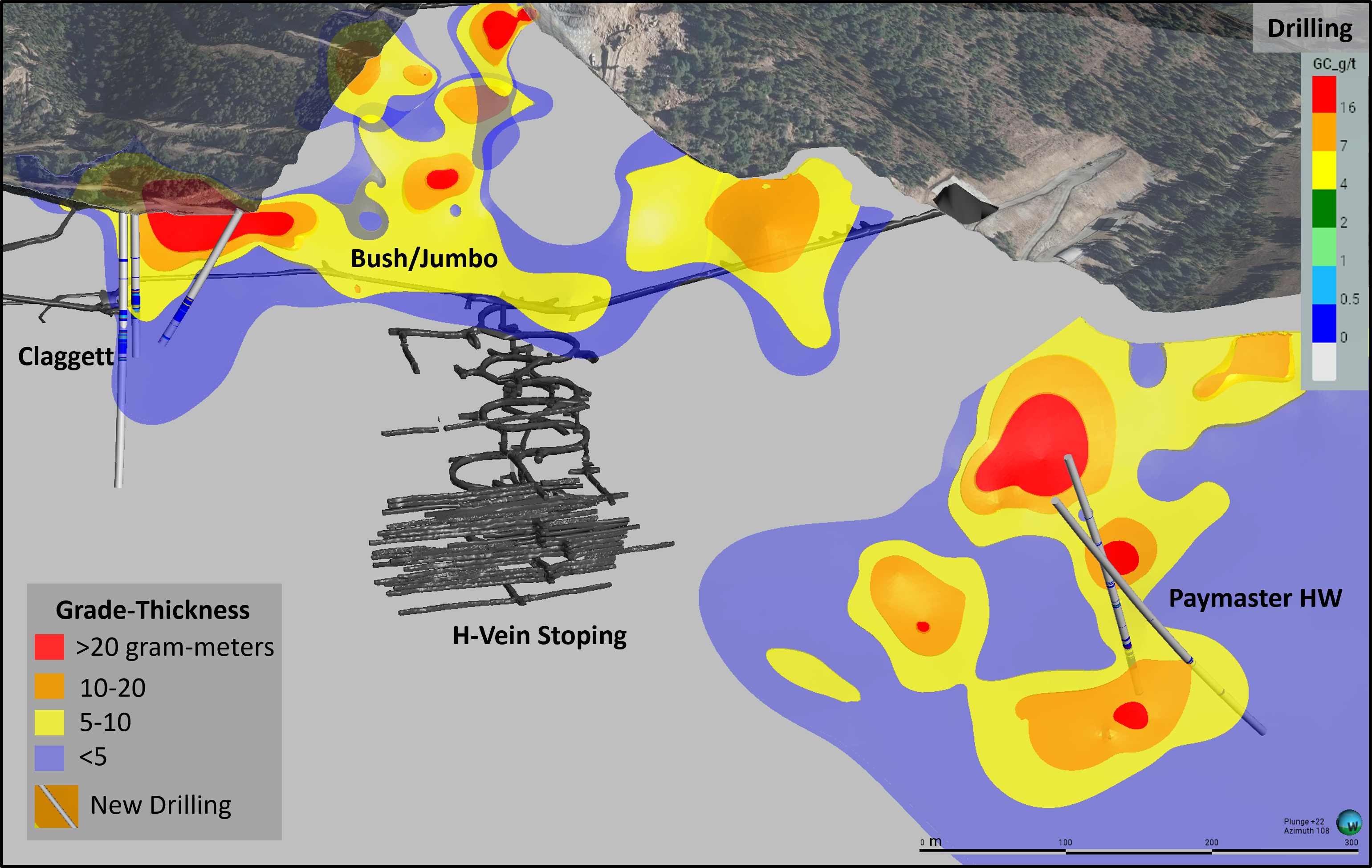

The Paymaster Veins, located south of the current underground workings, are two moderately dipping gold-bearing veins flanking a quartz monzonite sill. The geological continuity and prior high-grade intercepts from the Paymaster have advanced it to the pre-development stage for conceptual mine planning. The Paymaster is one of the primary areas of current mine reserves and remains open for exploration along strike and down-dip for potential future resource expansion. Idaho Strategic typically plans its exploration efforts in the Paymaster area to align with the winter months due to the relative ease of drilling close to the mine with readily available support when needed. However, the Company is expediting its planned drilling in the Paymaster area and moving in a drill rig next week.

Hole | Target: Bush/Jumbo | From (m) | To (m) | Drilled Thickness (m) | Gold Assay (gpt) |

GC 25-281 | Bush Vein | 53.5 | 55.9 | 2.4 | 6.90 |

including | 53.5 | 54.5 | 1.0 | 15.90 | |

GC 25-281 | Bush Vein | 63.8 | 65.4 | 1.6 | 5.38 |

including | 63.8 | 64.4 | 0.5 | 8.83 | |

including | 64.8 | 65 | 0.2 | 10.30 | |

GC 25-296 | Bush Vein | 61.6 | 63.8 | 2.2 | 2.48 |

including | 63.6 | 63.8 | 0.2 | 11.70 | |

GC 25-299 | Jumbo Vein | 70.7 | 71.5 | 0.8 | 8.33 |

GC 25-299 | Bush Vein | 74.8 | 75.4 | 0.6 | 4.83 |

GC 25-301 | Jumbo Vein | 72.4 | 72.7 | 0.3 | 8.50 |

GC 25-301 | Bush Vein | 81.7 | 83.4 | 1.7 | 10.55 |

including | 82.1 | 82.60 | 0.5 | 31.40 |

The Bush and Jumbo Veins, located above and to the north of the current underground workings, are characterized by high-grade gold-quartz veins in the hangingwall of the Idaho Fault. Recent in-fill drilling in this area has confirmed significant gold grades and positions it as a likely area of future gold resources and reserves. The proximity of the Bush and Jumbo Veins to existing infrastructure and to the planned location of the Murray Mill allows for future development with greater operational efficiencies. The Bush and Jumbo Veins have historically shown consistent mineralization, and these latest in-fill drill results reinforce its future production potential.

Hole | Target: Klondike | From (m) | To (m) | Drilled Thickness (m) | Gold Assay (gpt) |

GC 25-281 | Claggett Vein | 69.5 | 72.5 | 3 | 4.14 |

including | 70.3 | 70.54 | 0.24 | 24.40 | |

GC 25-301 | Claggett Vein | 99.6 | 101.4 | 1.8 | 5.94 |

including | 99.6 | 99.85 | 0.25 | 29.30 | |

GC 24-269 | Popcorn Vein | 218.7 | 218.9 | 0.2 | 8.67 |

GC 24-271 | Idaho Vein | 385.4 | 389.9 | 4.5 | 2.87 |

including | 389.6 | 389.9 | 0.3 | 29.10 |

The Claggett Vein, situated north of the current underground workings, is an emerging target with recent drilling revealing high-grade intercepts in previously underexplored ground. While the Claggett Vein is well documented in historic reports, these results prove that there is potential for additional discoveries where historic data gaps exist. The Claggett Vein is open down dip and along strike to the north. Additionally, with the planned development of an underground drill station, IDR will be positioned to drill both the newly discovered Red Star area and historic footwall veins such the Claggett, Popcorn, and Katie-Dora within the same drill holes.

Idaho Strategic's President and CEO, John Swallow, commented, "Our team is well into the busiest year in corporate history and the company is executing nicely. Reinvesting cash flows from ongoing operations across our asset base is the at the core of our production-backed exploration (and development) business plan - balancing sustained gold production with resource expansion and additional discovery. We now have 7 geologists on staff as we move into the prime months for exploration in 2025. Along with supporting geophysics, soil sampling, drilling, and other contractors, our geos are focused not only at the Golden Chest but across the broader Murray Gold Belt and our extensive REE holdings.

The drill results from the Paymaster Veins, the Bush and Jumbo Veins, and the Claggett Vein are a testament to the Golden Chest Mine's continued potential and our team's disciplined strategy. These additional high-grade intercepts, particularly in areas so close to our existing operations, give us a good base toward future production while supporting our plans for the buildout of the paste backfill plant and the new Murray Mill. In addition to the current underground drilling from the existing 941 level, development of a second underground drill station is now underway that will take approximately two months to complete and allow for greater flexibility in drill targeting and mine planning. We also broke ground on a new warehouse building that will aid in streamlining operations as our mine and mill crews eventually consolidate at the Golden Chest (yes, our accountants volunteered to do the foundation dirt-work for this building also)."

The image above shows the location of the Paymaster veins, the Bush/Jumbo veins, and the Claggett vein in relation to the current underground infrastructure at the Golden Chest Mine. Additionally, grade-thickness is also visible for the Paymaster veins and the Bush/Jumbo veins. Grade-thickness has not been estimated for the Claggett vein, as more drilling is needed.

Qualified person

IDR's Vice President of Exploration, Robert John Morgan, PG, PLS is a qualified person as such term is defined under S-K 1300 and has reviewed and approved the technical information and data included in this press release. Drill core samples from the Golden Chest Mine are analyzed by American Analytical Services, Inc., an ISO 17025-accredited laboratory in Osburn, Idaho, using 30-gram fire assay with a gravimetric finish. The Company's QA/QC program includes the insertion of blanks, certified reference materials, and duplicates to ensure analytical accuracy, with results reviewed by a Qualified Person.

About Idaho Strategic Resources, Inc.

Idaho Strategic Resources (IDR) is an Idaho-based gold producer which also owns the largest rare earth elements land package in the United States. The Company's business plan was established in anticipation of today's volatile geopolitical and macroeconomic environment. IDR finds itself in a unique position as the only publicly traded company with growing gold production and significant blue-sky potential for rare earth elements exploration and development in one Company.

For more information on Idaho Strategic Resources, visit https://idahostrategic.com/presentation/, go to www.idahostrategic.com or call:

Travis Swallow, Investor Relations & Corporate Development

Email: tswallow@idahostrategic.com

Phone: (208) 625-9001

Forward Looking Statements

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are intended to be covered by the safe harbor created by such sections. Often, but not always, forward-looking information can be identified by forward-looking words such as "intends", "potential", "believe", "plans", "expects", "may", "goal', "assume", "estimate", "anticipate", and "will" or similar words suggesting future outcomes, or other expectations, beliefs, assumptions, intentions, or statements about future events or performance. Forward-looking information includes, but are not limited to, The potential operational and economic viability of mining the veins that contain the drill intercepts included in this press release, the potential for additional drill results to be positive in the future, the potential for the second underground drill station to be developed and result in better drill targeting and mine planning, the potential for the full buildout of the Murray Mill on an unknown timeline, the Company's ability to drill all of the targets that it has planned this year, and the potential to add to resources and reserves through drilling. Forward-looking information is based on the opinions and estimates of Idaho Strategic Resources as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of IDR to be materially different from those expressed or implied by such forward-looking information. Investors should note that IDR's claim as the largest rare earth elements landholder in the U.S. is based on the Company's internal review of publicly available information regarding the rare earth landholdings of select companies within the U.S., which IDR is aware of. Investors are encouraged not to rely on IDR's claim as the largest rare earth elements landholder in the U.S. while making investment decisions. The forward-looking statement information above, and those following are applicable to both this press release, as well as the links contained within this press release. With respect to the business of Idaho Strategic Resources, these risks and uncertainties include risks relating to widespread epidemics or pandemic outbreaks; interpretations or reinterpretations of geologic information; the accuracy of historic estimates; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms; the ability to operate the Company's projects; and risks associated with the mining industry such as economic factors (including future commodity prices, and energy prices), ground conditions, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Idaho Strategic Resources filings with the SEC on EDGAR. IDR does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

SOURCE: Idaho Strategic Resources, Inc.

View the original press release on ACCESS Newswire