Ivanhoe Electric's Preliminary Feasibility Study for the Santa Cruz Copper Project in Arizona Defines a High-Quality Underground Mining Operation with Strong Economics

Rhea-AI Summary

Positive

- High-grade reserves of 136M tonnes at 1.08% copper with 92.2% recovery rate over mine life

- Strong economics with $1.9B after-tax NPV and 24% IRR at current copper prices

- First quartile low operating costs at $1.32/lb, lowest in America

- Located on private land with streamlined permitting process and excellent infrastructure

- Potential government support with up to $825M in debt financing from Export-Import Bank

- Long 23-year mine life with significant expansion potential

- High annual production of 72,000 tonnes of copper cathode in first 15 years

Negative

- Substantial initial capital requirement of $1.24B needed

- 4.4-year payback period from start of operations

- Production not expected to start until 2028

- Project still requires securing full financing

News Market Reaction – IE

On the day this news was published, IE gained 4.83%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Advanced United States Copper Project on Private Land with an After-Tax Net Present Value

Updated Reserves and Mine Plan Support

Low Initial Capital of

Highly Engineered Study Will Be Used to Secure Project Financing

Initial Construction Targeted for First Half 2026, with First Copper Cathode Production Projected in 2028

Significant Copper Resources Support Future Expansion Potential on Existing Land Package

Phoenix, Arizona--(Newsfile Corp. - June 23, 2025) - Ivanhoe Electric Inc. (NYSE American: IE) (TSX: IE) ("Ivanhoe Electric") Executive Chairman Robert Friedland and President and Chief Executive Officer Taylor Melvin are pleased to announce the completion of the Preliminary Feasibility Study (the "Study") for the Company's Santa Cruz Copper Project in Arizona. Located in the heart of Arizona, a state known for its prolific mining history and its booming technology industry, the Santa Cruz Copper Project is poised to become one of the nation's next major domestic producers of refined copper. The highly engineered Study confirms the strong economics of a high-quality, high-grade underground copper mining operation and heap leach processing facility supported by modern technologies. The NI 43-101 Technical Report co-filed in Canada will include the Study as a Feasibility Study as defined by the Canadian Institute of Mining, Metallurgy and Petroleum.

The Preliminary Feasibility Study, as prepared under United States regulatory requirements, provides the requisite engineering studies needed to pursue long-term project financing. Project financing efforts are already underway. Ivanhoe Electric is pursuing multiple avenues of funding, including support from United States government agencies, commercial lending institutions, and potential strategic partners at the asset level. On April 15, 2025, Ivanhoe Electric received a Letter of Interest from the Export-Import Bank of the United States outlining the potential to provide up to

Mr. Friedland commented: "Given global conflicts that concern us all, the United States is now awake to the urgent national security imperative to restore domestic American mineral production to the scale of the American economy. Our government, industry, and defense establishment clearly recognize the paramount importance of having a secure, domestic supply of all critical minerals in the 21st century, including copper. The skillsets and government support required to mine copper, the king of metals, are the same skillsets required to mine any and all elements on the periodic table. Our Santa Cruz Copper Project is at the leading edge of this resurgence - as one of the first new copper mines that will be opened in the United States in a generation…right in the heart of Arizona - "the Copper State", with its burgeoning automotive, defense, and technology industries…including the likes of Lucid Motors and Taiwan Semiconductor Manufacturing Company. A simple Google search will show anyone there are over 1,250 aerospace and defense-related companies in the state of Arizona alone.

Santa Cruz will mine the largest high-grade copper oxide orebody in America…which will be processed onsite by a new generation of skilled and highly paid American workers. Santa Cruz will produce an LME Grade A

Mr. Melvin commented: "I am proud of the extraordinary work by our Santa Cruz Project team to complete our Preliminary Feasibility Study on time and on budget. We have assembled a dedicated team of talented mine engineers and underground specialists who have been critical in getting us to this point. Working together with our expert industry consultants, our team's tireless efforts have resulted in a highly engineered underground mine plan and a simplified heap-leach process design with low initial capital, low unit operating costs, and high copper recoveries. Our advanced Santa Cruz Project will provide high-paying jobs in Arizona and be a significant long-term U.S. producer of copper cathode to help meet domestic demand. We are fortunate to have such a high-quality copper asset on private land with excellent infrastructure in Arizona, a state with a rich mining history and a bright mining future."

Highlights of the Preliminary Feasibility Study

High-grade Mineral Reserves

- Probable Mineral Reserves of 136 million tonnes at a grade of

1.08% copper totaling 1.5 million tonnes of contained copper supports a 23-year mine life

Large, Modern Underground Mining Operation with Simple Process Flowsheet

- 20,000 tonnes per day mining operation utilizing modern mining technology

- Conventional on/off heap leaching lowers operating costs and initial surface capital while yielding high copper recoveries of

92.2% over the life of mine and allowing spent ore to be utilized underground as paste backfill - Average annual production of 72,000 tonnes of copper cathode during the first 15 years of mining

Low Project Capital Intensity and Unit Operating Costs Underpin Strong Economic Results

- Initial project capital of

$1.24 billion and a capital intensity of approximately$17,000 per tonne of copper1 - Global first quartile2 C1 cash costs of

$1.32 per pound of copper over the life of mine, and lowest cost in America - At the current COMEX copper price of

$4.83 per pound, the after-tax net present value at an8% discount rate is$1.9 billion with an internal rate of return of24% - At a base case of

$4.25 per pound of copper, the after-tax net present value at an8% discount rate is$1.4 billion with an internal rate of return of20%

Clear Path to Development

- This is the final technical study to support ongoing project financing discussions

- Private land and mineral rights enable streamlined permitting process

- Indicative development plan targets initial construction in first half of 2026 and first copper cathode production in 2028

High copper grades, high copper recoveries, low initial capital, and low operating costs give the Santa Cruz Copper Project attractive economics at prices well below today's COMEX copper price (Table 1).

Table 1. Life of mine copper price sensitivity

| Copper Price ($/pound) | Pre-tax | After-tax | ||||

| Life of Mine Free Cashflow ($ billon) | Net Present Value ($ billion) | Internal Rate of Return (%) | Life of Mine Free Cashflow ($ billion) | Net Present Value ($ billion) | Internal Rate of Return (%) | |

| 3.75 | 4.73 | 1.29 | 3.85 | 0.91 | ||

| 4.00 | 5.44 | 1.59 | 4.41 | 1.14 | ||

| 4.25 (Base) | 6.15 | 1.88 | 4.96 | 1.38 | ||

| 4.50 | 6.86 | 2.17 | 5.52 | 1.61 | ||

| 4.75 | 7.56 | 2.47 | 6.07 | 1.84 | ||

| 4.83 (COMEX Spot*) | 7.79 | 2.56 | 6.25 | 1.91 | ||

| 5.00 | 8.27 | 2.76 | 6.63 | 2.07 | ||

*COMEX spot price of

Details of the Preliminary Feasibility Study

The Preliminary Feasibility Study is a Highly Engineered Study Supported by Extensive Drilling, Metallurgical and Hydrogeological Testwork, and Trade-off Studies Involving Global Leaders in Mine Engineering

Since the 2023 Initial Assessment Study, Ivanhoe Electric has invested more than

Fluor Canada Ltd. served as Project Lead for the Study and was also responsible for surface infrastructure and heap leach pads, working in close collaboration with Ivanhoe Electric's Project team of more than 40 engineers, geologists, and technicians. Other industry-leading consultants involved in major workstreams of the Study include BBA USA Inc. for resources, reserves, underground mine planning and economic analysis, KCB Consultants Ltd. for heap leaching, Paterson & Cooke USA, Ltd. for paste backfill, Met Engineering, LLC for metallurgical testing, and INTERA Incorporated for hydrogeology.

The Study summary results are presented below in Table 2. The Santa Cruz Copper Project compares favorably on a global scale in terms of C1 cash cost, and in terms of capital intensity when compared to North and South American greenfield copper projects (Figure 1 and Figure 2, respectively).

Table 2. Summary results

| Description | Units | Life of Mine | First 15 Years |

| Production Data | |||

| Mine Life | Year | 23 | 15 |

| Reserve Tonnes | Million tonnes | 136 | 106 |

| Copper Grade | % | 1.08 | 1.10 |

| Daily Throughput | Tonnes per day | 15,000 | 20,000 |

| Annual Copper Production | Tonnes per year | 56,685 | 72,186 |

| Total Copper Cathode Produced | Thousand tonnes | 1,360 | 1,083 |

| Recovery | % | 92.2 | 92.4 |

| Capital Costs | |||

| Initial Capital | $ million | 1,236 | - |

| Sustaining Capital | $ million | 1,281 | 1,176 |

| Unit Costs | |||

| Mining Cost | $ per tonne processed | 19.07 | 19.55 |

| Processing Cost | $ per tonne processed | 7.31 | 7.02 |

| General and Administrative Cost1 | $ per tonne processed | 3.04 | 3.03 |

| Royalties | $ per tonne processed | 5.26 | 5.56 |

| Total Operating Cost | $ per tonne processed | 34.68 | 35.16 |

| Operating + Sustaining Cost | $ per tonne processed | 43.98 | 46.23 |

| C1 Cash Cost | $ per pound of copper | 1.32 | 1.29 |

| All-in-sustaining Cost | $ per pound of copper | 2.01 | 1.99 |

| Financial Analysis | |||

| Copper Price | $ per pound | 4.25 | 4.25 |

| Domestic Cathode Premium | $ per pound | 0.14 | 0.14 |

| Pre-tax Free Cashflow | $ million | 6,148 | 4,501 |

| Pre-tax Net Present Value | $ million | 1,880 | - |

| Pre-tax Internal Rate of Return | % | 22.0 | - |

| After-tax Free Cashflow | $ million | 4,961 | 3,637 |

| After-tax Net Present Value | $ million | 1,376 | - |

| After-tax Internal Rate of Return | % | 20.0 | - |

| After-tax Payback Period2 | Year | 4.4 | - |

1. General and Administrative Cost inclusive of property tax. 2. After-tax payback period from the start of operations in 2029.

Figure 1. Cash cost curve of global copper mines, highlighting United States operating mines

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3868/256435_6d59063a2413fbe8_002full.jpg

Figure 2. Initial capital intensity compared to North and South American greenfield copper projects

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3868/256435_6d59063a2413fbe8_003full.jpg

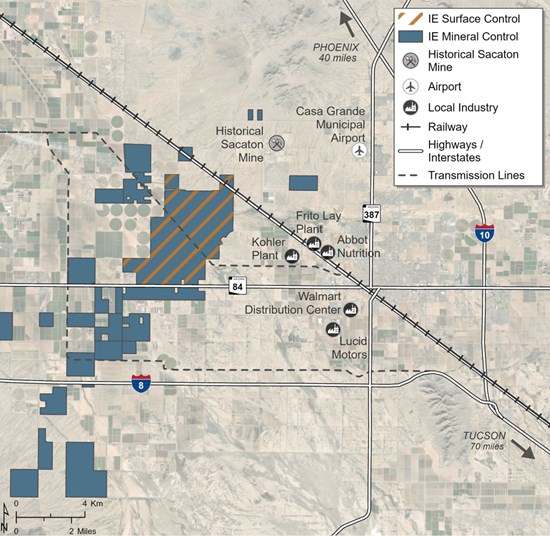

The Santa Cruz Copper Project is Located on

The Santa Cruz Copper Project is located approximately 40 miles southeast of Phoenix, Arizona in Casa Grande on nearly 6,000 acres of

Figure 3. Santa Cruz Copper Project location

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3868/256435_6d59063a2413fbe8_004full.jpg

The planned site layout provides for a compact surface footprint of less than 2,600 acres, representing approximately

The site layout provides sufficient space for future expansion opportunities.

Figure 4. Planned site layout

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3868/256435_6d59063a2413fbe8_005full.jpg

High-Grade Oxide and Chalcocite Mineral Reserves Amenable to Heap Leaching Support a 23-Year Mine Life

The Study includes an initial Mineral Reserve Estimate for the Santa Cruz Copper Project, including Probable Reserves for the Santa Cruz and East Ridge Deposits. Stope shapes were created based on mineralized zone geometry and optimized based on economic prospectivity and geotechnical parameters specific to the rock type, the orebody orientation, and the mining sequence. Recovery and dilution factors were applied to calculate the final tonnes and grade of the reserve.

Probable Reserves of 136 million tonnes at a

Figure 5. Santa Cruz Copper Project Mineral Reserves and mine infrastructure

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3868/256435_6d59063a2413fbe8_006full.jpg

Table 3. Santa Cruz Copper Project Mineral Reserves summary

| Deposit | Classification | Tonnes (thousand tonnes) | Total Copper (%) | Contained Copper (thousand tonnes) |

| Santa Cruz | Probable | 132,061 | 1.08 | 1,430 |

| East Ridge | Probable | 4,112 | 1.03 | 42 |

| Total | Probable | 136,173 | 1.08 | 1,472 |

Notes: 1. The mineral reserves in this estimate are current to June 23, 2025 and were independently prepared, including estimation and classification, by BBA USA Inc. They are reported in accordance with the definitions for mineral reserves in S-K 1300. 2. The point of reference for the estimate is the point of delivery to the process facilities. 3. The mineral reserves for the Santa Cruz and East Ridge deposits were completed using Deswik mining software. Mineral reserves are defined within stope designs that are prescribed by rock mechanics, considering the specific characteristics of deposits, mineral domains, mining methods, and the mining sequence. Transverse longhole stoping is the optimal mining method with uppers and cut & fill methods used where appropriate. Mining will occur in blocks, extracting ore from the bottom upwards, with paste backfill providing ground support to sustain a production rate of 20,000 tonnes per day for the first 15 years of operation. 4. Mineral reserves are estimated at an NSR cutoff value of

Simplified Design and the Use of Modern Mining Technologies Contribute to a Faster Development Timeline, Targeting First Copper Cathode Production in 2028 and Ramp-up to Full Production From 2029

The Project's Mineral Reserves will be accessed by conventional twin decline drifts. The Study design includes the use of roadheader technology to construct the declines, measuring approximately 8 kilometers in combined length. Main intake and exhaust raises will be developed using blindbore shaft sinking to supply ventilation to the mine workings (Figure 6 and Figure 7).

The underground mine will utilize the latest mining equipment, including a tele-remote-operated electric fleet, mine telemetry, and grade control technologies. Underground mining will primarily use longhole stoping and local drift-and-fill, totaling approximately 201 kilometers of stope cuts completed across 16 main levels. Hydrogeological mitigation strategies during decline development and mining include grouting, hydrostatic lining, and silica gel injection. Groundwater modelling and mitigation result in residual passive inflow rates ranging from approximately 6,000 to 8,000 gallons per minute during peak mining periods.

Throughput will steadily increase from the start of production onward to achieve an average of 20,000 tonnes per day, producing an annual average of 72,000 tonnes of copper cathode over the first 15 years of the mine life (Figure 8).

Figure 6. Santa Cruz Copper Project underground mine design, orthogonal view

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3868/256435_6d59063a2413fbe8_007full.jpg

Figure 7. Santa Cruz Copper Project underground mine design, long-section

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3868/256435_6d59063a2413fbe8_008full.jpg

Figure 8. Santa Cruz Copper Project production profile

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3868/256435_6d59063a2413fbe8_009full.jpg

Study Supports High-Grade Heap Leach Operation that will Produce Pure Copper Cathode for United States' Consumption

Data analysis and trade-off studies related to the extensive drilling and associated metallurgical, hydrogeological, and geotechnical studies identified the material benefits of using a conventional chloride-assisted on/off heap leaching flowsheet to produce copper cathode. A simple leaching operation reduces surface processing and ramp-up complexities while maintaining the ability to balance mine feed. Heap leaching also lowers surface initial and sustaining capital and lowers operating costs, which in turn enhances Mineral Reserves.

Mined ore will be brought to the surface and processed through a conventional chloride-assisted on/off-heap leach process to produce copper cathode through solvent extraction and electrowinning (Figure 9). The high-grade nature of the Santa Cruz and East Ridge orebodies enables high copper recoveries averaging

Figure 9. Santa Cruz Copper Project simplified flowsheet showing the production of copper cathode

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3868/256435_6d59063a2413fbe8_010full.jpg

As is common in modern solvent extraction-electrowinning plants, London Metal Exchange Grade A copper production will be expected after an initial commissioning phase.

Private Land Enables Streamlined Permitting Process

The Santa Cruz Copper Project requires permits primarily from the City of Casa Grande, Pinal County, and the State of Arizona, with only one Federal permit required. Land use authorizations from the City of Casa Grande, including a General Plan Amendment and Major Amendment to a Planned Area Development Zone, have already been obtained and allow mining activities and infrastructure within the project site.

Table 4. Current Santa Cruz Copper Project permitting status and timeline

| Permit | Status | Submittal Timeline |

| The following permits have been obtained for exploration activities and are in the process of being amended for project construction activities: | ||

| Arizona State Mine Inspector Mined Land Reclamation Plan | Active/amendment in progress | Q3 2025 |

| Pinal County Dust Control permit | Active/annual renewal | Ongoing |

| The following permits for construction activities are in preparation or have been submitted: | ||

| City of Casa Grande Major Site Plan and Development permit | In progress | Q3 2025 |

| Pinal County Air Quality Control District Class II Air permit | Submitted | Q1 2025 |

| Arizona Department of Environmental Quality General Aquifer Protection permits for construction | In progress | Q3 2025 |

| Arizona Department of Water Resources 45-513 Groundwater Withdrawal permit | In progress | Q4 2025 |

| The following permits for construction and operation will be prepared and submitted as design and engineering details become available: | ||

| Arizona Department of Transportation Encroachment permit for access off Highway 84 | Road improvements engineering in progress | Q4 2025 |

| US Environmental Protection Agency Class V Underground Injection Control permit | Engineering to inform application in progress | Q4 2025 |

| Arizona Department of Environmental Quality Individual Aquifer Protection permit | Engineering to inform application in progress | Q3 2026 |

| Arizona Department of Environmental Quality Recycled Water Discharge permit | Detailed engineering required for application, if necessary | Q1 2027 |

The current Santa Cruz Copper Project development plan, subject to project financing and receipt of necessary permits, targets initial construction in the first half of 2026 and first copper cathode produced in 2028 (Figure 10). The indicative development plan is an illustrative timeline, subject to permitting and project financing.

Figure 10. Santa Cruz Copper Project indicative development plan

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3868/256435_6d59063a2413fbe8_011full.jpg

Additional Indicated Mineral Resources, Exclusive of Mineral Reserves, Provide Potential Opportunities for Future Expansion

Indicated Resources at Santa Cruz and East Ridge, exclusive of Mineral Reserves, comprise a total of 1.5 million tonnes of contained copper. Indicated Resources in mineralized domains amenable to heap leaching at Santa Cruz total 0.8 million tonnes and 41,000 tonnes at East Ridge. These Indicated Resources at Santa Cruz and East Ridge are not included in the current mine plan, and if converted to Mineral Reserves, represent near-mine expansion potential. Santa Cruz also includes Indicated Resources of 0.5 million tonnes of contained copper grading

Additionally, the Santa Cruz Copper Project includes Inferred Resources, which are not included in the Study or the associated mine plan, which comprise a further 3.3 million tonnes of contained copper across the Santa Cruz, East Ridge, and Texaco Deposits.

Table 5. Mineral Resource Estimate, Exclusive of Mineral Reserves Summary

| Deposit | Classification | Tonnes (thousand tonnes) | Total Copper (%) | Gold (grams per tonne) | Silver (grams per tonne) | Contained Gold (thousand troy ounces) | Contained Silver (thousand troy ounces) | Contained Copper (thousand tonnes) |

| Santa Cruz | Indicated | 178,451 | 0.80 | 0.024 | 1.43 | 139 | 8,211 | 1,435 |

| Inferred | 31,998 | 0.73 | 0.021 | 1.78 | 21 | 1,832 | 232 | |

| East Ridge | Indicated | 4,407 | 0.94 | 0.015 | 0.71 | 2 | 101 | 41 |

| Inferred | 48,676 | 0.89 | 0.006 | 0.40 | 9 | 623 | 436 | |

| Texaco | Inferred | 341,345 | 0.78 | 0.028 | 0.81 | 302 | 8,850 | 2,664 |

| All Deposits | Indicated | 182,859 | 0.81 | 0.024 | 1.41 | 141 | 8,312 | 1,476 |

| All Deposits | Inferred | 422,020 | 0.79 | 0.025 | 0.83 | 333 | 11,304 | 3,332 |

Notes on mineral resources: 1. The mineral resources in this estimate were independently prepared, including estimation and classification, by BBA USA Inc., and are reported in accordance with the definition for mineral resources in S-K 1300. 2. Mineral resources that are not mineral reserves do not have demonstrated economic viability. 3. Mineral resources are reported in situ, exclusive of mineral reserves. 4. The mineral resources for Santa Cruz, East Ridge, and Texaco deposit were completed using Datamine Studio RM software. 5. The mineral resources are current at June 23, 2025. 6. Mineral resources constrained assuming underground mining methods for the Santa Cruz deposit are reported at an NSR cutoff of US

Ivanhoe Electric to host conference call on the Santa Cruz Copper Project Preliminary Feasibility Study

On Monday, June 23, 2025, Ivanhoe Electric will host a conference call to discuss the results of the Santa Cruz Copper Project Preliminary Feasibility Study.

The call will include remarks from Ivanhoe Electric's Executive Chairman Robert Friedland, President, Chief Executive Officer Taylor Melvin, Senior Vice President of Mine Development Glen Kuntz, and other members of the Company's executive management team.

DATE: Monday, June 23, 2025

TIME: 10:00 am Eastern / 7:00 am Pacific / 7:00 am Arizona

LINK: https://ivanhoe-electric-june-2025-webcast.open-exchange.net/

A replay of the webcast, together with supporting presentation slides, will be made available on Ivanhoe Electric's website at www.ivanhoeelectric.com following the event.

Qualified Persons

The Study, entitled "S-K 1300 Preliminary Feasibility & Technical Report Summary, Santa Cruz Copper Project, Arizona," is dated June 23, 2025, and was prepared in accordance with Subpart 1300 and Item 601 of Regulation S-K. The Study was prepared by the following firms: Fluor Canada Ltd. (Fluor), BBA USA Inc. (BBA), KCB Consultants Ltd. (KCB), Met Engineering, LLC (Met), INTERA Incorporated (INTERA), Burns & McDonnell Engineering Company, Inc. (Burns & McDonnell), Geosyntec Consultants, Inc. (Geosyntec), Haley & Aldrich, Inc. (Haley & Aldrich), Life Cycle Geo, LLC (Life Cycle Geo), Paterson & Cooke USA, Ltd. (Paterson & Cooke), Stantec Consulting Services Inc. (Stantec) and Tetra Tech, Inc. (Tetra Tech).

The Study will be available on the SEC's EDGAR website as an exhibit to a Form 8-K filed by Ivanhoe Electric in connection with this news release. Ivanhoe Electric will have prepared and filed an independent technical report prepared under Canadian National Instrument 43-101 within 45 days of this news release. This report will be available on Ivanhoe Electric's website and on its SEDAR+ profile.

For the purposes of Canadian National Instrument 43-101, the independent Qualified Persons responsible for preparing the scientific and technical information disclosed in this news release announcing the Study are Todd McCracken, Shane Ghouralal, and David Willock (BBA), Ulises Arvayo (Burns & McDonnell), Subhamoy Dasgupta and Ivan Sanchez (Fluor), Kirk Craig (Geosyntec), Rick Frechette (Haley & Aldrich), Annelia Tinklenberg (INTERA), Jim Casey (KCB), Tom Meuzelaar (Life Cycle Geo), James Moore (Met), Casey Schmitt (Paterson & Cooke), Kim Trapani (Stantec), and Daryl Longwell (Tetra Tech). Each Qualified Person has reviewed and approved the information in this news release relevant to the portion of the scientific and technical information for which they are responsible.

Other disclosures of a scientific or technical nature included in this news release regarding the Santa Cruz Copper Project, have been reviewed, verified, and approved by Glen Kuntz, P.Geo., who is a Qualified Person as defined by Regulation S-K, Subpart 1300 promulgated by the U.S. Securities and Exchange Commission and by Canadian National Instrument 43-101. Mr. Kuntz is an employee of Ivanhoe Electric Inc.

The Study and 43-101 technical report include relevant information regarding the assumptions, parameters and methods of the mineral resource and mineral reserve estimates on the Santa Cruz Copper Project, as well as information regarding data verification, exploration procedures and other matters relevant to the scientific and technical disclosure contained in this news release.

About Ivanhoe Electric

We are a U.S. company that combines advanced mineral exploration technologies with electric metals exploration projects predominantly located in the United States. We use our accurate and powerful Typhoon™ geophysical surveying system, together with advanced data analytics provided by our subsidiary, Computational Geosciences Inc., to accelerate and de-risk the mineral exploration process as we seek to discover new deposits of critical metals that may otherwise be undetectable by traditional exploration technologies. We believe the United States is significantly underexplored and has the potential to yield major new discoveries of critical metals. Our mineral exploration efforts focus on copper as well as other metals including nickel, vanadium, cobalt, platinum group elements, gold and silver. Through the advancement of our portfolio of electric metals exploration projects, headlined by the Santa Cruz Copper Project in Arizona and the Tintic Copper-Gold Project in Utah, as well as other exploration projects in the United States, we intend to support United States supply chain independence by finding and delivering the critical metals necessary for the electrification of the economy. We also operate a 50/50 joint venture with Saudi Arabian Mining Company Ma'aden to explore for minerals on ~48,500 km2 of underexplored Arabian Shield in the Kingdom of Saudi Arabia.

Website: www.ivanhoeelectric.com

Contact Information

Mike Patterson

Vice President, Investor Relations and Business Development

Email: mike@ivnelectric.com

Phone: 1-480-601-7878

Follow us on

Ivanhoe Electric's Executive Chairman Robert Friedland: @robert_ivanhoe

Ivanhoe Electric: @ivanhoeelectric

Ivanhoe Electric's investor relations website located at www.ivanhoeelectric.com should be considered Ivanhoe Electric's recognized distribution channel for purposes of the Securities and Exchange Commission's Regulation FD.

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking statements" or "forward-looking information" within the meaning of applicable U.S. and Canadian securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Ivanhoe Electric, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as "may", "would", "could", "will", "intend", "expect", "believe", "plan", "anticipate", "estimate", "scheduled", "forecast", "predict", "target", "project" and other similar terminology, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. These statements reflect Ivanhoe Electric's current expectations regarding future events, performance and results and speak only as of the date of this news release.

Such statements in this news release include, without limitation: the projections, assumptions and estimates contained in the Preliminary Feasibility Study related to the Santa Cruz Copper Project, including but not limited to those related to capital and operating costs, metal prices, cash flow, cash costs, revenue, net present value, internal rate of return, mine design and mining techniques and processes, copper production, grade and recoveries, development, throughput, life of mine, illustrative timelines related to mine construction, permitting and copper production, potential financing, including through Export-Import Bank of the United States, jobs during construction and operations, mine sequencing, mining technology, equipment, staffing and infrastructure, emissions, use of land, water management and estimates regarding groundwater flow, power and other resources, estimates of mineral resources and reserves, potential for expansion of mineral resources, copper grade and cash cost costs relative to other mines, use of renewable energy, use of energy storage technologies, the ability to produce pure copper cathode, the ability to secure state and local permits, and planned or potential developments in the businesses of Ivanhoe Electric.

Forward-looking statements are based on management's beliefs and assumptions and on information currently available to management. Such statements are subject to significant risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including changes in the prices of copper or other metals Ivanhoe Electric is exploring for; the results of exploration and drilling activities and/or the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations; the final assessment of exploration results and information that is preliminary; the significant risk and hazards associated with any future mining operations, extensive regulation by the U.S. government as well as local governments; changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with Ivanhoe Electric to perform as agreed; and the impact of political, economic and other uncertainties associated with operating in foreign countries, and the impact of the COVID-19 pandemic and the global economy. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements and risk factors described in Ivanhoe Electric's Annual Report on Form 10-K filed and other disclosures with the U.S. Securities and Exchange Commission.

No assurance can be given that such future results will be achieved. Forward-looking statements speak only as of the date of this news release. Ivanhoe Electric cautions you not to place undue reliance on these forward-looking statements. Subject to applicable securities laws, Ivanhoe Electric does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release, and Ivanhoe Electric expressly disclaims any requirement to do so.

1 Initial capital expenditures divided by average annual copper production for the first 15 years of mining

2 S&P Global Market Intelligence co-product C1 copper cash cost curve (Q4 2024 dataset dated June 2025), compared to Santa Cruz Copper Project Preliminary Feasibility Study life of mine C1 cash cost and annual average copper production for the first 15 years of mining

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/256435