Greene Concepts Strengthens National Commitment to Preserving America's Water Sources

Rhea-AI Summary

Compass (NYSE: COMP) and Anywhere Real Estate (NYSE: HOUS) signed a definitive all-stock merger agreement to create a combined real estate platform with an implied enterprise value of approximately $10 billion. The deal exchanges one Anywhere share for 1.436 Compass Class A shares, valuing Anywhere at $13.01 based on Compass' 30‑day VWAP as of Sept 19, 2025.

The combined company would cover ~340,000 real estate professionals, ~1.2 million transactions, add >$1 billion in revenue, target >$225 million in non‑GAAP OPEX synergies, and expects close in H2 2026 subject to approvals.

Positive

- Enterprise value of approximately $10 billion

- Adds over $1 billion in revenue

- Combined network of ~340,000 real estate professionals

- Approximately 1.2 million combined transactions

- Targeted non‑GAAP OPEX synergies of $225+ million

- Financing commitment of $750 million from Morgan Stanley

Negative

- Compass shareholders to own ~78% and Anywhere ~22%

- Transaction subject to regulatory and shareholder approvals (closing risk)

- Integration and realization of synergies may take longer or fail

- Post‑close deleveraging target of ~1.5x Adjusted EBITDA by 2028

MARION, NC / ACCESS Newswire / November 18, 2025 / Greene Concepts Inc. (OTCID:INKW), owner and operator of a 60,000-square-foot bottling and beverage facility in Marion, North Carolina, announces its dedication to protecting and sustaining America's natural water systems, beginning with its pristine Blue Ridge Mountain aquifer source in Marion, North Carolina. Building on its legacy detailed in Greene Concepts' earlier Accesswire feature, the Company is advancing aquifer conservation initiatives, community partnerships, and water restoration programs aimed at addressing nationwide water scarcity.

Across the U.S., groundwater depletion in regions such as the Colorado River Basin, California's Central Valley, and the Floridan Aquifer highlights a growing national need for sustainable water management. Greene Concepts is responding by:

Partnering with regional experts to monitor and preserve the Blue Ridge aquifer, ensuring responsible and sustainable withdrawal practices.

Supporting water education programs that promote EPA WaterSense conservation practices.

Exploring collaborations with organizations such as the U.S. Water Alliance and The Nature Conservancy to promote aquifer recharge and drought resilience.

"Preserving clean water is essential to the future of our communities and our company," stated Lenny Greene, CEO of Greene Concepts. "Be Water stands as both a product and a promise-to sustain, protect, and responsibly manage the natural sources that make our brand possible."

"As we expand our national retail footprint, sustainability remains central to our business model," added Greene. "Our focus on long-term water stewardship not only protects our communities but also reinforces confidence among our investors, partners, and consumers who expect lasting value and responsible growth from Greene Concepts."

These actions reflect Greene Concepts' broader environmental and investor alignment-combining sustainability, innovation, and growth to enhance long-term shareholder value while safeguarding America's most vital natural resource.

Follow Greene Concepts, Inc. on Social Media at: X - @GreeneConcepts , Facebook - @inkw2025, Instagram - Greene Concepts, Inc. and Be Water

About Greene Concepts, Inc.

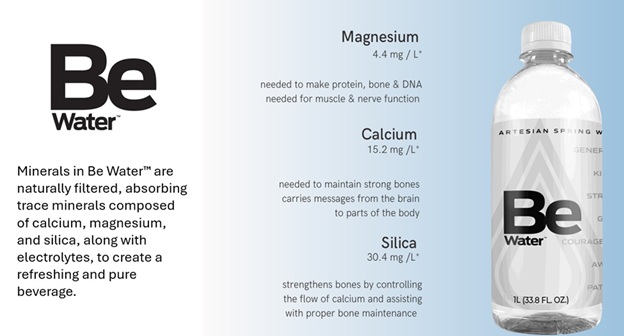

Greene Concepts, Inc. (https://www.greeneconcepts.com) is a publicly traded company whose purpose is to provide the world with high-quality, healthy and enhanced beverage choices that meet the nutritional needs of its consumers while refreshing their mind, body and spirit. The Company's flagship product, Be Water™, is a premium artesian bottled water that supports total body health and wellness. Greene Concepts' beverage and bottling plant is located in Marion, North Carolina, and their water is ethically sourced from spring and artesian wells that are fed from a natural aquifer located deep beneath the Blue Ridge Mountains. Greene Concepts continues to develop and market premium beverage brands designed to enhance the daily lives of consumers.

Safe Harbor: This Press Release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on the current plans and expectations of management and are subject to a few uncertainties and risks that could significantly affect the company's current plans and expectations, as well as future results of operations and financial condition. A more extensive listing of risks and factors that may affect the company's business prospects and cause actual results to differ materially from those described in the forward-looking statements can be found in the reports and other documents filed by the company with the Securities and Exchange Commission and OTC Markets, Inc. OTC Disclosure and News Service. The company undertakes no obligation to publicly update or revise any forward-looking statements, because of new information, future events or otherwise.

CONTACT:

Greene Concepts, Inc.

Investor Relations

IR@greeneconcepts.com

SOURCE: Greene Concepts Inc.

View the original press release on ACCESS Newswire