Mineral Hill Carbonatite Yields Greater than 17.6% Total Rare Earths at Idaho Strategic's Recently Added Cardinal Prospect

Rhea-AI Summary

Idaho Strategic Resources (NYSE American:IDR) has discovered high-grade rare earth elements at its Mineral Hill project, with samples yielding over 17.6% total rare earth oxides (TREO) at the Cardinal prospect. The company completed a drone-based magnetics survey revealing a 3.5 km northwest-trending zone connecting three carbonatite prospects: Roberts, Cardinal, and Lower Lee Buck.

The Cardinal prospect, discovered in 1953, features three subparallel carbonatite seams with abundant monazite, traceable for over 1,000 feet with widths of 1-3 meters. IDR recently secured a long-term lease for Cardinal and approximately 1,300 acres of additional holdings within the Mineral Hill and Lemhi Pass projects. The company plans to utilize existing infrastructure for drilling operations to test carbonatite depth.

Positive

- Extremely high-grade rare earth oxide content of 17.6% TREO in samples

- Extensive mineralization zone spanning 3.5 km with multiple carbonatite prospects

- Existing infrastructure (roads and open cuts) reduces development costs

- Strategic land position with 1,300 acres of additional holdings acquired

Negative

- Some samples exceeded upper detection limits and require reprocessing

- Limited information on depth and continuity of mineralization pending drill results

News Market Reaction – IDR

On the day this news was published, IDR gained 2.66%, reflecting a moderate positive market reaction. Our momentum scanner triggered 2 alerts that day, indicating moderate trading interest and price volatility. This price movement added approximately $7M to the company's valuation, bringing the market cap to $275M at that time.

Data tracked by StockTitan Argus on the day of publication.

COEUR D'ALENE, ID / ACCESS Newswire / July 24, 2025 / Idaho Strategic Resources (NYSE American:IDR) ("IDR" or the "Company") is pleased to announce that it has sampled greater than

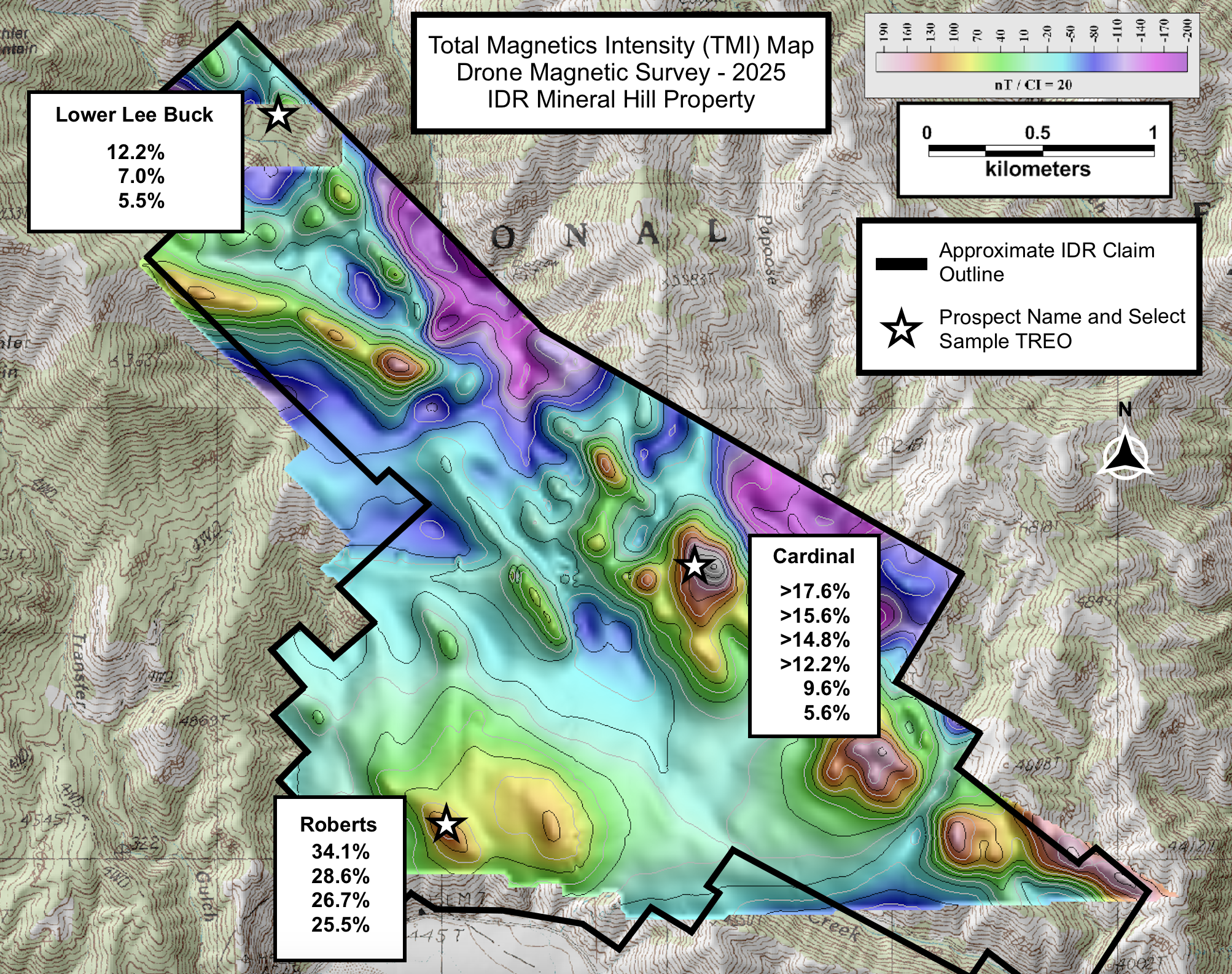

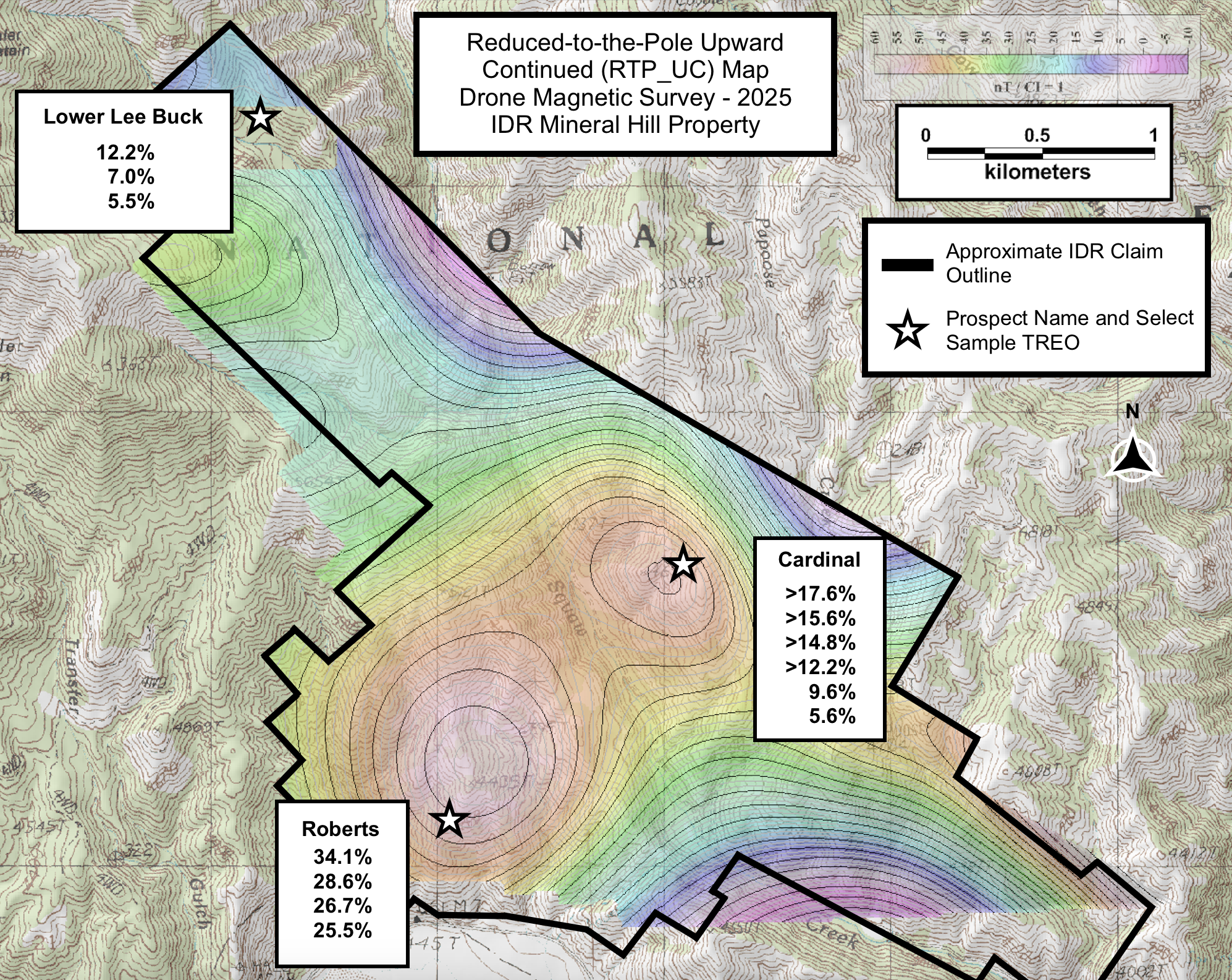

The following two figures show magnetic survey data covering three known carbonatite prospects in the Mineral Hill district: Roberts, Cardinal, and Lower Lee Buck (all controlled by IDR).

The map above shows the Total Magnetic Intensity (TMI) and identifies an extensive northwest trending, semi-linear zone of magnetic highs with a response consistent with a dike swarm. This zone extends 1.5 km southeast of the Cardinal prospect, through Cardinal, to the Lower Lee Buck prospect for a total of 3.5 km. The Roberts area displays a very strong circular magnetic anomaly.

The map above is a reduced-to-the-pole upward continued (RTP_UC) map generated from the processed magnetic survey data. This map indicates a deep sourced, large magnetic feature extending in a northeast orientation from Roberts to Cardinal. The southwest end of this feature is larger and deeper which is suggestive of an intrusion.

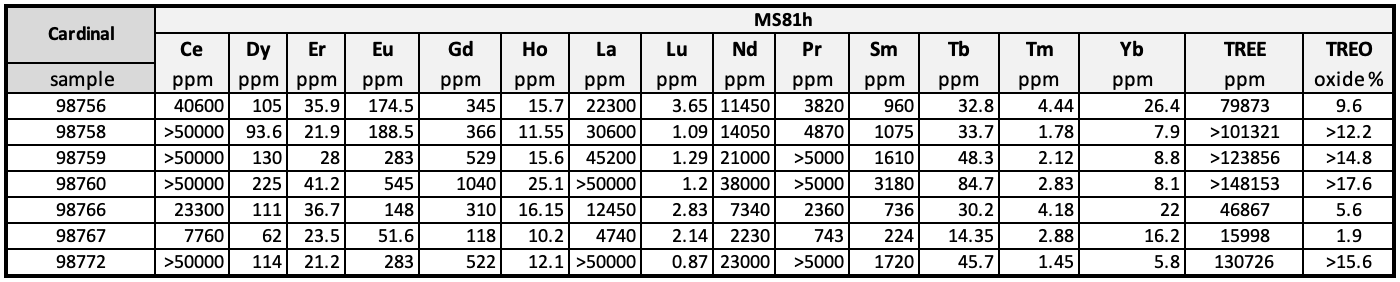

The TMI magnetics data correctly reflects the geologic mapping and spatial location of the known carbonatites and provides a template for identifying other potential carbonatite prospects throughout the project. Monazite is the primary ore mineral and occurs in relatively pure bands up to 20 cm within the carbonatite. Select grab samples were taken from the areas of the carbonatite outcrop with visible monazite. Samples where certain rare earth elements exceeded the upper detection limits of the selected lab analysis are being re-processed to account for overruns. The table below highlights the recent sample results obtained from the Cardinal prospect at the Company's Mineral Hill project:

Idaho Strategic's geologists were successful at identifying at least three subparallel carbonatite seams with abundant visible monazite and consistently high pXRF sample results. The Cardinal prospect is a well-known high-grade carbonatite that was discovered in 1953. The occurrence has an extraordinary assemblage of minerals that contain rare earth elements, chromium, niobium and titanium. The carbonatite forms prominent outcrops as it is protected from weathering by an adjacent quartz vein. It can be traced in semi-continuous outcrop for greater than 1,000 feet and has widths from 1 to 3 meters. In addition to high-grade rare earth elements at the surface, the Company's Cardinal prospect benefits from a network of roads constructed sometime between 1950 and 1970. The roads were constructed to access the carbonatite outcrop where numerous large open cuts and at least one adit are present. Idaho Strategic plans to utilize the existing roads and open cuts as drill pads to test the depth of the carbonatite, requiring minimal road building and excavation prep work.

Earlier this year, IDR executed a long-term lease agreement for the mineral claims comprising the Cardinal prospect, as well as approximately 1,300 acres of additional various in-holdings within the Company's Mineral Hill and Lemhi Pass projects. Key prospects covered by the mineral claims leased by IDR include the Cardinal (Mineral Hill), Lucky Horseshoe (Lemhi Pass - Idaho), Silver Queen (Lemhi Pass - Idaho), Last Chance (Lemhi Pass - Montana), Trapper (Lemhi Pass - Montana), and other prospects. While IDR's geologists were familiar with the Cardinal prospect from historic literature, the grade and extent of its rare earth elements mineralization were not well-known.

Idaho Strategic's President and CEO, John Swallow commented, "I think most would agree the DoD partnership announcement by MP on July 10th marks a step change in the rare earth industry. We view a market going forward where results matter and the context around a project also matter. At Mineral Hill, the overall desirability of high grade REE surface samples and the complimentary nature of having multiple carbonatite occurrences in distinct areas (Lower Lee Buck, Roberts, Cardinal) is something that sets it apart. This includes the added benefit of having monazite-based mineralization, Idaho jurisdiction, and IDR's operational track record as an Idaho company. With this field work underway, we are also advancing first phase drill plans as we work toward resource definition, making this an exciting time for our company."

Qualified Person and QA/QC

IDR's Vice President of Exploration, Robert John Morgan, PG, PLS is a qualified person as such term is defined under S-K 1300 and has reviewed and approved the technical information and data included in this press release. Rare earth samples from the Cardinal prospect were analyzed by ALS Chemex using Ore Grade Rare Earth Elements analysis (ME-MS81h). The Company's QA/QC program includes certified reference materials to ensure analytical accuracy, with results reviewed by a Qualified Person.

About Idaho Strategic Resources, Inc.

Idaho Strategic Resources (IDR) is an Idaho-based gold producer which also owns the largest rare earth elements land package in the United States. The Company's business plan was established in anticipation of today's volatile geopolitical and macroeconomic environment. IDR finds itself in a unique position as the only publicly traded company with growing gold production and significant blue-sky potential for rare earth elements exploration and development in one Company.

For more information on Idaho Strategic Resources, visit https://idahostrategic.com/presentation/, go to www.idahostrategic.com or call:

Travis Swallow, Investor Relations & Corporate Development

Email: tswallow@idahostrategic.com

Phone: (208) 625-9001

Forward Looking Statements

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are intended to be covered by the safe harbor created by such sections. Often, but not always, forward-looking information can be identified by forward-looking words such as "intends", "potential", "believe", "plans", "expects", "may", "goal', "assume", "estimate", "anticipate", and "will" or similar words suggesting future outcomes, or other expectations, beliefs, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of Idaho Strategic Resources as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of IDR to be materially different from those expressed or implied by such forward-looking information. Forward-looking information includes the potential for the magnetics survey to lead to additional carbonatite discoveries, the potential for a deep intrusive system beneath the Roberts and Cardinal prospects, and the potential for the recent MP deal to result in positive developments for IDR's rare earth elements projects. Investors should note that IDR's claim as the largest rare earth elements landholder in the U.S. is based on the Company's internal review of publicly available information regarding the rare earth landholdings of select companies within the U.S., which IDR is aware of. Investors are encouraged not to rely on IDR's claim as the largest rare earth elements landholder in the U.S. while making investment decisions. The forward-looking statement information above, and those following are applicable to both this press release, as well as the links contained within this press release. With respect to the business of Idaho Strategic Resources, these risks and uncertainties include risks relating to widespread pandemic outbreaks; interpretations or reinterpretations of geologic information; the accuracy of historic estimates; unfavorable exploration results; inability to obtain permits, development or production; general economic conditions; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms; and risks associated with the mining industry such as ground conditions, failure of plant, equipment, processes and transportation services to operate as anticipated, government regulation, possible variations in ore grade or recovery rates, capital and construction expenditures, and reclamation activities. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Idaho Strategic Resources filings with the SEC on EDGAR. IDR does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

SOURCE: Idaho Strategic Resources, Inc.

View the original press release on ACCESS Newswire